Information event

On July 7, 2021, Premier Li Keqiang presided over the State Council executive meeting and mentioned the RRR cut.The meeting decided that in view of the impact of rising commodity prices on the production and operation of enterprises, it is necessary to maintaincurrencyPolicy stability, enhancement of effectiveness, timely use of monetary policy tools such as RRR cuts, to further strengthen financial support for the real economy, especially small, medium and micro enterprises, and promote a stable and moderate reduction in comprehensive financing costs.

Comment

We are concerned about the potential impact of the “timely use of currency policy tools such as RRR cuts” on the bond market’s trend proposed by the meeting:

(1) Judging from historical data, there is no inevitable trend connection between the RRR cut and the subsequent trend of the bond market.

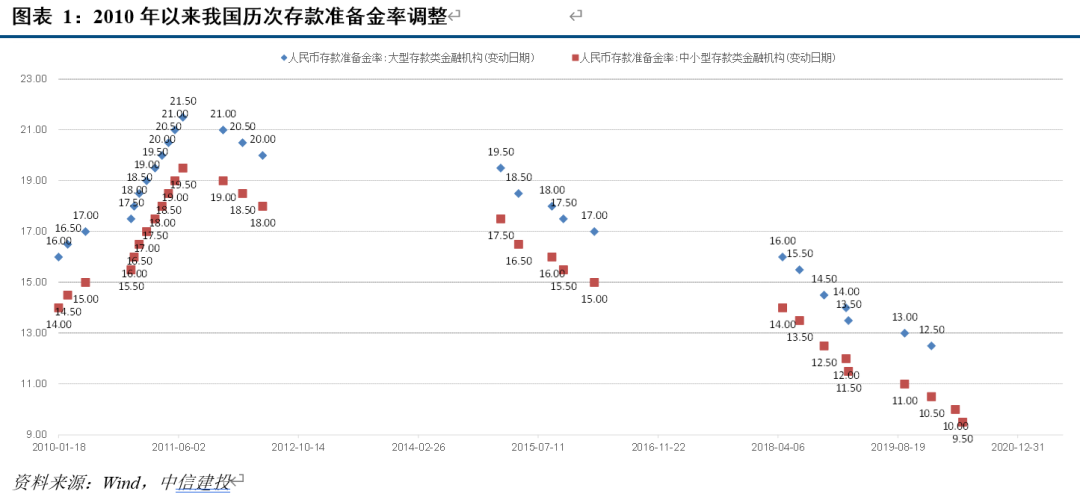

Since 2010, my country has made a total of 17 RRR cuts. Among them, 15 times were the overall RRR cuts for large, medium and small deposit financial institutions; two were structural RRR cuts for small and medium deposit financial institutions, which occurred during the special period of the new crown epidemic in April and May 2020 respectively.

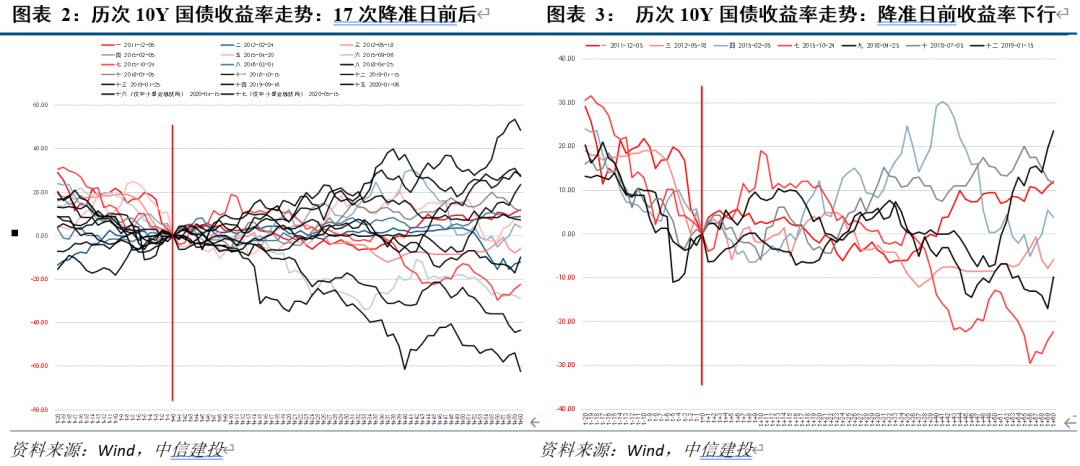

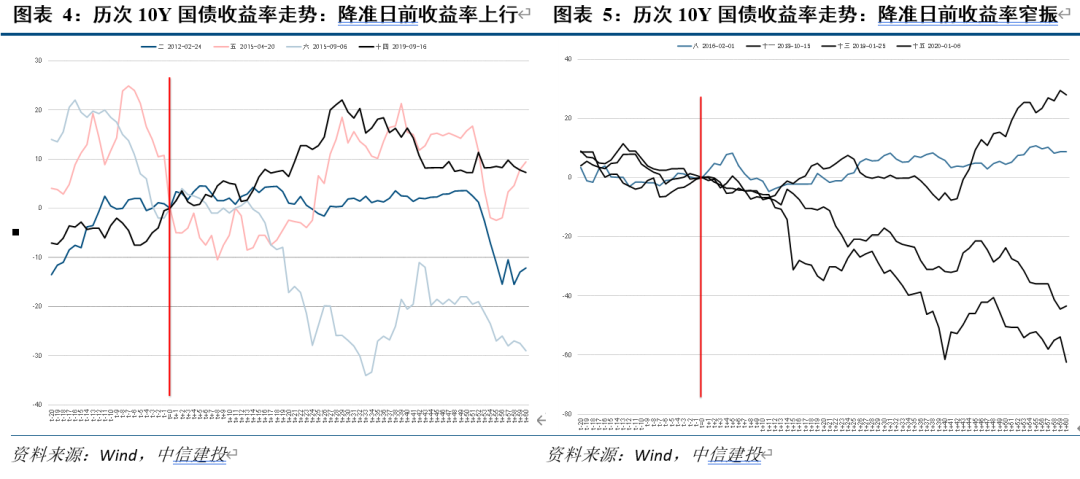

We examined the bond market trends before and after all 17 RRR cuts. On the whole, there is no inevitable trend connection between the RRR cut and the subsequent trend of the bond market. When examining the trend of 10Y Treasury bond yields from the first 20 trading days to 60 trading days after the date of all 17 RRR cuts, as shown in Chart 2 to Chart 5, whether it is all 17 times or the yield before the RRR cut It is difficult to conclude that there is an inevitable trend connection between the significant RRR cut and the subsequent bond market yield trend.

(2) We believe that if the RRR is reduced, it is not to release liquidity, but to reduce financing costs.

Judging from my country’s past RRR cuts, there are uncertainties in the timing and motivation of the RRR cuts, as well as uncertainties in the subsequent monetary policy operations. If the RRR is lowered this time, it may be a directional reduction, or it may be a general reduction.The most likely way is to replace a large number of expired MLFs by reducing the RRR, releasing cheaper funds.bankCosts, thereby reducing financing costs for SMEs. This should be the original intention of the RRR cut (if any).Since the beginning of this year, the weighted average of RMB loans by financial institutionsinterest rateSome rise, the signal of the RRR cut and the previous depositinterest rateMeasures such as the reform of the pricing mechanism are all conducive to reducing the financing costs of enterprises, especially small and medium-sized enterprises, and solving structural problems.

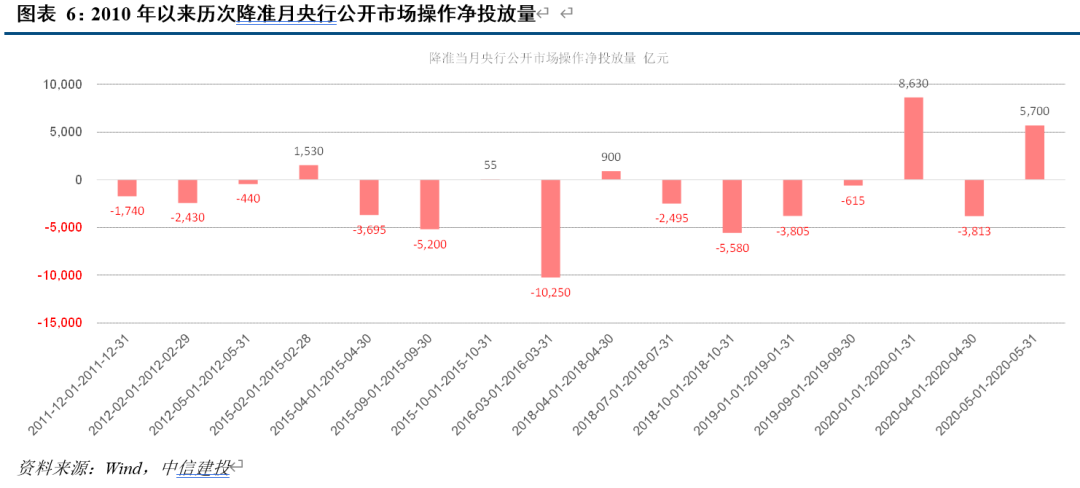

But the RRR cut does not mean flooding. When we look at the central bank’s open market operations in the past month of RRR cuts, in most of the months that the RRR cuts, the central bank conducted a net withdrawal of funds through open market operations; only two of the months where the RRR cuts had a relatively large net investment The situation all happened during the special period of the outbreak of the new crown epidemic in 2020.

As pointed out in the decision of this session of the State Council, in view of the impact of commodity price increases on the production and operation of enterprises, it is necessary to maintain the stability and effectiveness of monetary policy on the basis of not engaging in flood irrigation, and to apply monetary policies such as RRR cuts in a timely manner. Tools to further strengthen financial support for the real economy, especially for small, medium and micro enterprises, and promote a steady but slow decline in comprehensive financing costs.

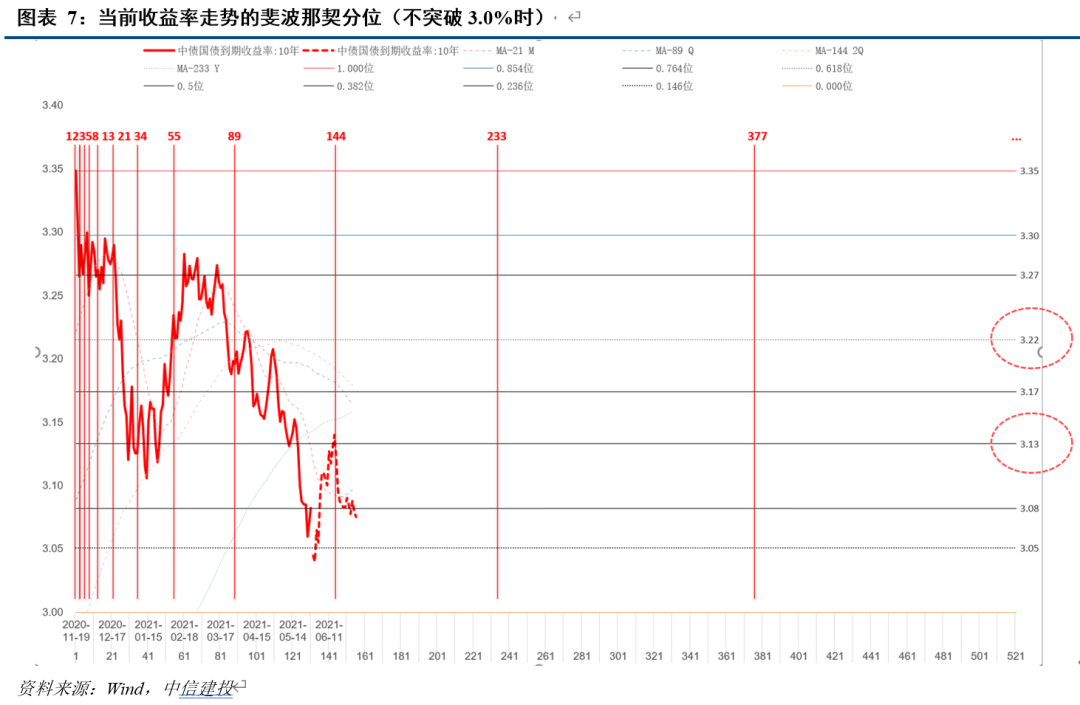

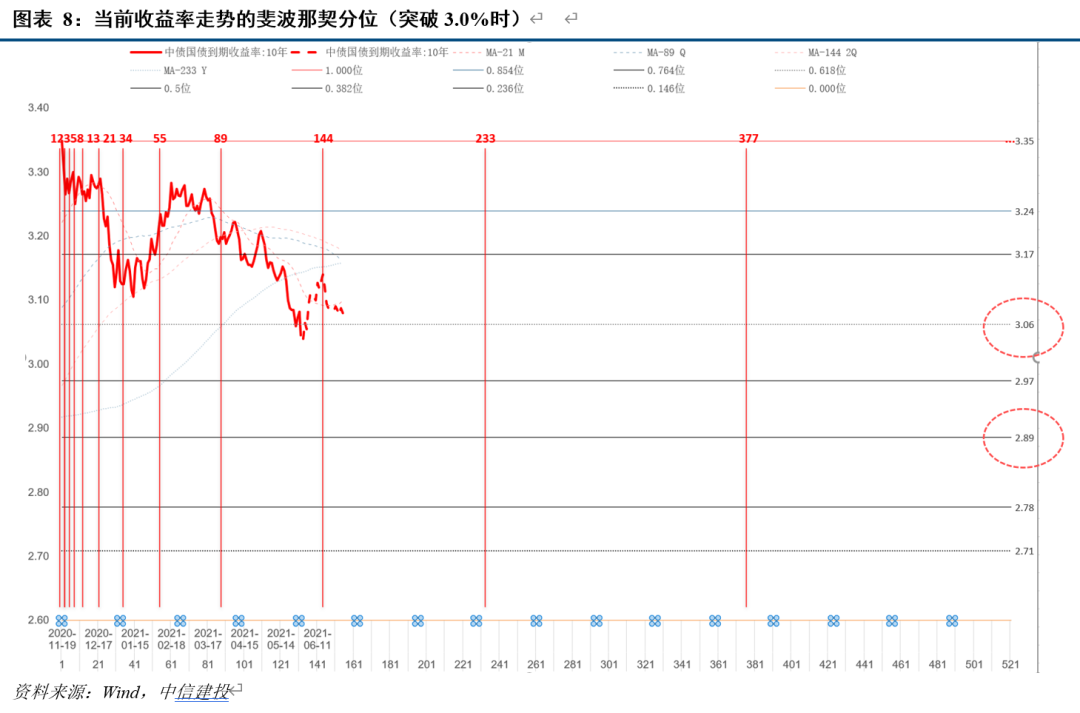

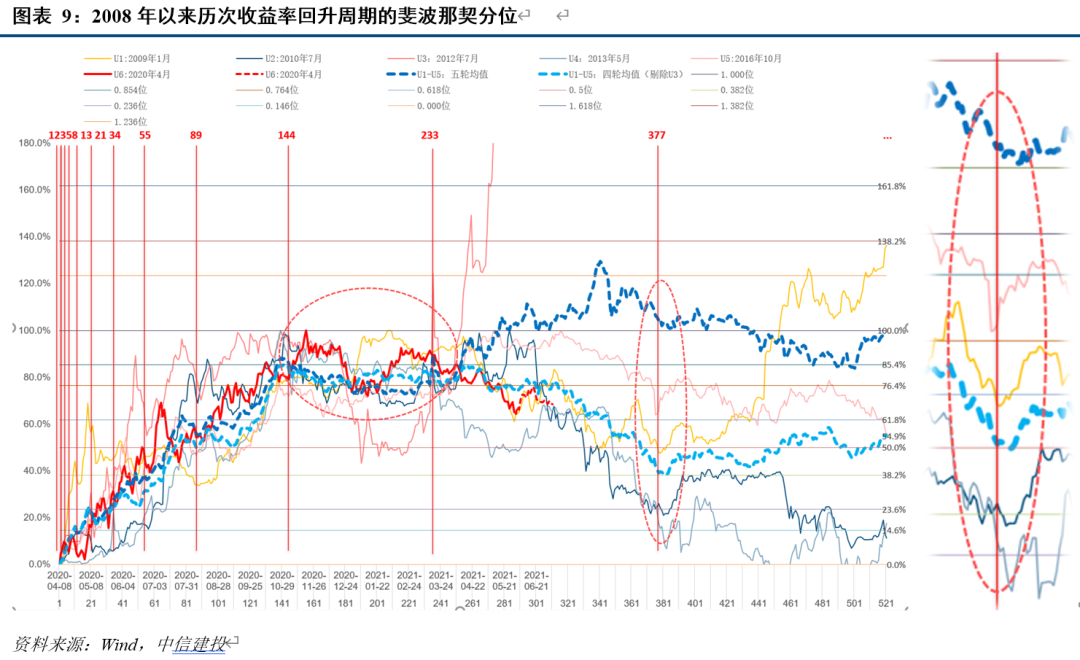

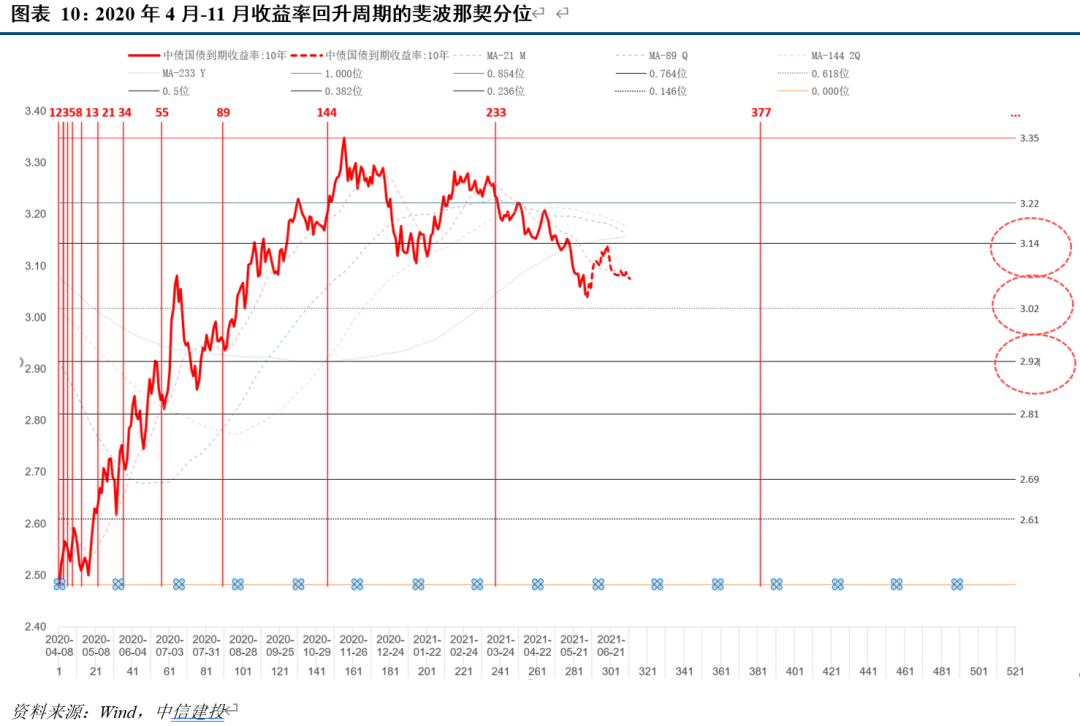

(3) According to the analysis logic of our Fibonacci report on June 1, if the yield of 10Y Treasury bonds can effectively break through the 3.0%-3.05% pressure zone, the follow-up technical side will directly point to the 2.89%-2.92% front line; If the rate cannot be effectively broken, the technical upward retracement will again point to the 3.13% quintile and continue to oscillate; no matter what the trend, the technical cyclical tends to be from mid-to-late October to early November, and the yield may appear ” V-shaped” small cycle trend.

Our report on June 1 “Has a New Round of Downward Cycle of Bond Market Yield Started?” ——Based on Fibonacci Cycle Analysis” made a series of forecasts based on cyclical and technical analysis, including: the end of this round of yield recovery cycle has been confirmed on the technical side; 3.05% is a strong resistance to the downward return. Line, if there is no new fundamental force to cooperate, it is difficult to effectively break through the technical force alone, and it will rebound to a strong retracement line 3.13%, etc.

At present, the market from June 1 to the present has evolved within the logical path of analysis and outlook:

Chart 7, as shown by the red dotted line, the 10Y Treasury bond yields from June 1 to the present have dropped 3.05% and 3.13% respectively, fluctuating within a narrow range, and further converged to the Fibonacci golden ratio of 0.236 and 3.08. %. Technically, a further decline in the rate of return will mean that it is again close to the downward breakthrough pattern, which requires the cooperation of new fundamental forces.

Chart 8 and Chart 10, as shown by the red dotted line, if the fundamentals and technical forces cooperate to effectively break through the 3.0%-3.05% strong resistance zone, the technical point of return can be the first step to drop to 2.89%-2.92% First line.

Chart 9, as shown in the 377 cycle line and its partial enlarged chart, 1) The current market rate of return is still in a stage of turbulence and downward pressure. Whether this RRR cut constitutes a fundamental and technical force resonance breakthrough remains to be followed Confirmation of the evolution of fundamental and technical patterns; 2) Regardless of whether there is a breakthrough, the cyclicality of the technical side tends to be from mid-to-late October to early November, and yields may show a “V-shaped” small cycle trend, so you need to be prepared in advance .

risk warning:The trend of the epidemic has exceeded expectations; the economy and policies have exceeded expectations; overseas uncertainties have exceeded expectations, etc.

(Article Source:China SecuritiesSecurities Co., Ltd.)

.