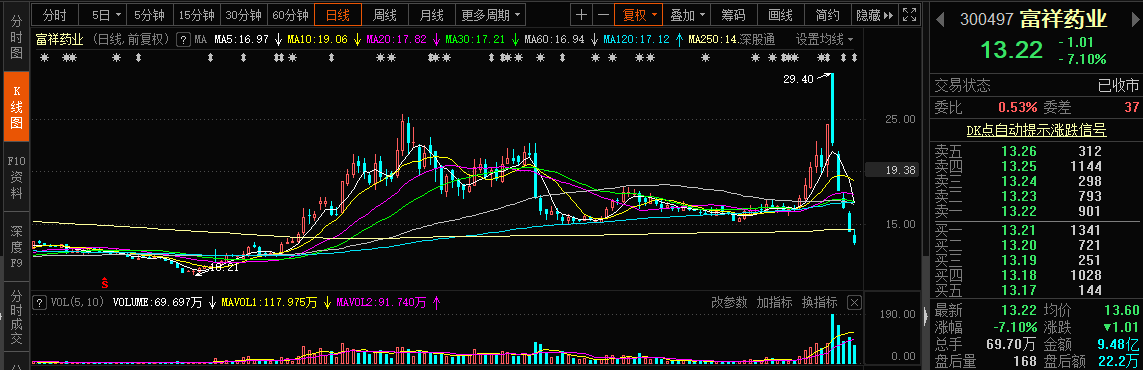

In just 5 trading days, the stock price fell by more than 50%.Fuxiang PharmaceuticalIt can be called a “nightmare” for investors in 2022.

Shares fell in half for 5 consecutive days

29.4 yuan has temporarily becomeFuxiang PharmaceuticalHigh for 2022, after peaking, the stock continued to tumble in subsequent sessions,In just 5 trading days, the stock fell more than 55%, as of today’s close,Fuxiang PharmaceuticalShares hit a five-month low.

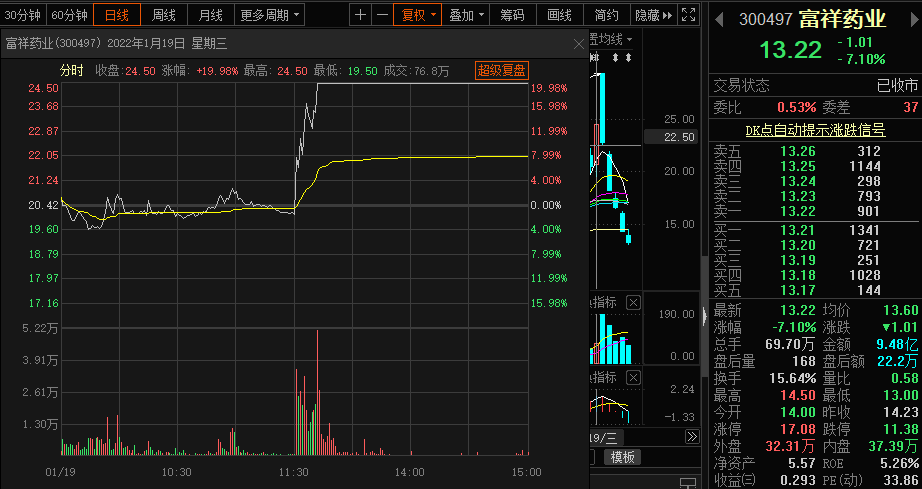

The A-type trend of the stock price made many investors call the “reversal” too fast. Just the day before the stock price hit a record high, Fuxiang Pharmaceutical had a strong daily limit, and the day after the daily limit, it used a one-word daily limit. The “posture” of the stock price opened, and it was this strong opening that laid the root of the “collapse” of the stock price.

January 20,Fuxiang Pharmaceutical opened the market at the daily limit on the previous day, and the auction sold 339 million yuan., the rush to raise funds is still fierce. But the 20% increase is an “instant” profit even for investors who made the board the day before. The huge profit-making funds fled after the opening, but the relay funds were insufficient. After Fuxiang Pharmaceutical exploded, the stock price fell gradually.The whole day opened high and moved low, and finally fell 7%, and the transaction amount also set a historical record of 5 billion yuan。

It is also worth mentioning that the collapse of Fuxiang Pharmaceutical’s share price is also a microcosm of the trend of “anti-epidemic concept stocks”. Whether it is new crown testing or new crown drug concept stocks, since January 20, the decline has been quite tragic. In addition, the recent performance of the entire broader market is also quite sluggish, which means that the market has little chance for the stock to “save itself”.

Big bosses fail, retail investors lose money

The stock price has rolled down from the historical high price of 29.4 yuan, and Fuxiang Pharmaceutical is a “nightmare” for the investors involved. Even for investors trying to hunt for the bottom, Fuxiang Pharmaceutical’s 5-straight downtrend did not give people a chance to “make money” and leave the market.In the process of this round of sell-off, both bigwigs and retail investors have lost a lot of money。

On January 20 and January 21, Fuxiang Pharmaceutical twice boarded theDragon Tiger List, Combined with the data of the two dragon and tiger rankings, we can clearly see the tragic “return of the big man”. January 20, ShengangsecuritiesThe Zhejiang branch spent 113 million yuan to buy the stock, ranking first on the Dragon Tiger list at that time. In addition, CaixinsecuritiesHangzhou West Lake International Trade Center Sales Department,Everbright SecuritiesNingbo South Jiefang Road Sales Department and other well-known sales departments have spent tens of millions to buy the stock.

However, the stock almost closed the “enema” trend that day, which means that almost all investors who bought the stock on that day lost money, and the gap opened the next day, no matter how low the price was the previous day. Investors who entered can not escape the fate of being “smothered”, ShengangsecuritiesNaturally, the Zhejiang branch was not spared.

On January 21, Fuxiang Pharmaceutical once again appeared on the Dragon and Tiger List. The data showed that the Zhejiang Branch of Shengang Securities, which had a net purchase of 113 million in the stock the previous day, only sold 76 million yuan, which means that,In the two trading days, the Zhejiang branch of Shengang Securities lost as much as 37 million yuan, and the loss ratio reached nearly 33%.

It is worth mentioning that retail investors are the biggest victims in this “car accident scene”. According to the data disclosed by the Shenzhen Stock Exchange,From January 20 to January 26, Fuxiang Pharmaceutical fell by 46% accumulatively. During the period of serious and abnormal decline, natural persons bought a total of 10.157 billion yuan, accounting for 86.59%.; Among them, small and medium investors bought a total of 4.994 billion yuan, accounting for 42.57%. Institutions bought a total of 1.305 billion yuan, accounting for 11.12%.

(Article source: Financial Associated Press)