2021 and 2022 will likely be remembered as bad years for the bond market. The first quarter of 2022 saw drops ranging from -12% for emerging markets in hard currency, to -7% for high quality bonds and -10% for corporate bonds. This is the worst quarter on record for bond markets.

To destabilize the bond markets are the inflation data in the US and the Eurozone which continue to surprise on the upside. To contain inflation, the Fed and the ECB have decided on a significant tightening of their monetary policy. The inflation alarm is raging on the markets in a context made even more complicated by a war in Ukraine that shows no sign of ending. In the US, the Fed has already raised rates to 0.5% and the board expects another 2 or 3 hikes over the course of the year. In Europe, the situation is not too different with the institute led by Lagarde which did not rule out the cancellation of purchases in the third quarter and the start of the rise in interest rates. In this scenario, we try to analyze the trend of the main very long-term bonds in Europe and in the world, focusing on the Italian ones.

The Italian 50-year-old BTP

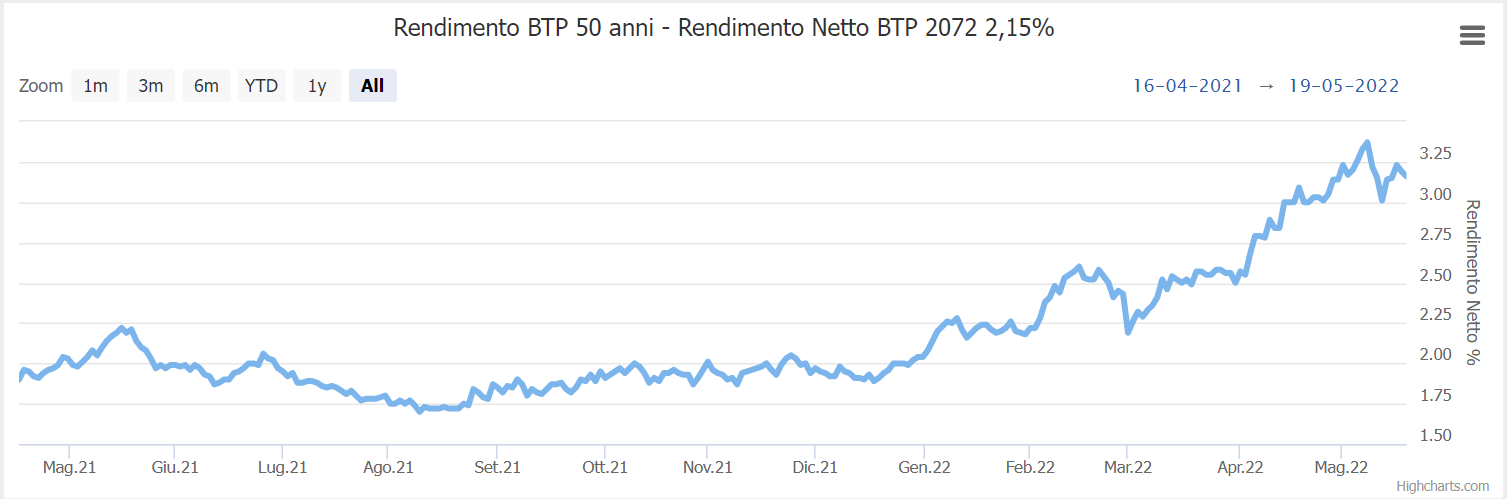

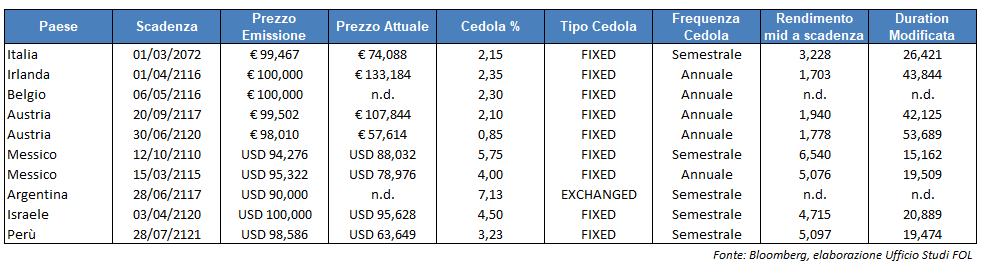

The longest-lived bond we have in Italy is the 50-year BTP which is now quoted at € 74.08 on Borsa Italiana’s Mercato Obbligazionario Telematico. As we know, this type of long-term bonds have fluctuations that are more marked than the classic 10-year bonds, this is because the longer-term sovereign bond is also the more sensitive to changes in market rates.

Specifically, the 50-year BTP (ISIN IT0005441883) has a maturity on 1 March 2072 and offers a semi-annual gross coupon of 2.15% and a net coupon of 2.54% with a net yield of 3.16%. This bond at the turn of February and March came to gain almost 11% and this jump was caused by the race for “safe assets” that occurred following the invasion of Russia in Ukraine. However, from there the scenario has changed again and again the trend has again reversed. In fact, if on the one hand the war pushes investors to prefer bonds to shares, on the other hand the conflict is causing sharp rises in the price of raw materials due to the impact on inflation rates in Europe that reached in March the record level of 7.5% yoy (in April it dropped slightly to 7.4% yoy). The BTP-Bund spread is in the 190 basis points area and from this point of view a rise above 200 would be very worrying.

The coupon of the 50-year BTP should not be underestimated in fact if we assume that in the next few years inflation will return to normal levels and closer to the ECB target of 2%, a net coupon of 2.54% would be very interesting because at least it would protect us from loss of purchasing power. The same net coupon, compared to the actual value of the investment, would allow us at least theoretically to cover ourselves both from inflation and from the 0.2% stamp duty applied to deposit accounts. However, before the pandemic, in periods of no specific tension on Italy, the 50-year BTP yielded around 3.5%.

And how is the situation in other countries?

Austria has two centenary bonds. Uno (ISIN: AT0000A1XML2) was issued in September 2017 and expires in September 2117. Currently this stock is quoted at € 107.84 and offers a gross annual coupon of 2.10%. The other bond (ISIN: AT0000A2HLC4) is more recent, in fact, it was placed on the market in June 2020 and will expire in June 2120. At the moment this bond has a current price of 57.61 euros and offers a lower gross annual coupon compared to the first being this of 0.85%.

Among other countries in the world it should be noted that, precisely to support the fight against Covid, two years ago Israel has issued its first 100-year bond, maturing April 3, 2120 with a 4.5% coupon (ISIN: US46513JB593) and denominated in US dollars for the amount of 1 billion. This bond, in addition to the country risk (Israel enjoys high ratings from international rating agencies: AA- for S&P, A + for Fitch and A1 for Moody’s) is exposed to the euro-dollar exchange rate risk.

Risks associated with centenary bonds

In conclusion, interest rates are likely to rise and bond prices will fall. That is until the next one is completed restrictive monetary cycle so it could take years. Meanwhile, long-dated securities will continue to pay the consequences more than others for the duration effect.

But let’s go in order. The prices and yields of longer-term bonds are more volatile than those of shorter-term bonds. This consideration is important and leads us to the definition of the so-called interest rate risk, that is linked to the change in the price of securities in response to changes in market interest rates.

The further away the maturity of a fixed rate security, the greater the sensitivity of the security’s price to a change in market interest rates. This sensitivity does not depend only on the residual life of a security, but also on the distribution over time of payments in the form of a periodic coupon (a security which, with the same residual life, has cash flows that are shorter over time due to coupons high, exposes it to a lesser extent to risk than a security with lower coupons or even without coupons).

A synthetic indicator to measure it is the average financial duration (the so-called “duration“), Ie the average life time of the payment flows relating to a specific security: it is the average of the maturities of the flows, weighted with the present value of the flows. Duration therefore makes it possible to measure the change in the price of a bond following the change in market interest rates. The use of duration in the management of a bond portfolio is essential, also because its sensitivity to any changes in interest rates can result in large losses. Suffice it to say that a growth of two percentage points can result in losses of the order of 40% on a 30-year government bond, let alone for a 100-year bond. Pending a rise in interest rates, for example, a bond investor can reduce the duration of his portfolio to reduce interest rate risk. Finally, to summarize, the duration of a bond lengthens as its maturity increases and shortens as the coupon rate and yield to maturity increase.