After the U.S. stock market opened on the evening of October 14, two cross-border Internet brokers listed on the U.S. stocks-Tiger Securities and Futu Securities-both dived. As of 23:00 in the evening, Tiger Securities had fallen 22.5%.

On October 14, People’s Daily Online published the title “Financial Observation: The Personal Information Protection Law is about to be implemented, what should cross-border Internet brokers do?” “The article pointed at the test that Tiger Securities and other cross-border Internet brokers will face on the issue of the personal information of mainland citizens going abroad.

Since the beginning of this year, Chinese concept stocks have been hit frequently by “short positions”. For example, many Chinese concept stocks in education have fallen 90% this year. In contrast, the performance of cross-border Internet brokers such as Tiger Securities during the year has been strong. However, in the second half of the year, the situation has changed dramatically. Tiger Securities has fallen by more than 70% since the third quarter.

Cross-border Internet brokers encounter “air raids”

Tiger Securities fell after the opening of U.S. stocks on October 14

After the U.S. stock market opened on the evening of October 14, two cross-border Internet brokers listed on the U.S. stocks-Tiger Securities and Futu Securities-both dived. As of 23:00 in the evening, Tiger Securities had fallen by 22.5%, and Futu Securities had fallen by nearly 15%.

Some analysts believe that the sharp plunge of the two cross-border Internet brokers is related to the reports of some media on Internet brokers’ “Personal Information Protection Law” and other compliance status.

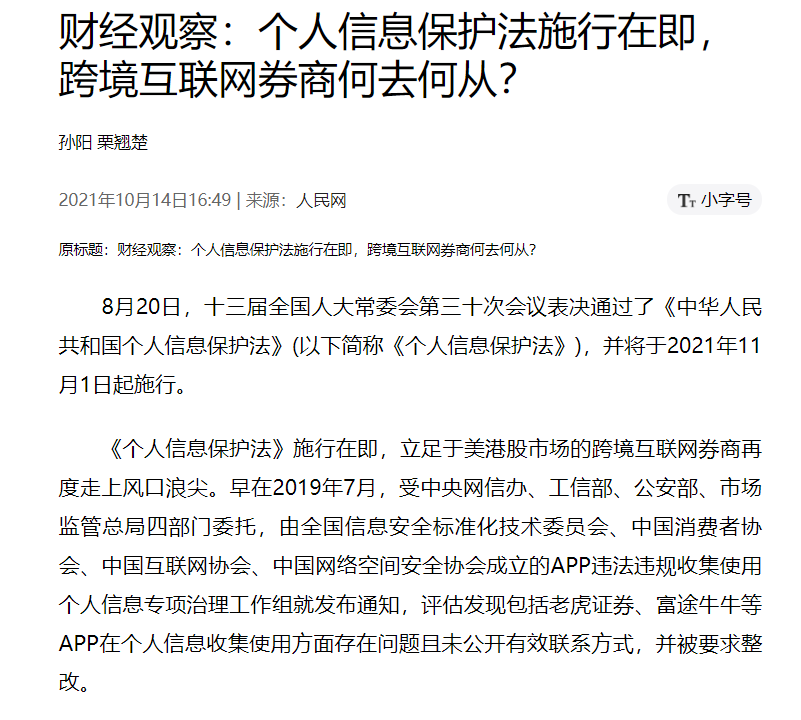

Image source: People’s Daily Online

On October 14, People’s Daily Online published the title “Financial Observation: The Personal Information Protection Law is about to be implemented, what should cross-border Internet brokers do?” “The article pointed at the test that Tiger Securities and other cross-border Internet brokers will face on the issue of the personal information of mainland citizens going abroad.

The article stated that the “Personal Information Protection Law” will come into effect on November 1, 2021. In the context of the “Personal Information Protection Law” clarifying the rules for cross-border provision of personal information, the issue of the personal information of mainland citizens going abroad may become a new test for Internet brokers that provide stock trading services in major global markets such as US stocks and Hong Kong stocks.

In addition, the article pointed out that on July 10 this year, the National Internet Information Office issued a notice on the “Network Security Review Measures (Revised Draft for Solicitation of Comments)”. The draft for comments includes content such as “Operators who have personal information of more than 1 million users going to list abroad must report to the Cyber Security Review Office for a cyber security review.” The issuance of the notice will also be a new test for cross-border Internet brokers who are listing abroad.

The article quoted a legal person’s opinion that the promulgation of the Personal Information Protection Law puts forward higher compliance requirements for the cross-border transmission and use of domestic investor data. Cross-border Internet brokers such as Futu and Tiger have risks in terms of user information security and legalization and compliance.

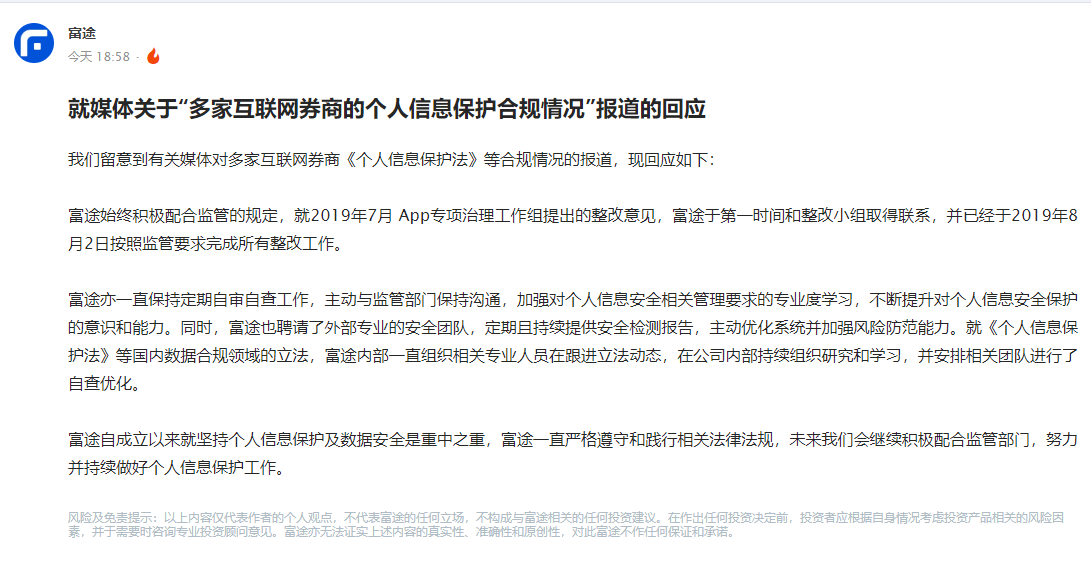

Image source: Futu Securities

In fact, before the opening of US stocks on the evening of October 14, Futu Securities had already responded to the above-mentioned related reports.

In this response, Futu Securities stated that the company has always been actively cooperating with regulatory requirements. Regarding the rectification opinions put forward by the App Special Governance Working Group in July 2019, Futu contacted the rectification team as soon as possible. Completed all rectification work in accordance with regulatory requirements on August 2, 2016.

Futu has also maintained regular self-examination and self-inspection work, actively maintained communication with regulatory authorities, strengthened the professional learning of personal information security-related management requirements, and continuously improved the awareness and ability of personal information security protection. At the same time, Futu has also hired an external professional security team to provide regular and continuous security inspection reports, actively optimize the system and strengthen risk prevention capabilities. Regarding the “Personal Information Protection Law” and other domestic data compliance legislation, Futu has been organizing relevant professionals to follow up the legislative developments, continuously organizing research and learning within the company, and arranging related teams to conduct self-examination and optimization.

In the second half of the year, “a sudden change”

Since the beginning of this year, Chinese concept stocks have been frequently hit by “shorts”. For example, many educational Chinese concept stocks such as Good Future and Puxin Education have fallen 90% this year.

According to statistics from Choice, as of now, among the 325 US stocks that have been traded during the year, 216 of them have experienced negative gains during the year. Among them, the number of Chinese concept stocks with a cumulative decline of not less than 50% during the year has reached 76. Accounted for 23.4%.

In contrast, the performance of cross-border Internet brokers such as Tiger Securities and Futu Securities has been strong this year. As of 23:30 on the evening of October 14, Futu Securities’ cumulative increase this year was more than 50%, and the highest increase in the first half of the year was once close to 350%.

However, since the second half of the year, “the situation has changed suddenly”, according to statistics, Tiger Securities has fallen by more than 70% since the third quarter, almost erasing all the gains in the first half of the year.

In fact, in addition to the challenges faced by cross-border Internet brokerages on the issue of the export of personal information, their business models themselves are not lacking in doubts. For example, according to the current policies, my country’s relevant policies prohibit individual investors from directly engaging in overseas investment, and the exchange quota per person per year is US$50,000, but they cannot be used for overseas investment.

Starting from January 1, 2017, individuals who purchase foreign exchange at the counter or online banking are required to fill in the “Personal Foreign Exchange Purchase Application” (referred to as the “Application”), clearly filling in the purpose of purchasing foreign exchange.

The “application” clearly stated: “When domestic individuals purchase foreign exchange, they must not use it for overseas purchases of houses, securities investment, purchase of life insurance, investment return and dividend insurance, and other capital projects that have not yet been opened.”

Therefore, there are many opinions that the business models of cross-border Internet brokers such as Tiger Securities have actually been wandering in a certain “grey area”.

In late October last year, Ding Zhijie, director of the Foreign Exchange Research Center of the State Administration of Foreign Exchange, stated at the 2020 Financial Street Forum annual meeting that he would study the integration of cross-border securities investment account management. In the view of some industry insiders, strengthening the supervision of cross-border securities accounts will be the general trend.

In addition, cross-border Internet brokers such as Tiger Securities often adopt the business model of borrowing channels, which is almost a “channel” between foreign brokers such as Interactive Brokers and domestic investors.

In this regard, a securities lawyer previously told the “Daily Business News” reporter that cross-border Internet brokers, as agents of foreign brokers in the country, are suspected of illegal business development. “The Securities Regulatory Commission has never allowed us to act as agents for U.S. stock transactions. If something goes wrong Is not protected by Chinese law.”