Financial Lianliankan | Stock Market Weekly Review: In 2021, what do these new records of A shares indicate?Fly into the homes of ordinary people

Stock trading ends in 2021, the three major indexes of Shanghai and Shenzhen stock markets rose slightly, and the annual K-line closed positive for the third consecutive year. On the whole, it seems that this has been a dull year. Surprisingly, A shares have set a number of historical records, including a record high in historical turnover, the smallest amplitude in history, and both the number of new shares issued and the amount of financing. Record highs and so on. These new records indicate that A-shares are undergoing major changes.

Caption: K-line chart of GEM index year

The pattern of bull short and bear long is changing

First look at the index trend and 2 new historical records.

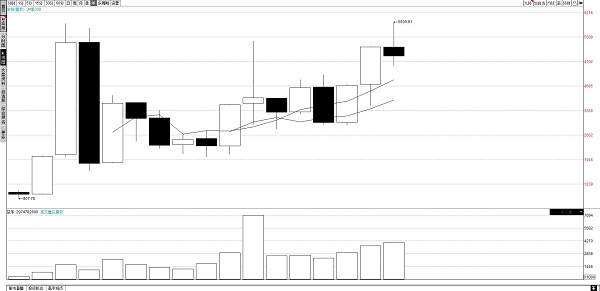

In 2021, the Shanghai Composite Index opened at 3474.68 points and closed at 3639.78 points, an annual increase of 4.8%; the Shenzhen Component Index opened at 14516.12 points and closed at 14857.35 points, an annual increase of 2.67%; the GEM opened at 297.32 points and closed at 3,322.67 points. An increase of 12.02%.

The index has not risen much, but the Shanghai Composite Index and the Shenzhen Component Index have set two historical records. First of all, since the establishment of the SZSE Component Index in 1991, the annual K-line has only been two consecutive positives at most. This record was broken in 2021. Since 2019, the Shenzhen Component Index has risen for three consecutive years, and the annual K-line has three consecutive positives. Set a new record. After 1993, the Shanghai Composite Index has only 2 consecutive K-lines each year. After the 2021 harvest, there will be 3 consecutive K-lines after a lapse of 28 years.

Caption: Annual K-line chart of the Shanghai and Shenzhen 300 Index

Secondly, the Shanghai Composite Index and the Shenzhen Component Index both hit the smallest amplitude in history. The Shanghai Composite Index has a high of 3,731.69 points and a low of 3,32.72 points in 2021. The annual amplitude is only 12.06%, which is the smallest year in history. The Shenzhen Component Index’s amplitude in 2021 is 21.01%, which is also the smallest annual amplitude in history.

Two new records show that the A-share market is undergoing major changes. The biggest feature of the A-share market in history is the large fluctuations in the ups and downs, the bulls are short and the bears are long. Now this pattern has been broken. For the Shanghai Composite Index, the amplitude is only 12.06%, which is a little more than a daily limit. It is hard to imagine that there is only such a small fluctuation in a year. The monthly K-line and quarterly K-line also fully reflect this characteristic. Looking at the monthly K-line, there are only 4 Yin lines in 2021, and 8 Yang lines. The fluctuations are small, and the largest is the fall of 5.4 in July. %, recovered in the next 2 months. The quarterly K-line has a smaller fluctuation range. In the quarter of 2021, the K-line has 2 positive and 2 negative, and the three quarterly K-lines have only increased or decreased by about 1%.

Regardless of the monthly K-line, the quarterly K-line or the annual K-line, the stability of the Shanghai Composite Index in 2021 is unprecedented. At the same time, the annual K-line of the Shanghai Stock Exchange Index and the Shenzhen Stock Exchange Component Index have been able to reach three consecutive positives, which is not before, showing that the pattern of bull short and bear long is changing. We have been looking forward to the emergence of a continuous bull market, which is now taking shape. If it continues for a few years, a long bull market can be fully confirmed.

It is worth mentioning that the Shanghai Composite Index closed in December and the fourth quarter, both hitting new monthly and quarterly closing highs since 2015. This is a good phenomenon for 2022.

Caption: Annual K-line chart of Shanghai Composite Index

A-share market enters the institutional era

Look at the new record of turnover.

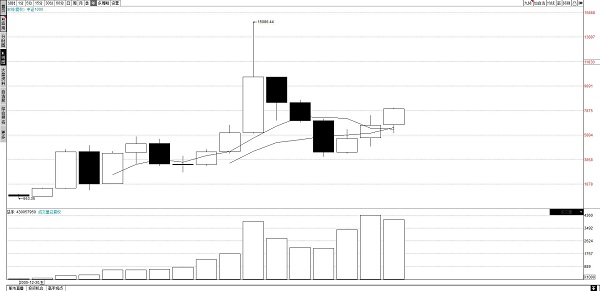

The Shanghai and Shenzhen stock markets’ turnover in 2021 broke historical records and set new highs. This year, the Shanghai and Shenzhen stock markets had a turnover of 257 trillion yuan, surpassing the historically highest annual turnover of 254.5 trillion yuan in 2015, setting a new record. At the same time, the Shanghai and Shenzhen stock markets also set the record for the longest transaction volume ever recorded in the trillions. From July 21 to September 29, 2021, the turnover of Shanghai and Shenzhen stock exchanges exceeded RMB 1 trillion for 49 consecutive trading days, the highest in history, exceeding RMB 1 trillion for 43 consecutive trading days in 2015, October 22, 2021 From January to December 24, the Shanghai and Shenzhen stock markets had 46 consecutive trading days with a turnover exceeding one trillion yuan.

The record high turnover was mainly due to the continuous growth of institutions such as funds, pension funds, and foreign investment. A related new record was that foreign institutions entered A-share funds to a record high. Since 2021, the net purchase of northbound funds in the A-share market has exceeded 430 billion yuan, exceeding the historical record of 351.743 billion yuan in 2019.

In 2021, the total scale of China’s public offering industry will exceed RMB 25 trillion for the first time, setting a record high. As of the end of the third quarter of 2021, the total market value of A shares held by public funds reached 5.72 trillion yuan, accounting for 8.31% of the market value of A shares in circulation. The A-share market is moving from the retail era to the institutional era.

The biggest change brought about by the institutional era is that the market has become stable and continuous. In 2021, the turnover is so large, but the volatility of the Shanghai Composite Index is so small. The reason is the sector effect brought by the institution. One sector rises while another sector falls. This kind of hedging This resulted in small gains and small fluctuations in the Shanghai Composite Index.

Caption: SZSE Component Index Year K-line Chart

Old routines are not suitable for new markets

In terms of style, in 2021, the large-cap stocks of previous years will be converted to small-cap stocks. As a result, although the index increase in 2021 is small, the performance of individual stocks is not bad. In 2021, nearly 2,800 stocks in Shanghai and Shenzhen stock markets rose. The ratio is up to 60%, and the index will rise even more in 2020, but the proportion of rising stocks is only 50%. In 2021, there are 344 stocks that have increased by more than 100%. In 2020, there are only 330 stocks that have increased by more than 100%. In 2019, there are only 266 stocks that have increased by more than 100%. In these three years, the index rose the least in 2021, but the number of bull stocks was the largest.

This divergence between the index and individual stocks is due to the fact that the rising stocks in 2021 are dominated by small-cap stocks, while large-cap stocks are mostly falling. Because of the larger number of small-cap stocks, the rise is broader. Most large-cap stocks fell, suppressing index gains.

Of the 344 stocks that rose more than 100% in 2021, only 30 stocks are large-cap stocks with a market value of more than 50 billion yuan, accounting for 9%. Among them, there are only 9 companies with a market value of over 100 billion yuan. Ninety percent of bull stocks are small and medium-cap stocks, of which, small-cap stocks with a market value of less than 10 billion yuan account for one-third. For example, Hubei Yihua, which has the largest increase in 2021 (up 566%), has a market value of only 2.9 billion yuan at the end of 2020.

Caption: Annual K-line chart of CSI 1000 Index

In 2021, individual stocks are more differentiated. There are 344 bull stocks that have risen more than 100%, and 339 bear stocks that have fallen more than 30%. Among these bear stocks, 126 stocks have a market value of more than 10 billion yuan in 2020, and 42 of them are large-cap stocks with a market value of more than 50 billion yuan in 2020, accounting for 12%. For example, the three stocks with a decline of more than 70% in 2021 are all stocks with a market value of over 10 billion. Zhonggong Education, the first decliner (down 77.63%), has a market value of 216.6 billion at the end of 2020; and China Fortune Land Development is the second decliner (down 72.16%). , The market value of 50.6 billion yuan at the end of 2020; the third decliner ST Kaile (down 71.56%), the market value of 10.9 billion yuan in 2020.

Ping An of China, which has a market value of nearly one trillion at the end of 2020, will fall by 40.48% in 2021; Haitian Weiye, Hengrui Medicine, and Arowana, which have a market value of over 500 billion yuan at the end of 2020, will fall by 32%, 45%, and 42% respectively in 2021.

As a result, the Shanghai and Shenzhen 300 Index, which represents large-cap stocks, fell 5.2% in 2021, and the China Securities 1000 Index, which represents small-cap stocks, rose 20.52% in 2021.

In terms of sectors, huge changes will also take place in 2021. The biggest winner is the new energy sector, and half of the bull stocks belong to the new energy sector. At the same time, industries that have been downturn in the past few years (coal, steel, non-ferrous metals, electricity, power equipment, etc.) will perform outstandingly in 2021, while the major consumer sectors that have performed the most in the past few years (including food and beverage, home appliances, medicine, etc.), In 2021, it will fall.

It can be said that 2021 is the year of change. In the institutional era, some previous methods of operation are no longer applicable. For example, timing investment is not suitable. Some investors are accustomed to selling when the index is high and then bargaining the bottom when the index falls. Now, the index rises and falls are very small, basically There is no timing window, and the decline in the index is often caused by a decline in one sector, and at the same time another sector will rise again. There is no such thing as a decline in all stocks. It is the hedging between the rising and falling sectors that caused the index to rise slightly but very steadily.

The most important thing now is to choose stocks instead of timing. At the same time, the strategy of chasing the rise and killing the fall is not applicable. A timely follow-up at the initial stage of the rise of a sector can obtain better returns. Stand guard at a high position, because the organization may choose a new sector. The conversion of large-cap stocks and small-cap stocks, and the conversion of consumer stocks and resource stocks in 2021 are typical. It should be said that there are more opportunities in the stock market now than before. Of course, risks coexist.

Xinmin Evening News reporter Lian Jianming

Editor: Lu Changqing

.