For the price increase of power batteries, is there any other way besides cracking down on “fried lithium”?liveIn a certain degree of speculation, the impact on the industry will be huge in the long run, and the slowdown in industrial penetration may make China lose its first-mover advantage.

On April 30, CATL disclosed its first quarterly report for 2022. Unsurprisingly, the performance was far below market expectations.

The financial report shows that during the reporting period, CATL achieved operating income of 48.678 billion yuan, a year-on-year increase of 153.97%; net profit was 1.493 billion yuan, a year-on-year decrease of 23.62%. It is worth noting that the non-net profit of CATL was 977 million yuan, a year-on-year decrease of 41.57%, almost halved.

Regarding the serious decline in net profit, CATL explained that “some upstream material prices have risen rapidly”.

Since 2021, the demand for power battery installed capacity has increased significantly, driving the price of power battery raw materials soaring. Compared with the same period last year, the market price of battery-grade lithium carbonate has increased by nearly 10 times, and the prices of nickel and cobalt, raw materials of power batteries, have also nearly doubled in the same period.

The strong downstream demand is coupled with the crazy price rise of raw materials, and the price of power batteries has also risen. However, it is strange that battery manufacturers are generally miserable, and they are all caught in the dilemma of “increasing revenue without increasing profits”.

The official financial report shows:

-

Guoxuan Hi-Tech’s revenue in the first quarter of this year was 3.916 billion yuan, a year-on-year increase of 203.14%, and its net profit was 32.2 million yuan, a year-on-year decrease of 32.79%;

-

Yiwei Lithium Energy’s operating income in the first quarter reached 6.734 billion yuan, a year-on-year increase of 127.69%, and its net profit was 521 million yuan, also a year-on-year decrease of 19.43%;

-

During the same period, Sunwoda’s revenue was 10.621 billion yuan, a year-on-year increase of 35.11%, and its net profit was 94.9232 million yuan, a year-on-year decrease of 26.13%.

Guoxuan Hi-Tech’s revenue in the first quarter of this year was 3.916 billion yuan, a year-on-year increase of 203.14%, and its net profit was 32.2 million yuan, a year-on-year decrease of 32.79%;

Yiwei Lithium Energy’s operating income in the first quarter reached 6.734 billion yuan, a year-on-year increase of 127.69%, and its net profit was 521 million yuan, also a year-on-year decrease of 19.43%;

During the same period, Sunwoda’s revenue was 10.621 billion yuan, a year-on-year increase of 35.11%, and its net profit was 94.9232 million yuan, a year-on-year decrease of 26.13%.

“The main customers are almost the same. Overseas customers are basically linked to metal prices, and domestic customers are similar.” At the first quarter performance interpretation meeting, the overwhelmed CATL revealed that the company’s products will increase in price in the second quarter.

So, who made the money?

01 Q2 battery price increase is a sure thing

“I didn’t expect lithium carbonate to rise from 30,000/ton to 500,000/ton. I used to think it would be a big increase of 20% – 30%, but I didn’t expect it to rise 20 times.” At the earnings conference call, relevant executives of CATL The price of some raw materials such as lithium carbonate has increased far beyond previous expectations.

“At present, the main reason is that the price of lithium is rising.” Li Ming, a consultant for SMM battery materials, told reporters. Unlike cobalt, nickel and other materials, lithium occupies an irreplaceable position in the manufacture of power batteries. Whether it is a ternary lithium battery, a lithium iron phosphate battery, a solid-state battery, or a graphene battery, lithium is an essential element.

According to statistics from the Advanced Industrial Research Institute (GGII), the new energy vehicles will sell 1.044 million new energy vehicles in Q1 2022, a year-on-year increase of 136%; the installed capacity of power batteries is about 46.87 GWh, a year-on-year increase of 140%.

As the sales of new energy vehicles and the installed capacity of power batteries have both increased, the lithium element on the market has become insufficient. As a result, the price of raw materials for power batteries has risen again. According to data from Shanghai Nonferrous Metals Network, at the beginning of 2021, the price of lithium carbonate was less than 50,000 yuan/ton, and it rose to about 250,000 yuan/ton at the beginning of this year, and by March it had risen to 500,000 yuan/ton.

Wang Jingzhong, full-time vice chairman of China Battery Industry Association, said in an interview with the media, Mineral resources such as cobalt, nickel, and lithium required for the production of power batteries are becoming increasingly tight, and there is a risk of supply chain security due to high external dependence.。

Power battery companies are under severe pressure, and their performance is polarized. Although revenue has increased significantly, net profit has fallen sharply. Taking CATL as an example, in the first quarter of this year, CATL’s market share in the domestic market exceeded 50%, revenue rose 153.97%, but net profit fell by more than 20%. at the same time, The gross profit margin of CATL also experienced a serious decline, from 27.28% in the same period last year to 14.48%, nearly halving。

The overwhelmed Ningde era had to pass the pressure on to car companies. “The price increase of raw materials in the supply chain is so huge now that the company has to negotiate with customers about how to deal with the pressure. The main customers have a good talk, and the customers are very understanding and supportive.” CATL executives said in the earnings conference call. .

For different customers, the negotiation conditions of CATL are also different, for example, Some customers have paid more advance payments to CATL, or invested in production lines, CATL will also reciprocate, “the increase is small”, and try to be fair。

CATL has set the price increase time node in the second quarter of this year, which may set off a new wave of power battery price increases. “Actually, friends and businessmen are waiting for us to raise prices, so that they can follow up.”Ningde Times executives revealed.

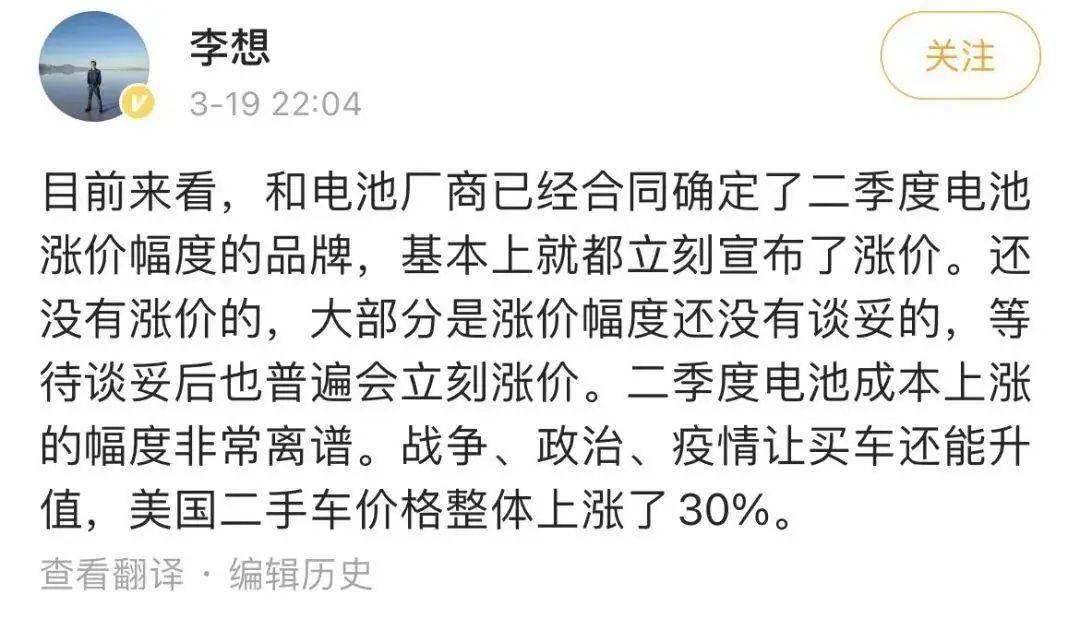

“The rate of increase in battery costs in the second quarter is very outrageous.” This is what Li Xiang, CEO of Ideal Motors, said on the social platform. He bluntly stated that the reason for the collective announcement of price increases for new energy vehicles is the increase in battery costs.

Li Xiang also revealed, “The brands that have contracted with battery manufacturers to determine the price increase of batteries in the second quarter basically announced price increases immediately. Most of the price increases have not been negotiated yet. , the price will generally increase immediately after the negotiation is completed.”

Liu Jincheng, chairman of Yiwei Lithium Energy, also said in an interview with reporters that the price of raw materials rose faster in the first quarter of this year, but the company did not increase prices quickly at that time. However, as the situation changed, the company actively discussed prices with major customers and reached a consensus.

That is to say, it is a sure thing for battery companies to increase supply prices for car companies in the second quarter, and judging from Li Xiang’s complaints and battery company executives’ complaints, the price increase may be much higher than expected, but this There are also differences. First, for the car companies that used spot cash settlement in the past and CATL, the increase will definitely increase by a large part; second, for the car companies that paid a large amount of advance payment before, CATL also said that the increase will be reduced; third, Joint-venture battery factories and joint-venture battery factories generally supply cells from CATL, and there is room for bargaining.

It can be seen from this that CATL still has a very strong voice as a battery manufacturer.

02 “Lithium speculators” wandering in the gray area

In the same chain, battery companies are “busy”, while the life of raw material suppliers is completely opposite.

Tianqi Lithium’s annual report shows that in 2021, the operating income will be 7.663 billion yuan, a year-on-year increase of 136.56%, and the net profit will be 2.079 billion yuan. A year ago, Tianqi Lithium Industry was still in a loss state, with a loss of 1.834 billion yuan. In the first quarter of this year, the performance grew even more rapidly. From January to March, Tianqi Lithium achieved operating income of 5.257 billion yuan, a year-on-year increase of 481.41%; net profit was 3.328 billion yuan, a year-on-year increase of 1442.65%.

In the first quarter of 2022, Ganfeng Lithium achieved operating income of 5.365 billion yuan, a year-on-year increase of 233.91%; net profit attributable to the parent was 3.525 billion yuan, a year-on-year increase of 640.41%.

The performance has risen sharply, which both companies attribute to the booming production and sales of power battery raw materials and the increase in shipping prices.

According to statistics, Ganfeng Lithium has acquired the equity of nearly 20 companies including Wuxi Xinneng Lithium, International Lithium Ireland, and American Lithium, so there is no need to worry about lithium resources. Tianqi Lithium can also achieve 100% self-sufficient supply of lithium mines.

Zhao Wei, head of a power battery raw material processing enterprise, confirmed to reporters that the most upstream mine resources of battery raw materials are indeed controlled by several companies such as Ganfeng Lithium Industry and Tianqi Lithium Industry, and due to the serious imbalance between supply and demand, the agreement price of raw materials is indeed high. Not too high.

There are mines at home, and there is no need to worry about gold and silver. The financial reports of the two companies show: “In the first quarter of 2021 and 2022, Tianqi Lithium’s gross profit margins were 61.97% and 85.28%, respectively; while Ganfeng Lithium’s gross profit margins were 39.81% and 66.65%.”

However, Zhao Wei also said, “In the power battery supply chain, there are other factors that affect the price.”

Zhao Wei explained that the power battery industry chain includes upstream mineral resources (such as Tianqi Lithium, Ganfeng Lithium, responsible for resource output), midstream lithium battery equipment (responsible for material processing, processing positive/negative power battery materials) and downstream Manufacturers (Ningde Times, BYD, etc., integrate positive/negative grade materials into batteries).

The battery industry chain is already out of balance between supply and demand, and companies in the midstream have further magnified the “imbalance”. Zhao Wei said, “In the industry, the demand for a resource is 50, but the supply is 40. According to industry rules, upstream companies will increase the price of the resource by more than 20% ((demand – supply) / demand ). But midstream companies will carry out various operations, and the price of this resource will increase several times.”

But in the eyes of midstream processors, the so-called operations are actually reasonable.

Fang Fang, head of a power battery cathode material processing enterprise, told us, “On the one hand, the purchase price of raw materials has become higher. On the other hand, due to the strong downstream demand, the factory is full every day, and the production line and labor costs will also generate additional expenses.”The shipping price of power battery cathode materials is directly linked to the purchase price of raw materials, production line depreciation costs and labor costs. “Based on the purchase price of raw materials, we will adjust the shipping price of cathode materials accordingly.”However, Fang Fang did not disclose how the adjustment range is defined.

The pricing power is in the hands of upstream companies, and the bargaining power is firmly controlled by midstream companies. Fang Fang explained, “Midstream companies are like a link, importing and processing raw materials from upstream companies upward, and supplying processed raw materials to power battery manufacturers downward. Neither upstream nor downstream can avoid midstream raw material processors, so the bargaining power belongs to midstream companies.」

The real headaches for car companies and battery manufacturers are the secondary agents active in the industry chain. These agents have transformed themselves into “Lithium players” and took the opportunity to drive up prices.

“Suppliers of raw materials usually have to contact dozens of customers, and they will choose the agency sales model to share the sales pressure, and the procurement department of power batteries mainly deals with these agents.”Zhao Jian, an employee of the purchasing department of a power battery company, said.

“They (second-level agents) will hoard goods for 1-3 months, and release goods in small batches when prices soar, deliberately creating a situation where supply exceeds demand.” Zhao Jian revealed.

NIO Chairman and CEO Li Bin once said in the 2021 earnings conference call:

We have conducted a very detailed investigation of upstream materials from mining to all links. Generally speaking, we believe that there are more speculative factors in the price increase of lithium carbonate.

We have conducted a very detailed investigation of upstream materials from mining to all links. Generally speaking, we believe that there are more speculative factors in the price increase of lithium carbonate.

Ningde Times agreed that yesterday’s lithium carbonate did not have any technological breakthrough compared to today’s. It sold 350,000 yesterday and 500,000 today. There must be a speculative factor.

The reason why “Lithium speculators” are unscrupulous is that there is still a lack of a corresponding market management mechanism. At present, the supply source of lithium ore is mainly in overseas markets led by Australia. The formation mechanism of lithium price is mainly the auction of spodumene concentrate by major Australian lithium mining companies on the BMX electronic platform, while the price of lithium ore is currently at the Chinese price. outside the scope of regulation.

03 Car companies and battery companies end up mining

The intensifying tide of price increases has not only affected the nerves of the new energy vehicle market, but also successfully attracted the attention of relevant departments. In order to curb the skyrocketing price of raw materials, the government took the lead in rectification.

In mid-March 2022, four ministries and commissions, the Ministry of Industry and Information Technology’s Raw Materials Department, the National Development and Reform Commission’s Price Department, the State Administration of Market Supervision and the Anti-Unfair Competition Bureau held a symposium to discuss the issue of securing supply and stabilizing prices for lithium resources. At the meeting, it was proposed to jointly guide the rational return of lithium salt prices. Increase efforts to ensure market supply.

After the regulator’s statement, the price of lithium carbonate has been adjusted; Guorong Securities data shows that the actual transaction price of lithium carbonate fell to 450,000-500,000 yuan / ton after the symposium of the Ministry of Industry and Information Technology.

But in the long run, the supply and demand relationship of power battery raw materials is still tense. It is better to ask for others than to ask for yourself. Power battery companies such as Ningde Times and BYD even “end mining” in person. “If there is a stable supply chain, the company will not do it on its own.” Zeng Yuqun, chairman of CATL, once said on an investor conference call.

Ningde Times executives revealed that they have obtained the exploration rights in Yichun this year, and will build a local mine in Yichun. According to the executive, the Yichun lithium mine has very large reserves of resources. With surplus mines in hand, I don’t panic, “If the price of lithium mines is high, the company will dig a little more to drive down the price of lithium mines.”

On October 29, 2021, Chuaneng Power announced that in order to accelerate the development of the company’s “new energy power generation + energy storage” industry, the company plans to jointly invest with Sichuan Luqiao, BYD and Hefeng to establish a joint venture company to comprehensively develop Mabian County. Phosphate resources and lithium iron phosphate projects.

Power battery companies are striving to be “miners”, and those car companies that are unwilling to be controlled by others have also begun to “leapfrog layout”. Tesla CEO Elon Musk tweeted: If the “crazy” lithium price continues to skyrocket, Tesla “may have to go directly to the mining and refining industry on a massive scale.”

Ford Motor CEO Jim Farley also said that “the vertical integration is very important,” and the company may plan to extend its supply chain layout “all the way to the mining industry” in the future.

For a time, the “mining tide” prevailed among car companies and power battery companies. According to Tianyancha data, there are more than 400 lithium mine-related enterprises in China, of which 64 will be newly registered in 2021, with a growth rate of 20.3%. From the perspective of geographical distribution, Jiangxi, Sichuan and Qinghai have the largest number of related enterprises. In terms of the time of establishment, nearly 50% of the enterprises were established within five years, and 21.7% of the enterprises were established within one year.

However, an industry insider believes that even if power battery companies and car companies mine by themselves and want to achieve self-production and self-sufficiency, the imbalance between the supply and demand of power battery raw materials will still be difficult to alleviate in the short term.

“It will take at least 5 years from the completion of exploration to the construction of production lines for lithium mines, and the penetration rate of new energy vehicles will increase this year and next. It is difficult for companies to actively mine to meet the growth in downstream market demand this year and next year.” Zhao Wei tell us.

That is to say, within three to five years, the dilemma of rising prices of power battery raw materials will continue, and power battery companies may face further declines in gross profit margins. “(Our) some important customers have clearly put forward a price red line. If the price exceeds a certain price, it may not be able to continue.” Liu Jincheng, chairman of Yiwei Lithium Energy, said in an interview with us.

(At the request of the interviewee, Zhao Wei, Fang Fang, and Zhao Jian are pseudonyms in the text)

read more

Tesla has been profitable for 7 consecutive quarters: Autopilot accelerates radar exit to pure visual switch

Tesla Model S Plaid: The fastest production car to date?

Xiaopeng P5 released, with urban NGP, equipped with lidar, 180,000 will be sold out?

How to know new energy vehicles | One sentence review

Do not repost without permission

Other public accountsReturn to Sohu, see more