Core point of view

The US non-agricultural employment population increased by 235,000 after the August seasonal adjustment, which was far lower than the expected increase of 720,000. The Delta mutant strain caused the epidemic to rebound. Residents’ increased concern about the epidemic is the main reason why the number of new non-agricultural employment is far below market expectations, which is manifested in the unexpected zero growth of the leisure hotel industry.Job repair has slowed again, leading toMidlandThe timing of Chu’s announcement of Taper may be pushed to the end of the year. Under the expectations of Taper’s delay, U.S. debtinterest rateThe upward turning point has not yet arrived, and has little impact on the domestic bond market. As far as the domestic bond market is concerned, the broad credit logic is still in the mid-to-long term; in the short term, the asset shortage may continue for some time. Under bullish factors such as expectations of weak fundamentals, the bond market is still going well, and the current risk of holding bonds is low.

data:According to data released by the US Department of Labor, the US non-agricultural employment population increased by 235,000 after the August seasonal adjustment, and is expected to increase by 720,000. The previous value was revised up from an increase of 943,000 to an increase of 1.053 million; the unemployment rate in August was 5.2%. The forecast is 5.2%, the previous value is 5.4%; the average annual rate of wages in August increased by 4.3%, the expected increase was 4%, and the previous value increased by 4%; the labor participation rate in August was 61.7%, the expected value was 61.8%, and the previous value was 61.7 %.

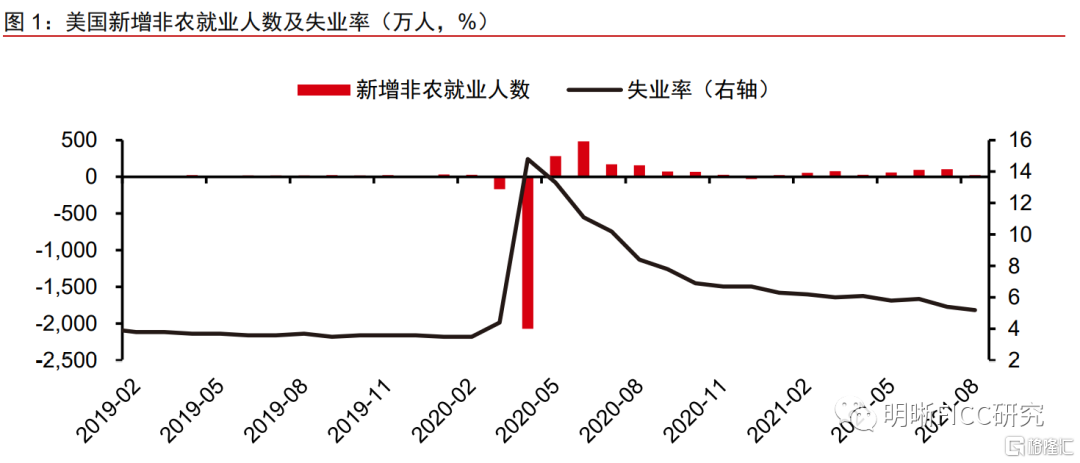

The epidemic has disrupted employment restoration, and non-agricultural markets are far lower than market expectations.From the perspective of changes in the number of non-agricultural employment, the US non-agricultural employment population increased by 235,000 after the seasonal adjustment in August, which is expected to increase by 720,000. At the same time, non-agricultural employment increased from 943,000 to 1.053 million in July. Increased from 938,000 to 962,000, the number of newly-added non-agricultural employment hit a new low since January 2021, and the unemployment rate fell to 5.2%, the lowest since March 2020. We believe that the Delta mutant strain caused a rebound in the epidemic, and residents’ increased concern about the epidemic is the main reason why the number of new non-agricultural employment is far below market expectations.

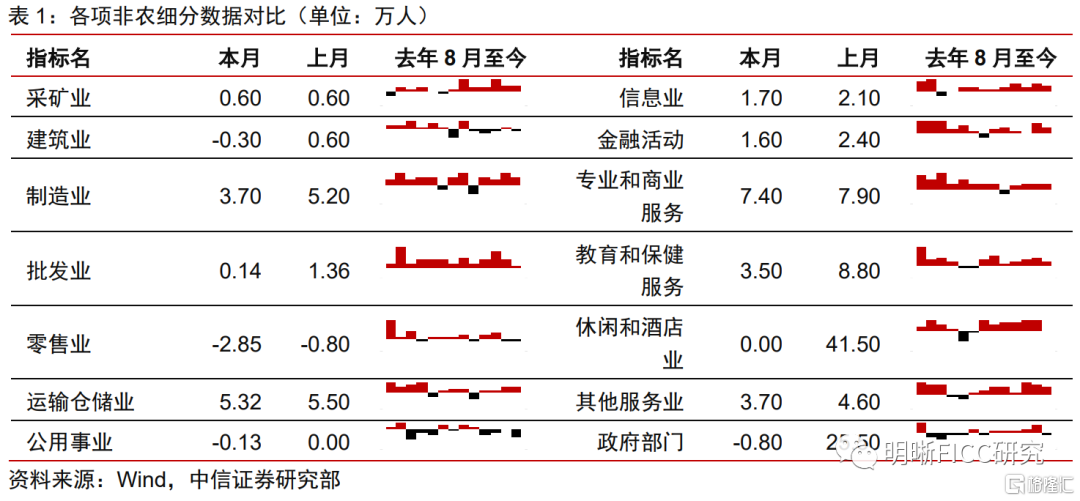

The leisure hotel industry has unexpectedly zero growth, and the growth of the service industry and education industry has slowed down.In terms of industries, the industries that contributed more to the increase in non-agricultural employment in the United States in August came from professional and commercial services and transportation and warehousing. The main source of agricultural employment was the unexpected zero growth in the leisure hotel industry, which resulted in a weaker-than-expected non-agricultural data, which decreased by about 415,000 month-on-month compared to July. From the perspective of industry data, the slowdown in employment growth in the service industry in the United States is one of the main factors that caused the number of employment to be significantly lower than the overall growth rate. The impact of the new round of epidemic on consumption and employment activities is higher than expected. As the new round of infection peak caused by the Delta strain has not passed, the people spontaneously reduce their outings and continue to suffer economic activities, personal education and return to the workplace. The plan was also disrupted.

A number of previous data heralded a slowdown in non-agricultural sectors in August, and both the private and government sectors fell back.We mentioned that “AugustSMEsThe report shows that the spread of the Delta strain has led to a slowdown in demand growth, and the most important thing is the slowdown in recruitment. The employment growth rate is the lowest since July last year. The main reason is that companies cannot find suitable employees or existing employees are changing jobs. . The employment slowdown shown by the PMI is likely to be reflected in the August non-agricultural employment data. If the August non-agricultural employment data deteriorates again, thenMidlandThere will be greater uncertainty in the decision of Chu Taper. “This data is also in line with our previous expectations. In addition, the employment sub-item of the ISM manufacturing PMI also recorded 49.0 in August, falling below the line of prosperity and decline, which is a new low since November 2020. In terms of sub-sectors, The number of new jobs in the private sector fell from 798,000 to 243,000, which was close to the previously announced ADP data; the number of new jobs in the government sector changed from an increase of 255,000 to a decrease of 8,000.

Employment repair has slowed again, and Taper announced that it may wait for the end of the year.The number of new non-agricultural employment was 235,000 in August, which is still advancing to the level of employment before the epidemic, but the growth rate has slowed down. Powell emphasized the importance of employment for Taper at the Jackson Hole meeting. The August data led to the previously expected September FOMC meeting to announce that Taper was basically impossible. Employment data in the next few months will be very critical,MidlandVice Chairman Clarida said last week that there has been an average monthly employment growth of 800,000 in the past three months. If this continues to happen in the fall, it will support a reduction in the rate of debt purchases starting later this year. Since the November FOMC meeting on interest rates was held on November 3, the October non-agricultural employment data has not yet been announced. Therefore, if the September non-agricultural employment data reaches about 1.5 million, the November FOMC meeting may announce Taper, otherwise it may be Wait until the FOMC meeting in December.

Bond market strategy:U.S. debtinterest rateAfter the dive, it rebounded slightly, but Taper delayed the expectation that the upward turning point of U.S. bond interest rates has not yet arrived, which has little impact on the domestic bond market.As far as the domestic bond market is concerned, the lenient credit policy is still in a state of unintended development. Infrastructure andreal estateThere are still constraints in the field. The logic of lenient credit is still in the mid-to-long term; in the short term, as the lenient credit policy is gradually implemented, it is expected that the asset shortage may continue for some time. Under bullish factors such as expectations of weak fundamentals, the bond market is still going well, and the current risk of holding bonds is low.

Risk factors:The severity of the epidemic has exceeded expectations, leading to social lockdowns and work stoppages that once again dragged down employment growth.

data

According to data released by the US Department of Labor, the US non-agricultural employment population increased by 235,000 after the August seasonal adjustment, and is expected to increase by 720,000. The previous value was revised up from an increase of 943,000 to an increase of 1.053 million; the unemployment rate in August was 5.2%. The forecast is 5.2%, the previous value is 5.4%; the average annual rate of wages in August will increase by 4.3%, the expected increase is 4%, and the previous value will increase by 4%; the labor participation rate in August is 61.7%, the expected value is 61.8%, and the previous value is 61.7 %.

Reviews

The epidemic disrupts employment restoration, and non-agricultural employment data is far lower than market expectations

From the perspective of changes in the number of non-agricultural employment, the US non-agricultural employment population increased by 235,000 after the seasonal adjustment in August, which is expected to increase by 720,000. At the same time, non-agricultural employment increased from 943,000 to 1.053 million in July. Increased from 938,000 to 962,000, the number of newly-added non-agricultural employment hit a new low since January 2021, and the unemployment rate fell to 5.2%, the lowest since March 2020.The number of new non-agricultural employment in the United States in August was much lower than the previous value and market expectations. From the perspective of the trend of new non-agricultural employment, despite the acceleration of the US vaccination rate and the early suspension of unemployment benefits in some states Driven by this, the number of newly-added non-agricultural jobs in June and July increased substantially, consistently higher than market expectations. However, the previous non-agricultural employment data did not reflect the disturbance to the job market caused by the new round of the epidemic rebound caused by the Delta mutant strain. The non-agricultural employment data in August was far below market expectations due to the disturbance of the epidemic.

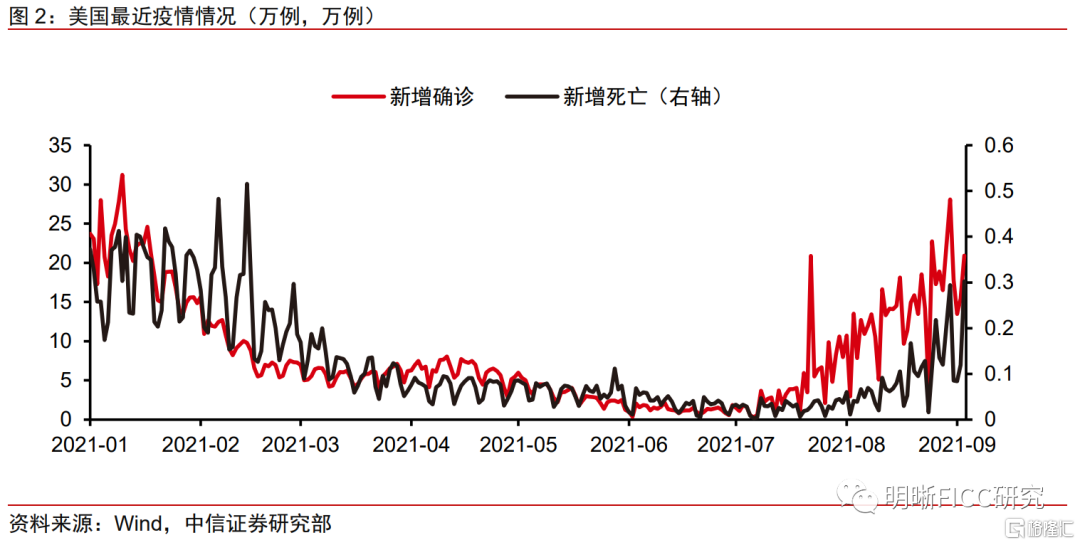

We believe that the Delta mutant strain caused a rebound in the epidemic, and residents’ increased concern about the epidemic is the main reason why the number of new non-agricultural employment is far below market expectations.Although the July non-agricultural data did not reflect the disturbance of the epidemic, the rebound of the epidemic in the United States in the past two months is a fact. The number of new confirmed cases and new deaths has been on the rise, and so far there is no sign of a clear peak. This change in the impact of the epidemic can also be traced in the speech of Fed Chairman Powell. After the FOMC meeting on interest rates in July, Powell pointed out in his speech that “Delta strain will have an impact on public health, but the recent rebound will have less impact on the economy.” At the Jackson Hole global central bank annual meeting in August, Powell The expression becomes “The Delta strain is accelerating its spread.” The impact of the Delta strain is also reflected in the recent U.S. consumption data andConsumer Confidence IndexData.

Unexpectedly zero growth in the leisure hotel industry, slowing growth in the service and education industries

In terms of industries, the industries that contributed more to the increase in non-agricultural employment in the United States in August came from professional and commercial services and transportation and warehousing. The biggest change stems from zero growth in the leisure hotel industry.Specifically, the main source of new non-agricultural employment has been the unexpected zero growth of the leisure hotel industry, which has led to a weaker-than-expected non-agricultural employment data, which is about 415,000 fewer than in July. The professional and business services industry continued to increase, recording 74,000, a month-on-month decrease of about 5,000, but it still became the industry with the largest number of new non-agricultural jobs in August, and the storage and transportation industry increased by 53,200. The number of employees in government departments decreased by about 263,000 month-on-month, from an increase of 255,000 from the previous value to a decrease of 8,000 people today; the number of new jobs in education and health services decreased by about 53,000 month-on-month. From the perspective of industry data, the slowdown in employment growth in the service industry in the United States is one of the main factors that caused the number of employment to be significantly lower than the overall growth rate. The impact of the new round of epidemic on consumption and employment activities is higher than expected. As the new round of infection peak caused by the Delta strain has not passed, the people spontaneously reduce their outings and continue to suffer economic activities, personal education and return to the workplace. The plan was also disrupted.

A number of previous data heralded a slowdown in non-agricultural sectors in August, and both private and government sectors fell back

Before the release of non-agricultural employment data in August, a number of data had already indicated that employment growth would slow down.We mentioned that “The August Markit Comprehensive PMI report in the United States showed that the spread of the Delta strain has slowed down demand growth. At the same time, the most important thing is the slowdown in recruitment. The employment growth rate is the lowest since July last year. The main reason is that companies cannot find Employees in suitable positions or current employees are changing jobs. The slowdown in employment shown by the PMI is likely to be reflected in the August non-agricultural employment data. If the non-agricultural employment data deteriorates again in August, then the Fed’s Taper decision will be more pronounced. Big uncertainty.” This data is also consistent with our previous expectations. In addition, the employment sub-item of ISM manufacturing PMI also recorded 49.0 in August, which fell below the prosperity and decline line, the lowest since November 2020. In terms of sub-sectors, the number of new jobs in the private sector fell from 798,000 to 243,000, which was close to the previously announced ADP data; the number of new jobs in the government sector changed from an increase of 255,000 to a decrease of 8,000.

Employment repair slows down again, Taper announces or waits for the end of the year

Although the number of new non-agricultural jobs is still increasing in August, the growth rate has slowed down, and there is still a large gap from the Fed’s goal of maximizing employment. Taper’s announcement may be postponed to the December FOMC meeting, depending on the situation. Employment data for the next few months.The number of new non-agricultural employment was 235,000 in August, which is still advancing to the level of employment before the epidemic, but the growth rate has slowed down. Powell emphasized the importance of employment for Taper at the Jackson Hole meeting. The August data led to the previously expected September FOMC meeting to announce that Taper was basically impossible. Employment data in the next few months will be very critical. Fed Vice Chairman Clarida said last week that there has been an average monthly employment growth of 800,000 in the past three months. If this situation continues to occur in the fall, it will support later this year. Time began to reduce the speed of debt purchases. Since the November FOMC meeting is held on November 3, the non-agricultural data in October has not yet been announced. Therefore, if the non-agricultural data in September reaches about 1.5 million, the November FOMC meeting may announce Taper, otherwise it may wait until December. FOMC meeting of the month.

Bond market strategy

U.S. bond interest rates rebounded slightly after the plunge, but Taper’s postponement of expectations, the upward turning point of U.S. bond interest rates has not yet arrived, which has little impact on the domestic bond market.As far as the domestic bond market is concerned, the lenient credit policy is still in a state of unintended development. Infrastructure andreal estateThere are still constraints in the field. The logic of lenient credit is still in the mid-to-long term; in the short term, it is expected that the asset shortage may continue for a while as the lenient credit policy is gradually implemented. Under bullish factors such as expectations of weak fundamentals, the bond market is still going well, and the current risk of holding bonds is low.

Risk factors

The severity of the epidemic has exceeded expectations, leading to social lockdowns and work stoppages that once again dragged down employment growth.

(Article Source:CITIC SecuritiesObviously)

.