Energy crisis in Ecuador: the Government declared a state of exception to prevent attacks on infrastructure

Ecuador Declares State of Emergency Due to Energy Crisis President Daniel Noboa of Ecuador has declared a

Unveiling Your Lucky Number for the Lottery with Artificial Intelligence

Artificial intelligence has become a popular tool for finding solutions to various tedious jobs, but it has

Érika Villalobos Confirms New Romance with Erik Zapata: Leaving Aldo Miyashiro Behind

Érika Villalobos, the renowned Peruvian actress, apparently left her story with Aldo Miyashiro behind and has decided

Popular Stories

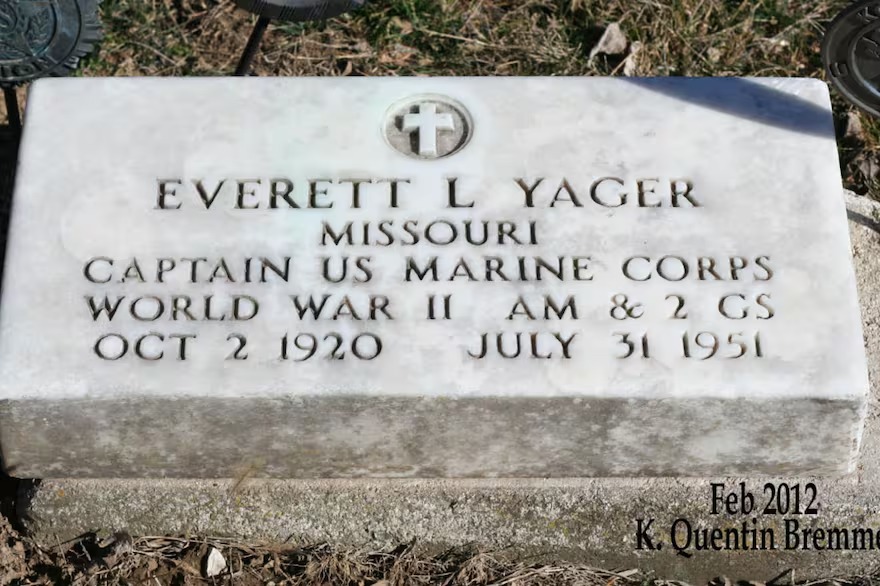

20 years later he learned a horrendous truth

The Mysterious Discovery of a Marine Corps Captain’s Jawbone in Arizona In a bizarre turn of events,

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/ZYFS6BK5POGMQQ6V2MVYW4GAR4.jpg)

Energy crisis in Ecuador: the Government declared a state of exception to prevent attacks on infrastructure

Ecuador Declares State of Emergency Due to Energy Crisis President Daniel Noboa of Ecuador has declared a

Unveiling Your Lucky Number for the Lottery with Artificial Intelligence

Artificial intelligence has become a popular tool for finding solutions to various tedious jobs, but it has

Érika Villalobos Confirms New Romance with Erik Zapata: Leaving Aldo Miyashiro Behind

Érika Villalobos, the renowned Peruvian actress, apparently left her story with Aldo Miyashiro behind and has decided

Travel & Explore the world

20 years later he learned a horrendous truth

The Mysterious Discovery of a Marine Corps Captain’s Jawbone in Arizona In a bizarre turn of events,

:quality(85)/cloudfront-us-east-1.images.arcpublishing.com/infobae/ZYFS6BK5POGMQQ6V2MVYW4GAR4.jpg)

Energy crisis in Ecuador: the Government declared a state of exception to prevent attacks on infrastructure

Ecuador Declares State of Emergency Due to Energy Crisis President Daniel Noboa of Ecuador has declared a

Unveiling Your Lucky Number for the Lottery with Artificial Intelligence

Artificial intelligence has become a popular tool for finding solutions to various tedious jobs, but it has

Érika Villalobos Confirms New Romance with Erik Zapata: Leaving Aldo Miyashiro Behind

Érika Villalobos, the renowned Peruvian actress, apparently left her story with Aldo Miyashiro behind and has decided

Mazatlan vs. Juárez LIVE. Match TODAY Liga MX Matchday 16 ONLINE

Matchday 16 of the Clausura 2024 tournament kicked off with a match between the Cañoneros and the

The Importance of Mental and Emotional Health in Modern Society: Strategies for Well-being

In modern life, mental and emotional health has become a topic of growing concern and awareness. Beyond

With two goals from Borja, River Plate beat Rosario Central 2-1 and was one step away from the quarterfinals of the League Cup

“,”type”:”raw_html”},{“_id”:”THXJZDO4ONHWXJFCDXQIKIENZA”,”additional_properties”:{},”embed”:{“config”:{“data”:{“date”:”07/04/2024″,”dateToShow”:”07/04/24″,”hour”:”22:58″,”isPinned”:false,”timestamp”:1712541481111}},”id”:”1712541481111″,”url”:” Se juegan cinco minutos más”,”type”:”text”},{“_id”:”EFDHQS53HRBM5LIGGXX57UYMVI”,”additional_properties”:{},”embed”:{“config”:{“data”:{“date”:”07/04/2024″,”dateToShow”:”07/04/24″,”hour”:”22:55″,”isPinned”:false,”timestamp”:1712541336215}},”id”:”1712541336215″,”url”:” ¡GOL DE RIVER PLATE!”,”type”:”text”},{“_id”:”2C7IC6XCTBCV7F5QQA52DXVKPU”,”additional_properties”:{},”content”:”Miguel Borja definió tras un gran pase de