Just entering 2022, major events have begun to occur in the automotive industry, one of which is that the power exchange market has ushered in a strong competitor-Ningde era. On January 18, CATL held an online press conference, announcing its official entry into the power exchange market, and released the power exchange brand “EVOGO”. According to reports, “EVOGO” will target all car companies and provide battery swap services for most models on the market through the principle of adaptability.

CATL stated that its current power station can be applied to A00-class to C-class passenger cars and logistics vehicles, and is suitable for 80% of the models developed based on pure electric platforms that have already been launched and will be launched in the next three years in the world. Its battery swap business is operated by its wholly-owned subsidiary, Times Electric. According to data from Qixinbao, Times Electric Service Technology Co., Ltd. was established in August 2021 and is wholly-owned by CATL with a registered capital of 200 million yuan. Its business scope includes sales of new energy vehicle battery swap facilities, as well as technology development and service. Wait.

CATL is one of the largest power battery manufacturers in the world. Why did it choose to enter the battery swap market at this point in time? And how is its swap station and business model different from the existing “players”? What kind of disruptive changes will its addition bring to the battery swap market? These have become the focus of the industry after the conference of CATL.

Chen Weifeng, general manager of Times Electric Service, elaborated on the thinking behind CATL’s entry into the power exchange market, and answered relevant questions.

Regarding the reason for entering the battery swap market, Chen Weifeng said that in fact, CATL has been pre-researching the research and development of battery swap for many years, and since this year, CATL found that users’ anxiety about cruising range has weakened, and the biggest anxiety is the charging time. This Ningde era hopes to launch a battery swap service. “We think the time has come to help more users use new energy vehicles.” Chen Weifeng said.

In fact, since the second half of last year, CATL has been very frequent in terms of power exchange. Not only did it set up Times Electric Service, but it also signed an agreement with Futian to carry out business cooperation including power exchange, and signed a cooperation agreement with Guiyang City to build power exchange. network protocols, etc.

It is worth noting that before the Ningde era, there were already some players in the power exchange market. For example, Aodong New Energy was the operator in the power exchange market. Previously, it mainly served BAIC New Energy. In addition, Weilai, Changan Automobile, Geely Automobile And so also began to build their own power station. So as a new entrant, what is the difference between the power exchange service in the Ningde era?

At the press conference, Ningde Times pointed out that the uniqueness of its battery replacement mode is that users can choose different numbers of batteries for free replacement according to their needs, creating a new mode of renting electricity on demand.

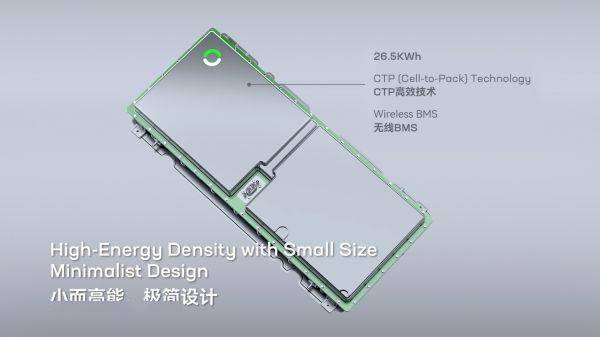

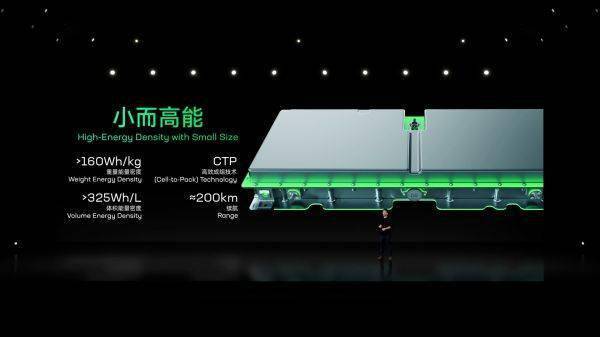

The replacement battery of CATL is called “chocolate battery replacement block”. Unlike direct replacement of the entire battery, users can choose different numbers of batteries to freely combine according to mileage requirements to realize on-demand rental electricity. If you are commuting in the city, you only need one battery, you can choose to replace only one battery, and if you travel long distances, you can choose two and three batteries. The power exchange block of CATL adopts ternary lithium battery, the energy density of a single power exchange block is 160Wh/kg, and the battery life is about 200km.

Before that, when many operators on the market who claimed to be changing batteries in tens of seconds actually provided services for car owners, due to the small number of batteries in stock, users had to wait in line for a long time, and there were also battery replacements. The situation of power loss and dissatisfaction occurs. Ningde Times emphasized that each power exchange station can store 48 power exchange blocks, which is much more than the current power exchange block reserves of power exchange stations on the market, which can reduce the waiting time of users. The Ningde era power exchange station covers an area of about 3 parking spaces, and the power exchange time of a single power block is about 1 minute.

The Ningde Times swap station has been adapted to real vehicles, and the first cooperative model is FAW Bestune NAT. NAT is a pure electric MPV model developed by FAW Bestune for the travel market such as rental and online booking. It is built on the Bestune FME pure electric platform. According to market reports, the combined battery swap version of FAW Bestune NAT is about 50% cheaper than its charging version. CATL said that more models will be adapted in the future. Geographically, in the early stage of the Ningde era, ten “small green ring” cities will be selected to provide power exchange services.

It is understood that for the models developed on the market based on the pure electric platform, if you want to realize the adaptation of the Ningde era battery replacement service, you only need to install a conversion bracket in the space where the battery was originally installed, and adapt to the standard battery. “As long as the space can be put in (the conversion bracket), it can be done, and finally the generalization of the battery can be realized through the customization of the bracket.” Chen Weifeng said. However, he also pointed out that it is best to take it into account (the battery replacement standard) when the corresponding model is developed, which may be better than adapting it after development.

The power exchange market may be disrupted

For the entire industry, the entry of the Ningde era may bring disruptive changes to the power exchange market. Because if the power exchange business in the Ningde era expands, it means that the industry power exchange standards are expected to be unified. At present, whether it is the Aodong New Energy power exchange station that mainly serves BAIC New Energy, or the power exchange stations built by each car company, they generally fight each other due to different standards, that is, the charging station can only exchange power for its own brand or specific brand. . However, based on the supply cooperation with almost all car companies in terms of batteries, CATL may rapidly promote the unification of industry power exchange standards.

“The biggest difference between us and others in doing this is that we hope to be able to adapt to various models, which is also our advantage, because we provide services and support for various car companies, so our chocolate power exchange blocks can basically be used in the market. Most of the models developed on the pure electric platform are technically adapted.” Chen Weifeng said.

According to the data, CATL customers have covered most of the mainstream car companies in China, including self-owned brands, joint venture car companies and most of the current new car companies. In 2021, the annual installed capacity of CATL batteries will reach 80.51GWh, with a market share of 52.1%.

For car companies, the more adaptable Ningde era battery swap may also be a good choice. Because if there is a standard and unified power exchange mode, car companies do not have to customize the power exchange battery for each model, save development time and cost, and do not have to invest heavily in self-built power exchange stations. On the purchase side, almost all brands can achieve “separation of car and electricity”, users no longer need to buy batteries, and the cost of car purchases has dropped significantly, which may stimulate an increase in overall car sales.

However, the Ningde era also faces some challenges when entering the field of battery swapping. The first is the difficulty of making profits that has been criticized for battery swapping. The reasons include large initial investment and low battery swapping frequency. In terms of capital, CATL, as one of the world‘s largest power battery manufacturers, is not considered to be a big problem, and its current total market value has reached 1.33 trillion. As for the frequency of battery replacement, Chen Weifeng said that more models will replace batteries under standardization, so he is more confident in the future market and profitability. “If there is no car to come (replace), the power station swap is really miserable. But from the business plan of the Ningde era, if there are more cars replaced by the power station, there will be opportunities to achieve profitability.” Chen Weifeng said.

Another challenge is the transformation of CATL from a battery manufacturer to a service operator. Chen Weifeng admitted that the biggest risk of Ningde era’s entry into power replacement is that he has no experience in service operations, because this will be the company’s transition from B-side to C-side directly. “We hope to learn from various predecessors in the industry for a period of time to improve the user’s service experience skills. We will also rhythmically launch various markets, and build the world‘s largest service network within two or three years.” Chen Weifeng said.

In general, the battery swap market continues to be encouraged by policies and has great market prospects. China National Financial Securities predicts that in 2025, my country’s power exchange stations are expected to reach 22,000, the operating market size is expected to reach 263.1 billion yuan, and the power exchange station equipment market is expected to reach 69.3 billion yuan. The compound annual growth rate is 80%-107%.

Among the current power exchange operators, as of the end of 2021, the operator with the largest number of power exchange stations is NIO with 789, followed by Aodongda with 402 and Hangzhou Bertanda with 107. It is worth looking forward to whether the newly entered Ningde era can break through quickly.Return to Sohu, see more