A few days ago, Donghua Software (002065) issued an announcement stating that the company held the 43rd meeting of the seventh board of directors to review and approve the “Regarding the capital increase of Donghua Medical Technology Co., Ltd. Proposal on the Implementation of Employee Equity Incentive Plan for Share Expansion.

It is worth noting that the voting result of the motion is: 8 votes in favor, 0 votes against, and 1 abstention. Among them, Director Chen Guangyu abstained from voting due to reservations on this matter.

On June 14, Donghua Software issued another announcement, supplementing the disclosure of the clear reason for director Chen Guangyu’s abstention: he has reservations about the pricing policy and pricing basis of this equity incentive.

According to public information, Chen Guangyu is 47 years old. He has successively led business teams such as Tencent Internet + and the Medical and Health Division. He is currently the Senior Vice President of Tencent Cloud and Smart Industry Business Group and the head of the Industrial Ecological Cooperation Department. Since November 30, 2021 Director of Donghua Software.

As of March 31, 2022, Tencent Technology (Shanghai) Co., Ltd. held 157 million shares of Donghua Software, with a shareholding ratio of about 4.90%. There has been no reduction in the shareholding in the past two years, ranking the third largest shareholder of Donghua Software.

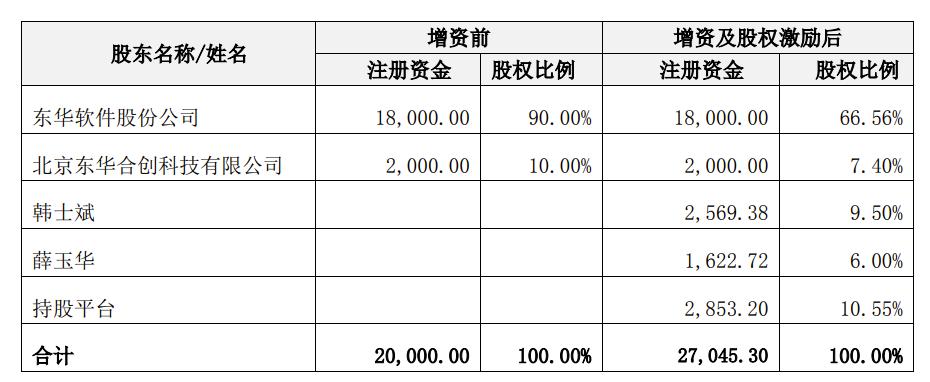

It is understood that Donghua Medical, a subsidiary of Donghua Software Holdings, plans to provide equity incentives to 163 employees including the company’s high- and middle-level managers and core technicians at a price of 3.70 yuan/yuan of registered capital through capital increase and share expansion.

Specifically, Donghua Medical plans to increase the capital of no more than 70.46 million yuan for this time, and the new registered capital accounts for no more than 26.05% of the company’s registered capital after this capital increase. Among them, the share of incentives granted by the equity incentive plan to the incentive objects does not exceed 70.38 million yuan, accounting for no more than 26.02% of the registered capital of Donghua Medical after this capital increase.

Beijing Guorong Xinghua Appraisal Co., Ltd. determined Donghua Medical as the shareholder’s entire equity value of about 1.235 billion yuan on June 30, 2021, the evaluation base date, according to the income method. Combined with the data of Donghua Medical’s total registered capital of 200 million yuan before the capital increase, the value of each 1 yuan of registered capital is about 6.17 yuan. The equity incentive price of 3.70 yuan/registered capital is about 60% of the appraised value.

(Editor in charge: Tian Yunfei)