Affected by geopolitical conflicts, shocks have become the main theme of the recent market. On Monday (February 28), the three major stock indexes in Shanghai and Shenzhen stubbornly closed in the red, achieving a perfect end to February.Industry insiders generally believe that the disturbance is fading away, and March is the layout of the spring marketHershey’smachine.

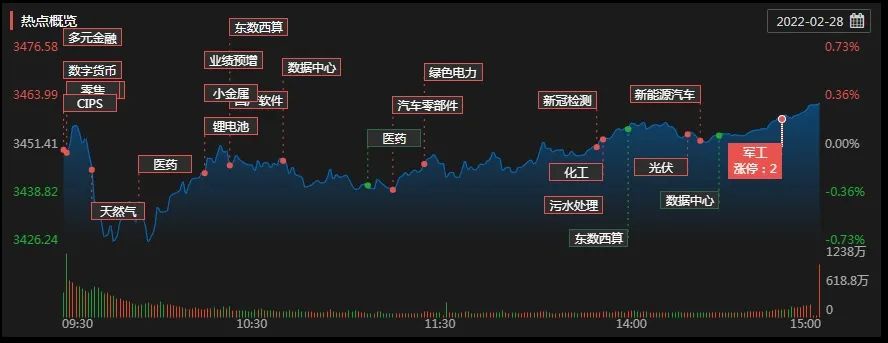

On February 28, the three major A-share indexes closed up.The Shanghai Composite Indexup 0.32%,Shenzhen Component Indexup 0.32%,GEM refers toUp 0.89%; stocks in Shanghai and Shenzhen fell more and rose less, with a total turnover of 949.1 billion yuan. Specifically, the Sino-Russian trade concept sector led the gains,Jinzhou Port、Zhejiang DongriWait for the collective daily limit of 5 stocks; numberscurrencyWeChat applet, CIPS concept, data security,small metalThe performance of other sectors was active; the kitchen and bathroom appliances sector led the decline,Boss Electricfell more than 6%; prefabricated buildings, industrial machines,real estate servicesand other sectors among the top decliners. Today, Hongying Intelligence was listed on the main board of the Shenzhen Stock Exchange, up 44%; Han’s CNC was listed on the GEM of the Shenzhen Stock Exchange, down 13.58%. Nine stocks on the Beijing Stock Exchange rose today, and Hongxi Technology landed on the Beijing Stock Exchange, up 2.17%. In February, the Shanghai Composite Index rose 3%, the Shenzhen Component Index rose 0.96%, and the ChiNext Index fell 0.95%.

On Monday, the three major A-share indexes bottomed out and rebounded, and they closed up collectively. As of the close, the Shanghai Composite Index rose 0.32% to 3462.31 points; the Shenzhen Component Index rose 0.32% to 13455.73 points; the ChiNext Index rose 0.89% to 2881.31 points ; The total turnover of Shanghai and Shenzhen stock markets was 949.1 billion yuan; the net purchase of northbound funds was 2.047 billion yuan; overall, individual stocks in the two cities fell more and rose less.

In terms of industry sectors, on Monday, 16 of the first-tier industries in Shenwan achieved gains, among which coal (2.23%),non-ferrous metals(1.98%), power equipment (1.51%) and other industries were the top gainers by more than 1.5%; in addition, household appliances, commerce, retail and other industries were the top decliners, all exceeding 1%.

Specifically, the Sino-Russian trade concept sector led the gains,Jinzhou Port、Zhejiang DongriThe collective daily limit of 5 stocks; digital currency, WeChat applet, CIPS concept, data security,small metalThe performance of other sectors was active; the kitchen and bathroom appliances sector led the decline,Boss Electricfell more than 6%; prefabricated buildings, industrial machines,real estate servicesand other sectors among the top decliners.

It is worth noting that Monday is the closing day of February. Judging from the market performance of this month, the three major indexes were mixed, showing a pattern of strong Shanghai and Shenzhen. The Shanghai Composite Index rose by 3%, the Shenzhen Component Index rose by 0.96%, and the ChiNext Index fell by 0.95%. In terms of northbound funds, the cumulative net purchase amount since February has reached 3.98 billion yuan.

For the market outlook,Guotai Junansecuritiesthink,Under the influence of external events, inflation is disturbed, and risk assets are gradually desensitized. In terms of style, the low-valued sectors are still dominant. We should focus on the direction of loss of profit in the early stage and the driving force for marginal improvement, grasp stable growth, and deploy consumption. In the short term, under the background that the downward pressure on earnings has not yet eased and the inflection point of global liquidity has reached, risk appetite has become the main disturbance factor in the market. Regarding the conflict between Russia and Ukraine, firstly, it affects risk appetite, and the current risk aversion is dominant; secondly, by affecting the supply of energy and other commodities, it will raise global inflation expectations. From a medium-term perspective, the recovery of the domestic economy remains at the core. Taking into account the marginal relaxation in the real estate sector (down payment ratio, purchase restrictions and loan restrictions), the expectation of relaxed credit is heating up again, and the drive from the credit cycle → profit cycle will boost the recovery of the stable growth market.

CITIC Construction InvestmentsecuritiesExpress,The market is still in a favorable window period, and A shares will face four major challenges.In the medium term, A shares will still face four major challenges: the economic bottom period bringsperformanceDownward pressure, policy has its rhythm and intensity, the Fed’s rate hike cycle, and the US mid-term election year’s China policy.In terms of configuration, the word is stable: grasp the “three lows and one change” (low price, low valuation and low congestion are based on the expectation of marginal improvement in fundamentals), high dividends as bottom positions, and counter-cyclical upward industries aremain forceMarginal improvement of low-profile industries as the theme.

at the same time,fundprivate equity and other institutions also expressed an optimistic view on the market outlook.Hu Bo, manager of Rongzhi Investment Fund, a subsidiary of private equity Pai Pai.com, believes that,Since the beginning of the month, the entire market has undergone certain adjustments, and then the adjustment of the high-boom track has been relatively sufficient, including the stable demand for the two sessions, so there has been a rebound in the high-boom track recently. In the short term, we can pay attention to two aspects. On the one hand, the current rebound should be sustainable; on the other hand, we can pay close attention to the relevant industry regulatory policies issued by the government during the two sessions.

Huang Yi, investment director of Hongfeng Assets, said,The market has bottomed out and is in a rising trend, so there is no need to be pessimistic about the market outlook. After the rapid market adjustment in the early stage, under the influence of a series of unfavorable events in the periphery, the A-share market went out of the bottom and rose, and it can start to actively allocate. There is a high probability that the follow-up market will still be a structural market.

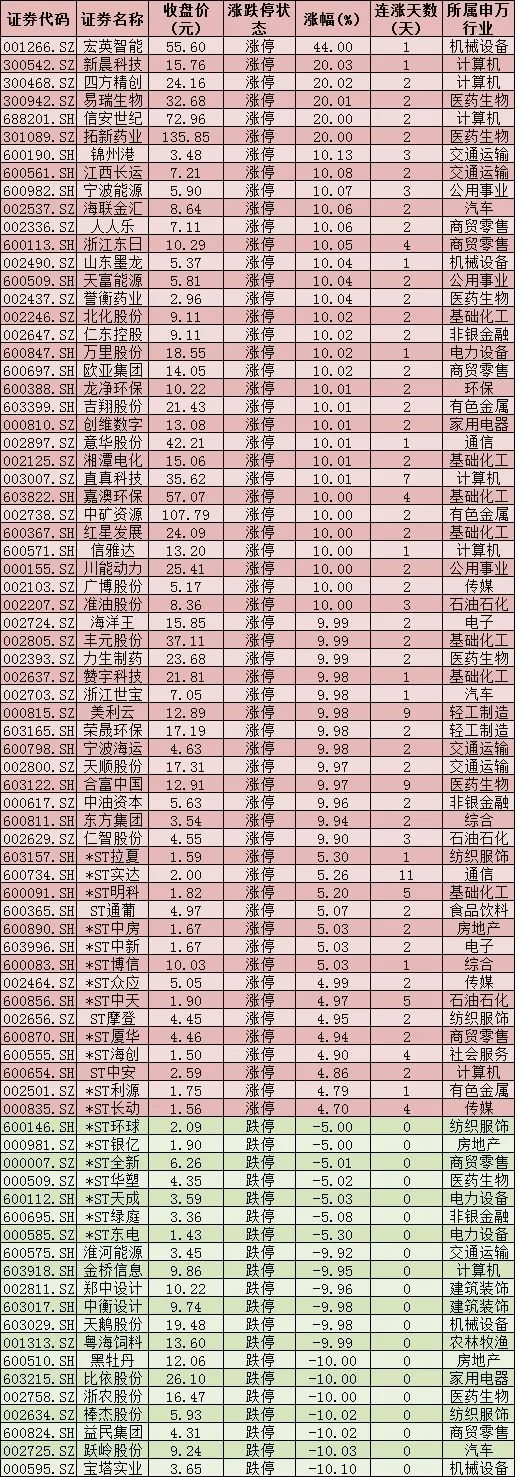

On Monday (February 28), the individual stocks with the limit up and down:

Watchmaker: Zhang Ying

Hot spot one: digital currency soars more than 3% Sifang JingchuangWait for 3 shares 20CM daily limit

On Monday, the concept of digital currency rose strongly. As of the close, the sector rose 3.4%, ranking first in the list of gainers. 4 concept stocks collective daily limit, of which,Sifang Jingchuang、Xinchen Technology、Principal CenturyWait for the 20CM daily limit of 3 stocks.

On the news, the recently released “14th Five-Year Plan for Digital Economy and Informatization Development of Henan Province” proposes to clearly strive for the pilot of digital renminbi. According to incomplete statistics, digital renminbi is mentioned in the “14th Five-Year” development plans issued by more than ten provinces and cities.

AnshinsecuritiesIt is pointed out that the introduction of the “14th Five-Year Plan for Financial Standardization” has put forward new requirements for the development of digital renminbi standards. Standard formulation is an important part of industrial development. A unified digital renminbi infrastructure, issuance and circulation return process, and terminal acceptance environment will become the prerequisites for the large-scale promotion of digital renminbi. The unification of standards will lay a solid foundation for the deepening of digital RMB application scenarios and the expansion of application fields in the future.

Hot spot 2: Development assistance and the coal and oil sector have risen strongly

At the close on Monday, the development assistance and coal and oil sectors were among the top gainers, reaching 2.46% and 2.31%, respectively. of which,Quasi Oil Shares、Renzhi sharesOne after another, the daily limit was closed, and they all closed 3 daily limit.

On the news, Brent crude oil rose more than 7% in early trading on Monday, breaking the $100 mark again.Affected by the escalating conflict between Russia and Ukraine, WTI crude oil and Brent crude oil both exceeded 100 US dollars a barrel last week, but after the United States reiterated its decision not to sanction Russia’s energy exports, the two crude oil prices fell.oil priceBoth grids fell back.

The Pacific OceanSecurities said that the current war between Russia and Ukraine has exacerbated global tensions, and international crude oil prices are in a high and volatile stage. the fall back. Looking at the future, oil prices will likely remain high, mainly because the global oil and gas industry is still in a stage of serious underinvestment.

Hot spot 3: Han’s CNC lost nearly 5,200 yuan in the first sign

On Monday, Hongying Intelligence landed on the Shenzhen Stock Exchange’s main board, up 44%; Han’s CNC landed on the Shenzhen Stock Exchange’s ChiNext, down 13.58% to close at 66.16 yuan.

In early trading, Han’s NC opened flat at the issue price of 76.56 yuan, and then dived in a straight line, falling by 15% in 6 minutes, becoming the first company to break after listing since the Year of the Tiger.New crotch. If calculated based on the closing price, each investor who signed a lottery lost nearly 5,200 yuan.

The price-earnings ratio of Han’s CNC issued is 108.4 times, while the “C35” issued by China Securities IndexProfessional settingThe average static price-earnings ratio of “manufacturing industry” in the last month is only 38.88 times. Han’s CNC is the second highest issued stock on the ChiNext during the year, second only toternary biology.Previously, the issuance results released by Han’s CNCannouncementIt shows that the amount of abandoned purchases by online investors is 37.5463 million yuan.

It is reported that Han’s CNC isHan’s LaserIt is famous for its equipment R&D and production in the PCB industry. The business income of PCB equipment is a strong support for the growth of Han’s CNC performance. In 2020, Han’s CNCOperating incomereached 2.21 billion yuan, accounting forHan’s Laser18.51% of the total revenue; in 2021, Han’s CNC revenue will be 4.062 billion yuan, accounting forHan’s Laser24.89% of total revenue, revenue increased by 86.01% year-on-year.

(Article source: Voice of Securities Daily)