The battery sector will continue to be booming over the next few decades due to the green transformation and spread of electric vehicles. It can be read in the report by Peter Garnry, Head of Equity Strategy per BG Saxo, in which he examines and analyzes an equity-themed portfolio with a focus on the battery sector. It is a difficult portfolio to create as it is difficult to find “pure” operators, but it is also difficult to understand if focus on mining titles and to what extent.

The composition of the portfolio

BG Saxo’s portfolio with exposure to the battery sector has 30 stocks across most of the value chain: companies that collect lithium, graphite and nickel, manufacturers of batteries (both for electric vehicles, bicycles and consumer electronics), charging networks for electric vehicles and large battery systems for energy storage. The 30 shares represent 523 billion dollars of market value and, although analysts are generally very optimistic about battery-related companies (see table), the sector in general only experienced 7% growth in 2020 and earnings came under pressure. But as we know, writes BG Saxo, actions reflect the future and not the problems of the past.

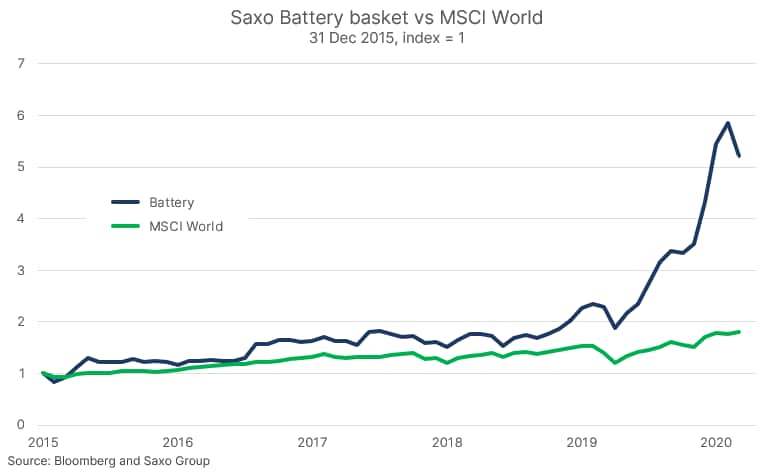

BG Saxo’s battery portfolio had a tough 2021, down 11%. Performance was strongly correlated by the “green transformation” portfolio, the report reads, but over time BG Saxo expects the two baskets to reflect different trends. The battery wallet has increased 422% since December 2015 in terms of total return, beating the MSCI World. But as we all know, the long-term performance chart should be taken with a grain of salt because past performance is not an indicator of future performance.

The bet on the battery sector

It is expected that the global lithium-ion battery market will reach $ 92 billion in 2025, driven by the adoption of electric vehicles and to a lesser extent by energy storage. As noted in BG Saxo’s research note, Bloomberg New Energy Finance estimates that a lithium-ion battery pack that cost around $ 156 / kWh in 2019 will drop to $ 94 / kWh in 2024 and $ 62 / kWh in 2030, definitely relaunching the ‘adoption of large-scale electric vehicles. The main bet on the battery industry is a bet on electric vehicles, consumer electronics, electric bicycles, and possibly semi-trailers. For larger and heavier transports, batteries may not be as good as hydrogen-powered fuel cells.

According to BG Saxo, the biggest “pure” operator on batteries is the Chinese manufacturer Contemporary Amperex Technology (CATL), with a market value of $ 103 billion, but the stock is unfortunately listed on the ChiNext tab of the Shenzhen Stock Exchange and therefore only accessible to professional investors. This company was recently chosen to be the preferred battery supplier for both Tesla and Volkswagen, and therefore appears to have a strong outlook. Another noteworthy company is QuantumScape, which deals with solid-state batteries that have the potential to hold more energy and recharge faster, and therefore plays on the evolution of lithium-ion battery technology.

Hydrogen versus batteries

The rise of renewable energies will continue over the next three decades and this will create a challenge for intermittent generation of energy. According to BG Saxo, this energy must be stored or wasted and this will create a huge market for energy storage on a much larger scale than batteries used for light transport or consumer electronics. Consequently a very interesting title is represented byDutch company Alfen, a very active company in this emerging sector.

In addition to the batteries, we read in the report, too hydrogen has been proposed as an alternative for energy storage. Some studies suggest that the energy stored on invested ratio (ESOI) index is better for a regenerative hydrogen fuel cell due to lower production costs than batteries; but it is also claimed that lithium-ion batteries have better round-trip efficiency and therefore, at the moment, are the best alternative. It is possible that both hydrogen and batteries are used for energy storage depending on the application.

There is no shortage of risks

The main risk for BG Saxo’s portfolio is theobsolescence of lithium-ion batteries in favor of solid-state ones. This, in fact, would entail a huge price risk for lithium-ion producers, including the largest operator CATL. According to BG Saxo, less government support for the adoption of electric vehicles could then slow growth rates more than is currently valued in the share price. The portfolio is valued at 24.5 times on EV / EBITDA which is a high premium (double the global stock market), which means it is still more exposed to growth setbacks or higher interest rates. Even the growing tensions between the United States and China they could impact equity valuations and growth opportunities for many of the Chinese manufacturers, representing a negative impact. These are the main sources of risk for this portfolio concludes BG Saxo.