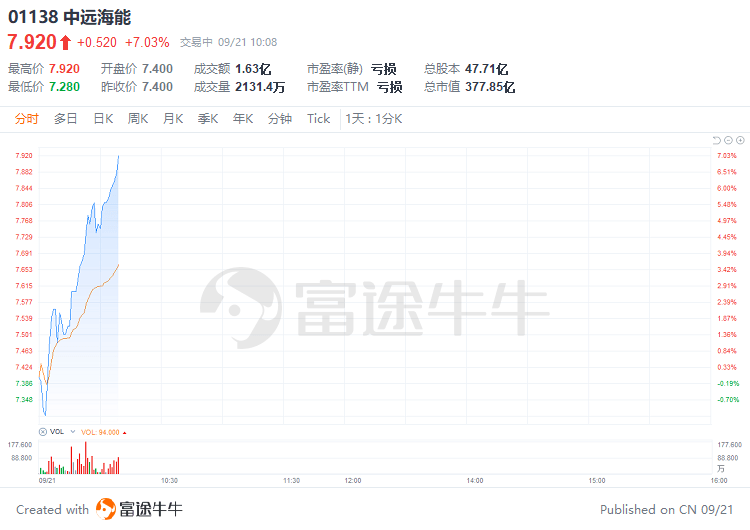

Futu Information reported on September 21 that the port and shipping sector bucked the trend and rose. As of press time, COSCO SHIPPING Energy (01138.HK) rose 7.03% to HK$7.92, and its stock price has risen more than 166% this year.

On the news, the Baltic dry bulk index rose to a more than one-and-a-half-month high on Tuesday, due to firm shipping demand.The Baltic index for overall dry bulk rose 176 points, or 11.3%, to 1,729, its highest level since Aug. 3.

According to a research report released by CITIC Securities,The continuous improvement of VLCC freight rates in the past two months is due to the influence of the heavy export volume of the US Gulf, the Brent-WTI crude oil price difference and the progress of the Iran nuclear agreement, which has attracted some VLCC ships to move westward to the Atlantic route, and the VLCC supply side previously accumulated in the Middle East market. The situation has changed structurally.Continue to suggest paying attention to the layout opportunities on the right side of the oil transportation cycleoptimistic about the upturn in the foreign trade crude oil transportation cycle in the next year.

Essence Securities Research Report said,The current economic globalization has changed from a moderate and stable state to a rebalancing of conflicts and sanctions, the value of resources is highlighted, the supply chain is reshaped, and the major shipping cycle is approaching.The inflection point of oil transportation supply and demand has arrived, ushering in an upward cycle, the short-term geopolitics, new environmental protection regulations and other factors may further affect the demand and supply, and push up the oil transportation boom. The oil transportation demand curve is steep, and the gap between supply and demand is expected to bring about a significant increase in freight rates. It is recommended to pay attention to COSCO SHIPPING Energy and China Merchants Steamship.

edit/ruby

Risk warning: The opinions of the authors or guests shown above have their own specific positions, and investment decisions need to be based on independent thinking. Futu will endeavour but cannot guarantee the accuracy and reliability of the above content, and will not be liable for any loss or damage arising from any inaccuracies or omissions.Return to Sohu, see more

Editor:

Statement: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.