Storm current accounts ING: yesterday was certainly a bad day for some current account holders of the Dutch bank, which they use the paid notification service (“alert”), and who have been charged with sums as monstrous as they are incomprehensible.

Bewilderment, panic, in some cases irony: customers vented on the various social channels, asking the banking group for explanations, which had already made a lot of talk about itself in the previous months, due to the decision to close all ATMs and cash machines present in Italy.

Charges of up to 234 billion euros, ING apologizes

The case – and chaos – that exploded yesterday, Wednesday 1 September, can be summed up in a few words: practically, several customers of ING have been charged billions of commissions, up to 234 billion euros on their checking account, or they found themselves struggling with blocked accounts.

After hours of bewilderment, terror and controversy, the bank statement arrived, complete with an apology:

“We confirm some customers last night have displayed an excessive charge for the SMS alert service on their current account which may have caused them some inconvenience. This was a technical error and not a hacker attack. The anomaly was resolved by our technicians in a short time and in the late evening the situation was completely resolved. All the customers involved are receiving a communication from ING with the appropriate apologies ”.

The outbursts on Twitter: Did I buy Holland by chance?

What happened yesterday was documented by several complaints posted on social media.

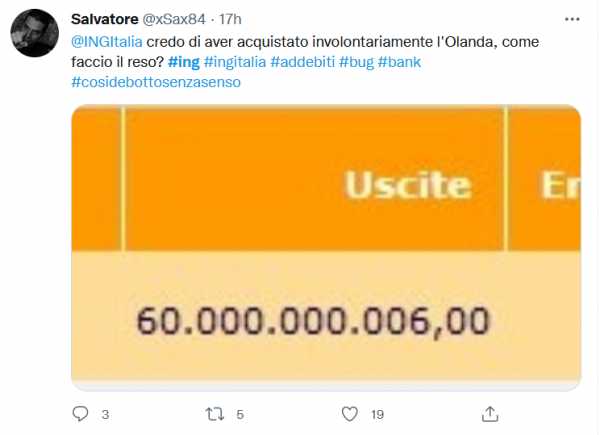

Especially on Twitter Salvatore @xSax84 so he turned to the bank: @INGItalia i think i bought Holland unintentionally, how do i return? #ing #ingitalia #debiti #bug #bank #cosidebottosenzasenso:

Like this Alessandro Pavanati @Alexpavanati in commenting on another Twitter user’s post, he wrote:

“Me too. The call center says everything ok, but I’m worried #ingdirect #ing #contoarancio ”

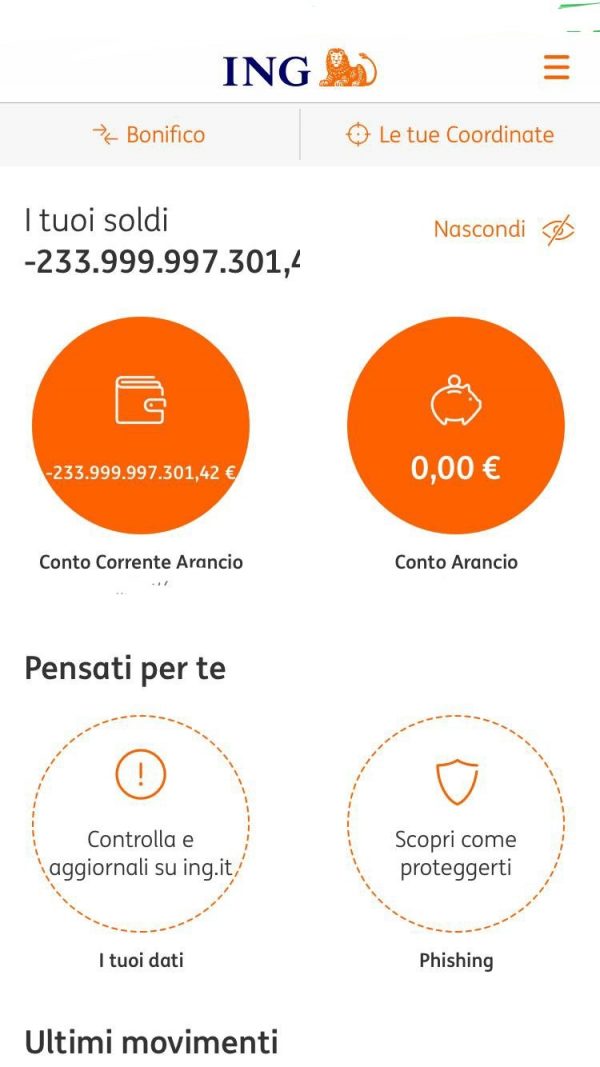

Pavanati commented on what happened to the user BedailBardo @BedailB, who photographed the absurd charge that appeared on his account: almost 234 billion euros, in fact.

A strong blow to the reputation of ING in Italy, already scratched by the closure, on 1 July, of its members ATMs and automatic pay stations located in the Italian territory. A decision that, in itself, had contributed to making relations between account holders and banks in Italy even more tense, as it was taken in the context of stinged on current accounts launched by some banks at the beginning of the year.

Fineco had begun, with the message in style either invest or we’ll close your account.; he continued UniCredit, increasing the costs of some accounts up to + 70% “, and also the customers of Widiba (Mps) they had had a nice letter delivered.

He had also talked about the issue and the concern of Italian account holders, among others Giuseppe Castagna, Chief Executive Officer of Banco BPM, during an episode of the Economic soup by Nicola Porro, consulted not only by the conductor Porro also by Leopoldo Gasbarro, Managing Director of Wall Street Italy.

ING and the case of the farewell to cash in Italy

In fact, ING had been talked about after the bank’s decision to say goodbye to cash in Italy, according to rumors that had been reported in the spring by Il Sole 24 Ore.

Il Sole commented on ING’s decision as “a unicum in the Italian and in fact European panorama. Also because – the article read – it does not come from a purely digital bank (and therefore by definition never had its own network of branches) but from a group with a mixed model, which in our country has combined with a strong presence the physical one is digital, with a network of ATMs and automatic teller machines (63 are subject to closure) but also of branches, a network that will similarly be revisited “.

A few days before, by the way, ING had announced a new rate blow to the customers of its Orange Account, by letter. In the letter, the credit institution wrote as follows:

“The base rate of Conto Arancio, starting from 30 June 2021, will suffer a decrease from 0.02% to 0.001%… We also inform you that on the same date ING will discontinue the Conto Arancio feeding service. Therefore, starting from 1 July 2021 you will no longer be able to use the feeding service to credit funds to your Orange Account “.

In June, a new shock unfolded: ING was preparing to close the accounts of inactive customers, as Milano Finanza informed: customers “guilty” of keeping the money parked in their accounts, in a context in which the liquidity boom had now become a ballast for the banks, due to negative or zero interest rates.

The financial newspaper talked about how the recipients of the letters were caught “off guard”, and how they were destined to solve a lot of trouble. In fact, they would have had “60 days to migrate to other banks and save all bank transfer receipts and above all of F23, F24, Mav, Rav, and so on”.

Yesterday, Cherry on the cake, with blocked current accounts and hit by maxi commissions. Having clarified the mystery, the hope is that there may be a period of respite for the bank’s account holders.