last nightAppleThe new color scheme of “Cangling Green” mobile phone was launched. Today, A-shares really turned green. The three major indexes dived at one point, and the Shenzhen Component Index fell by more than 5%. The thrilling level scared many friends!

01

jokes flying

All kinds of pessimism in the market are flying together, and there is no reason to say anything. At the same time, all kinds of jokers that emerged during the big plunge and diving in the past have also come out. After all, the market is not good, so I don’t look at the market but just look at the jokes!

02

Mysterious Fund Protection

A-share “deep V” rebound

However, with the outpouring of extreme panic, mysterious large funds appeared in midday to support the market. From the time-sharing chart, it was 13:49 in the afternoon until the close.The Shanghai Composite IndexDuring the period, the turnover was 151.2 billion yuan, and the Shenzhen Component Index turnover was 189.1 billion yuan. This total of more than 340 billion “protection funds” poured in, causing the three major indexes to start a “deep V” rebound.

In the end, A-shares staged the “Great Miracle Day”, and the three major indexes closed down slightly. The turnover of the two cities was 1,161.7 billion, which was 51.8 billion higher than the previous trading day.

03

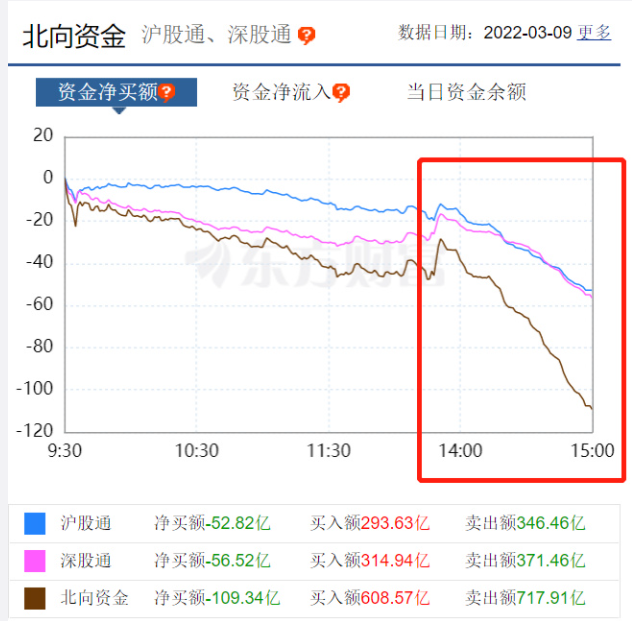

Exceeds 10 billion to flee to the north

However, the much-watched northbound funds staged the scene of yesterday’s midday session. When the late session began to stabilize and rebound, foreign capital took the opportunity to flee after 14:00, and finally sold a net total of 10.934 billion yuan throughout the day, of whichShanghai Stock ConnectNet sales of 5.282 billion yuan,Shenzhen Stock ConnectNet sales of 5.652 billion yuan.

04

The bottom of the shout appears

And the extreme panic market poured out, the superimposed support funds entered the market, and the voice of shouting bottom began to emerge.

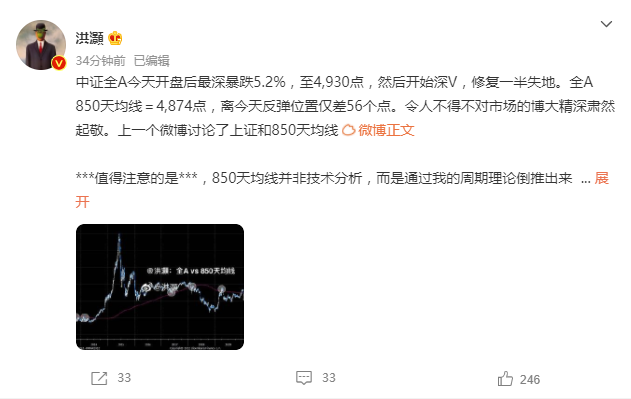

for exampleBOCOM InternationalEconomist Hong Hao said that the All-A Index is only one step away from the key 850 antenna today. Hong Hao has always believed that the A-share cycle is about three and a half years, which corresponds to the 850 antenna.

It is also a market practitioner who said that the conditions of the trading system resonate and believe that the short-term low is approaching.

The legendary investor, known as the godfather of emerging markets, also said that although China’s stock market has not performed well in the past year. However, as China begins to stabilize growth, it is believed that the Chinese stock market will benefit greatly. He believes that the weakness of the Chinese stock market will not last long and will soon usher in a turnaround.

05

External market counterattack

There was also news from the after-hours. According to CCTV news reports, Ukrainian Deputy Prime Minister Vereshuk said that the Ukrainian military agreed to a ceasefire between 9:00 and 21:00 local time in Kyiv and opened six humanitarian corridors for civilian evacuation.

The European stock market started a strong rise, the German DAX30 index rose nearly 5%, the French CAC40 index rose 4.7%, and the UK FTSE 100 index rose 1.93%.

Although U.S. stocks have not yet opened, the three major index stock index futures continued to rise, the Nasdaq futures rose to 2%, the S&P 500 futures rose 1.67%, and the Dow futures rose about 1.5%.

As the peripheral markets start to rebound one after another, the market will tell us whether A-shares can temporarily stabilize and bottom out.

06

Nickel stocks tumbled nearly 20%

On March 9, the domestic commodity market rose more and fell less, and Shanghai nickelmain forceThe contract closed the daily limit for three consecutive days. However, the hyped nickel concept stocks fluctuated with the market sentiment.

Yesterday’s two-piecePengxin ResourcesBroken board, and yesterday’s 20CM daily limitQingdao Mid-RangeIt plummeted by nearly 20%, making the chasing highs miserable.

Qingdao Mid-RangeannouncementSaid that the main business income does not involve the sale of nickel ore, and the nickel ore held is notperformancemake an impact. The company signed an agreement with the investor of ferronickel smelting in Qingdao Indonesia Comprehensive Industrial Park to supply nickel ore to it, but the investor’s RKEF ferronickel smelting project has not yet been put into operation, so the company has not mined and sold nickel ore.

Although listedCompany Announcement“I don’t”, but after the close to 20% plunge, some netizens still said that they are ready to play a reverse game.

07

merchandisefund:

Set off a “stop” tide

The general rise in commodities has caused a number of related commodity equity funds to rise collectively. March 9 Harvest GoldLOFCathay Pacific Commodities LOF, Harvest Crude Oil LOF, Crude Oil LOF E Fund and Southern Crude Oil LOF set off a daily limit tide, China Fortune Globalprecious metalLOF and E Fund gold-themed LOF both rose by more than 8%.

Commodity funds rose sharply, but it attracted managers’ restrictions on the scale. The analysis believes that the purpose is to prevent investors from chasing high quilts.

Dacheng FundThe announcement stated that in order to safeguard the interests of fund share holders, the company decided to suspend Dacheng from March 9, 2022non-ferrous metalsfuturesETFThe subscription of the feeder fund (including regular fixed investment) business, the redemption business is handled normally.

Some fund analysts believe that the recent rapid rise in commodities will inevitably increase volatility.fund companyFor the purpose of protecting investors, fund subscriptions are suspended to avoid opening positions at high commodity prices.

CCB FundHe said that although commodity funds have performed well recently, there are still some hidden concerns. It is difficult to judge the impact of geopolitics. Investors need to pay more attention to the fundamental factors such as the supply and demand of commodities themselves, inventory and so on.

08

Shanxi Fenjiu:

Net profit surged 50% in the first two months of this year

After Maotai,Shanxi FenjiuThe latest operating data was also released.

Shanxi FenjiuAnnouncement of operating data released today, from January to February 2022, the company is expected to achieve a total operating income of more than 7.4 billion yuan, a year-on-year increase of more than 35%; it is expected to be attributable to listed companiesshareholderofnet profitMore than 2.7 billion yuan, with a year-on-year growth rate of more than 50%.

alsoTongwei shares、Pien Tze Huang,WuXi AppTec、Godsend materialShanghai Silicon Industry,This world、Changshu Bank、ProyaandPanzhihua Iron and Steel Vanadium TitaniumIncluding more than 10 listed companies, they intensively released the first monthly operating data announcement in history.

The stock price of Shanxi Fenjiu performed well today, and it was the most affected by a flat close when it once fell by more than 3%.

Some market participants said that many white horse leading stocks rarely choose to publish monthly data at this time, and the purpose of stabilizing market expectations is self-evident, and then it depends on the feedback of the main market capital.

(Dividing line)

1、Huayou CobaltOn the evening of March 9, the company announced that it has deployed nickel-cobalt resource development business in Indonesia. In order to stabilize operations and prevent risks, in order to prevent and control the risk of falling prices and lock in operating profits when nickel prices continue to rise, the company combines its own production and operation. In strict accordance with the company’s hedging management system, the nickel hedging business was carried out. Hedging business is a commonly used risk prevention tool in production and operation, not active speculation. Recently, the nickel futures market has experienced ultra-abnormal fluctuations. Up to now, the company has not been forced to liquidate its positions, and the risks are controllable.

2、BOE AIt was announced that the net profit for 2021 will be 25.826 billion yuan, a year-on-year increase of 412.86%. Since the third quarter, with the adjustment of the demand side, the prices of products in the industry have undergone a structural correction, and the overall prosperity of the industry throughout the year is relatively higher than last year; The monthly shipments in December exceeded 10 million for the first time.

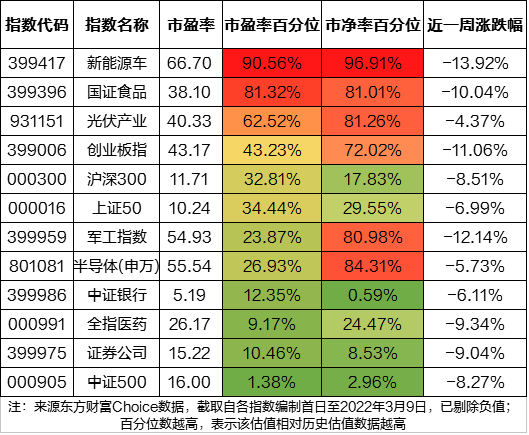

List of Popular Index Valuations

(Article Source:Eastern FortuneResearch center)