According to a report from Xinhua News Agency in New York, due to the failure of the Organization of the Petroleum Exporting Countries (OPEC) and its partner countries to announce the August production policy at the monthly meeting held yesterday, international oil prices ushered in a sharp rise on the 1st. On the same day, light crude oil futures closed at US$75.23 per barrel, and London Brent crude oil for September delivery closed at US$75.84 per barrel. New York crude oil futures contract prices closed at more than US$75 per barrel for the first time since October 2018.

From the perspective of domestic oil prices, the increase has also continued to rise. According to statistics, the increase in domestic oil prices has exceeded the upward red line of 50 yuan/ton, reaching 75 yuan/ton. For example, the price of Jiangxi 92 gasoline after adjustment is 7.04 yuan/liter, the price of 95 gasoline after adjustment is 7.56 yuan/liter, the price of 0 diesel after adjustment is 6.77 yuan/liter; the price of Hangzhou 92 gasoline is 6.87 yuan/liter, the price of gasoline It is 7.31 yuan/liter; the price of No. 0 diesel is 6.52 yuan/liter.

This must be bad news for friends who drive gasoline-powered cars: the epidemic has not passed yet, the wallet is flat, and the car is expensive to leave at home. Everyone unanimously turned their attention to new energy vehicles.

01

Is there a chance for new energy vehicles with rising oil prices?

This oil price increase started as early as the end of June. On June 28, the price of gasoline rose again, and the price of No. 92 gasoline once again returned to the era of 7 yuan.

Why is the oil price rising? It turned out that Iran, a major exporter of crude oil, saw a substantial increase in its oil exports in March, once surpassing 1 million barrels per day, and a large amount of cheap crude oil poured into China. According to internal sources, shipments to China reached 30 million barrels in March alone. The price of Iranian crude oil per barrel is 3 to 5 US dollars (about 20 to 33 yuan) cheaper than the benchmark Brent crude oil price. This is the third consecutive week that international oil prices have fallen and have already fallen below the $70 mark.

However, as the world‘s major crude oil exporter, Saudi Arabia is unwilling to lower crude oil prices. At the meeting of the Organization of the Petroleum Exporting Countries and its allies (OPEC+), they supported extending crude oil production cuts to May and June, while expanding the country’s voluntary production cuts to boost oil prices. Even Russia will support OPEC+ to continue its production reduction measures until May, but it will strive to increase production for its own country slightly.

As a result, with the economic recovery, the market’s demand for oil is increasing, and with OPEC’s limit, oil prices have also risen.

Regarding the increase in gasoline prices, will the sales of new energy vehicles increase? It is reported that many car owners said: “We are ready to consider changing to new energy vehicles.”

It is worth noting that China will achieve the complete withdrawal of traditional fuel vehicles from the new car market in 2050 (the private cars with a large volume and wide range will be withdrawn in 2045). By then, the proportion of traditional fuel vehicles in the stock market is expected to be 5%. Around, follow-up through natural elimination to withdraw. In other words, fuel vehicles have actually begun the countdown to delisting.

But for new energy vehicle manufacturers, although rising oil prices force consumers to have a strong desire to buy new energy vehicles, they themselves have to face additional pressure.

02

The chip crisis has led to a substantial increase in car costs

According to foreign media reports, due to the continued impact of chip shortages, 55,000 cars in North America were discontinued in early June. Looking at the world, the cumulative number of cars discontinued due to chip shortages has reached 2.99 million. Foreign media have predicted that the shutdown due to chip problems may reach 4.09 million vehicles.

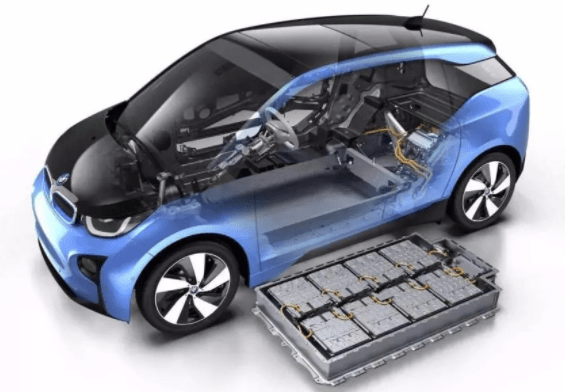

Industry insiders said that an ordinary car will use at least more than 40 kinds of chips, while high-end models need more than 150 chips. Car chips are divided into three categories according to their functions. The first category is functional chips, which are responsible for computing power, specifically processors and control chips, such as central control systems, ADAS (advanced driving assistance systems) and autonomous driving systems, as well as engines and chassis. And body control. The second category is semiconductors responsible for power conversion for power supplies and interfaces, such as IGBT (Insulated Gate Bipolar Transistor) power chips for EVs. The third category is sensors, which are mainly used for various radars, airbags, and tire pressure detection.

Among them, new energy vehicles, as mid-to-high-end models on the market, require more chips. Behind the chip shortage, not only the production of new energy vehicle manufacturers has declined, but the cost of vehicles has also increased.

In addition, as more people want to buy new energy vehicles, the prosperity of the core industries in the upstream of the industry chain is now rising. Not only the supply and demand imbalance of lithium copper foil, but also the supply of power batteries and upstream raw materials are in short supply.

According to the industry, there are two main reasons for the shortage of power batteries. One is the substantial increase in sales of new energy vehicles on the demand side, and the demand for power batteries, known as the “heart” of new energy vehicles, has also increased significantly; the second is the supply of upstream raw materials. Supply is tight. In addition to lithium battery copper foil, there is also a tight supply of mineral resources.

In addition to the strong demand for power batteries, the global supply of lithium resources is the main reason. At present, precious metal resources such as lithium mines are mostly concentrated in overseas countries such as Australia and Chile. The epidemic has slowed down their lithium mining and export speeds, and there is a trend of further tightening, and the supply of lithium resources cannot be guaranteed.

Therefore, in order to maintain the healthy development of the new energy vehicle market, relevant government subsidies and favorable policies are very important.

So for consumers, are new energy vehicles worth buying now? An old driver suggested that if you want a transportation tool in the city, you may consider new energy vehicles, but for consumers who have long-distance needs and frequent vehicle needs, new energy vehicles have not yet reached the long-term endurance. Ability, or fuel vehicles are more reliable.Return to Sohu to see more

Editor:

Disclaimer: The opinions of this article only represent the author himself. Sohu is an information publishing platform. Sohu only provides information storage space services.

.