Recent performance of Hong Kong stocks: stabilized after a sharp correction, and the market has gradually entered a “layout period”

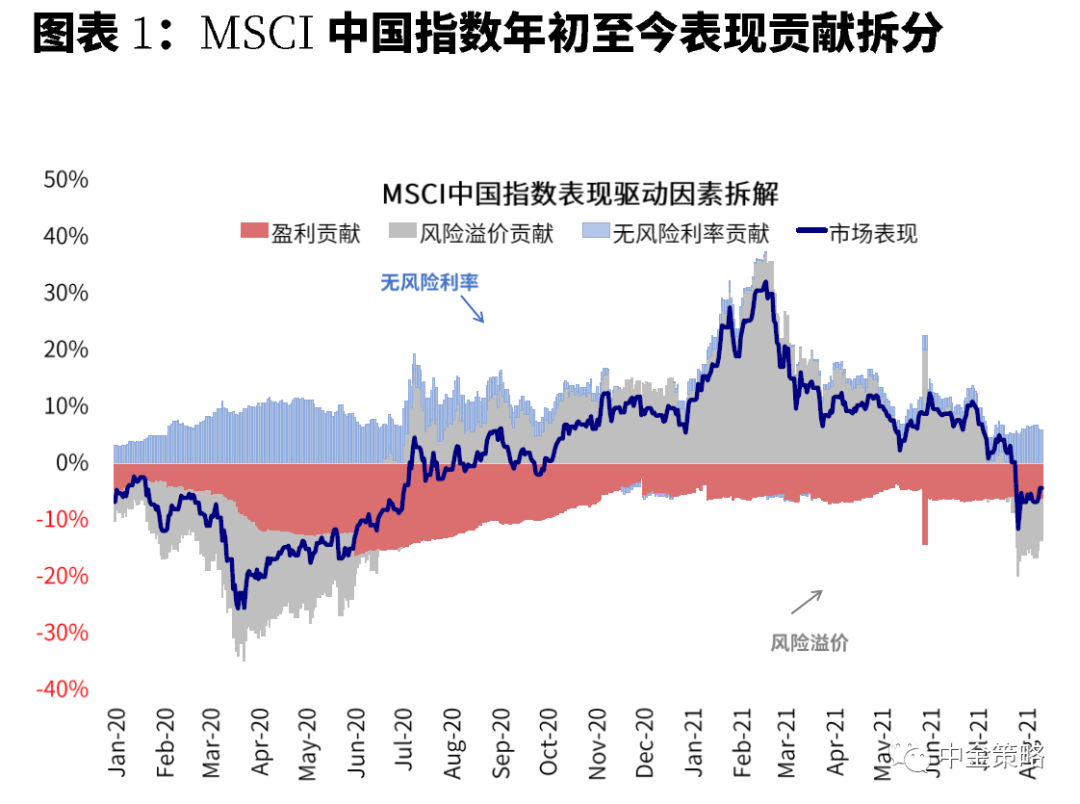

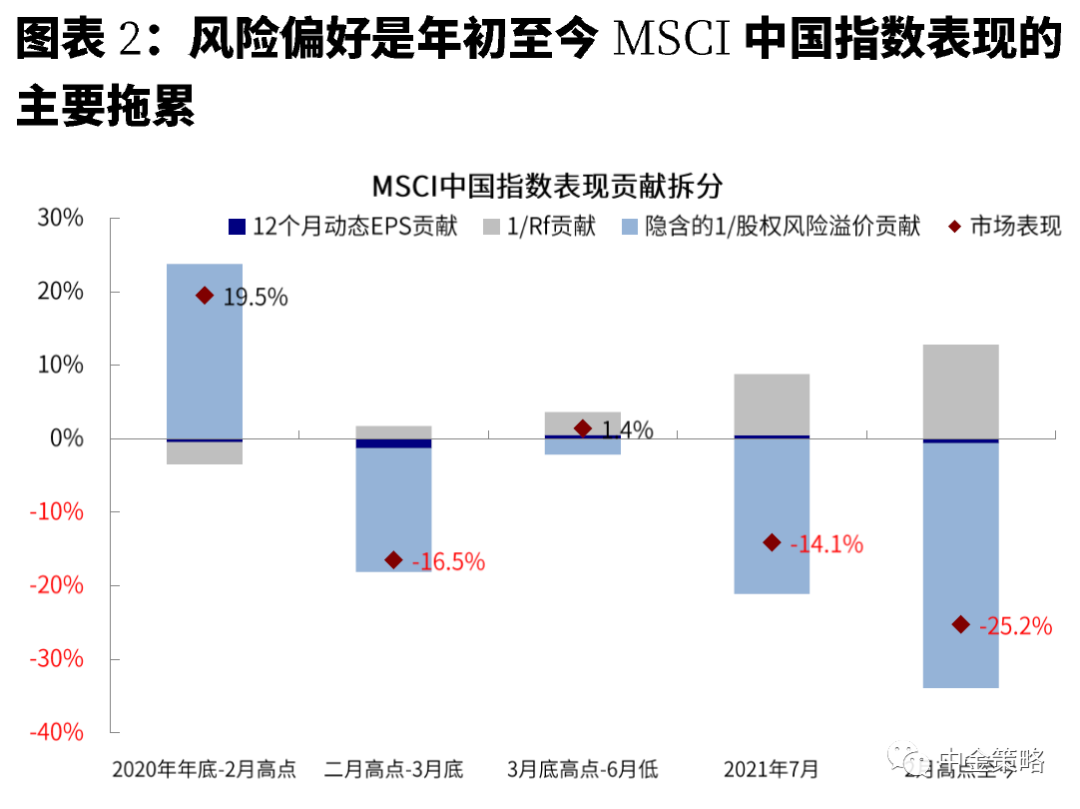

Hong Kong stocks have generally declined since the mid-February high, especially at the end of July due to policy and regulatory concerns that triggered a new round of panic selling, which significantly underperformed the global market and bottomed out. Since the high point, the Hang Seng Technology Index, which bears the brunt, fell 39.8%, MSCI China pulled back 26.1%, the Hang Seng Index fell 16.1%, and the State-owned Enterprise Index fell 23.3%, which was once close to the low point during the epidemic last year.

We pointed out in our recent special report “CICC: Hong Kong Stocks Gradually Entering the “Layout Area””,Although regulatory uncertainty is still the main factor affecting short-term market volatility, we believe that the market may have included too much pessimism, especially for high-quality growth stocks. Several factors we have observed indicate that the market may gradually enter the “layout area”: 1) Market valuations include more pessimism. The current dynamic valuation level has dropped to 0.5 times the standard deviation below the long-term average. Even after assuming a 10%-20% reduction in earnings, some valuations are still below the average; a horizontal comparison of other markets and other assets also shows that Hong Kong stocks are relatively attractive; 2 ) In terms of market sentiment, some technical indicators showed extreme signals such as oversold; 3) Overseas funds did not have the large outflow that the market was worried about, and southbound funds returned again after the market stabilized, and so on.

On the whole, considering that the current market is still sensitive to changes in media and official stances, we believe that short-term uncertainty may still cause disturbances, but the attractiveness of the market for long-term investors is also becoming prominent.

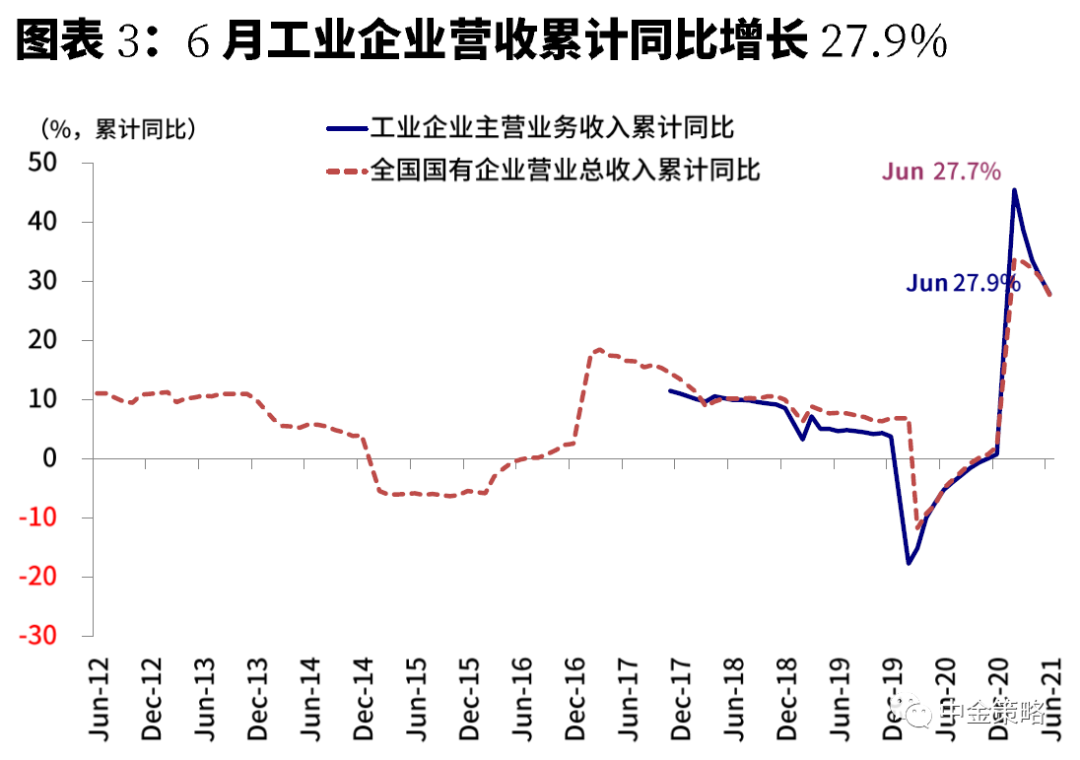

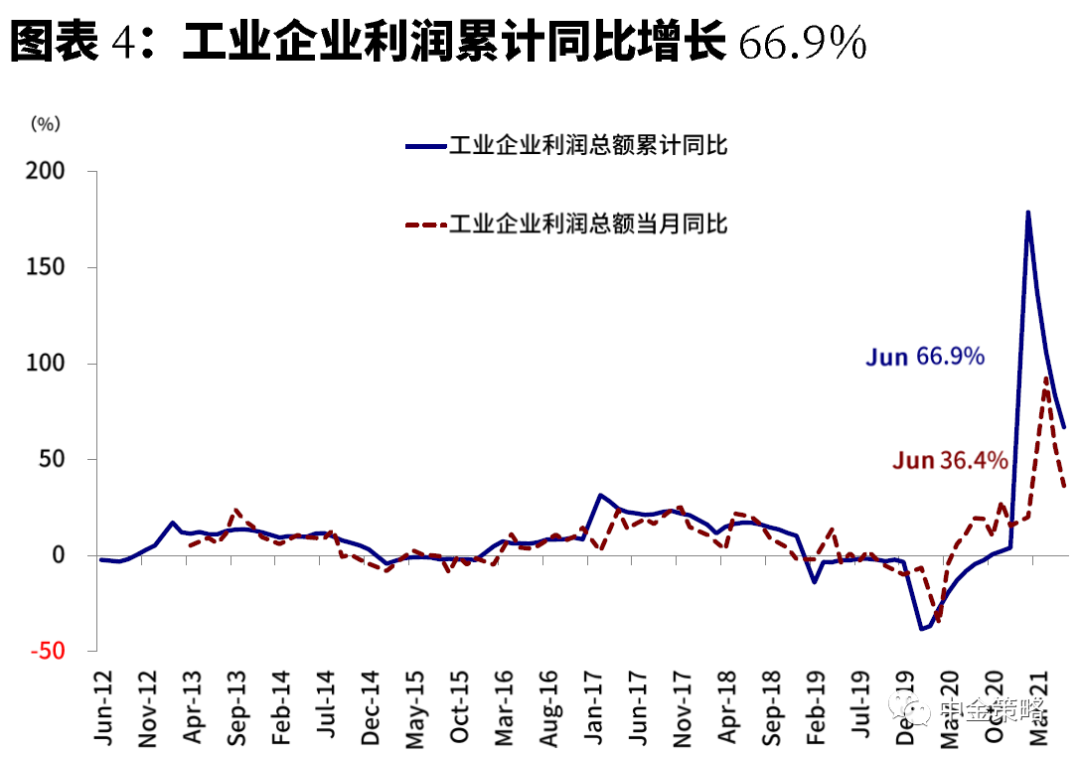

Interim ReportPerformancePreview: Growth in the second quarter is expected to remain strong, and the performance growth of the semiconductor, automotive, and raw materials sectors may be higher; but the overall growth is still in a downward adjustment channel

In this context and market environment,The upcoming second quarter/interim report performance period of Hong Kong stocks and China concept stocks is particularly critical. On the one hand, it can be used as a reference for the market to evaluate the impact of previous policy pressures on profitability, and on the other hand, it can also be the main basis for investors to choose the best layout. .

The Hong Kong stock market will enter an intensive period of performance disclosure in late August. We use MSCI China as the analysis object (~85% of the weights are Hong Kong stocks and China stocks), and the current disclosure rate is not high (about 12%).

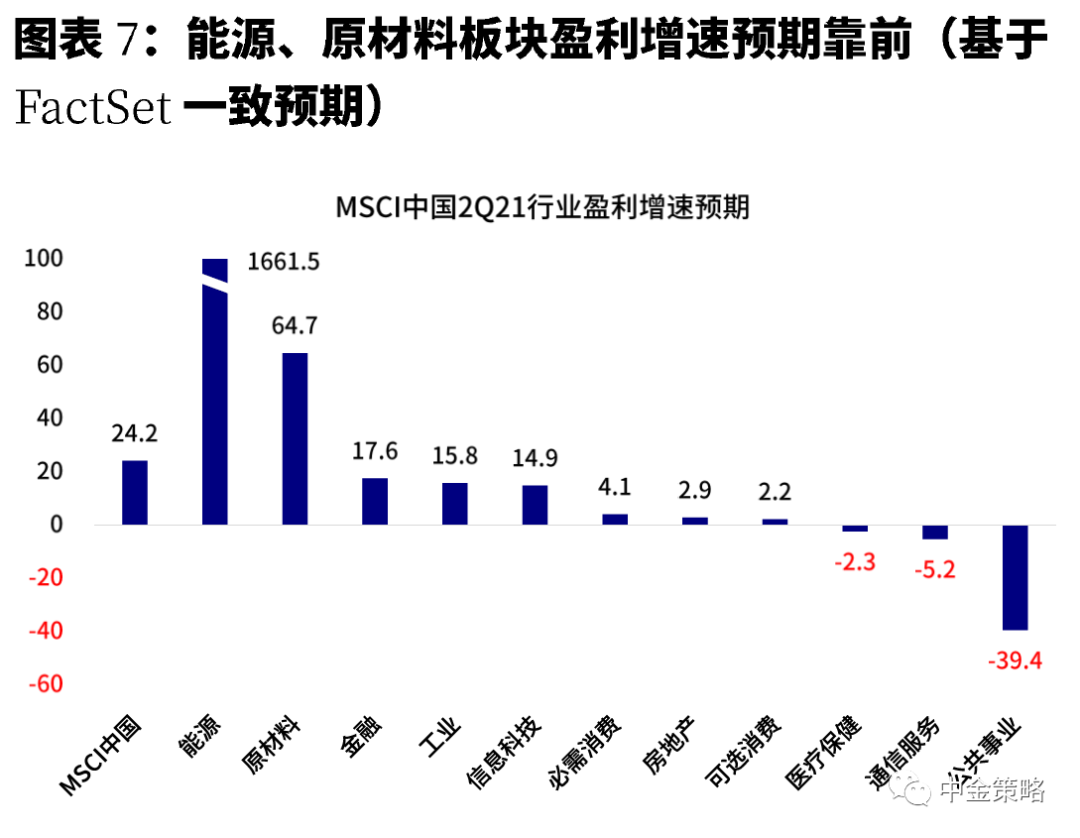

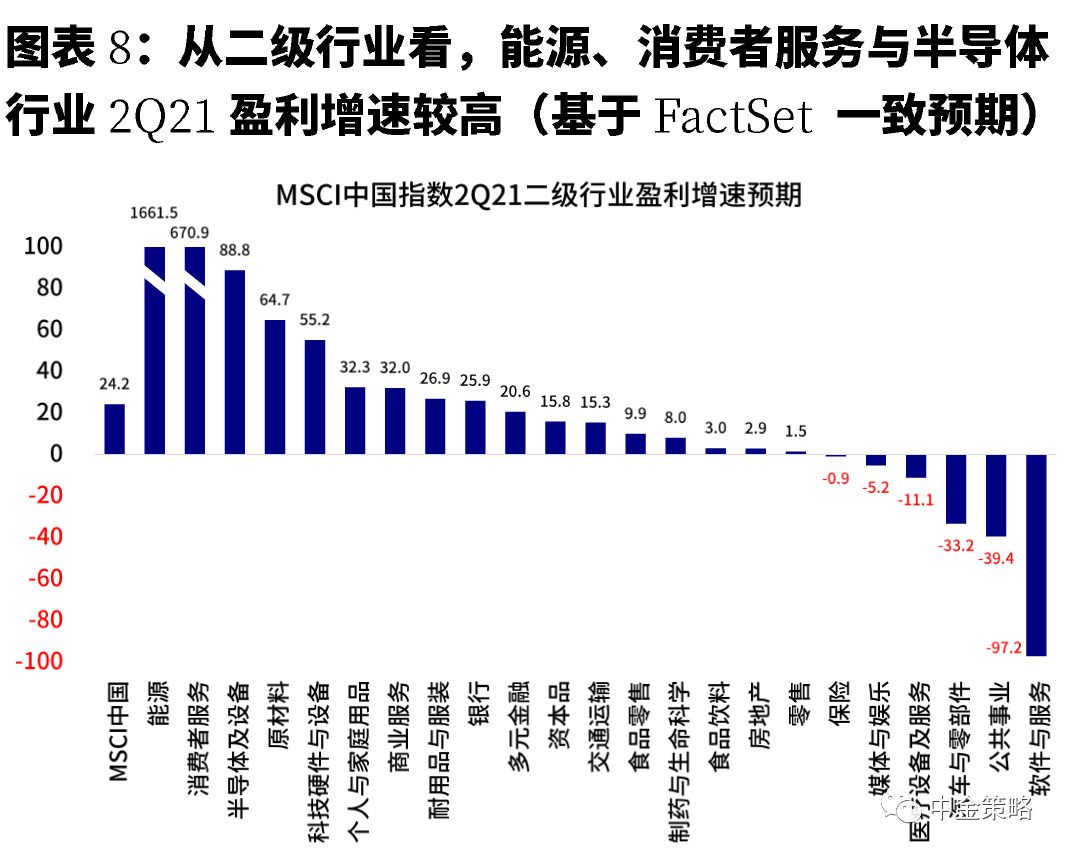

Taken as a whole, the consensus expectations of FactSet summary show that,MSCI China’s profit growth rate in the second quarter is expected to reach 24.2%, slower than the 37.9% in the first quarter. At the sector level, the current FactSet expectation shows that energy, consumer services, semiconductors, raw materials and technology hardware are expected to achieve a profit growth rate of more than 50%, while software and services, public utilities, automobiles, medical equipment and services, media and entertainment sectors are profitable. The growth rate is negative. Compared with the first quarter, the profitability of food retail, commercial services, and other sectors that have suffered more from the epidemic has improved significantly. In contrast, the profit growth of medical equipment and services, media and entertainment, and automobiles has dropped significantly.

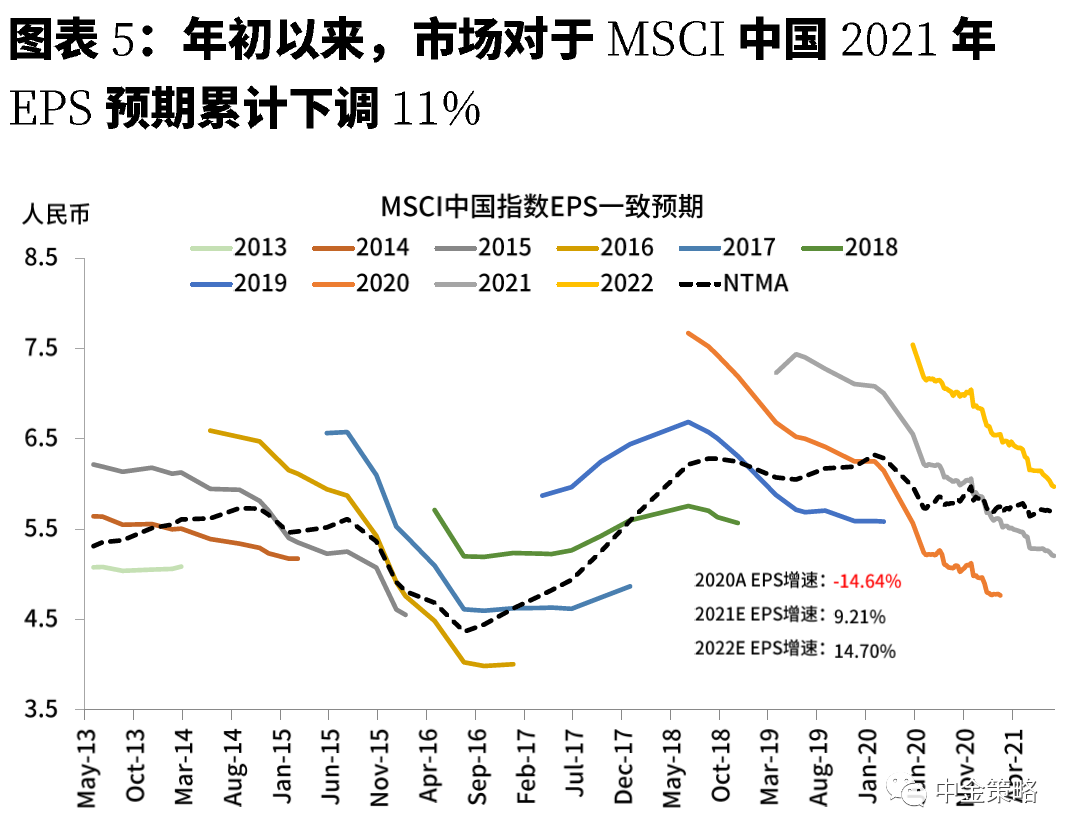

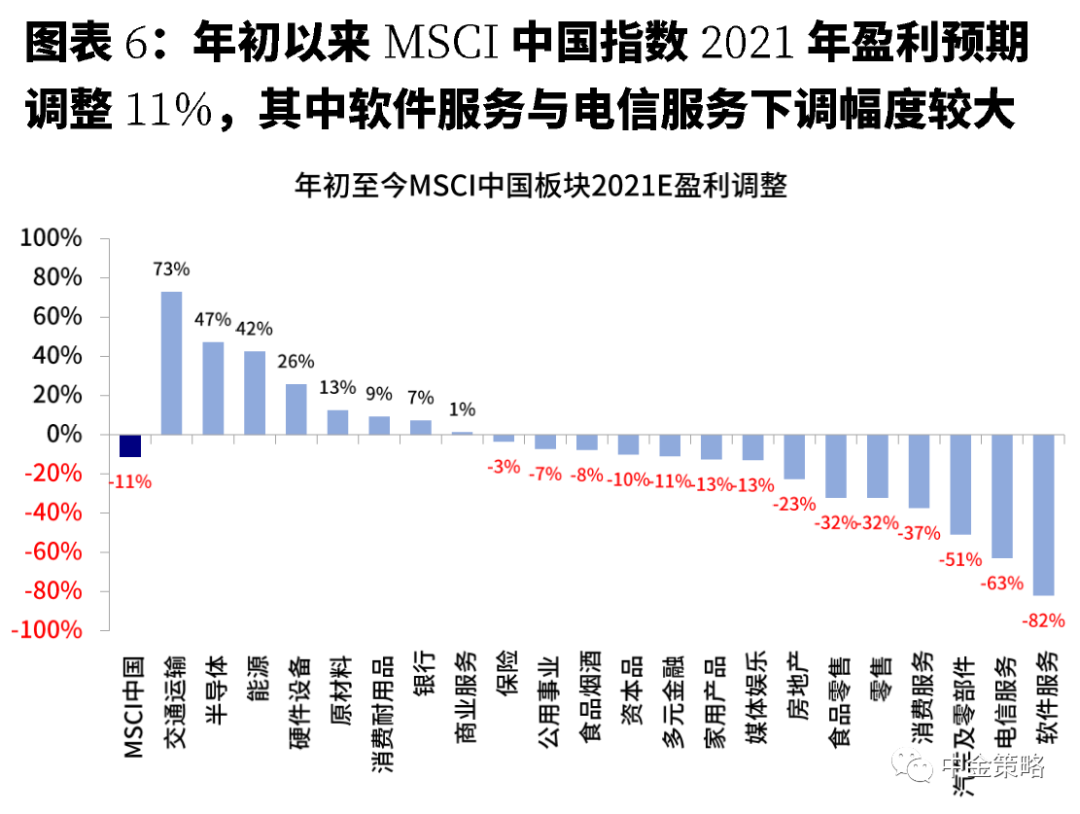

Since the beginning of the year, the market has lowered its forecast for MSCI China’s 2021 EPS by 11%., Among which the profit adjustment between the sectors is clearly differentiated. The transportation, semiconductor, and energy sectors have increased their earnings by more than 30%, whilesoftware service, Telecommunications services, automobiles and parts, consumer services, retail and other profitability fell sharply by more than 30%.

Which companies report performance may exceed expectations?Based on CICC IndustryAnalystBottom-up summary

We combined with CICC industry analysts to sort out individual stocks whose performance in the first half of the year may exceed expectations from the bottom up.. Specifically, we found that, affected by the rise in upstream energy and raw material prices,Oil and gas, coalas well asSteelThere are many companies in the sectors that are expected to exceed expectations, including Maanshan Iron and Steel,Yanzhou Coal IndustryAnd CNOOC, etc. In the middle and lower reaches of the industry,Automotive and parts sectormiddleGuanghui BaoxinandYongda AutomobileMany other companies benefit from strong external demand and are expected to exceed expectations.real estatePlates such asYuexiu PropertyAnd Sunac has been actively acquiring land since the beginning of the year, or promoting annual sales and delivery upgrades.Some consumer sectors such asTextile and ApparelindustryThe China Sports sector has benefited from the “rise of domestic products” and the Tokyo Olympics. There are also many companies such as Chaoying International andVirginieEarnings may be higher than expected.

Companies whose performance in this interim report may be lower than expected are also mainly concentrated inTextile and Apparelindustry,likeGoodbaby InternationalandUrban beautyLower than expected or caused by the company’s internal management reform, andChina ToshiroIt is because its offline business growth is lower than expected.

In addition, companies that have disclosed their performance also present a similar situation.The upstream industry has benefited from rising energy and raw material prices,Zijin Mining、China ShenhuaMany other companies exceeded expectations; thanks to strong external demand, leading auto and parts sectorsZhongsheng HoldingsandFuyao GlassAlso exceeded expectations; the delivery sector was affected by the rise in global freight rates,SITC InternationalandCOSCO SHIPPINGMany companies have performed well; in the real estate sector, there are also many companies in property management, such asChina Resources Vientiane Life、Country GardenAnd other performance exceeds expectations, and is expected to maintain a relatively high degree of prosperity.However, lower-than-expected companies are concentrated on gaming and luxury goods that have been severely affected by repeated epidemics, such asSJM HoldingsWait. The performance of the media and Internet sector is divided, reading articles,BaiduBenefited from the outstanding performance of the main business, exceeding expectations, andTencent MusicIt was lower than expected due to the large investment in content and new business.

In the original report, we provided individual stocks whose bottom-up performance may exceed expectations, as well as a combination of oversold rebounds and high-quality leaders selected from the perspective of top-down strategies for investors’ reference.

Source: Wind Information, Bloomberg Information, Factset,CICCResearch

(Source: CICC Strategy)

.