In August, with the rising risk of global stagflation, unstable and uncertain factors increased significantly. Unexpected factors such as frequent outbreaks of domestic epidemics, extreme weather with high temperature, drought and little rainfall have had a greater impact, and the situation facing my country’s economic development is still complex and severe. From the perspective of the industry, the price of raw materials fluctuates weakly. With the weakening of factors such as high temperature and power cuts, the opening rate of enterprises has rebounded. Approaching the peak season of traditional textiles, downstream demand has picked up, companies have increased out of warehouses, product inventories have declined, and market activity has increased.

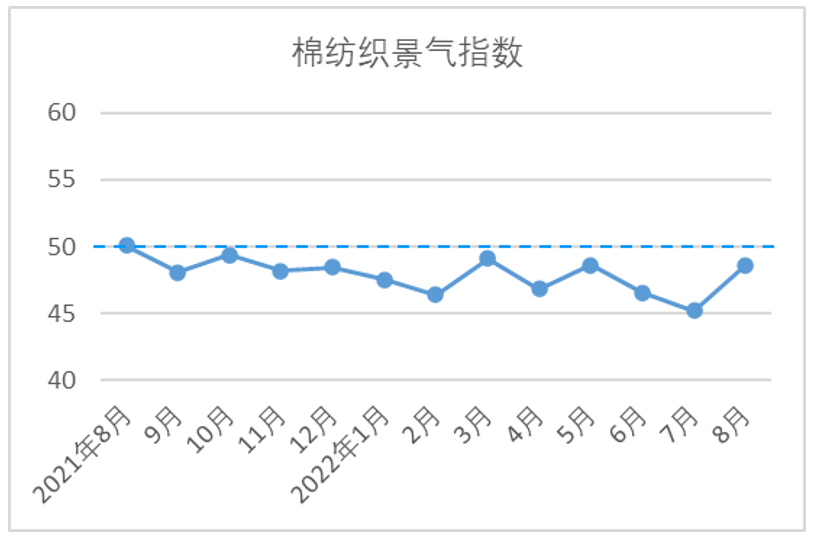

August, Chinacotton textileThe prosperity index was 48.62, an increase of 3.39 compared with July, and the industry prosperity level has rebounded. From the perspective of sub-indices, the seven sub-indices that constitute the China Cotton Textile Prosperity Index all increased compared with July, and the increase rate was higher. Among them, the product inventory index broke through the continuous downturn and rose above the dry and prosperous line.

Raw Material Purchasing Index

In August, the raw material purchasing index was 47.48, up 4.34 from July. From the perspective of market prices, domestic cotton prices fluctuated and declined, and the rate of decline narrowed;viscoseThe price of staple fiber is weak and down,polyesterShort fiber price volatility declined.Specific data, the monthly average spot price of domestic 3128 grade cotton is 15,517 yuan/ton, down 775 yuan/ton from the previous month, a decrease of 4.76%; 1.4D direct spinningPolyester Staple FiberThe monthly average price was 7604 yuan/ton, a month-on-month decrease of 389 yuan/ton, a decrease of 4.87%; the monthly average price of mainstream viscose fiber was 14,509 yuan/ton, a month-on-month decrease of 716 yuan/ton, a decrease of 4.71%. From the perspective of purchase volume, affected by the epidemic, Xinjiang’s cotton output has declined, and textile factories have purchased more resources from inland warehouses, and the purchase volume has increased slightly; chemical fiber staple fibers are affected by price factors, and enterprises are not very motivated to purchase.

Raw material inventory index

In August, the raw material inventory index was 47.6, up 0.33 from July. In the month, the price of raw materials fluctuated downward, and the contradiction of insufficient market demand was still prominent, and cotton textile mills purchased on demand. At the same time, new cotton is about to be launched, the spot market is in sufficient supply, and cotton textile mills are not willing to stock up in large quantities. Most companies say that the high-priced cotton purchased in the early stage has not been used up, and the raw materials will be replenished by sales to reduce business risks. In terms of sub-indices, the cotton inventory index was 46.98, an increase of 0.29 from July; the non-cotton fiber inventory index was 48.21, an increase of 0.37 from July.

production index

In August, the production index was 49.66, an increase of 4.64 from July, showing a significant recovery. During the month, under the influence of unfavorable factors such as the epidemic, insufficient demand and extreme weather, the production of some enterprises was affected, but the overall start-up situation showed a rebound. According to the coordination and research of China Cotton Bank, most enterprises can maintain normal production, and some enterprises start intermittently or limit the operating hours, and the opening rate is not high. The opening rate of spinning mills is slightly better than that of weaving mills. The equipment opening rate index of cotton textile mills in the month was 49.82, an increase of 5.62 compared with July. In terms of output, the yarn and cloth output indexes both increased compared with July, of which the yarn output index increased by 3.38 and the cloth output index increased by 4.01.

Product Sales Index

In August, the product sales index was 47.37, up 3.56 from July.From the perspective of market prices, due to the continued weakness of the market and overall weak orders, gauze prices maintained a weak run, and the decline was narrowed.cotton yarn. In that month, the monthly average price of 32-count pure cotton carded yarn was 24,035 yuan/ton, down 1,211 yuan/ton or 4.8% month-on-month. The average monthly price of pure cotton grey fabric (32*32 130*70 2/1 47″ twill) was 5.13 yuan /m, a decrease of 0.3 yuan/m or 5.52% month-on-month. From the perspective of market sales, with the slight improvement in the domestic market, the company’s shipments have improved compared with the previous period. Most of the orders are in small batches, and the price competition for large orders is fierce. In August, the sales volume indexes of yarn and cloth were 51.21 and 51.31 respectively, both of which were higher than that in July, and were above the dry and prosperous line. The market began to show signs of recovery.

Product Inventory Index

In August, the product inventory index was 52.31, an increase of 4.42 compared with July, which was above the dry-boom line and reached the highest value in the past one year. With the gradual improvement of downstream demand, the destocking speed of cotton textile mills has accelerated, conventional products have been shipped relatively smoothly, and the inventory has dropped significantly. The decline in product inventory of weaving mills is higher than that of spinning mills. Judging from the sub-indices that constitute the product inventory index, the yarn inventory index is 51.9 and the cloth inventory index is 52.93, both of which are higher than that in July, and they are above the line of decline and prosperity, maintaining a rebounding trend, and the prosperity level is gradually picking up.

Enterprise operation index

In August, the business operation index was 48.1, up 3.01 from July. In the month, inquiries in the downstream market increased, corporate sales improved, and revenue conditions improved. Due to the large backlog of inventory on the supply side, the intensified market competition, the continuous decline in product quotations, the company’s profit is weak or even no profit. Some companies purchased a certain amount of high-priced cotton in the early stage, resulting in a serious depreciation of raw material inventories and difficulties in capital turnover. In the month, the main business income index was 49.55, an increase of 4.34 compared with July; the total profit index was 46.66, an increase of 1.69 compared with July.

Business Confidence Index

In August, the business confidence index was 46.68, up 1.35 from July. As inflation in developed economies continues to rise, in response to inflationary pressures, countries such as Europe and the United States have accelerated monetary policy tightening, increasing downward pressure on the world economy and weakening global consumer demand and spending power.Although domestic market demand has gradually improved,ExportObstructed, there are still certain blocking points in the industrial chain and supply chain. At present, the inventory of the industry chain is backlogged on the supply side, and the downstream market recovery is lower than expected. Although the peak season is approaching, there are many uncertain and unstable factors, and the company is optimistic and cautious about the market outlook.

Note: The prosperity index of China’s cotton textile industry is collected from nearly 500 secondary cotton textile mills across the country. With reference to the national manufacturing PMI and other index formulation methods, it is calculated by weighting a number of main indicators. When the index is higher than 50, it means the cotton textile industry The prosperity of this month is better than that of the previous month, and if it is lower than 50, it means that the prosperity of this month is not as good as that of the previous month.

[Copyright Statement]Adhering to the spirit of Internet openness and inclusiveness, Textile Network welcomes all parties (from) media and institutions to reprint and quote our original content, but the source must be strictly indicated. At the same time, we advocate respect and protection of intellectual property rights, such as If you find that there are copyright issues in the articles on this site, please send your copyright questions, authorization certificates, copyright certificates, contact information, etc. to [email protected], and we will verify and deal with them as soon as possible.