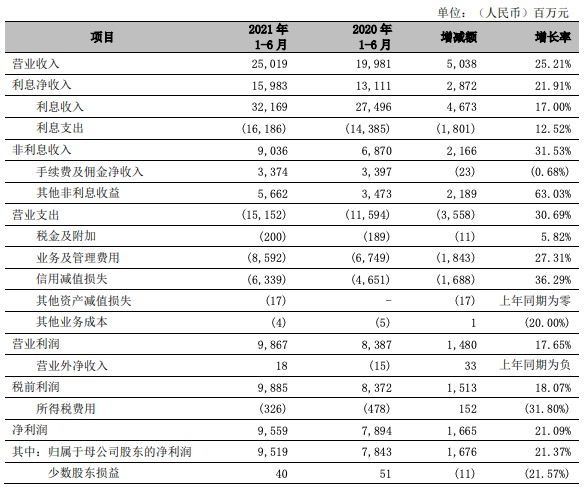

August 13,Bank of NingboRelease the 2021 semi-annual report, which is also listedBankThe first semi-annual report. In the first half of 2021,Bank of NingboRealize attribution to the parent companyshareholderofNet profit9.519 billion yuan, an increase of 21.37% year-on-year;Operating income25.019 billion yuan, an increase of 25.21% year-on-year; the non-performing loan ratio was 0.79%, the loan-to-appropriation ratio was 4.02%, and the provision coverage ratio was 510.13%.

In the first half of 2021,Bank of NingboRealized net interest income of 15.983 billion yuan, a year-on-year increase of 21.91%; realized non-interest income of 9.036 billion yuan, a year-on-year increase of 31.53%. The proportion of non-interest income increased by 1.74 percentage points year-on-year to 36.12%; the proportion of personal loans increased by 0.80 percentage points from the beginning of the year to 38.85%; the proportion of demand deposits increased by 1.25 percentage points from the beginning of the year to 46.20%.

As of the end of June 2021, NingboBankTotal deposits amounted to RMB1,043,795 million, an increase of RMB118,621 million or 12.82% over the beginning of the year; deposits accounted for 61.24% of total liabilities. The balance of corporate deposits was 819,221 million yuan, an increase of 13.18% over the beginning of the year; the balance of private deposits was 224.574 billion yuan, an increase of 11.52% over the beginning of the year.

As of the end of June 2021, NingboBankThe total amount of corporate loans was 424.44 billion yuan, an increase of 14.64% over the beginning of the year. The total amount of personal loans was 309.156 billion yuan, accounting for 38.85% of the total loans and advances, an increase of 0.80 percentage points from the beginning of the year. The total amount of personal consumption loans was 198.424 billion yuan, an increase of 20.046 billion yuan over the beginning of the year.

In the first half of 2021, Ningbo Bank’s business and management expenses were 8.592 billion yuan, a year-on-year increase of 27.31%, mainly due to the large increase in two aspects. One is that the company has continued to grow its workforce in order to strengthen the implementation of the large retail strategy, and staff costs have increased rapidly; The second is to strengthen technological empowerment, the company has increased technological R&D and strategic investment in digital and online operations.

In the first half of 2021, Bank of Ningbo accrued a total of 6.356 billion yuan in credit and asset impairment losses, a year-on-year increase of 1.705 billion yuan. Loan impairment losses are the largest component of company credit and asset impairment losses. In the first half of 2021, the company accrued loan impairment losses of 4.532 billion yuan, a year-on-year increase of 696 million yuan, mainly due to the company’s continued increase in support for the real economy, the promotion of loan scale growth and the increase in macro-prudential supplementary provisions.

In the first half of 2021, the cash generated by Ningbo Bank’s operating activitiesNet inflow6.332 billion yuan. Among them, cash inflow was 169.394 billion yuan, a year-on-year decrease of 69.519 billion yuan, mainly due to a decrease in inter-bank deposits; cash outflows were 163.06 billion yuan, an increase of 23.027 billion yuan year-on-year, mainly due to the increase in financial asset investment outflows for customer loans and transactions. The net cash outflow from investment activities was 69.772 billion yuan.Among them, cash inflow was 676.350 billion yuan, an increase of 181.531 billion yuan year-on-year; cash outflow was 746.122 billion yuan, an increase of 185.822 billion yuan year-on-year.Precious metalsThe scale of investment increased. The net cash inflow from financing activities was 60.89 billion yuan. Among them, cash inflow was 260,223 million yuan, an increase of 141,045 million yuan year-on-year, mainly due to an increase in the issuance of interbank certificates of deposit; cash outflows were 199.333 billion yuan, an increase of 40.745 billion yuan year-on-year, mainly due to the increase in debt repayment funds in the current period.

In terms of customers, as of the end of June 2021, Bank of Ningbo had 374,000 basic retail customers, an increase of 16,000 from the beginning of the year; investment banking basic customers reached 1,730; custody customers reached 615; foreign exchange transactions basic customers reached 18,044; Wealth 7.07 million customers, an increase of 690,000 from the beginning of the year; 11,209 private banking customers, an increase of 3,592 from the beginning of the year; as of the end of June 2021, new credit cardsAdditional issuanceThere were 410,000 cards and a total of 3.33 million cards were issued.

In terms of electronic channels, as of the end of June 2021, the number of Bank of Ningbo APP customers was 5.3473 million, an increase of 18.04% over the end of the previous year; the number of APP monthly active customers was 2.5534 million, an increase of 11.5% over the end of the previous year. During the reporting period, the company’s corporate electronic channel transactions totaled 12.8 million, a year-on-year increase of 37%, and the transaction value was 8,309.6 billion yuan, a year-on-year increase of 20%; the company’s corporate electronic channel customers numbered 386,300, a year-on-year increase of 20%. As of the end of the reporting period, the number of WeChat Bank customers was 1.86 million, a year-on-year increase of 44%.

As of the end of June 2021, the total non-performing loans of Bank of Ningbo were 6.272 billion yuan, an increase of 816 million yuan from the beginning of the year, and the non-performing loan ratio was 0.79%. Non-performing loans are mainly concentrated in manufacturing,real estateThe non-performing loans of the industry and the commercial trade industry were 1.157 billion yuan, 537 million yuan, and 518 million yuan, accounting for 18.45%, 8.56%, and 8.26% of the bank’s total non-performing loans. The non-performing rates were 0.96%, 1.48%, and 8.26%, respectively. 0.68%.

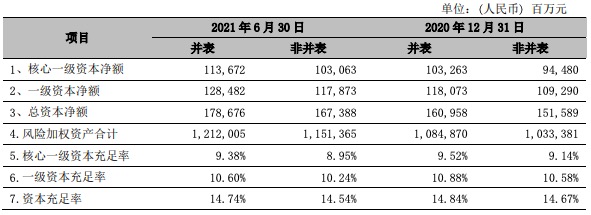

As of the end of June 2021, the capital adequacy ratio of Bank of Ningbo was 14.74%, the tier one capital adequacy ratio was 10.60%, and the core tier one capital adequacy ratio was 9.38%; the capital adequacy ratio at the beginning of the year was 14.84%, and the tier one capital adequacy ratio was 10.88%. , The core tier 1 capital adequacy ratio was 9.52%, a decrease compared with the beginning of the year.

Bank of Ningbo stated that in response to the new normal of “strong supervision”, the company will closely follow the progress of international capital regulatory reforms, strengthen research, prediction, and monitoring capabilities, and raise capital sources through multiple channels to ensure stable business development.The company plans to passAllotmentThe raised funds do not exceed 12 billion yuan to supplement core Tier 1 capital. On the other hand, the company will continue to implement the strategic transformation of light banking, accelerate the pace and intensity of retail banking transformation, integrate the concept of capital conservation into all aspects of operation and management, continue to optimize the efficiency of capital allocation, and strive to achieve endogenous capital in the near future increase.

(Source: CDC Finance)

.