“Daily Economic News” learned that Wind data shows that as of August 15, the number of new funds established this year has reached 1,347, and the total amount of funds raised has reached 1.97 trillion yuan, which will soon exceed the 2 trillion yuan mark. ! In half of August, a total of 102 funds were established this month, raising 103.7 billion yuan.

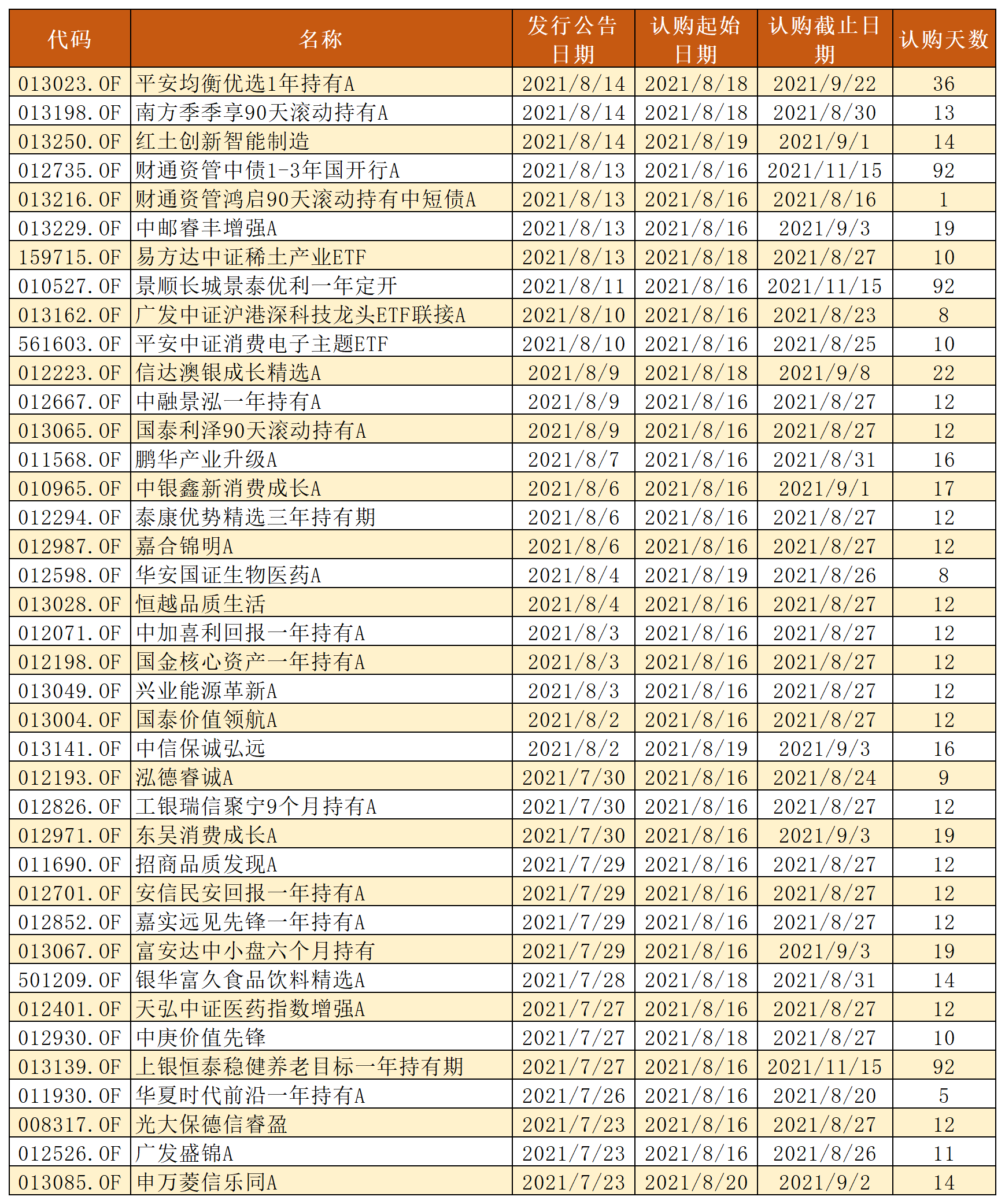

Many celebrity fund managers have issued products since August, but there are still a number of new fund managers on the way that have attracted much attention from investors in the second half of the year. Specifically, next week, a total of 39 new funds will be issued, a slight decrease from 44 this week. However, looking at the composition of these upcoming funds, it is mainly because the content of passive index funds has declined, but the number of active equity funds has greatly increased. Next week, it will reach an astonishing 27, ushering in a wave of small peaks. And this may also reflect to a certain extent the attitude of institutions towards the next market conditions.

Among them, there are not a few funds with themes such as consumption and biomedicine, and some star fund managers’ products are also very eye-catching. For example, the star fund manager Jiao Wei of Yinhua Fund will issue a new work Yinhua Fujiu Food and Beverage Selection A on August 18. Yao Zhipeng of Harvest Fund will also issue a partial-share hybrid fund with a one-year holding period tomorrow. . In addition, the famous Chinese fund’s Lin Jing and Tu Huanyu will jointly issue a partial-share hybrid fund, and Cheng Xi of the E Fund will continue to issue a new index fund next week. With so many new products worth looking forward to, the entire market is quite lively.

Next, we have sorted out the fund manager information of some new funds in detail, the situation of similar funds, and the recent performance of the performance comparison benchmark for your judgment.

Weekly market review

The performance of US stocks this week can be described in two words, that is, “repetition.” The Dow Jones Index rose 0.87% during the week and closed at 35515.38 points on Friday; the Nasdaq Composite Index closed at 14822.90 points on Friday, down 0.09% after a week of tug-of-war; the S&P 500 Index rose 0.71% on Friday It closed at 4468.00 points.

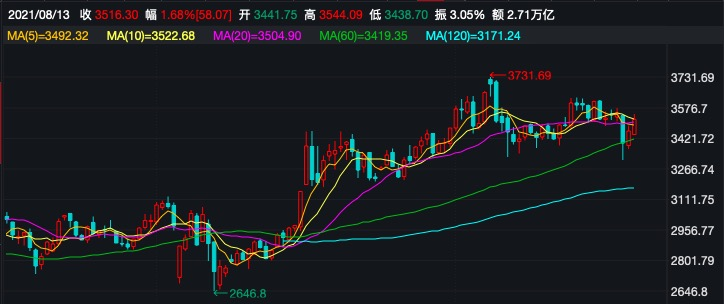

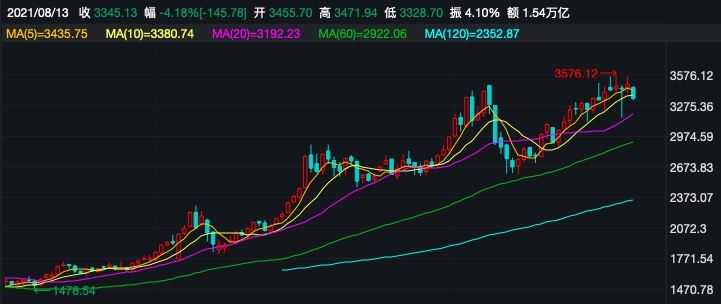

Let’s take a look at the A-share market. The A-share market performed well this week, but the differentiation of the three major indexes is still very obvious. The Shanghai Composite Index rose sharply for two consecutive weeks, almost regaining the previous “lost ground”. This week it continued to rise by 1.68% and closed at 3516.30 on Friday. In contrast, the Shenzhen Component Index rose first and then fell this week and closed on Friday. 14799.03 points, a slight decrease of 0.19% this week; the ChiNext index saw a sharp decline this week, falling 4.18% throughout the week, ending at 3345.13 points as of Friday’s close.

The cumulative net inflow of northbound funds this week was 1.276 billion yuan, of which the net inflow of Shanghai Stock Connect was 837 million yuan and the net inflow of Shenzhen Stock Connect was 439 million yuan.

39 new funds will be launched next week, and active equity funds will usher in a small peak of issuance

There are a total of 39 funds to be sold next week, which is a slight decrease from the 44 funds this week. However, the market’s enthusiasm for active equity funds can be said to be increasing.

Next Monday, a total of 20 partial stock hybrid funds, 3 common stock funds, 3 partial debt hybrid funds and 1 flexible allocation fund will be on the market. That is to say, a total of 27 active equity funds are issued, accounting for the total number. 69.23% of the total. Passive index funds dropped from 15 this week to 5, in addition to 2 short-term pure debt funds, 1 medium and long-term pure debt funds, and 1 secondary debt base issuance.

Entering August, star funds get together to release new works, and there will be no shortage of products from star fund managers next week. Yinhua Fund’s famous general Jiao Wei will release a new work Yinhua Fujiu Food and Beverage Selection A on August 18, with a subscription time of 14 days; Harvest Fund’s post-80s Mesozoic new fund manager Yao Zhipeng will start the release of Harvest Vision Pioneer One on August 16. Holds A each year and the subscription time is 12 days; Lin Jing, the star fund manager of China Asset Management, and Tu Huanyu, who has soared in popularity some time ago, will jointly issue a new fund China Times Frontier holds A for one year. From August 16th to 20th.

Next, look at the detailed list:

Below, we will take a detailed inventory of the fund manager information of some new funds, the number of similar funds (calculated separately for A and C shares) and their performance comparison benchmarks for you. It should be noted that when this article counts the past performance of fund managers, many fund managers default to the statistics of fund managers with the longest tenure.

Fund name: E Fund CSI Rare Earth Industry ETF

Fund type: passive index fund

Release time: August 18 (Wednesday)

Fund Manager: Cheng Xi

Number of funds of the same type: 1295

Main tracking subject: China Securities Rare Earth Industry Index Yield

Part of the past performance of fund managers:

Fund name: Harvest Vision Pioneer holds A for one year

Fund type: partial stock hybrid fund

Release time: August 16 (Monday)

Fund Manager: Yao Zhipeng

Number of funds of the same type: 2291

Main tracking subject: CSI 800 Index Yield*65%+ChinaBond Comprehensive Wealth Index Yield*20%+Hang Seng Index Yield*15%

Past performance of fund managers:

Fund name: Yinhua Fujiu Food and Beverage Selection A

Fund type: partial stock hybrid fund

Release time: August 18 (Wednesday)

Fund Manager: Jiao Wei

Number of funds of the same type: 2291

Main tracking subject: CSI Food and Beverage Index Yield*80%+ CSI Hong Kong Stock Connect Composite Index (RMB) Yield*10%+Commercial Bank RMB Current Deposit Interest Rate (After Tax)*10%

Past performance of fund managers:

Fund name: China Times Frontier holds A for one year

Fund type: partial stock hybrid fund

Release time: August 16 (Monday)

Fund Manager: Lin Jing, Tu Huanyu

Number of funds of the same type: 2291

Main tracking subject: CSI 800 Index Yield*60%+ CSI Hong Kong Stock Connect Composite Index Yield*20%+Shanghai Securities Treasury Bond Index Yield*20%

Past performance of fund managers:

Fund name: China Post Ruifeng Enhanced A

Fund type: hybrid bond secondary fund

Release time: August 16 (Monday)

Fund managers: Zhang Yue, Chen Liang

Number of funds of the same type: 714

Main tracking subject: ChinaBond Composite Full Price (Total Value) Index Yield*90%+Shanghai and Shenzhen 300 Index Yield*7%+Hang Seng Composite Index Yield*3%

Past performance of fund managers:

(Risk reminder: This article is for reference only and does not constitute a basis for buying and selling. Enter the market at your own risk.)