Operation Praetorian: MP requests preventive detention for Madureira and “Polaco” | public ministry

This Tuesday, the Public Prosecutor’s Office (MP) requested preventive detention for Fernando Madureira, leader of the Super

Sayco Authors in search of the crown at the Vallenato Festival

Twenty-six composer partners of Sayco will enter the race for the crown of the Unpublished Vallenata Song

Inter-Toro, first all-female refereeing team in Serie A

Of ANSA 25-04-2024 – 13:52 (ANSA) – ROME, APRIL 25 – Sunday’s match at 12.30 pm at

Popular Stories

[Notice]For customers from the European Economic Area (EEA) and the United Kingdom – Yahoo! JAPAN

From Wednesday, April 6, 2022, Yahoo! JAPAN is no longer available in the EEA and the United

Operation Praetorian: MP requests preventive detention for Madureira and “Polaco” | public ministry

This Tuesday, the Public Prosecutor’s Office (MP) requested preventive detention for Fernando Madureira, leader of the Super

Sayco Authors in search of the crown at the Vallenato Festival

Twenty-six composer partners of Sayco will enter the race for the crown of the Unpublished Vallenata Song

Inter-Toro, first all-female refereeing team in Serie A

Of ANSA 25-04-2024 – 13:52 (ANSA) – ROME, APRIL 25 – Sunday’s match at 12.30 pm at

Travel & Explore the world

[Notice]For customers from the European Economic Area (EEA) and the United Kingdom – Yahoo! JAPAN

From Wednesday, April 6, 2022, Yahoo! JAPAN is no longer available in the EEA and the United

Operation Praetorian: MP requests preventive detention for Madureira and “Polaco” | public ministry

This Tuesday, the Public Prosecutor’s Office (MP) requested preventive detention for Fernando Madureira, leader of the Super

Sayco Authors in search of the crown at the Vallenato Festival

Twenty-six composer partners of Sayco will enter the race for the crown of the Unpublished Vallenata Song

Inter-Toro, first all-female refereeing team in Serie A

Of ANSA 25-04-2024 – 13:52 (ANSA) – ROME, APRIL 25 – Sunday’s match at 12.30 pm at

Famillicides – The Camerounaiseries blog

There is a young man in his twenties who murdered his own mother, here in the Damas

Africa: Barrick Gold, a successful first quarter in Africa

by: Andrea Spinelli Barrile | April 24, 2024 The Canadian mining company Barrick Gold mined more than

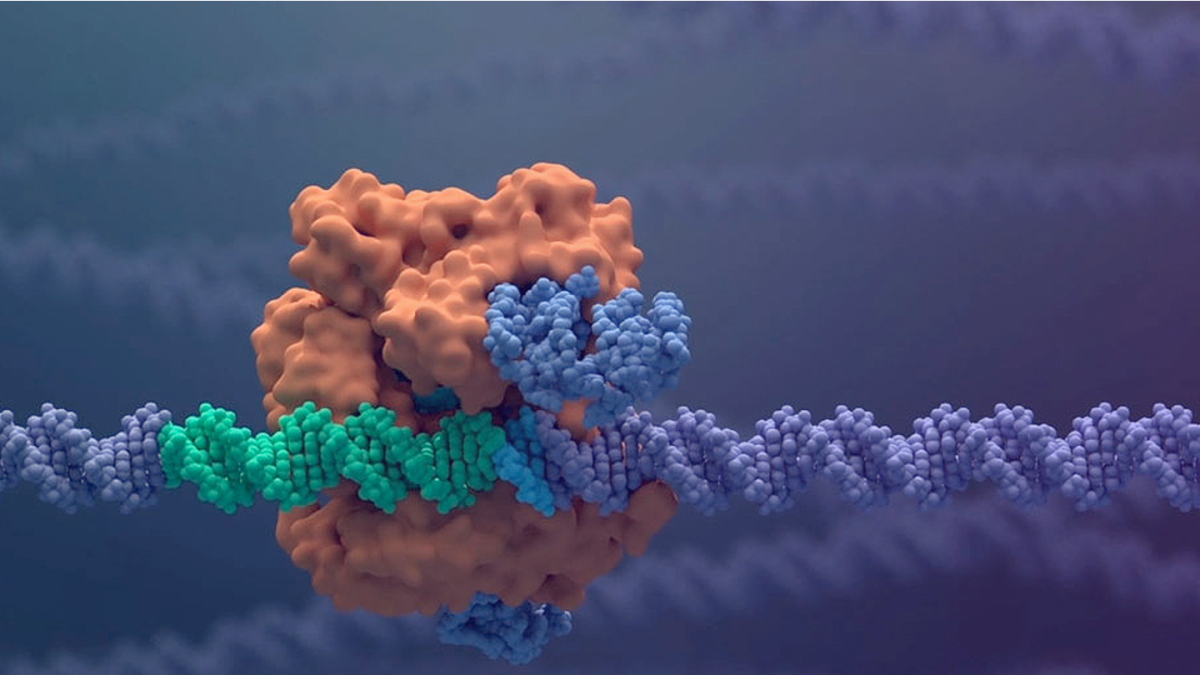

Correcting the genome with “molecular scissors” to cure thalassemia and sickle cell anemia

Elena Meli From Bambino Gesù in Rome, data demonstrating the effectiveness of CRISPR-Cas9 therapy to treat two