China.com Finance News November 3 A few days ago, Zhejiang Caidie Industrial Co., Ltd. (hereinafter referred to as “Color Butterfly Industrial”) disclosed the prospectus (declaration draft). This public issuance of 29 million new shares, accounting for 25% of the total share capital after the issuance. %, the shareholders of the company do not publicly offer shares during this issuance. After this stock issuance, it is planned to be listed on the main board of the Shanghai Stock Exchange. Guosen Securities is the sponsor and plans to raise 583 million yuan. Previously, Caidie Industrial was listed on the Innovation Board of Zhejiang Equity Exchange Center on October 18, 2013 and terminated on November 18, 2019.

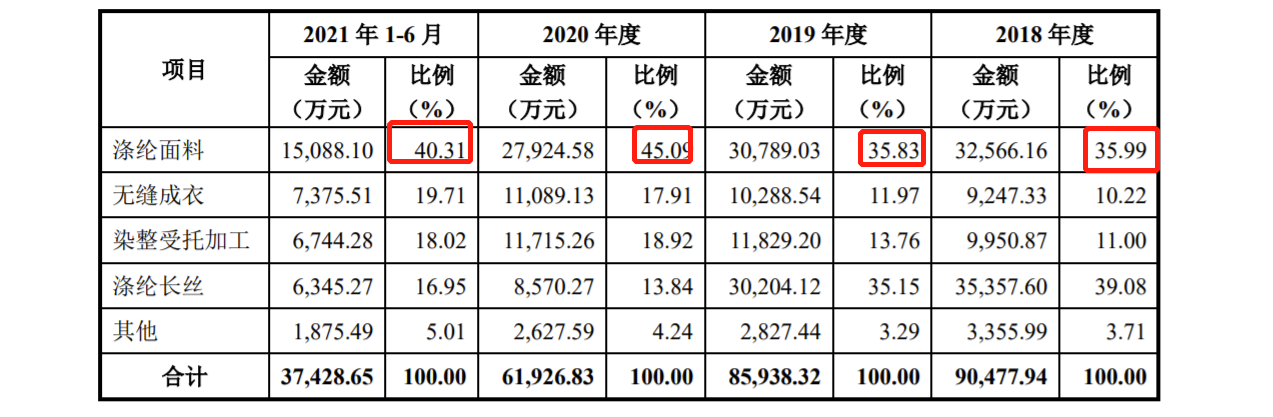

Caidie Industry was established on December 5, 2002, dedicated to the research and development, production and sales of polyester fabrics, seamless garments and polyester filaments, as well as entrusted processing of dyeing and finishing. The main products are polyester fabrics, seamless garments and polyester filaments. The downstream industries are mainly clothing, home textile manufacturing and other related industries. The main services are entrusted processing of dyeing and finishing.

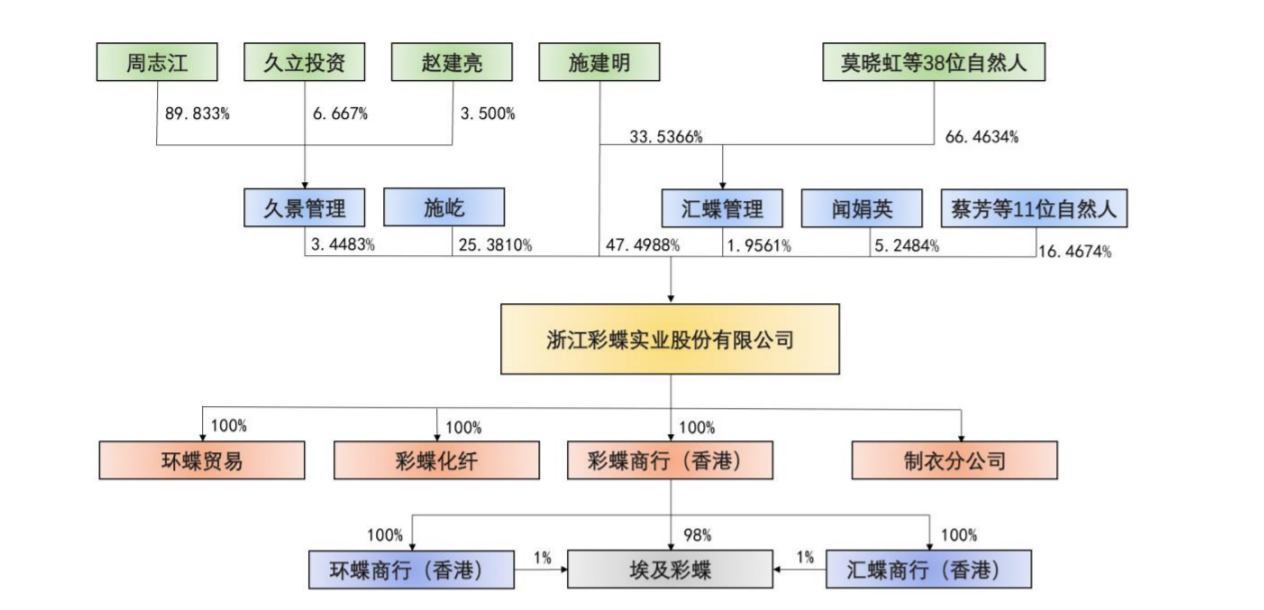

In terms of shareholding structure, the actual controllers of Caidie Industrial are Shi Jianming and Shi Yi, and the two are in a father-son relationship. The two directly and indirectly control 74.8359% of the company’s shares before the issuance.

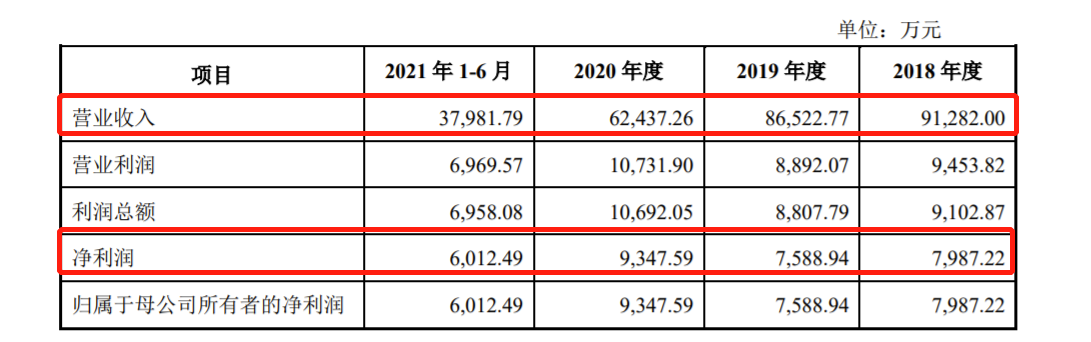

In terms of financial data, according to the prospectus, Caidie Industry achieved revenues of 913 million yuan, 865 million yuan, 624 million yuan, and 380 million yuan from January to June 2018-2021 (hereinafter referred to as the reporting period). . The net profit for the same period was RMB 79,872,200, RMB 75,889,400, RMB 93,475,900, and RMB 60,124,900 respectively. It is worth noting that the revenue in 2020 has dropped by 27.84% compared with the previous year. Caidie Industrial explained that the main reason is that the market price of polyester filaments will drop more in 2020, which has greatly reduced the production and sales scale of polyester filaments.

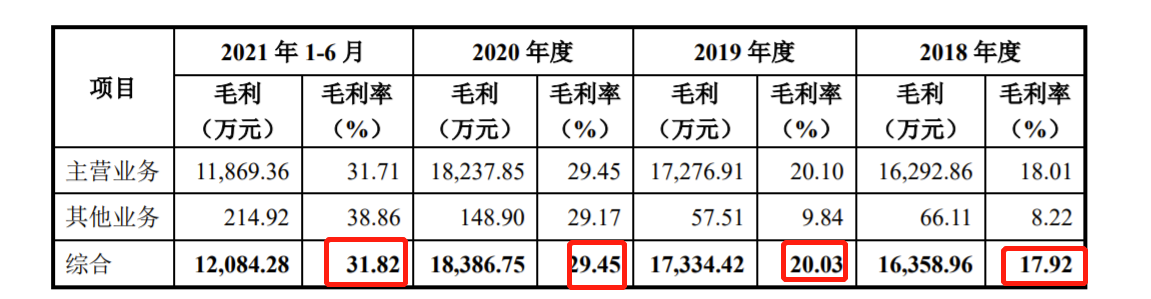

During the reporting period, Caidie Industrial’s comprehensive gross profit margin was 17.92%, 20.03%, 29.45%, and 31.82%, respectively. The gross profit margin of other businesses will increase significantly in 2020. Caidie Industry explained that it is mainly because the company leased out temporary idle land and workshops corresponding to the investment projects that it intends to use to raise funds.

In addition, Caidie Industrial’s main business income was 905 million yuan, 859 million yuan, 619 million yuan and 374 million yuan, and the main business gross profit margin was 18.01%, 20.10%, 28.26% and 30.58%, respectively. Among them, the sales revenue of polyester fabrics during the reporting period and the proportion of the main business revenue were 35.99%, 35.83%, 45.09%, and 40.31%, respectively.

In terms of risk warning, Caidie Industry has pointed out in the prospectus the risk of the impact of the dual energy consumption control policy and the increase in power costs. From October 2021, Caidie Industrial’s polyester filament production will be affected by power restrictions, and the daily output will be greater. The decrease range is 50%-60%; if the subsequent company’s annual energy consumption exceeds the benchmark energy consumption, or the energy consumption per unit product exceeds the energy consumption limit standard, or the market transaction electricity price rises higher, the company will face an increase in the unit price of electricity and production The risk of rising costs and declining profitability.

In addition, at the end of the reporting period, the asset-liability ratios of Caidie Industrial were 53.73%, 40.89%, 42.24% and 42.63%, current ratios were 1.11, 1.29, 1.27 and 1.15, and quick ratios were 0.62, 0.76, 0.72 and 0.72 respectively. 0.71, the asset-liability ratio is high, the current ratio and the quick ratio are low, and there is a risk of insufficient short-term debt solvency.

In addition, Caidie Industrial’s export products are mainly exported to the United States, South America, Southeast Asia, Europe and other regions. During the reporting period, revenues were 341 million yuan, 338 million yuan, 306 million yuan, and 167 million yuan, respectively, accounting for the proportion of main business revenues. They were 37.70%, 39.38%, 49.45% and 44.64%. If the new crown pneumonia epidemic in the future worsens or is difficult to effectively suppress in a short time, it will have an impact on the company’s sales and may cause the company’s operating results to be adversely affected.

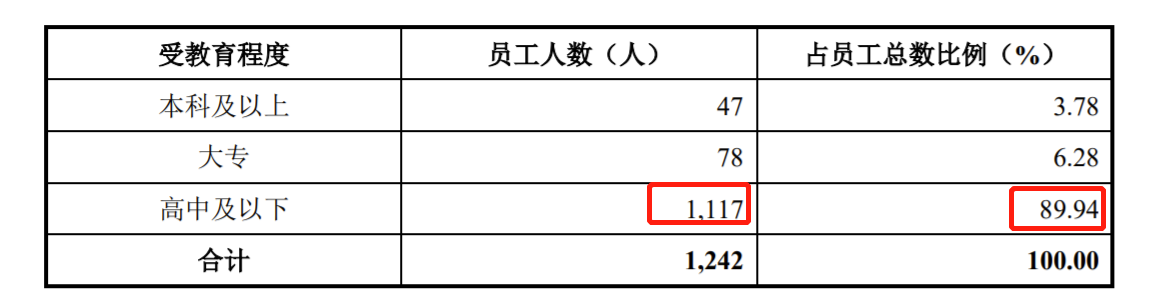

In terms of employees’ education level, there are 1,117 people at Caidie Industrial High School and below, accounting for 89.94%. There are only 47 people with bachelor degree and above. The overall education level is low.

In addition, the prospectus indicated that Caidie Industry had accepted falsely-issued special value-added tax invoices and paid up to 43,090.97 yuan in tax and late fees. In addition, it had accepted falsely-issued ordinary value-added tax invoices and paid a total of 1,520.32 yuan in corporate income tax and late fees.

1. Accept false VAT invoices

On March 2, 2021, the Inspection Bureau of Changzhou Taxation Bureau of the State Administration of Taxation issued the “Verified False Issuance Notice”, confirming that Changzhou Taijia Logistics Co., Ltd. issued 4 VAT special tickets to the issuer on March 13, 2018 The invoice was a false invoice, and the total amount of the invoice involved was 294,715.20 yuan, of which 29,206 yuan was tax.According to the statement issued by the issuer to the State Administration of Taxation Huzhou Nanxun District Taxation Bureau and the State Administration of Taxation Huzhou Nanxun District Taxation Bureau issued the “About<国家税务总局常州市税务局稽查局税收违法案件协查函>“Description of the situation”, the issuer actually received two special value-added tax invoices from the other party and performed corresponding accounting treatments. The total invoice amount was 147,357.60 yuan. The other two special VAT invoices were not received by the issuer and the account was not processed. In March 2021, the issuer paid a total of 43,090.97 yuan in tax and late fees for the two falsely-issued special value-added invoices.

2. Accept false ordinary VAT invoices

From September to November 2017, the issuer entrusted the freight company of the deliveryman Du Zeyuan to deliver the goods, and the total transportation fee was 7,860 yuan. Du Zeyuan submitted to the issuer an ordinary value-added tax invoice for transportation fees issued by Shenzhen Qiaoke Transportation Co., Ltd. The invoice amount was 7,860 yuan, of which the tax was 228.93 yuan. The issuer paid the transportation fee in December 2017 and processed the aforementioned invoices accordingly. In November 2020, the issuer received a notice from the local tax authority confirming that the invoice was a false invoice. The issuer paid a total of 1,520.32 corporate income tax and late payment fees for the false invoice on November 6, 2020. Yuan.

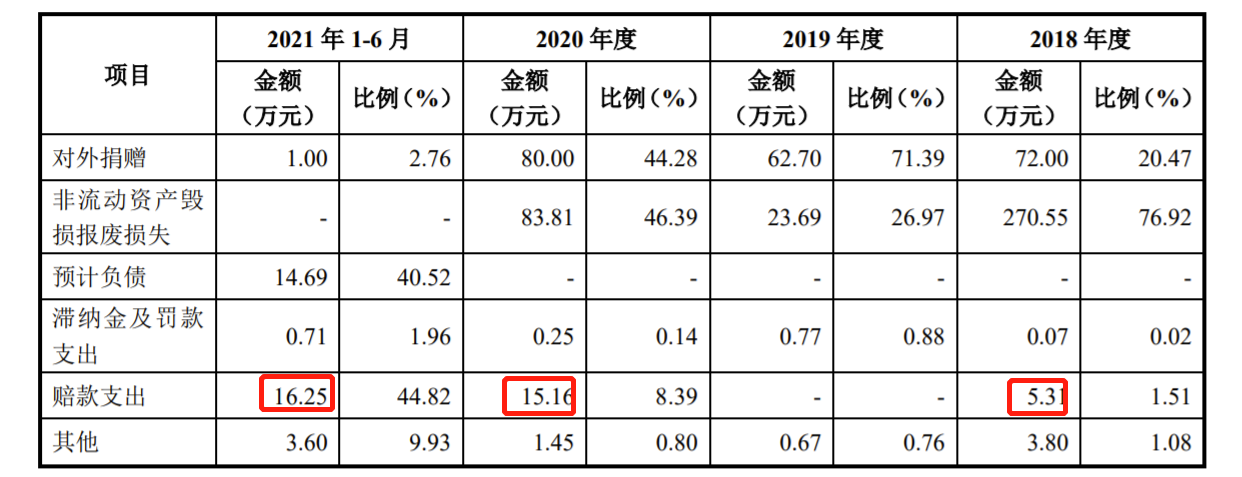

A total of 367,200 compensation expenditures in the past

In addition, in terms of non-operating expenses, CDC Finance found that Caidie Industrial’s compensation expenses in 2018 were 53,100 yuan. The compensation expenditure from 2020 to the first half of 2021 will be 151,600 yuan and 162,500 yuan respectively. Compensation expenditure was the highest in the first half of this year. However, Caidie Industry did not specify the details of the compensation expenses in the prospectus.

Involved in product quality dispute litigation, 300,000 bank deposits on the book were frozen

The prospectus disclosed a case involving product quality disputes. On October 9, 2020, Caidie Industry and Haojili Company signed a contract. According to the contract, Caidie Industry sold fabric products to Haojili Company. Due to product quality disputes, on May 25, 2021, Haojili Company filed a lawsuit with Haining City People’s Court in Zhejiang Province, requesting the cancellation of the contract signed by both parties on October 9, 2020, and requiring the company to double the payment The deposit was 164,800.00 yuan, the overpayment of 52,608.28 yuan was returned, and the sub-cloth payment was 64,455.34 yuan, totaling 281,863.62 yuan. According to the civil ruling issued by the People’s Court of Haining City, Zhejiang Province on June 2, 2021, Caidie Industrial’s book value of RMB 300,000.00 in bank deposits was frozen. As of the signing date of this prospectus, the case is still under trial.

The father and son are the actual controllers, and CDC Finance will continue to pay attention to whether Caidie Industry, which has a sharp decline in revenue of 27.84% in 2020, can be successfully listed!

(Editor in charge: Han Yijia)