On the evening of September 9th, China Fortune Land Development, a real estate company in the quagmire of debt, disclosed that the company’s shares held by its controlling shareholder, China Holdings were enforced, resulting in a decline in its shareholding ratio. Ping An Life, the original second largest shareholder, and its concerted actions People passively became the company’s largest shareholder.

However, China Fortune Land Development also pointed out that Ping An Life and its concerted parties have no intention to become the controlling shareholder or actual controller of the company, and that Ping An’s nominated directors are less than one-third of the seats on the board of directors. Therefore, this change in equity will not lead to the The actual controller of the company has changed.

In 2018 and 2019, Ping An Life, a subsidiary of Ping An of China, and its concerted parties acquired 25.2% of China Fortune Land Development’s equity in two times. In February of this year, China Fortune Land Development announced the “Thunderstorm” for the first time. As of September 4, the debt defaulted by nearly 90 billion yuan. Affected by this, Ping An’s 2021 semi-annual report has accrued impairment losses of 35.9 billion yuan, resulting in a 15.5% drop in net profit and almost “halved” its share price.

Screenshot of China Fortune Announcement

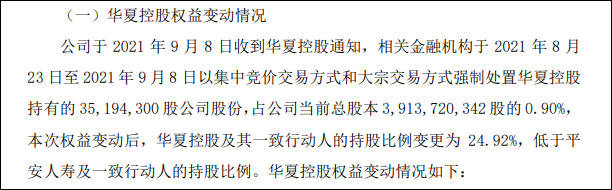

According to China Fortune’s announcement, the company received a notice from its controlling shareholder, China Holdings, on September 8. The relevant financial institutions used centralized bidding transactions and block transactions from August 23 to September 8. 35,194,300 shares of China Fortune Land Development.

After this equity change, the shareholding ratio of China Asset Management and its concerted parties has been changed to 24.92%, which is lower than the shareholding ratio of Ping An Life and its concerted parties. Therefore, Ping An Life and its concerted parties have become China Happiness No. 1 shareholder.

Regarding the decline in the shareholding ratio of the controlling shareholder, China Fortune Land Development said it was mainly due to the trustee of the exchangeable bonds of China Xia Holdings, its stock pledge repurchase transactions and financial institutions in the margin and securities lending business that held China Xia Holdings in accordance with relevant agreements. The implementation of mandatory disposal procedures for the company’s stocks led to a passive decline in China’s shareholding ratio.

After this equity change, Ping An Life and its concerted parties Ping An Asset Management Co., Ltd. hold a total of 25.19% of China Fortune Land; China Holdings and its concerted parties Dingji Capital Management Co., Ltd., Beijing Oriental UnionPay Investment Management Co., Ltd. The shareholding ratio has been reduced from 25.82% to 24.92%.

Screenshot of China Fortune Announcement

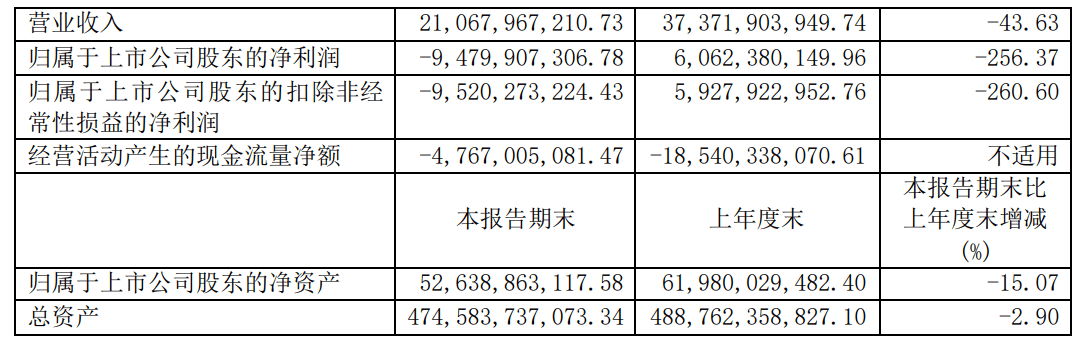

The 2021 semi-annual report shows that China Fortune Land Development achieved revenue of approximately 21.068 billion yuan, a year-on-year decrease of 43.63%; net profit loss attributable to shareholders of listed companies was approximately 9.48 billion yuan, a year-on-year decrease of 256.37%; realized sales of 13.968 billion yuan, compared with the previous year A decrease of 66.69% over the same period.

As of June 30, 2021, the book balance of China Fortune Monetary Funds was 13.98 billion yuan, of which available funds were 734 million yuan, various restricted or restricted-use funds were 13.246 billion yuan; the book balance of financial interest-bearing liabilities was 187.619 billion yuan Among them, short-term loans and short-term bonds payable were 29.136 billion yuan, and non-current liabilities (excluding lease liabilities) due within one year were 78.69 billion yuan.

Screenshot of China Fortune Land Development’s 2021 semi-annual report

With Ping An of China passively becoming the largest shareholder, some shareholders are worried about whether the company needs to consolidate the statements of China Fortune. This will further deteriorate the financial statements of Ping An of China.

However, China Fortune Land Development said that although the largest shareholder has changed, the actual controller status of the company’s chairman Wang Xuewen has not changed.

The announcement pointed out that among the 9 board members of China Fortune Land Development, 4 of the 6 non-independent directors are nominated by China Asset Management. All 3 independent directors are recommended by China Asset Management and nominated by the board of directors. Directors recommended and nominated by China Asset Management account for the members of the board of directors. The majority.

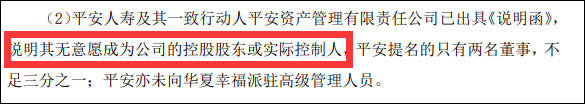

In addition, Ping An Life and its concerted parties Ping An Asset Management Co., Ltd. have issued an “Explanation Letter” stating that they have no intention to become the controlling shareholder or actual controller of China Fortune Land Development.

At the same time, Ping An has nominated only 2 directors, which is less than one-third of China Fortune’s board of directors, and Ping An has not sent senior executives to China Fortune. In summary, China Fortune Land Development believes that this change in equity will not lead to changes in the company’s controlling shareholders and actual controllers.

Screenshot of China Fortune Announcement

On February 2 this year, China Fortune Land Development announced for the first time “Thunderstorm”, claiming that the principal and interest involved in the overdue debts of the company and its subsidiaries were 5.255 billion yuan, involving bank loans, trust loans and other forms of debt. Subsequently, the company’s debt overdue announcements began to appear intensively.

As of September 4, China Fortune Land Development failed to repay the principal and interest of the debt as scheduled, totaling 87.899 billion yuan.

Screenshot of China Fortune Announcement

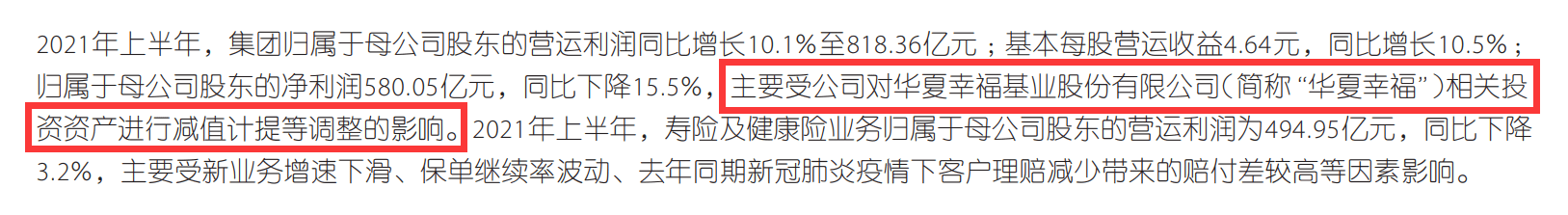

As China Fortune Land has fallen into the debt quagmire, in the first quarter of 2021, Ping An of China will impair China Fortune-related investment assets and mention a valuation adjustment of 18.2 billion yuan; throughout the first half of the year, Ping An of China reduced China Fortune-related investment assets. The amount of value provision, valuation adjustments and other equity adjustments rose to 35.9 billion yuan.

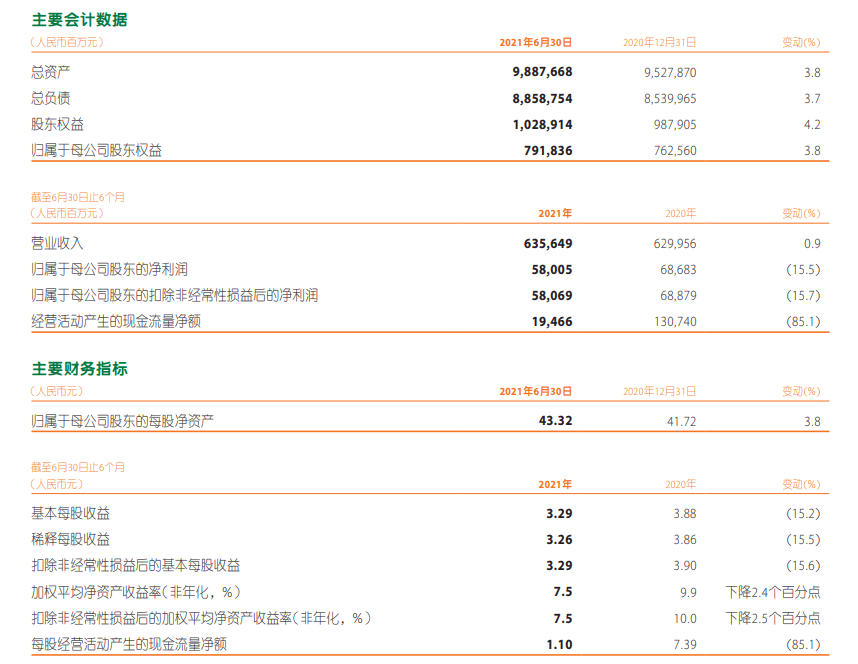

The financial report shows that in the first half of 2021, Ping An achieved revenue of 635.649 billion yuan, a year-on-year increase of 0.9%; realized net profit belonging to shareholders of the parent company of 58.05 billion yuan, a year-on-year decrease of 15.5%, mainly due to the company’s reduction of China Fortune-related investment assets. The impact of adjustments such as value accrual.

Observer NetworkReturn to Sohu to see more

Editor:

Disclaimer: The opinions of this article only represent the author himself. Sohu is an information publishing platform. Sohu only provides information storage space services.

.