On March 30, the central bank released the results of a national banker survey conducted by the People’s Bank of China in the first quarter of 2022:

one

Bankers Macroeconomic Heat Index

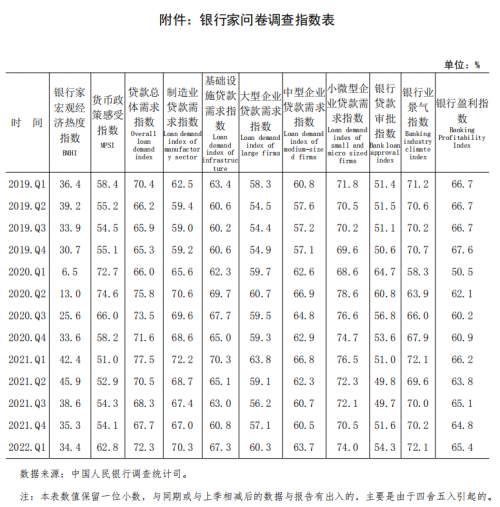

The banker’s macroeconomic enthusiasm index was 34.4%, down 0.9 percentage points from the previous quarter. Among them, 62.2% of bankers believed that the current macro economy was “normal”, a decrease of 3.7 percentage points from the previous quarter; 34.6% of bankers believed that it was “cold”, an increase of 2.7 percentage points from the previous quarter. For the next quarter, the bankers’ macroeconomic enthusiasm expectation index was 41.3%, 6.9 percentage points higher than this quarter.

two

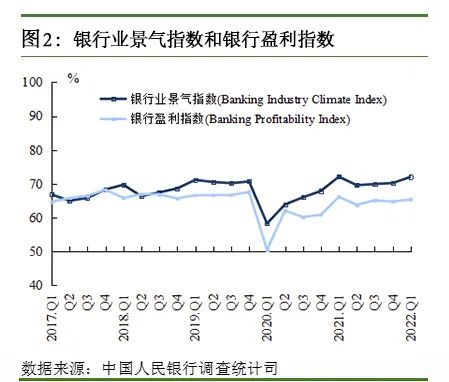

Banking Sentiment Index and Bank Profitability Index

The banking climate index was 72.1%, up 1.8 percentage points from the previous quarter and down 0.1 percentage points from the same period last year. The Bank Profitability Index was 65.4%, an increase of 0.6 percentage points from the previous quarter and a decrease of 0.8 percentage points from the same period of the previous year.

three

Overall Loan Demand Index

The overall loan demand index was 72.3%, an increase of 4.6 percentage points from the previous quarter and a decrease of 5.1 percentage points from the same period of the previous year. In terms of different industries, the loan demand index for manufacturing was 70.3%, up 3.3 percentage points from the previous quarter; the infrastructure loan demand index was 67.3%, up 6.5 percentage points from the previous quarter; the loan demand index for wholesale and retail trade was 62.7%, up 6.5 percentage points from the previous quarter. The quarterly increase of 0.6 percentage points; the loan demand index of real estate enterprises was 47.2%, an increase of 2.8 percentage points from the previous quarter. In terms of size of enterprises, the loan demand index of large enterprises was 60.3%, up 3.2 percentage points from the previous quarter; medium-sized enterprises were 63.7%, up 3.2 percentage points from the previous quarter; small and micro enterprises were 74.0%, up 3.6 percentage points from the previous quarter .

Four

Monetary Policy Feeling Index

The monetary policy sentiment index was 62.8%, an increase of 8.8 percentage points from the previous quarter and an increase of 11.8 percentage points from the same period of the previous year. Among them, 27.6% of bankers believed that monetary policy was “easy”, an increase of 15.8 percentage points from the previous quarter; 70.5% of bankers believed that monetary policy was “moderate”, a decrease of 14.0 percentage points from the previous quarter. For the next quarter, the monetary policy sentiment expectation index was 64.7%, 1.9 percentage points higher than this quarter.

Compilation Instructions:

The Banker Questionnaire is a quarterly survey established by the People’s Bank of China in 2004. The survey adopts a combination of comprehensive survey and sample survey, and conducts comprehensive survey on various banking institutions above the prefecture and city level in my country, and adopts stratified PPS sample survey on rural credit cooperatives. A total of about 3,200 various banking institutions were surveyed nationwide. The subjects of the investigation are the heads of the headquarters of various banking institutions (including foreign-funded commercial banking institutions) across the country, as well as the presidents of their first-level branches, second-level branches or vice presidents in charge of credit business.

Most of the indices in the Banker Survey Report are calculated using the diffusion index method, that is, the proportion of each option is calculated, and different weights are assigned to each option (the “good/growth” option is assigned a weight of 1, and the “normal/unchanged” option is assigned a weight of 1. is 0.5, and the weight of the “difference/decline” option is 0), multiply the proportion of each option by the corresponding weight, and then add up to obtain the final index. The value range of all indices is between 0 and 100%. If the index is above 50%, it reflects that the index is in a state of improvement or expansion; if it is lower than 50%, it reflects that the index is in a state of deterioration or contraction.

The main index calculation method is briefly introduced as follows:

1. Macroeconomic Heat Index:Diffusion index reflecting current macroeconomic conditions. The calculation method of the index is to first calculate the proportion of the bankers who believe that the current quarter’s economy is “hot” and “normal”, and then assign a weight of 1 and 0.5 respectively, and then sum it up.

2. Monetary Policy Feeling Index:An index that reflects how bankers feel about monetary policy. The index is calculated by first calculating the proportions of the bankers who believe that monetary policy is “loose” and “moderate” in this quarter, and then assigning weights of 1 and 0.5 respectively, and then summing them up.

3. Overall loan demand index:Diffusion index that reflects bankers’ judgment on the overall demand for loans. The index is calculated by first calculating the proportion of the bankers who believe that the bank’s loan demand for the current quarter is “increasing” and “basically unchanged”, and then assigning a weight of 1 and 0.5 to the sum.

4. Manufacturing Loan Demand Index:Diffusion index reflecting bankers’ judgments on the demand for manufacturing loans. The index is calculated by first calculating the proportions of the bankers who believe that the bank’s manufacturing loan demand in this quarter is “increasing” and “basically unchanged”, and then assigning weights of 1 and 0.5 respectively, and then summing up the results. out.

5. Infrastructure loan demand index:Diffusion index that reflects bankers’ judgments on the demand for infrastructure loans. The index is calculated by first calculating the proportion of the bankers who believe that the demand for infrastructure loans in the current quarter is “increasing” and “basically unchanged”, and then assigning weights of 1 and 0.5, respectively, and then summing up the results. out.

6. Loan demand index of large enterprises:Diffusion index that reflects bankers’ judgments on the demand for loans of large enterprises. The calculation method of the index is to first calculate the proportion of the bankers who believe that the demand for large-scale corporate loans in the current quarter is “increasing” and “basically unchanged”, and then assign weights of 1 and 0.5 respectively, and then sum up to obtain out.

7. Loan demand index of medium-sized enterprises:Diffusion index that reflects bankers’ judgment on the loan demand of medium-sized enterprises. The index is calculated by first calculating the proportion of the bankers who believe that the demand for loans to medium-sized enterprises in the current quarter is “increasing” and “basically unchanged” among all the bankers surveyed, and then assigning weights of 1 and 0.5 respectively, and then summing up the results. out.

8. Small and micro enterprise loan demand index:Diffusion index that reflects bankers’ judgment on the loan demand of small and micro enterprises. The calculation method of the index is to first calculate the proportion of the bankers who believe that the demand for loans to small and micro enterprises in the current quarter is “increasing” and “basically unchanged”, and then assign the weights of 1 and 0.5 to the sum. inferred.

9. Bank loan approval index:Diffusion index reflecting bankers’ slack in loan approval conditions. The index is calculated by first calculating the proportions of the bankers who believe that the bank’s approval conditions for the current quarter are “relaxed” and “basically unchanged”, and then assigning weights of 1 and 0.5 respectively, and then summing them up.

10. Banking Sentiment Index:Diffusion index that reflects bankers’ judgments on the overall operating conditions of banks. The index is calculated by first calculating the proportions of the bankers who believe that the bank’s operating conditions in the current quarter are “better” and “average”, and then assigning weights of 1 and 0.5, respectively, and then summing them up.

11. Bank Profitability Index:Diffusion index that reflects bankers’ judgment on bank profitability. The calculation method of the index is to first calculate the proportions of the bank’s “increase in profit (decrease loss)” and “equalize” in the current quarter among all the surveyed bankers, and then assign a weight of 1 and 0.5 respectively, and then sum it up.