Under the influence of rising prices of upstream raw materials for power batteries, CATL (300750.SZ) stabilized its gross profit margin in the third quarter, but its cash flow was obviously under pressure.

On the evening of October 27, CATL released three quarterly reports. According to the report, CATL achieved 29.287 billion yuan in revenue in the third quarter, a year-on-year increase of 130.73%; net profit attributable to the parent company was 3.267 billion yuan, a year-on-year increase of 130.16%.

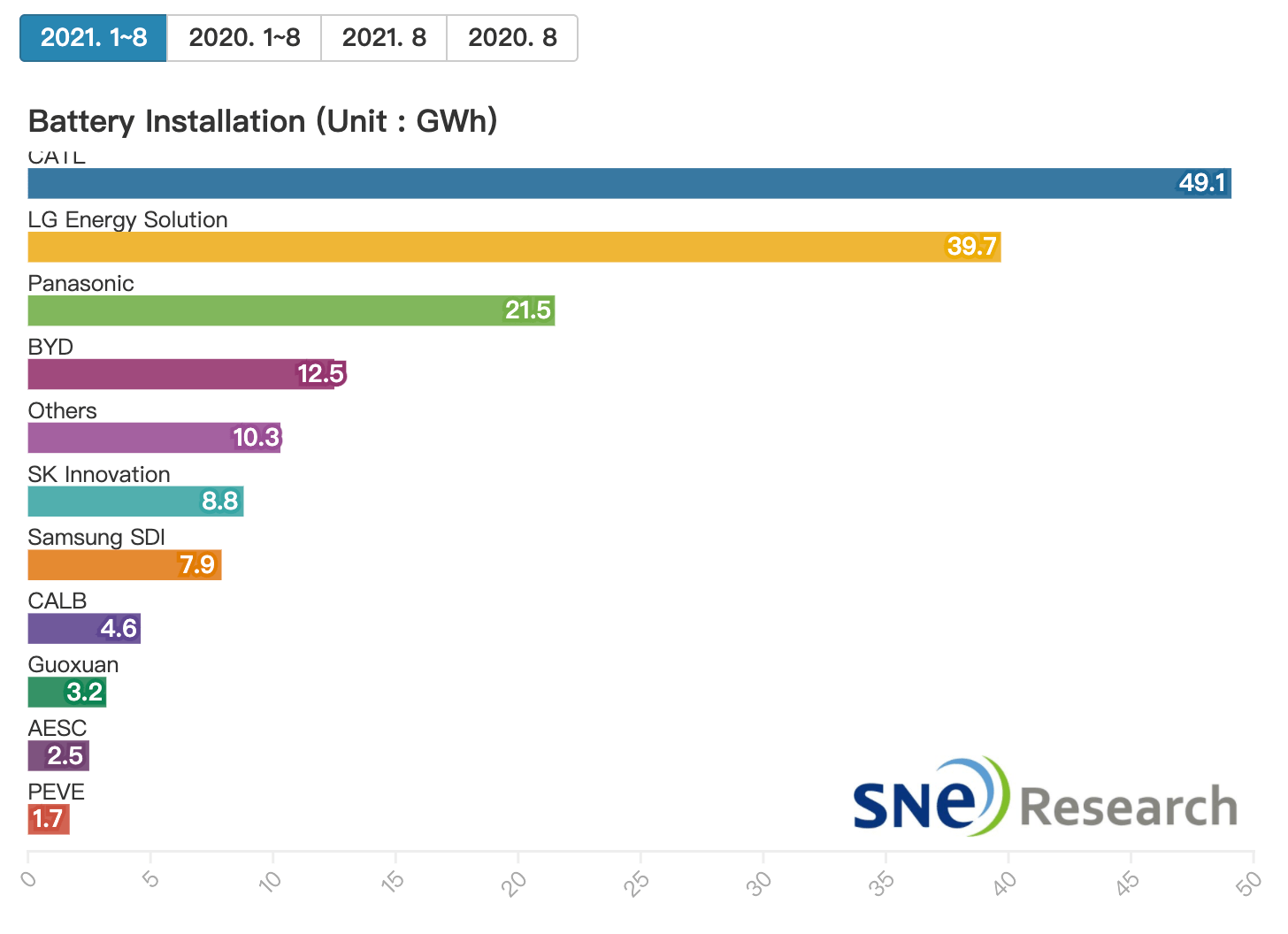

The growth is directly attributable to the increase in the installed capacity of power batteries. According to the latest data from South Korean research institute SNE Research, from January to August, CATL continued to lead in battery installed capacity, reaching 49.1 GWh-this figure is 1.2 times that of LG Chem and 2.3 times that of Panasonic.

After the financial report was released, CATL opened higher for two consecutive days, and the stock price rose to 635 yuan per share on the 28th. As of the press release on the afternoon of the 29th, its latest stock price was 636 per share, an increase of nearly 6%, over 80% from the beginning of the year, and its market value exceeded 1.5 trillion yuan.

The personal wealth of founder Zeng Yuqun has also risen with the stock price. According to the newly released “2021 Hurun Rich List” on the 27th, Zeng Yuqun ranked among the top ten for the first time, ranking third in the “China Rich List” with a net worth of 320 billion yuan, second only to the founder of Nongfu Spring Zhang Yiming, the founder of ByteDance.

Power battery raw materials are in short supply. In the third quarter, prices of raw materials such as lithium carbonate and lithium hexafluorophosphate jumped. But unexpectedly, CATL achieved its highest quarterly gross profit margin this year in the third quarter.

The data shows that CATL’s gross profit margin in the third quarter was 27.9%, an increase of 0.11 percentage points from the same period last year, and an increase of 0.66 percentage points from the second quarter.

This performance is better than the industry. Among domestic listed head power battery manufacturers, BYD (002594.SZ) had a gross profit margin of 13.33% in the third quarter, a year-on-year decrease of 8.99 percentage points; Yiwei Lithium Energy (300014.SZ) had a year-on-year decrease of 10.8 percentage points in the third quarter gross profit margin. 21.54%; Guoxuan Hi-Tech (002074.SZ) gross profit margin in the second quarter was 16.95%, a decrease of 6.39 and 8.05 percentage points from the previous quarter.

Direct raw materials account for the bulk of the cost of power batteries. According to the 2020 annual report of CATL, the direct material cost of the power battery system is 25.739 billion yuan, accounting for 78.17% of operating costs. The prices of upstream raw materials are still rising, putting pressure on the profitability of power battery manufacturers.

Recently, a “contact letter for battery price increase” from a wholly-owned subsidiary of BYD has been circulated on the Internet. The document mentioned that based on the actual price increase of raw materials, it was decided to increase the unit price of battery products such as C08M by no less than 20%. However, there are market sources that the entire series of CATL products have not yet increased in price.

On the one hand, it is the rising cost of raw materials, on the other hand, the price has not been raised. Why did the gross profit margin of CATL not decrease but increase? The third quarter report did not give specific data, but on the whole, in addition to the scale effect of the increase in installed capacity and better cost control,Most likely due to the further increase in the proportion of energy storage business in the third quarter.

As a leader in power batteries, CATL’s main business includes the development, production, sales and after-sales service of lithium-ion power battery systems and energy storage systems. At present, power batteries are still the business with the highest contribution rate to the Ningde era, but the energy storage business has begun to increase its volume.

According to the semi-annual report released earlier, the energy storage system is the biggest highlight of the CATL in the first half of this year. The sales revenue of its energy storage system in the first half of the year was 4.693 billion yuan, a year-on-year increase of 727.36%, accounting for 10% of CATL’s overall business; gross profit margin reached 36.6%, an increase of 12% compared to the same period last year. In contrast, the gross profit margin of the power battery business during the same period was 23%, a year-on-year decline of 3.5 percentage points.

Energy storage is regarded as a trillion-level market with broad prospects. On October 26, the National Development and Reform Commission issued the “Carbon Peaking Action Plan by 2030”, proposing to actively develop “new energy + energy storage”, source network load storage integration and multi-energy complementation, and support the rational allocation of distributed new energy energy storage system. Speed up the demonstration and application of new energy storage. By 2025, the installed capacity of new energy storage will reach more than 30 million kilowatts. By 2030, the installed capacity of pumped storage power stations will reach about 120 million kilowatts, and the provincial power grid will basically have a peak load response capacity of more than 5%.

Energy storage has room to grow into another pillar business of the Ningde era, which means that the degree of dependence on the power battery business of the Ningde era will continue to decrease in the future.

It is worth noting that, as a leading enterprise in the field of power batteries,Under the pressure of rising prices of raw materials, CATL still has very strong bargaining power in the upper and lower industrial chains, but the squeeze of working capital in the short term has already appeared.

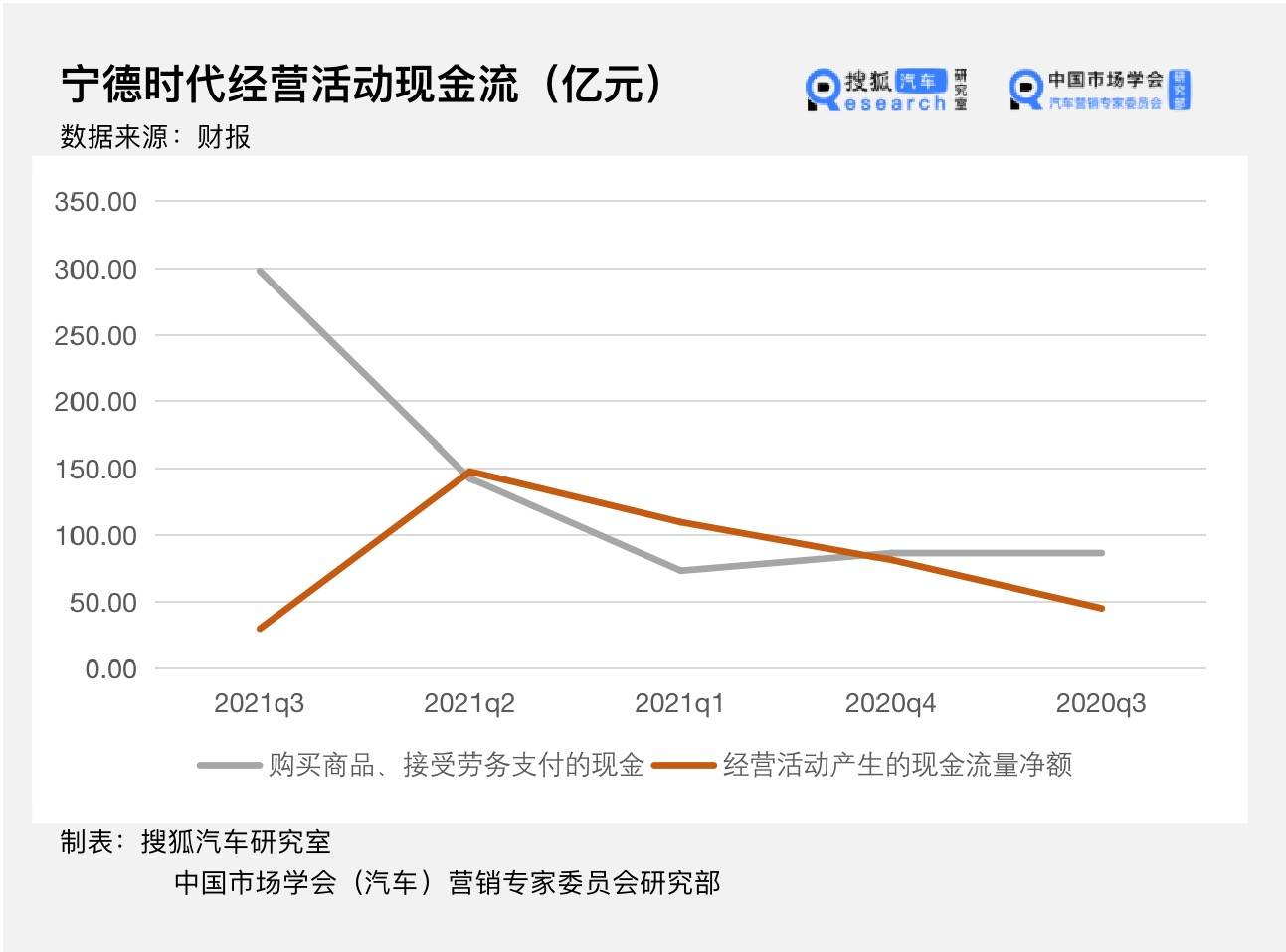

In the third quarter, with operating cash inflows of 36.62 billion yuan, CATL’s net cash flow from operating activities was only 2.9 billion yuan, a year-on-year decrease of 34% and a month-on-month decrease of 80%, the lowest level since the fifth quarter.

This was mainly due to the substantial increase in cash paid for purchasing goods and accepting labor services, reaching 29.82 billion yuan, an increase of 245.38% and 109.29% year-on-year, respectively. It is likely that CATL is locking some of the scarce power battery raw materials in advance for the fourth quarter.

However, on the whole, CATL has sufficient cash flow at the end of the third quarter, and still holds 70.291 billion yuan in cash and cash equivalents.

Accelerate the expansion of large-scale financing

Ningde era, which has occupied the first place in the global power battery market share for four consecutive years and half of the domestic market, is facing pressure: OEMs are frequently deploying power batteries for supply chain safety considerations, or deepen cooperation with battery companies, or expand the range of battery suppliers , Or self-developed batteries, self-built factories. As a result, competitors have gained more opportunities and followed closely. The “second” LG Chem’s market share has rapidly increased. Domestic BYD launched blade batteries and “dark horse” AVIC Lithium battery came out halfway.

Image source: SNE Research

Image source: SNE Research

To maintain about one-third of the current global market share, CATL needs a larger scale of production capacity, and it has also begun to expand in large steps.

Prior to August, CATL announced a huge increase of 58.2 billion yuan, which even attracted inquiries from the Shenzhen Stock Exchange. According to the plan, CATL plans to raise 58.2 billion yuan. Among them, 41.9 billion yuan was invested in five capacity construction projects, with a total planned production capacity of 167GWh; 7 billion yuan was used for new technology research and development; another 9.3 billion yuan was planned to be used to supplement working capital.

On September 13, Ningde Times issued a production expansion announcement, planning to invest in the construction of a new-type lithium battery production base (Yichun) project in Yichun City, Jiangxi Province, with a total project investment of no more than 13.5 billion yuan.

On October 12, CATL announced that it plans to invest in the construction of the Bangpu Integrated Battery Material Industrial Park project in Yichang City, Hubei Province, with a total investment of no more than 32 billion yuan. This is also the largest single investment project of CATL this year.

As of the third quarter, CATL has deployed 7 wholly-owned production bases. Together with the joint venture capacity of Time SAIC and Time Dongfeng, its capacity plan by 2025 will reach 637GWh, the largest scale among global battery companies.

Equity investment in the upstream and downstream industrial chain is also being deployed. In September this year, CATL completed two overseas mergers and acquisitions. After taking a stake in Manono, the world‘s largest lithium mine, CATL successfully bid for Canadian Millennium Lithium Corporation for 376.8 million Canadian dollars.

Reflected in the financial report data, at the end of the quarter, the balance of construction in progress of CATL reached 21.495 billion yuan, an increase of 15.745 billion yuan in the third quarter, an increase of 273.8% compared to the beginning of the year; capital expenditure was 10.577 billion yuan, an increase of 266.24% year-on-year; cash for financing activities in the third quarter The inflow was 14.404 billion yuan, and the cash outflow caused by investment activities reached 36.555 billion yuan, an increase of 326.05% year-on-year.

In terms of research and development, CATL is also increasing investment. Since the fourth quarter of last year, CATL’s quarterly R&D expenses have remained above 1 billion yuan. In the third quarter of this year, research and development expenses reached a new high, reaching 1.801 billion yuan, an increase of 119.1% year-on-year.Return to Sohu to see more

.