Since March, the market has experienced major adjustments. The Shanghai Composite Index once fell below 3,100 points on March 16, down 17.21% from its high in early January. The Shenzhen Component Index and ChiNext Index also fell 24.16% and 26.49% from their highs at the beginning of the year, respectively.

However, the market conditions have improved a few days ago. Since March 17, the Shanghai Composite Index has been hovering above 3200 points, and the cumulative decline of the Shenzhen Component Index and ChiNext Index has also narrowed.

Under the major adjustment of the market, the balance of margin financing and securities lending also showed a downward trend of fluctuation. Compared with the balance of financing and securities lending in Shanghai and Shenzhen, which was 1.73 trillion yuan at the end of February, Wind data showed that as of March 24, margin financing and securities lending in Shanghai and Shenzhen stock exchanges. The balance was 1,684.925 billion yuan, of which the financing balance was 1,591.278 billion yuan and the securities lending balance was 93.647 billion yuan. Since March 18, the balance of margin financing and securities lending has continued to stabilize at 1.68 trillion yuan, of which the financing balance has stabilized at 1.59 trillion yuan for 4 consecutive days.

The interest rate of securities companies’ two financings has dropped, and the behavior of employees is compliance-oriented

Behind the stabilization of the two financial data, the market behavior of institutions has also changed. Some brokerage practitioners told Shell Finance reporters that with the change of market conditions and the drop in account opening rates, the number of customers who have opened accounts for financing at their own brokerage firms has increased recently. “In the current market environment, securities companies are promoting the opening of two financing accounts and expanding the two financing business. We are looking for customers who meet the two financing requirements one by one, contact each other and invite them to open two financing accounts.”

It is worth mentioning that under strict supervision, institutional behavior is also more compliant, and the words of brokerage practitioners have been adjusted compared to the past. The above-mentioned personnel said that inflammatory remarks such as “it’s time to buy the bottom” are not in line with the norm. Moreover, when inviting customers, it is also recommended to open the authority for margin financing and securities lending at present, which is convenient for future use.

In addition, brokerage practitioners should also give customers certain risk warnings, such as, “It is difficult to tell the current market state… In the process of market movement, the lower the risk, the higher the premium. Understand, adjust positions reasonably, and maintain continuous participation in the later period. Opening a two-finance account now can lock in low rates.”

There are also brokerage practitioners reminding that the two financing accounts are only an authority, and participants in the two financing transactions should pay attention to risks. For example, if the ratio is lower than the maintenance guarantee ratio, it will trigger the requirement of forced liquidation.

Shell Finance reporters also learned that the official interest rate of the two financing is basically about 8%. At present, many securities companies have lowered the interest rate of the two financing a lot compared to the past, and some securities companies have reduced it to about 5%. A practitioner from a small and medium-sized brokerage told Shell Finance reporter that the interest rate of the ordinary two-finance account (usually the financing interest rate) of his brokerage firm is 7.2%, and those with a large amount of funds can apply for a lower interest rate.

In addition, the Shell Finance reporter also learned from a staff member who is engaged in opening multiple brokerage accounts that the two financing rates of Chuancai Securities and CITIC Securities are as low as 5.99% and 5.50% respectively; Galaxy Securities, Cathay Pacific Securities, Guosheng Securities, Haitong Securities The two-financing interest rate is around 6%, of which Haitong Securities is the highest, and the two-financing interest rate starts at 6.8%.

Under the market adjustment, what are financiers buying and selling?

When the market is undergoing major adjustments, the changes in the financial data and the behavior of financing customers have attracted much attention. So, which stocks were sold? Which stocks are the most popular?

Wind data shows that from the industry perspective, according to the Shenwan industry classification, since March, the net purchase of leisure service financing has reached 519 million yuan. The net purchase amount of financing is more than 100 million yuan, and the net purchase amount of communication and crude drug biological financing is also positive.

And 21 industries led by non-ferrous metals, electronics, chemicals, defense and military industries and other industries have net sales of financing. Among them, the net purchases of the top three financing were -6.344 billion yuan, -5.792 billion yuan and -4.693 billion yuan respectively. The net purchases of real estate and food and beverage industries that the market is concerned about are -966 million yuan and -151 million yuan respectively.

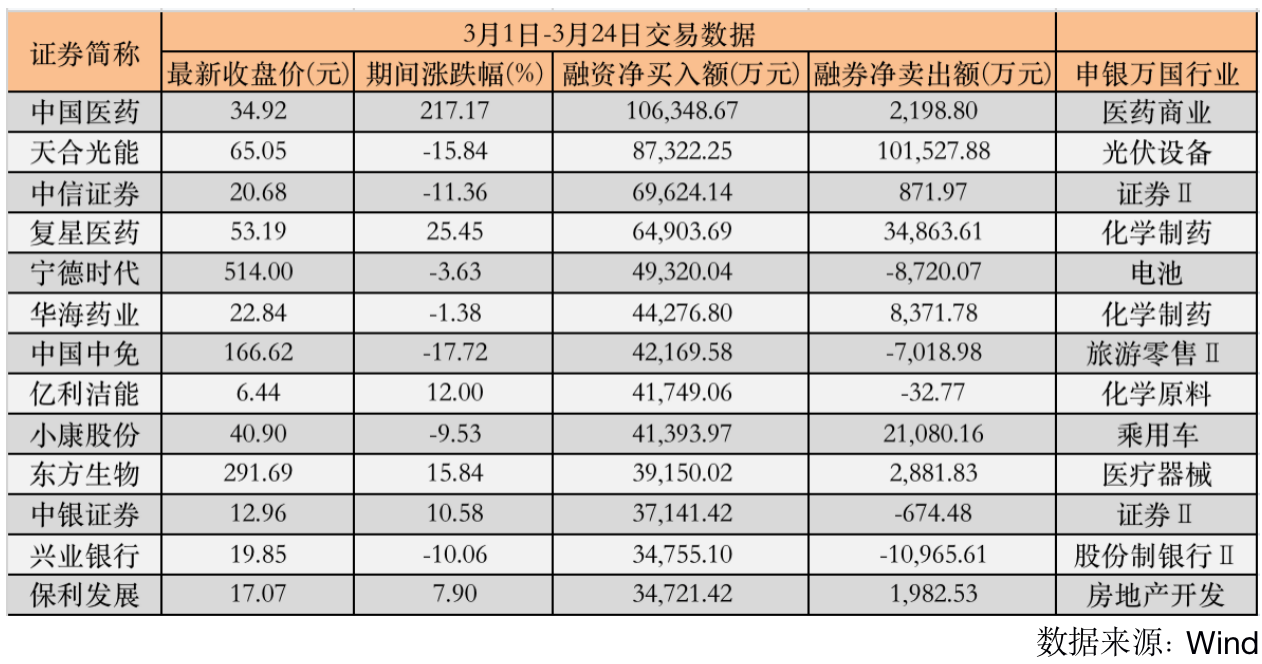

From the perspective of individual bond transactions, from March 1 to March 24, 861 individual stocks received net purchases by financing customers (only in terms of financing), but only 87 individual stocks had net purchases of more than 100 million yuan during the period. Among them, Sinopharm is the most favored by financing customers, with a cumulative net purchase of 1.063 billion yuan, Trina Solar ranked second with a net purchase of 873 million yuan, followed by CITIC Securities and Fosun Pharma , the cumulative net purchase of financing exceeded 600 million yuan, and the net purchase of financing of CATL during this period was also close to 500 million yuan.

During the period from March 1st to March 24th, only from the perspective of financing, 1434 stocks were sold by financing customers. Among them, Northern Rare Earth and Huayou Cobalt were the main sales force of financing customers, and the cumulative net sales exceeded 1 billion. Yuan. AVIC XAC, China State Construction, Shi Dashenghua, Oriental Fortune, Shaanxi Coal Industry, LONGi Co., Ltd., Shanxi Fenjiu, Zhonghuan Co., Ltd., and Xinhecheng have accumulated net sales of over 500 million yuan.

Beijing News Shell Finance reporter Hu Meng editor Song Yuting proofreading Liu Baoqing Return to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.