【Caixin】The tightening of epidemic prevention and control measures has significantly more disrupted the service industry than the manufacturing industry. In November, the service industry’s prosperity declined further in the contraction range.

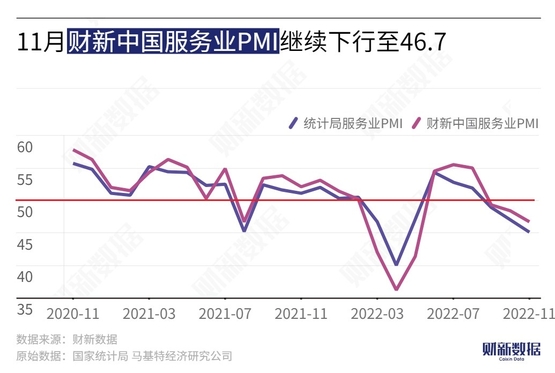

The November Caixin China General Service Industry Business Activity Index (Service PMI) released on December 5 recorded 46.7, down 1.7 percentage points from October, below the critical point for three consecutive months, and a new low since June.

The previously announced Caixin China manufacturing PMI in November rebounded by 0.2 percentage points to 49.4, continuing the contraction since August; mainly dragged down by the weakening of the service industry, Caixin China’s composite PMI fell by 1.3 percentage points to 47.0 in November. to the lowest since June.

The trend of Caixin China’s manufacturing PMI is not consistent with the manufacturing PMI of the National Bureau of Statistics, while the trend of the service industry PMI and comprehensive PMI is the same as that of the National Bureau of Statistics. Previously, the National Bureau of Statistics announced that the manufacturing PMI in November fell by 1.2 percentage points to 48.0, and the service industry PMI fell by 1.9 percentage points to 45.1, driving the comprehensive PMI to weaken by 1.9 percentage points to 47.1, showing that production and business activities have accelerated. Contraction.

From the perspective of sub-item data, with the tightening of epidemic prevention and control measures and the increase of confirmed cases, the production and demand of the service industry contracted for the third consecutive month in November, the largest decline since the peak of the last round of epidemic. In contrast, the new export orders index for the month rose into expansion territory, marking the second expansion in 2022. Respondents said that the improvement in exports was mainly due to the relative improvement in market conditions and the relaxation of international travel restrictions, but the weak global economy continued to restrain business growth.

Employment in the service sector improved briefly in October and contracted again in November, with the employment index falling to the lowest level since November 2005 when this sub-item was available. The survey shows that the epidemic prevention and control measures have restricted travel in some areas and prevented personnel from returning to work. At the same time, the decline in business demand has also actively tightened employment. In addition, the backlog of business volume index also rose to the highest since June in the expansion range in November.

Driven by rising costs of raw materials, transportation, labor, etc., the cost of the service industry is still increasing. In November, the input price index dropped slightly in the expansion range; cost pressure continued to be transmitted to the sales side, but due to insufficient demand, the pricing power of enterprises was limited. The ex-factory price index of the service industry also fell, only slightly above the threshold.

Market confidence suffered a setback. In November, the service industry business expectations index fell to the lowest level in nearly eight months and continued to be lower than the long-term average. The surveyed companies believe that output will pick up as the epidemic improves and operations will return to normal. However, the impact of the epidemic and related epidemic prevention measures on production capacity and demand is still relatively uncertain, which brings certain concerns.

Caixin Think Tank senior economist Wang Zhe said that China is currently in the third wave of the epidemic after the beginning of 2020 and the first half of 2022, and the epidemic continues to have an adverse impact on the economy. At present, it seems that the third wave of epidemics has weaker restrictions on supply and demand than the previous two waves of epidemics, but the deterioration of the job market is more prominent. Since October, the epidemic has spread in many provinces and cities, and how to balance epidemic prevention and control with economic development has once again become a core issue. A few days ago, the central government made important deployments and put forward clear requirements for measures to further optimize prevention and control work, and how to implement them has become the top priority.

He said that under the triple pressure of demand contraction, supply shock, and weakening expectations, the employment index has been at a low level for a long time. The employment downturn and the triple pressure have formed a negative feedback. The market’s requirements for policies to promote employment and stabilize domestic demand are particularly urgent. At the policy level, the coordination of fiscal policy and monetary policy should be strengthened, and efforts should be made to expand domestic demand and increase the income level of low-income groups.

Related reports:

Caixin PMI analysis|Economic sentiment in November fell to the lowest level since June, employment deterioration is expected to weaken

[Caixin PMI]November 2022 Caixin China Services PMI Report

【Caixin PMI】Analysis: Caixin China’s general service industry business activity index recorded a new low since June