Since bulk commodities are priced by fundamentals, inventory is the basis for market-oriented control. Generally speaking, bulk commodity reserves are divided into commercial stocks and national strategic stocks. Corporate commercial inventory is the result of the balance of supply and demand, and is a barometer of price tracking; while national strategic inventory is a factor that affects the balance of supply and is a cushion to stabilize price fluctuations. Over-increasing and over-declining commodity prices are common. “Adjusting supply and demand” and “stabilizing expectations” complement each other in the regulation of the commodity market, and both are based on inventory, because when necessary, strategic inventory can serve as a supplement to supply , It can also take the initiative to replenish the inventory to boost demand, and it can affect market expectations by balancing and affecting commercial reserves. We have seen that the recent 21st meeting of the Central Committee for Comprehensively Deepening Reforms proposed to improve the strategic reserve market adjustment mechanism and strengthen the bulk commodity reserve and adjustment capabilities. Looking forward, the regulation of the bulk commodity market needs to be more market-oriented, and the national strategic reserve is the first step in inventory management.

The construction of strategic bulk commodities reserves, the first step in inventory management

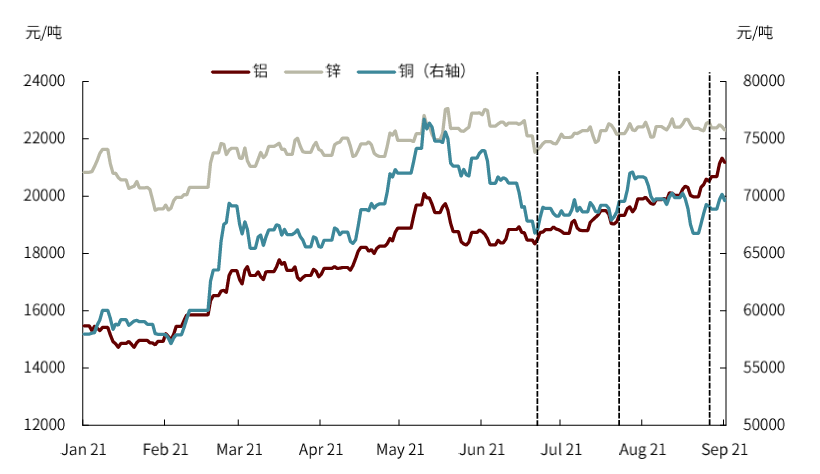

After the epidemic, the global economy recovered rapidly. However, on the supply side, due to the impact of the epidemic, environmental protection constraints, or production capacity constraints, the output of bulk commodities is generally limited, price elasticity is weak, and price fluctuations are relatively severe. The country has repeatedly adjusted market supply and demand to stabilize prices.For example, the State Reserve Bureau “released storage” three times in June, July, and August this year, and put a total of 80,000 tons of copper, 210,000 tons of aluminum, and 130,000 tons of zinc into the market to curbNon-ferrous metalsPrice overrise[1]。

Chart: This year, the State Reserve Bureau released copper, aluminum, and zinc reserves three times

Source: State Reserve Bureau website,CICCResearch

Chart: Price performance before and after storage

Since bulk commodities are priced by fundamentals, inventory is the basis for market-oriented control. Generally speaking, bulk commodity reserves are divided into commercial stocks and national strategic stocks. Corporate commercial inventory is the result of the balance of supply and demand, and is a barometer of price tracking; while national strategic inventory is a factor that affects the balance of supply and is a cushion to stabilize price fluctuations. Over-increasing and over-declining commodity prices are common. “Adjusting supply and demand” and “stabilizing expectations” complement each other in the regulation of the commodity market, and both are based on inventory, because when necessary, strategic inventory can serve as a supplement to supply , It can also take the initiative to replenish the inventory to boost demand, and it can affect market expectations by balancing and affecting commercial reserves.We have seen that the recent 21st meeting of the Central Committee for Comprehensively Deepening Reforms proposed to improve the adjustment mechanism of the strategic reserve market and strengthen the reserve and adjustment capabilities of bulk commodities.[2]. Looking forward, the regulation of the bulk commodity market needs to be more market-oriented, and the national strategic reserve is the first step in inventory management.

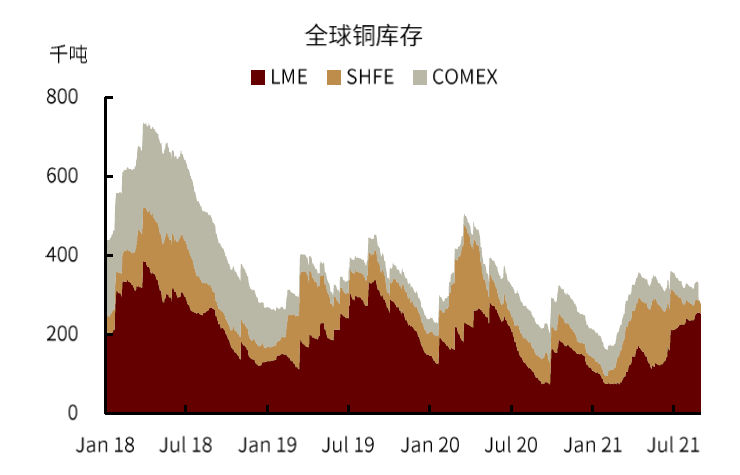

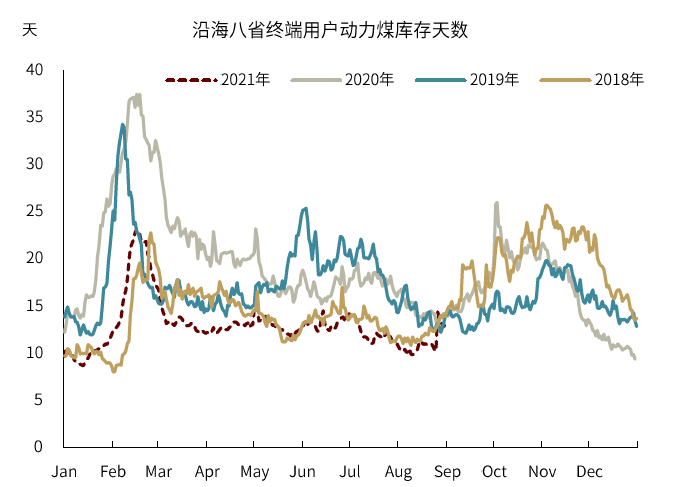

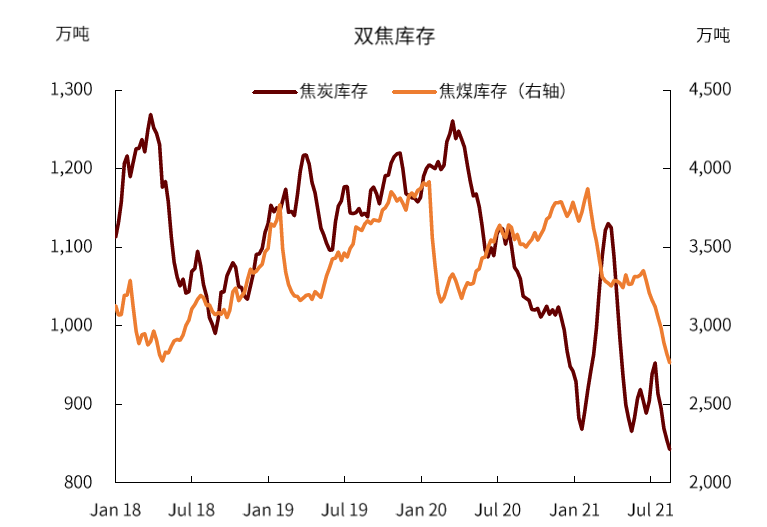

The bulk commodity reserve mechanism is gradually being established, but the reserve is uneven.Agricultural productsOn the one hand, based on the consideration of the absolute safety of rations, my country adopts a minimum purchase price policy for wheat and rice varieties, and purchases from the market to ensure the enthusiasm of farmers to grow grain.According to the State Reserve Bureau, my country’s national reserves of rice and wheat can meet the demand for ration consumption for more than one year.[3]. A relatively complete temporary reserve mechanism has also been established for the dietary necessities of residents such as pork and poultry eggs, and the regulation of supply and demand is achieved through policy-based purchases and storage and dumping of reserves.In terms of energy and metals, the Ministry of Land and Resources identified 24 strategic minerals in 2016[4], Which includes not only strategic metals such as rare earths and uranium, but also varieties with strong financial attributes such as copper, aluminum, and iron. However, in general, energy and metals are dominated by commercial inventories, and the national reserve mechanism still needs to be improved.Take coal as an example. According to the National Development and Reform Commission, the state is advancing the construction of about 600 million tons of coal reserves.[5]Among them, national reserves and commercial stocks complement each other. The government can dispatch coal reserves of no less than 200 million tons, and corporate stocks are about 400 million tons. This target is equivalent to 15% of annual consumption, or about 55 days of inventory days, which will be a substantial increase compared to the current coal inventory level of power plants of about 11 days.

Chart: Copper inventories of the three major exchanges

Source: Wind Information,CICCResearch

Chart: Days of Thermal Coal Inventory

Source: CCTD,CICCResearch

Chart: coking coal and coke inventory

Source: Mysteel,CICCResearch

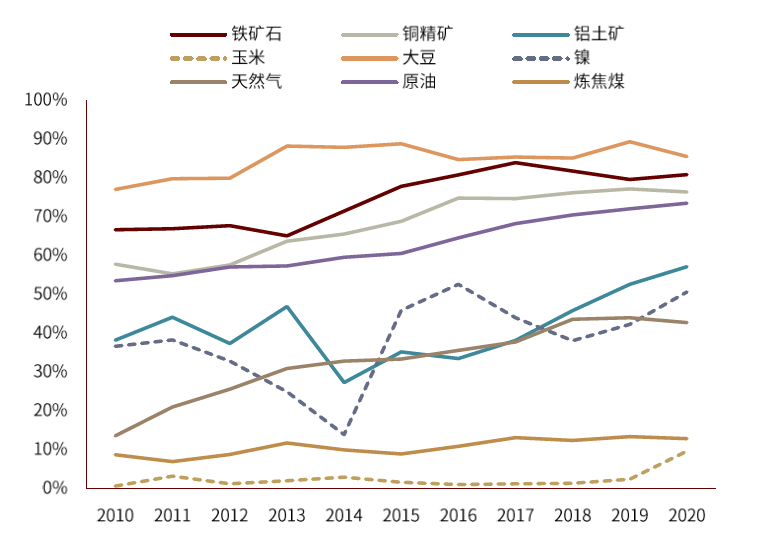

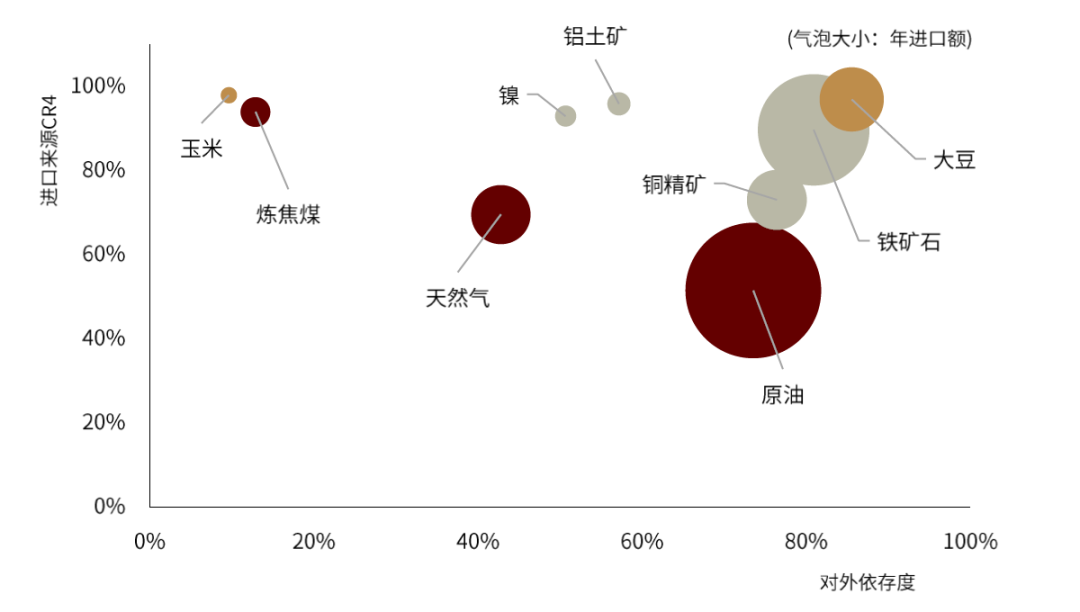

Taking into account the degree of foreign dependence, it is necessary to establish a strategic reserve of bulk commodities.At present, my country is still a major consumer of bulk commodities, and imports are still an important supplement to supply in the short term. The seasonality of demand and supply is not synchronized, which may lead to the seasonal existence of gaps, which is a greater challenge for bulk commodity imports. At present, domestic companies have established commercial reserves, but the scale still cannot guarantee the peak season supply. Horizontally comparing the commercial inventory level of bulk commodities, some upstream varieties that are mainly imported from abroad have relatively high inventory days, such as iron ore, bauxite, copper concentrate and other metal minerals. The inventory days remain above 25 days. However, Taking imported soybeans as an example, soybean crushing companies rely on imported soybeans to arrive in Hong Kong. According to the current crushing capacity, the inventory only supports about 20 days of production. We measure the import risk of the bulk commodity industry chain from three dimensions. The first is the degree of external dependence, that is, the proportion of net imports in total consumption, and the second is the concentration of sources, that is, the top four import source countries account for the proportion of total imports. The proportion, the third is the amount of imports. As can be seen from the figure below, crude oil, iron ore and soybeans have relatively high external dependence and source concentration, and the import amount is relatively large, which are commodities with high import risks. The external dependence of metals with new energy properties such as bauxite and nickel has increased rapidly in recent years. The energy transition will boost the corresponding demand, so there may be certain risks in the future.

Chart: Degree of Dependence of Commodities on Foreign Countries

Source: WoodMac, CRU, Wind Information,CICCResearch

Chart: Risks in the commodity import industry chain (2020, import source CR4 is 2019)

Source: Wind Information, CEIC, UN Comtrade, CICC Research Institute,CICCResearch

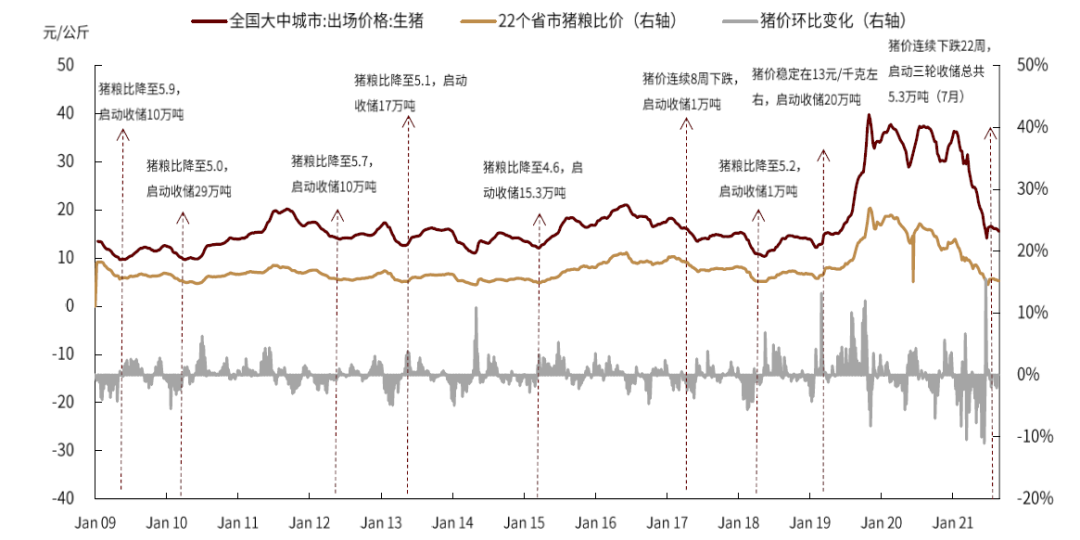

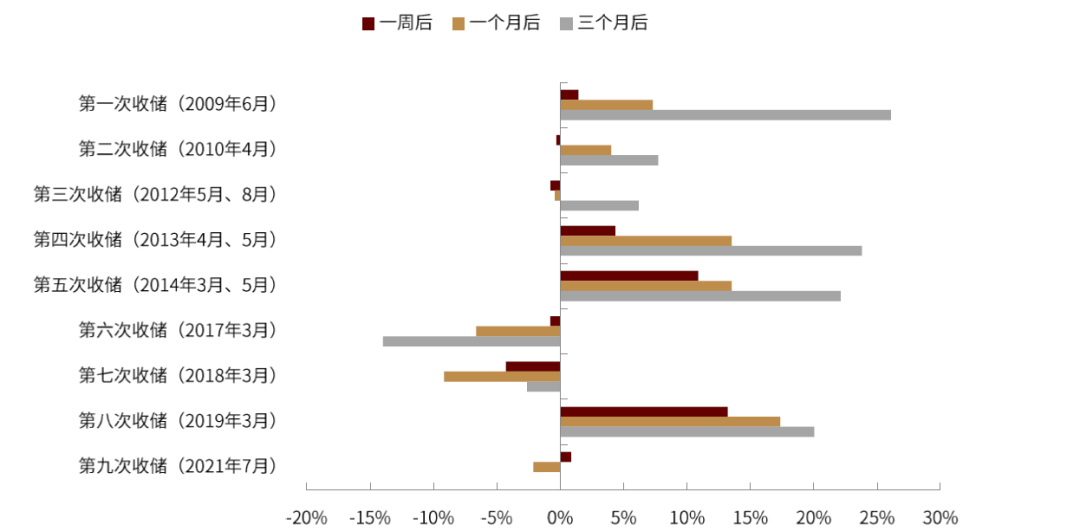

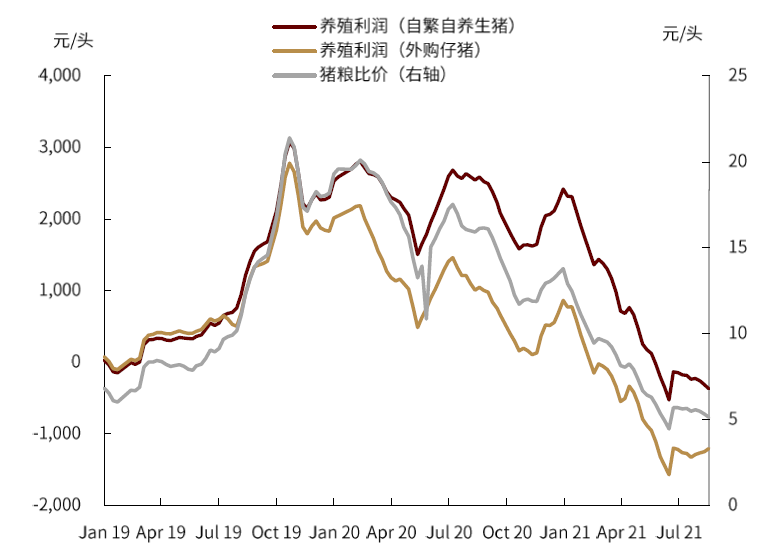

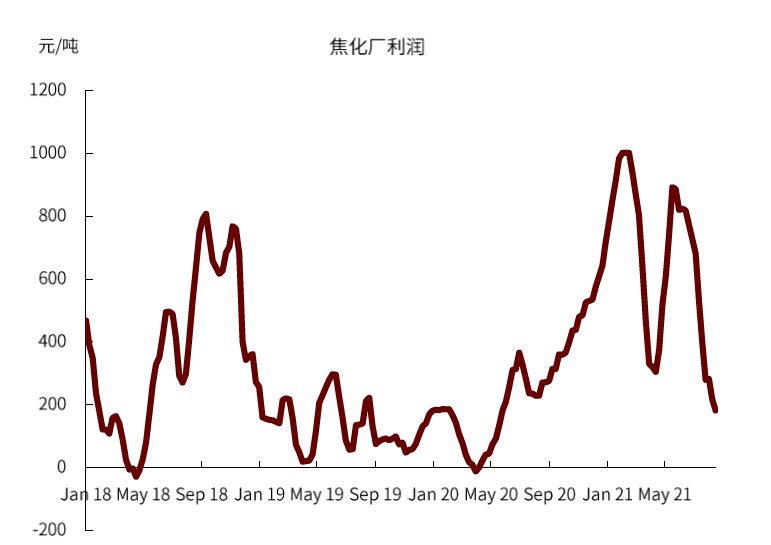

The uncertainty of external factors has increased, and it is time to establish a bulk commodity reserve.Under the impact of the global epidemic, it will take time for the economy and production activities to resume, and there is greater uncertainty in supply. We have seen in the first half of this year that under the influence of supply risks, oil, copper,Agricultural products, Iron ore ranks among the bulk commodities, and the pressure on raw materials in downstream industries is generally greater this year. For example, the rapid increase in overseas corn and soybean prices has led to a sharp increase in the cost of imported feed materials in China, a sharp drop in the price of superimposed pigs, and serious losses in the breeding industry. In addition, the price of imported iron ore remained high in the first half of the year, and the price of steel remained high due to cost support. , The profits of steel mills and downstream manufacturing are generally impaired. Power plants, coking plants, and copper smelters are also facing similar cost inflation dilemmas. Looking forward, a certain size of commodity reserves may help reduce supply shocks and ensure the safety of domestic production. After the epidemic, the supply of overseas bulk commodities has been more affected by the export policies of various countries and unfavorable weather. When the domestic gap widens, the reserve is a new supply.The recent frequent hurricanes in the southern United States may affect soybean exports, and the price of imported soybeans in my country will increase rapidly. When there is a stage of surplus, the reserve can also be new demand. In July of this year, the price of live pigs fell to the second-level warning range, and the National Development and Reform Commission and other ministries and commissions started the pork purchase and storage work, a total of about 53,000 tons[6]On June 30, 2021, our “Pig Price: Bottom and Rebound, but It’s Hard to Break Through”, on June 30, 2021, hinted at the possible impact of purchasing and storage.

Chart: Pork purchasing and storage and pig price performance

Source: China Government Network, National Development and Reform Commission, Huachu Network, CICC Research Department

Chart: The price performance of pigs after purchasing and storing over the years

Source: China Government Network, CICC Research Department

Chart: Profit from pig farming

Source: National Development and Reform Commission, Wind Information, CICC Research

Chart: Coking Plant Profit

Source: Mysteel, CICC Research

Commodities increase reserves and imports may increase, but we do not expect to bring new premiums

The national strategic reserve is an important link in the regulation of the spot market in the bulk commodity market. The increase in reserves at the initial stage may increase imports, but it may not create a too high price premium.Judging from the experience of crude oil’s strategic reserves, if domestic reserves are actively increased, it may increase imports, but it may not significantly push up international reserves.Oil price, Because purchasing and storage generally choose to proceed when the price is low. Therefore, when there is no cyclical upward trend in the bulk commodity market, the increase in domestic bulk commodity reserves may increase imports, but the impact on international prices may be small.

Looking forward, if the regulatory function of bulk commodity reserves is to be better reflected, the bulk commodity data system related to anticipatory management may still need to be improved. Recently, the National Development and Reform Commission issued the “Measures for the Management of Important Commodity and Service Price Index Behaviors (Trial)” (see our “Commodity Index: Strengthening Regulations, Just Time” released on June 17, 2021, which aims to regulate the spot prices of bulk commodities. , Reasonably guide market expectations, but it also requires objective, comprehensive, transparent and authoritative bulk commodity fundamental monitoring to “increase war reserves, adjust supply and demand, and stabilize expectations.”

(Source: CICC Dotting)

.