Data Eye | A-shares reappeared in the first day of new shares after two years

Yangcheng Evening News • Yangcheng School 2021-10-24

This year’s poor performance and break hair seem to be “reasonable”

Text, Watch/Ding Ling, All Media Reporter, Yangcheng Evening News

After nearly two years, the A-share market reappeared on the first day of listing. On October 22, the performance of new stocks has been sluggish since the opening of the market. The price was as low as 58.88 yuan in the intraday market. The price was 16.95% lower than the issue price of 70.90 yuan. There is still a certain distance from the issue price. As of the close, it closed at 66.03 yuan, a drop of 6.87% from the issue price.

As a result, China Self-Technology became the first new stock to be issued on the first day of the year under the registration system, and also the second new share to be issued since the pilot reform of the registration system. The first was Jianlong Micro Nano, which was listed on December 4, 2019.

Breaking hair seems to be “reasonable”

The break-up of China Self-Technology is called “the first stock of fuel cell catalysts.”Public information shows that Zhongzi Technology is a high-tech enterprise focusing on the research and development, production and sales of environmental protection catalysts. It is one of the few major domestic manufacturers in the field of exhaust gas treatment catalysts for mobile pollution sources (motor vehicles, non-road machinery, ships, etc.) in China. And actively explore the application of its technology in new energy fields such as hydrogen fuel cell catalysts.

According to the prospectus, the issue price of China Self-Technology is RMB 70.90, and the number of shares issued is 21.508 million; the net amount of funds raised is 1.407 billion yuan. b and above emission standard catalyst research and development capacity building projects and hydrogen energy fuel cell key materials research and development capacity building projects, etc.

However, judging from its operating performance, the break seems to be “reasonable.” From 2018 to 2020, Zhongzi Technology achieved operating income of 337 million yuan, 1.01 billion yuan, and 2.577 billion yuan, respectively, and realized net profits attributable to the parent company of -59.097 million yuan, 86,553,700 yuan, and 218 million yuan.

From January to June this year, the company’s operating income was 625 million yuan (after review), down 54.61% from the same period last year; net profit attributable to shareholders of the parent company was 28.713 million yuan (after review), down 81.76% from the same period last year ; After deducting non-recurring gains and losses, the net profit attributable to shareholders of the parent company was RMB 23,257,800 (after review), a decrease of 86.31% over the same period of the previous year. The decline in performance was mainly due to short-term unfavorable factors such as the reduction in the oil and gas price gap at the beginning of the year and the impulse sales of diesel heavy trucks during the first half of the year. As of the signing date of this listing announcement, the company’s sales of natural gas vehicle catalysts have not seen any significant improvement.

Many star fund products have also been recruited

The issue broke on the first day of listing, which caused many successful investors to call “cannot afford to hurt”. If they choose to sell at the lowest price of 58.88 yuan per share, the highest loss in the first lottery will reach 6000 yuan.

Regarding the emergence of new stocks on the first day of discovery, senior investment banker Wang Jiyue said that investors should not think that playing a new lottery is a risk-free lottery, and playing a new lottery is also risky. Buy if you are optimistic.

Gui Haoming, chief market expert at Shenwan Hongyuan, said that the mature capital market itself has risen and fallen. New stocks are the same as old stocks. They should not necessarily rise just because they are new stocks. The break is also the result of the capital market’s pricing function being truly reflected and the degree of marketization increased. It is not a normal phenomenon that the current market is like winning a lottery.

It is worth mentioning that in addition to the successful investors, many fund products are also “successful.” According to the company’s announcement from China Self Technology, a total of 4222 products of category A investors have been allocated new shares as offline investors, with a total allocation amount of about 560 million yuan.

Among the allocation recipients of category A institutions, more than 4,000 fund products are included, and almost all star fund products in the market are covered. According to previous media statistics, E Fund’s Blue Chip Selection and E Fund’s Consumer Selection are all listed. CEIBS Fund’s many star products, GF, Huitianfu, Lions Fund Cai Songsong, Invesco Great Wall Liu Yanchun, Cinda Australia Bank Feng Mingyuan, etc. are also listed. Funds under management are allocated.

Judging from the themes of the allocated funds, in addition to consumption, ESG, low-carbon, new energy and other theme funds that match the company’s business, many unrelated themes such as medicine, animal husbandry, and media have also appeared many times.

In this regard, some practitioners of public equity institutions said that because the new rules have revised the highest quotation rate to 1%-3%, the probability of institution quotation being removed has been reduced a lot. At this stage, investors are inclined to increase the price in order to obtain allocation. “For public offerings, the cost of launching new shares has become significantly higher, and the profit margin has been further reduced. Before, you can basically buy with your eyes closed. There are also some public offerings in the market that rely on the strategy of launching new shares to maintain stable returns. NS.”

Some people in the industry believe that, based on the experience of mature capital markets, “breaking” is a normal phenomenon in the capital market and reflects the effectiveness of price games. Investors should not be too worried about this. The investment research team is also able to do a good job of screening new stock subscriptions.

42 shares have fallen below the issue price this year

It is worth mentioning that the recent listings of new stocks have frequently broken. Xinghua Reflective, which was listed on September 30, went down continuously on the first day of listing and fell by 20.73% on the first day of listing. It fell below the issue price on the third trading day of the listing; Ingenuity Home, which was listed on September 13, also fell below the issue price. The lowest price is 13% lower than the issue price.

According to data, as of October 21st, 41 shares of the new stocks listed this year have fallen below the issue price. From the perspective of the drop in the lowest price from the issue price, Shennong Group has the highest degree of breakage, falling by 34.29%. The lowest prices of Sifang New Materials and Youan Design have fallen by more than 30% relative to the issue price.

In addition, among the sub-IPO stocks that broke, 21 main board stocks accounted for more than half. The reporter found that the proportion of main board stocks in the sub-new stocks listed this year was only 27.37%, which means that the proportion of main board stocks in the sub-IPO stocks has increased significantly. In addition, the issuance price of the new shares that broke is relatively high, with an average of 49.6 yuan, far exceeding the 23.71 yuan of all the new shares this year.

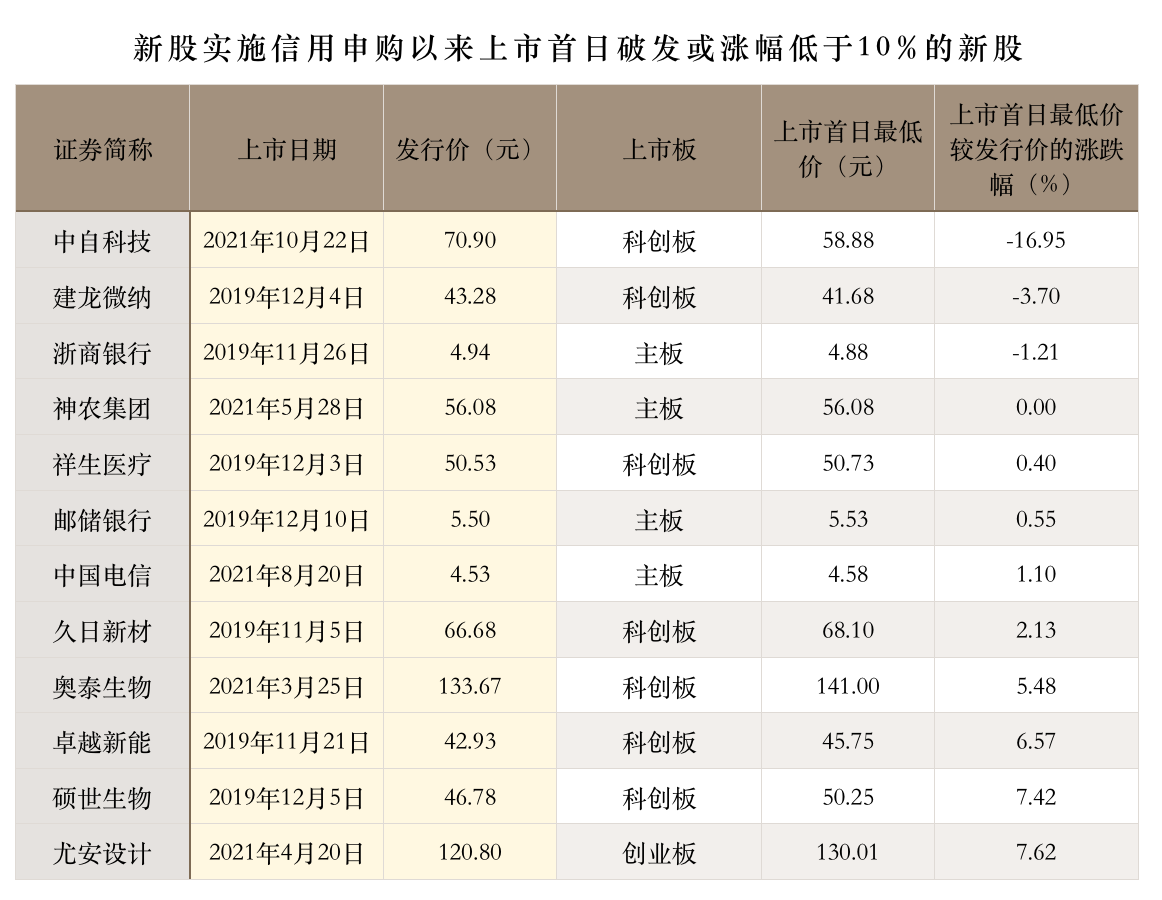

However, overall, for new stocks in recent years, there have been few breaks. Statistics show that since the implementation of credit subscription for new shares, the overall stock price after the listing of new shares has increased significantly compared with the issue price. In the new market, if investors can hit new stocks, they will make a lot of profits. Data from Flush iFinD shows that the average income of new shares winning this year is still more than 20,000 yuan.(For more news, please pay attention to Yangcheng Pai.ycwb.com)

Source | Yangcheng Evening News · Yangcheng School

Editor in charge | Shen Zhao

edit:

.