“The Fed will not raise interest rates preemptively.” This is what the president of the Federal Reserve, Jerome Powell, said in his hearing in the US House of Representatives, trying to give a clear message to the markets, confused after the outcome of the FOMC meeting of last June 15-16 and further stunned. from the hawkish statements, last Friday, by St Louis Fed chairman James Bullard, who dropped the real bomb on the markets.

At the moment Bullard is not a voting member of the FOMC, but he will be soon, starting next year. Powell yesterday had the task of easing concerns about the trend in US inflation as measured by the consumer price index, which rose by 5% in April and May. Not to mention inflation measured by the producer price index, which jumped 6.6% in May.

At last week’s meeting, Powell & Co were forced to admit that inflationary pressures could prove stronger than expected. Result: now two rate hikes emerge from the dot plot in 2023 when at the March meeting it was estimated that nothing happened at least until 2024. The markets were, however, further confused by the uncertainty shown by the Fed chairman, who in the following press conference at the announcement of the Fed’s news, he recommended a reading cum fiore salis.

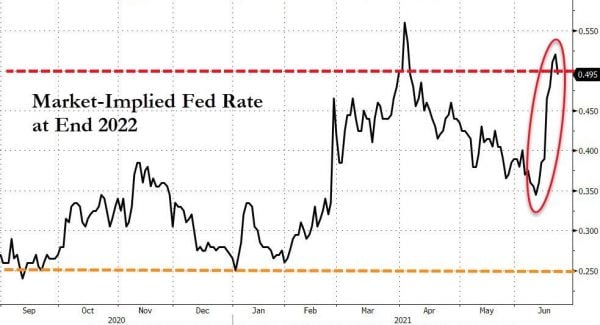

Yesterday Powell had the opportunity to clarify exactly what he thinks about the US inflation trend and, therefore, to what extent the markets are right to price the tapering of Quantitative easing and a rate hike ahead of forecasts. And the opportunity has seized it, reducing anxiety on the markets. Not entirely, however, as fed funds futures are betting more and more on a monetary tightening before the end of 2022. “An inflation of 5% is not acceptable – he said in his speech to the US House – and we believe that the inflation linked to the reopening of the economies will diminish over time”. The helmsman of the US central bank assured that “we will not raise rates because we will believe that employment is too high”, repeating that “the incoming (macro) data shows that the factors underlying inflation will fade over time. “. In short, Powell believes that inflation is “transient”.

“An inflation of 5% is not acceptable – he said in his speech to the US House – and we believe that the inflation linked to the reopening of the economies will diminish over time”. The helmsman of the US central bank assured that “we will not raise rates because we will believe that employment is too high”, repeating that “the incoming (macro) data shows that the factors underlying inflation will fade over time. “. In short, Powell believes that inflation is “transient”.

The number one of the Fed has specified to the US Congress that he also believes that it takes “a long time before the recovery of the labor market”. On the occasion of his speech, Powell was besieged by questions from the Republicans, the Subcommittee on the coronavirus crisis of the US House of Representatives, who feared the danger of hyperinflation for the American economy.

“It is very, very unlikely” that inflation will go towards those conditions of hyperinflation that characterized the 1970s and early 1980s, when it shot above 10%, explained the central banker: “We believe that what we are seeing now is inflation in particular categories of goods and services that are directly affected by this unique historical event that none of us have ever experienced before ”. And, again, the current situation is caused by “an extremely strong demand for work, goods and services” and by the fact that “the supply front has been caught a little off guard”.

Jerome Powell has guaranteed that, in any case, the Fed will be vigilant in its role. “You have a central bank that is committed to ensuring price stability, which has defined what price stability is and which is highly prepared to use its tools for inflation of around 2%. All these factors suggest to me that an episode similar to the one we witnessed in the ’70s… .I really don’t think anything like that could happen ”.