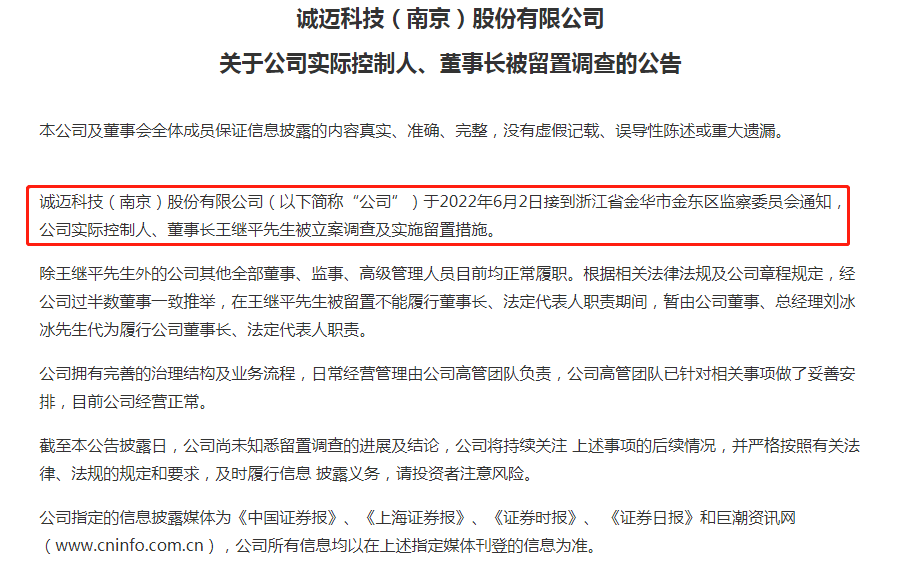

Caijing.com Capital Market News On the morning of June 6, ArcherMind Technology (Nanjing) Co., Ltd. (hereinafter referred to as “ArcherMind Technology”) suddenly announced that the company received supervision from Jindong District, Jinhua City, Zhejiang Province on June 2. The committee notified that the actual controller and chairman of the company, Wang Jiping, was placed on file for investigation and implementation of lien measures. During the period when Wang Jiping was detained and unable to perform the duties of the chairman and legal representative, Liu Bingbing, the company’s director and general manager, temporarily performed on his behalf. The reason for Wang Jiping’s detention was not disclosed. Affected by the news, ArcherMind fell sharply at the opening this morning, down more than 18% during the session; as of the close of noon, ArcherMind reported 38.71 yuan per share, down 13.48%.

Image source: ArcherMind Technology Announcement

According to public information, ArcherMind was established in September 2006, focusing on the research and development and innovation of embedded software technology in the fields of smart phones, smart cars, smart hardware, artificial intelligence and mobile Internet, and is committed to providing customers with full life cycle solutions. Developed solutions, covering Android, iOS, Linux, Windows, QNX, HarmonyOS, AliOS and other global mainstream operating system technologies. ArcherMind is headquartered in Nanjing, Jiangsu, and was listed on the Shenzhen Stock Exchange Growth Enterprise Market in January 2017.

ArcherMind’s controlling shareholder is Nanjing Debo Investment Management Co., Ltd. (hereinafter referred to as “Nanjing Debo”), with a shareholding ratio of 29.64%. Wang Jiping holds 82.88 shares of Nanjing Debo, and is the actual controller of ArcherMind. According to the data, Wang Jiping was born in January 1968, Chinese nationality, no permanent residency abroad, master’s degree. From February 1994 to January 1999, he was a software engineer of Communication Intelligence Corporation; from February 1999 to August 2000, he was the deputy general manager of Sino-US joint venture Zhitong Computer Co., Ltd.; in February 2001, he was founded In September 2006, he founded ArcherMind Technology (Nanjing) Co., Ltd. and served as the chairman; he is currently the chairman of ArcherMind.

It is worth noting that on May 16 half a month ago, ArcherMind just announced the pre-disclosure announcement of the controlling shareholder and actual controller’s share reduction plan. According to the announcement, Nanjing Debo, the controlling shareholder holding 47.4184 million shares (accounting for 29.63% of the company’s total share capital), plans to reduce its holdings of the company’s shares by a total of no more than 4.8 million shares (accounting for the company’s total share capital) through centralized bidding transactions or block transactions. 3%). The reason for the reduction is its own capital needs.

In addition to the controlling shareholder, two other shareholders have recently reduced their shares in ArcherMind. According to the announcement of ArcherMind on April 29, the company’s shareholders Scentshill Capital I, Limited intends to reduce their holdings of about 7.3969 million shares of the company through legal methods recognized by the Shenzhen Stock Exchange such as centralized bidding transactions and block transactions, that is, no more than ArcherMind’s current 4.62% of the total share capital; the company’s shareholders Scentshill Capital II, Limited intends to reduce their holdings of about 604,900 company shares through legal methods recognized by the Shenzhen Stock Exchange such as centralized bidding transactions and block transactions, that is, no more than 0.38 of ArcherMind’s current total share capital %. The two companies are enterprises under the same control, and it is planned to reduce their holdings of no more than 5% of the company’s shares.

In terms of performance, according to ArcherMind’s financial report, the company will achieve operating income of 1.424 billion yuan in 2021, a year-on-year increase of 51.88%; the net profit attributable to shareholders of the listed company is 29.93 million yuan, a year-on-year decrease of 49.14%, increasing revenue does not increase profits. In the first quarter of 2022, ArcherMind achieved an operating income of 120 million yuan, a year-on-year increase of 48.81%; the net profit attributable to the parent was a loss of 4599 trillion yuan, a year-on-year decrease of 341.36%.

On the secondary market, ArcherMind listed on the Growth Enterprise Market at an issue price of 8.73 yuan/share in January 2017; from September 2019 to March 2020, ArcherMind’s share price rose nearly 10 times, reaching a maximum of 180.88 yuan/share The market value is close to 29 billion yuan, but then the overall trend of shock and decline. As of the close of noon on June 6, 2022, ArcherMind’s share price fell to 38.71 yuan per share, a decrease of 13.48%, with a total market value of 6.2 billion yuan. As of the end of the first quarter of 2022, ArcherMind had 40,410 shareholders.

Image source: wind

Wang Miaomiao / text