The 67-year-old richest man Zhong Sui Sui will also enter the private equity circle!

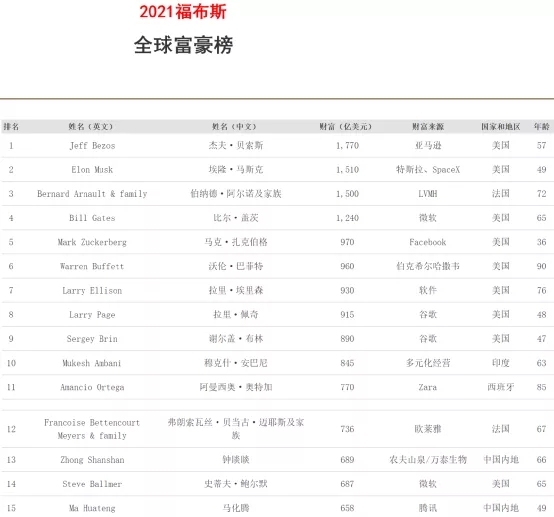

Recently, an institution called “Guanzi Private Equity Management (Hangzhou) Co., Ltd.” completed a low-key filing and registration with the China Foundation Association, and its actual controller is Zhong Suisui, the founder of Nongfu Spring. I worked as a plasterer, a reporter, and eventually became a businessman; I planted mushrooms, raised soft-shelled turtles, and sold water.Now do private equity investment. According to the Forbes Global Rich List in 2021, Zhong Suisui ranks 13th in the world with a wealth of US$68.9 billion (approximately 445.473 billion yuan). He is also the richest man in China.

Just established on March 23 this year

According to the China Fund News, on September 16 this year, “Guanzi Private Equity Management (Hangzhou) Co., Ltd.” completed the filing and registration with the China Securities Investment Fund Association. The type of organization is private equity and venture capital fund managers. The company currently has full-time There are 6 employees, and 4 of them have obtained the qualifications of fund business.

In fact, this cutting-edge private equity firm was just established on March 23 this year, with a registered capital of 30 million yuan and a paid-in ratio of 100%. The registered and office addresses are in Xihu District, Hangzhou City, Zhejiang Province.

It is worth noting that Qixinbao information shows that Guanzi Private Equity Management (Hangzhou) Co., Ltd. is wholly-owned by Yangshengtang Co., Ltd., and through the equity structure, we can see that the actual controller of the company is the founder of Nongfu Spring, Zhong Suisuan. Information from the Fund Industry Association also shows that the Guanzi Private Equity Fund is 100% owned by Yangshengtang, and the actual controller is Zhong Suansui.

Zhong Suisui serves as the chairman of Guanzi Private Equity Fund. The company’s main members include general manager Chen Bin, director Xue Lian, and supervisor Li Yamei.

According to information from the Fund Industry Association, Chen Bin, the general manager of Guanzi Private Equity, has more than 20 years of financial industry experience and has worked in Southern Securities, CICC and other institutions; in March 2004, he joined CICC Capital Operation Co., Ltd. as a director The general manager left until February this year; then in March this year, Chen Bin served as the general manager of the equity investment department of Yangshengtang Co., Ltd., and after the establishment of Guanzi Private Equity Management (Hangzhou) Co., Ltd., he served as the legal representative and general manager.

In addition, Shi Jin, the person in charge of compliance and risk control of Guanzi Private Equity Fund, has worked in COFCO Trust, CITIC Agricultural Industry Fund, etc., and is also very experienced.

The reporter also found that “Guanzi Private Equity Management (Hangzhou) Co., Ltd.” was originally called “Guanzi Equity Investment (Hangzhou) Co., Ltd.”, but now private equity regulatory regulations require private equity fund managers to indicate “private equity fund” and “private equity fund management.” “And other words, so this company changed its name on May 21 this year, and also changed its business scope to: private equity investment fund management, venture capital fund management services (must be registered with the China Securities Investment Fund Association Only then can engage in business activities) (except for projects that must be approved according to law, carry out business activities independently according to the business license according to the law).

According to Qixinbao information, Guanzi Private Equity currently has an outbound investment-Guanzi Management Consulting (Lishui) Partnership (Limited Partnership), with a registered capital of 10 million. Zhong Suansui holds 90% of the shares with 9 million and is a major shareholder; Guanzi Private Equity holds 10% with 1 million.

Guanzi Management Consulting (Lishui) Partnership (Limited Partnership) is the executive partner of Guanzi Equity Investment (Lishui) Partnership (Limited Partnership) and Chengguang Management Consulting (Lishui) Partnership (Limited Partnership). The registered capital is as high as 2.015 billion yuan and 403 million yuan respectively.

“The richest man” Zhong Suisui is now doing private equity investment

Since January this year, Zhong Sui Sui, who was born in 1954, has been rising continuously on the rich list. First, he successfully squeezed out Ma Yun and Ma Huateng on January 4 and returned to the throne of the richest man in China. Then on January 8, Zhong Sui Sui surpassed “Stock God” Buffett with a personal wealth of 94.8 billion U.S. dollars, becoming the sixth largest in the world and Asia. The first richest man. At that time, some media calculated that Zhong Suisui’s net worth ≈ Ma Huateng + Wang Jianlin + Liu Qiangdong.

According to the Forbes Global Rich List in 2021, Zhong Suisui ranks 13th in the world with a wealth of US$68.9 billion (approximately 445.473 billion yuan). He is also the richest man in China. Forbes real-time rich list information also shows that Zhong Sui Sui is still the richest man in China with a fortune of 62.2 billion US dollars.

Image source: China Fund News

The driving force for Zhong Sui’s wealth growth came from the astonishing gains of his two listed companies, Nongfu Spring and Wantai Bio: Hong Kong stock Nongfu Spring rose all the way from the listing to a maximum of 68.75 Hong Kong dollars, and the share price of A-share Wantai Bio increased to a maximum of 299.77 yuan. , However, the two stocks have recently recovered.

Nongfu Spring is a well-known product in China, but the founder behind it, Zhong Suansui, is more mysterious.Public information shows that Zhong Suansui was born in a family of intellectuals in 1954. Due to the special age, he was forced to drop out of school before graduating from elementary school to work as a coolie. During this period, he moved bricks, worked as a masonry, and worked as a carpenter.

In 1977, the college entrance examination resumed. Zhong Sui-sui failed in the college entrance examination twice. In the end, he had to study at TV University. After graduation, he entered Zhejiang Daily and worked for five years.

At the beginning of 1988, the state formally approved the establishment of the Hainan Special Economic Zone, which caused a big wave of Hainan’s gold rush. At that time, the three major sections of the “Zhejiang Daily” were all reporting in a concentrated manner. As a reporter for the Zhejiang Daily, Zhong Sui Sui couldn’t hold back his passion and decided to leave his job without pay to join the gold rush and start his own journey as a businessman.

After arriving in Hainan, Zhong Suisui ran a newspaper and opened a mushroom planting company, but they all failed in the end.

In 1990, Zong Qinghou founded Wahaha Oral Liquid with huge business opportunities, and Zhong Sui Sui became the general agent of Wahaha in Hainan and Guangxi. But he took the oral liquid sold in Hainan at a lower price and sold it to Guangdong at a higher price. This behavior was quickly discovered and he lost his qualification as a general agent.

Zhong Huisui turned to his own business. He found that the locals in Hainan especially like to use tortoise and tortoise soup, and tortoise and tortoise soup is a popular local dish to entertain guests. In 1993, Zhong Sui Sui established Hainan Yangshengtang Pharmaceutical Co., Ltd. in Haikou. He hired three experts from the University of Traditional Chinese Medicine and spent 8 months to develop the “Yangshengtang Fish Turtle Pill”, which officially entered the health care products. industry.

Zhong Suisui’s “Yangshengtang Fish Turtle Pills” became a hit in just one year, and he gained the first 10 million in his life as a result. After that, Zhong Suisui led the team non-stop to continue the research and development of “Duo Er”. “,” “Clear Mouth”, “Mother Beef Stick”, “Growing Up Happy” and many other health care, snack food and other product series. This provides him with a very critical starting capital for the development of more business models in the future.

In 1996, Zhong Suisui entered the beverage industry. In that year, Hainan Yangshengtang Co., Ltd. (the predecessor of Yangshengtang) and Hainan Damen Advertising Co., Ltd. (deregistered) established the predecessor of Nongfu Spring-Xinanjiang Health Care with a registered capital of 20 million yuan. Tang drinking water.

At the end of 1997, “Nongfu Spring” drinking natural water 550ml sportswear was officially launched.

In 2001, with the development of the company’s business, the company was restructured into a company limited by shares. After the restructuring, Nongfu Spring’s shareholders are Yangshengtang, Hainan Baoyi, Hainan Yangpu Bochuang Investment Management Co., Ltd., Shanghai Xinju High-tech Services Co., Ltd. and Hainan Damen, holding 61.43%, 23.21%, 10%, and 5% of shares respectively. And 0.36%.

Later, after a series of capital operations, both Yangshengtang and Nongfu Spring became a family business absolutely controlled by Zhong Sui Sui.

In terms of equity, he and his family are almost entirely arranged, except for his own holding more than 84% of the equity, Zhong Sui’s sister Zhong Xiaoxiao and other family members together hold about 6.44%; Qiu Hongying and other directors, core connected persons and affiliates of Nongfu Spring Supervisors and core connected persons hold approximately 0.55% of the shares.

Very few interviews, admire Ren Zhengfei and Zong Qinghou

With the listing of two consecutive companies under its umbrella, the label “lone wolf, low-key” and other labels on Zhong Sui Sui, the boss behind the scenes, seems to be difficult to conceal his brilliance.

Shaoxing people have a nickname for the character of Zhuji people, called “Zhuji Mutuo”, which means Zhuji people’s straightforward, open-minded, and willing temperament. In previous reports, Zhong Suijuan’s image also showed the multi-faceted “Zhuji Mutuo”.

He doesn’t like to wear formal clothes, and usually appears as a casual wear with sweaters and shirts not on special formal occasions. Zhong Sui Sui said that he is a lonely person. He doesn’t care what his colleagues are doing and thinking.

He left time for himself to study, from the beverage bottle to the product technology to the slogan. According to rumors, he personally participated in the creation of well-known advertising slogans such as “Nongfu Spring is a bit sweet”, “We do not produce water, we are porters of nature”, and “Shake before drinking”.

He rarely accepts interviews, and once publicly said that the Chinese entrepreneurs he admires most are Ren Zhengfei and Zong Qinghou.

The other side is his hot personality, and reports have evaluated him as one of the most troublesome bosses in the food and beverage industry. There are memories of previous subordinates, and they will be scolded if they are too verbose when reporting to the boss. A person in the Hangzhou business community also said that Zhong Suisuan was called the lone wolf because “the mouth is not forgiving, and many people are offended.”

However, regardless of the outside world‘s attitude towards Zhong Suisui, after more than 20 years of fighting, 2020 will undoubtedly be a big year for his capital harvest. The continuous listing of his subsidiary Wantai Bio and Nongfu Spring has allowed his wealth to expand rapidly. According to Qixinbao’s information, Zhong Suisui actually has a huge picture of the big health industry. The core capital of its 100% holding is Yangshengtang Co., Ltd. (hereinafter referred to as Yangshengtang), which was established in 1993 and owns hundreds of companies. The company covers food and beverages, biological vaccines, health care products, cosmetics and other fields.

In addition to Nongfu Spring, there are also multi-brand soft drink industries such as Oriental Leaf and Tea π, which are widely known to consumers, the food industry represented by the “Clear Mouth” and “Mother Beef Sticks” series, and the Yangshengtang Birch Juice series. Cosmetics industry, etc.

In addition, as a family business, the listing of Nongfu Spring has also brought a huge increase in the wealth of Zhong Sui’s family. According to the prospectus, Zhong Sui’s relatives, Lu Xiaowei, Lu Cheng, Lu Xiaofu, Zhong Xiaoxiao and Zhong Junjing 5 People hold 6.4426% of Nongfu Spring. Among them, Lu Xiaowei is the sister of Zhong Sui Sui’s wife and serves as the director and general manager of Yangshengtang. According to the prospectus, Zhong Shu Zi’s son “Zhong Shu Zi” also joined Nongfu Spring in January 2014 and began serving as a non-executive director in June 2017, responsible for providing opinions on business plans, major decisions and investment activities. From January 2020, “Zhong Shu Zi” will serve as the general manager of the Yangshengtang Brand Center.

Daily Economic News, Comprehensive China Fund News, Every Jingwang, etc.

Cover image source: Daily economic news data map