Original title: A-share “Research Gate”! Tumbled 20% in 3 days, the SSE ticket came

“Cheese Mao” who was trapped in the “meeting minutes door” was warned by supervision.

Last night, the Shanghai Stock Exchange’s website releasedMikolandoThe timely decision of Xie Yi, secretary of the board of directors, to give a supervisory warning, pointed outMikolandoFailed to strictly manage the content of business personnel’s inquiries and exchanges of information, leading to the company’s involvementPerformanceInformation was released through non-statutory information disclosure channels, and the information disclosure was unfair, and the company’s stock price fluctuated greatly during the period. In addition, the company failed to verify and clarify major media reports in a timely manner.

This morning,MikolandoIt fell 2.76% at the opening. As of press time, the stock price fell 0.82% to 64.31 yuan per share.

Failure to verify and clarify major media reports in a timely manner

Microcolumn and Secretary of the Board of Directors were given supervision and warning

On the evening of June 3rd, Myco Blue was also releasedannouncementAccording to the report, the Shanghai Stock Exchange made a supervisory warning on the company’s timely board secretary Xie Yi’s decision.

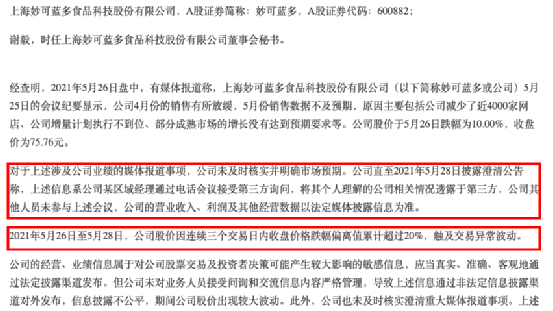

According to the announcement, it was found that on May 26, 2021, media reports said that the minutes of the May 25 meeting of Shanghai Miaocolanduo Food Technology Co., Ltd. showed that the company’s sales in April had slowed down. The sales data in May fell short of expectations, mainly due to the company’s reduction of nearly 4,000 online stores, inadequate implementation of the company’s incremental plan, and growth of some mature markets that did not meet the expected requirements. The company’s share price fell 10.00% on May 26, and the closing price was 75.76 yuan.

For the above-mentioned media reports involving the company’s performance, the company failed to verify and clarify market expectations in a timely manner.The company disclosed a clarification announcement until May 28, 2021, stating that the above information is that a regional manager of the company accepted a third-party inquiry through a conference call, and disclosed the company-related information that he personally understood to the third party. ofOperating income, Profits and other operating data are subject to information disclosed by the statutory media.

From May 26 to May 28, 2021, the company’s stock price deviated more than 20% from the closing price drop in three consecutive trading days, which touched abnormal trading fluctuations. The company’s business and performance information is sensitive information that may have a greater impact on the company’s stock trading and investors’ decision-making, and should be published truthfully, accurately, and objectively through statutory disclosure channels.

However, the company did not strictly manage the content of inquiries and exchanges of business personnel, resulting in the above-mentioned information being released through non-statutory information disclosure channels, and the information disclosure was unfair, and the company’s stock price fluctuated greatly during the period. In addition, the company failed to verify and clarify major media reports in a timely manner.

Stuck in the “meeting minutes gate” three days, the stock price plummeted 20%

Well-known public offering immediatelyResearch“Cheese Mao”

Due to the “meeting minutes”, on May 26, the company’s stock price fell to a limit, and fell by 2.34% and 9.46% respectively on the 27th and 28th, and the cumulative decline in the three trading days reached 20.42%. This has formed a huge gap with the stock’s record high of 84.5 yuan per share on May 25th.

In the morning of May 31, Myco Blue disclosed the record of investor relations activities. The company’s stock price ended its decline and rose 3.75% on the day.According to the announcement, on the afternoon of May 30th, Miao Kelan organized an eventAnalystAt the meeting, as many as 179 institutions participated in the conference, including Gao Yi Assets, China Investment Morgan, and Rui Yuanfund、Penghua Fund、InvescoMany well-known institutions such as Great Wall are listed, and there are many fund managers.

It is worth mentioning that the Xingquan Fund of Shigekura Myokolando also sent many people to the conference.At the end of the first quarter of this year, four funds of Xingquan Fund managed by well-known fund manager Dong Chengfei and others appeared in the top ten companiesshareholder.Two of the funds showed an increase in the number of shares held, and one (Xingquan Hefeng three-year holding periodHybrid fund) Is shown as a new entrant, and Ji Wenhua, who manages the new fund, also appeared on the research list.

“Hand in hand” Mengniu

Net profit in the first quarter increased by 215.60% year-on-year

In 2015, the predecessor of Microcolander, Guangze Dairy, was listed on the backdoor Hualian Mining. Since then, by placing Microcolander into a listed company, focusing on the cheese business, it has become the only A-share company in China with cheese as its core business. 2019 The company officially changed its name to “Miao Ke Lan Duo.”

Mycolando, which launched the core item of cheese sticks, quickly won the favor of the dairy giant Mengniu. After several hands-on cooperation, in mid-April this year, Mycolando announced that the company announced to Inner Mongolia.Mengniu Dairy(Group) Co., Ltd. (hereinafter referred to as “Mengniu”) fixed increase fundraising application was approved by the China Securities Regulatory Commission’s Issuance Examination Committee. Microcolumn plans to raise funds from Mengniu to no more than 3 billion yuan, and the latter will become the company’s controlling shareholder. After merging with Mengniu’s cheese business, Microcolon will directly surpass Baijifu to become the leader of the domestic cheese industry.

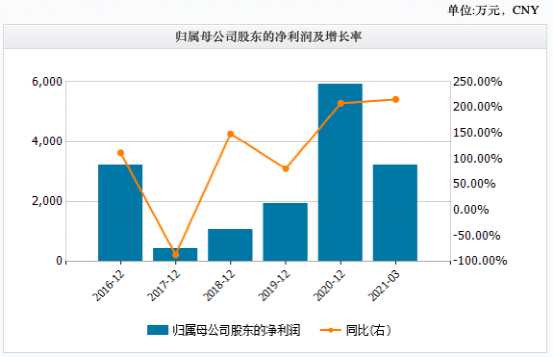

On April 29, Miracle Blue released its first quarter results announcement, stating that the revenue for the first quarter of 2021 will be approximately 951 million yuan, a year-on-year increase of 140.58%;Net profitAbout 32.03 million yuan, a year-on-year increase of 215.60%; basic earnings per share were 0.0775 yuan, a year-on-year increase of 212.50%.

Today cheese is regarded as an emerging blue ocean market for China’s dairy industry.China’s Cheese Industry Market Demand Prospects and Competitive Strategies from 2020 to 2026 issued by Zhiyan Consultingresearch report》Data shows: my country’s retail cheese terminal market in 2019 is about 6.55 billion yuan, with a compound growth rate of 22% from 2010 to 2019, and is expected to reach 11.2 billion yuan in 2024, with an average annual compound growth rate of 12% in 2020-2024.

(Source: China Fund News)

(Editor in charge: DF398)

Solemnly declare: The purpose of this information is to spread more information, and it has nothing to do with this stand.

.