North Korea’s leader supervises a maneuver simulating a “nuclear counterattack” – Al-Ghad Channel

North Korean leader Kim Jong-un supervised a maneuver that simulated a “nuclear counterattack,” according to what the

Pedophile tried to kidnap a child from a US school and his mugshot caught everyone’s attention

The Aurora Police Department recently made an arrest after a concerning incident at Black Forest Hills Elementary

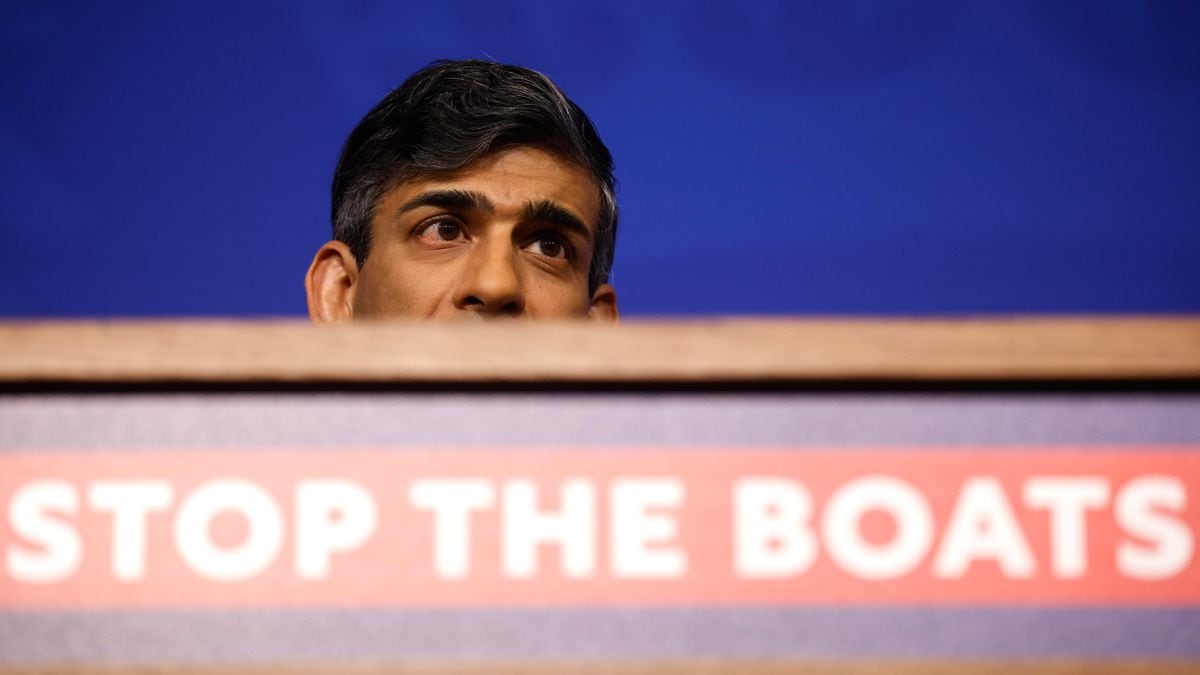

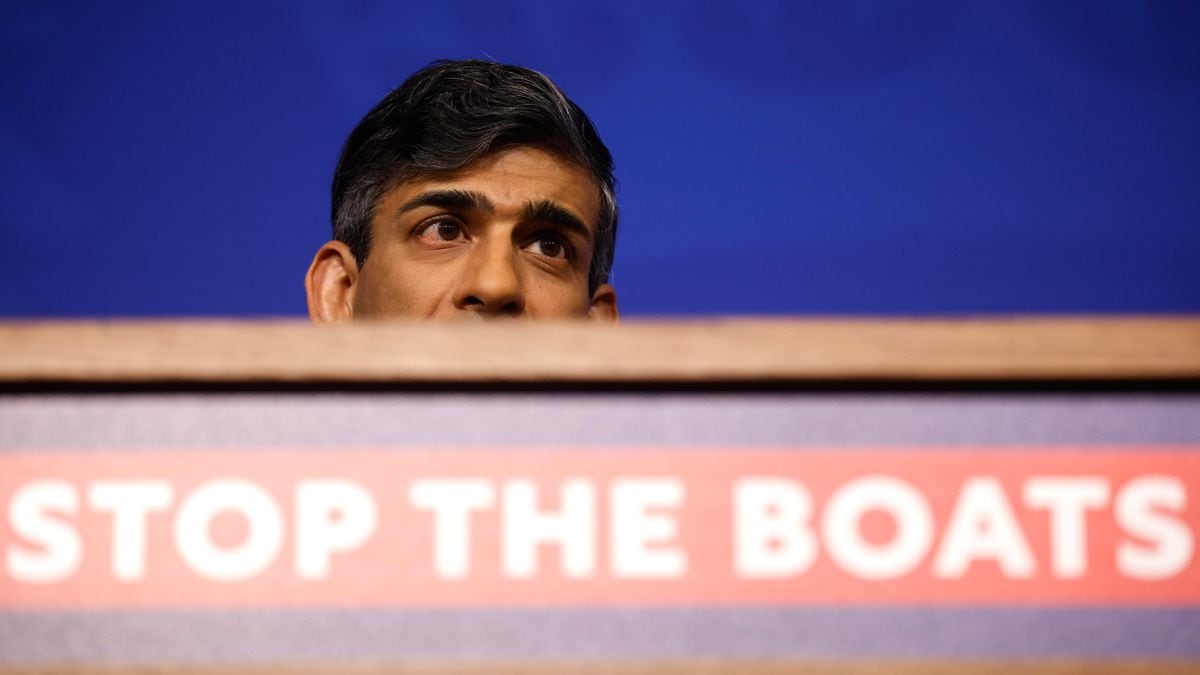

The British Parliament gives in to Sunak and gives the green light to the deportation of immigrants to Rwanda | International

British Prime Minister Rishi Sunak has faced a long and challenging battle in Parliament to push through

Popular Stories

Nintendo Switch 2: Release date, news and price speculation – Everything you need to know!

Are you excited to discover the Nintendo Switch 2? Wondering when this revolutionary new console will finally

North Korea’s leader supervises a maneuver simulating a “nuclear counterattack” – Al-Ghad Channel

North Korean leader Kim Jong-un supervised a maneuver that simulated a “nuclear counterattack,” according to what the

Pedophile tried to kidnap a child from a US school and his mugshot caught everyone’s attention

The Aurora Police Department recently made an arrest after a concerning incident at Black Forest Hills Elementary

The British Parliament gives in to Sunak and gives the green light to the deportation of immigrants to Rwanda | International

British Prime Minister Rishi Sunak has faced a long and challenging battle in Parliament to push through

Travel & Explore the world

Nintendo Switch 2: Release date, news and price speculation – Everything you need to know!

Are you excited to discover the Nintendo Switch 2? Wondering when this revolutionary new console will finally

North Korea’s leader supervises a maneuver simulating a “nuclear counterattack” – Al-Ghad Channel

North Korean leader Kim Jong-un supervised a maneuver that simulated a “nuclear counterattack,” according to what the

Pedophile tried to kidnap a child from a US school and his mugshot caught everyone’s attention

The Aurora Police Department recently made an arrest after a concerning incident at Black Forest Hills Elementary

The British Parliament gives in to Sunak and gives the green light to the deportation of immigrants to Rwanda | International

British Prime Minister Rishi Sunak has faced a long and challenging battle in Parliament to push through

Understanding Bank Accounts After Death: What Happens with and Without a Beneficiary?

What happens to a bank account when someone dies (with and without beneficiary)? Nobody wants to face

Lucía Méndez Opens Up About Relationship with Luis Miguel: “I Saw Him as a Kid”

Lucía Méndez opens up about her relationship with Luis Miguel: “I didn’t fall in love with him”

Marcell Ozuna leads MLB with historic start for Braves – MLB.com

Marcell Ozuna has been on fire for the Atlanta Braves, leading the MLB with a historic start