Flows into global ETPs in March increased compared to flows in February, with $ 115.6 billion added during the month. This is what emerges from iShare’s monthly research, which highlights how despite the increase in flows, trends differ by asset class: equity flows remained relatively stable with $ 74.8 billion dollars, slightly down from to $ 76.1 billion in February, while bond flows rose to $ 25.5 billion; while commodity buying rose to its highest level since April 2020 with $ 13.8 billion in inflows, including a record month for gold.

European equity flows are slowing down

Given Europe’s proximity to the conflict in Ukraine, European equity flows turned negative (- $ 6.5 billion) in March for the first time since October 2020. The sale was led by EMEA-listed European equity ETPs ($ 5 , 5 billion), which recorded the largest monthly net sale ever recorded. By contrast, March outflows from Europe quoted in the US came in at – $ 1.2 billion in net worth.

Investors bought European bond ETPs in March as European-centric investment grade credit returned to positive territory ($ 0.9 billion after the latest release of – $ 1.2 billion a month). European rate buying slowed from $ 1.3 billion in February to $ 0.3 billion in March, but inflows of $ 0.5 billion in the Inflation-linked bond ETPs represent the maximum monthly recorded allocation. This comes at a time when energy-led inflation is severely affecting Europe’s prices.

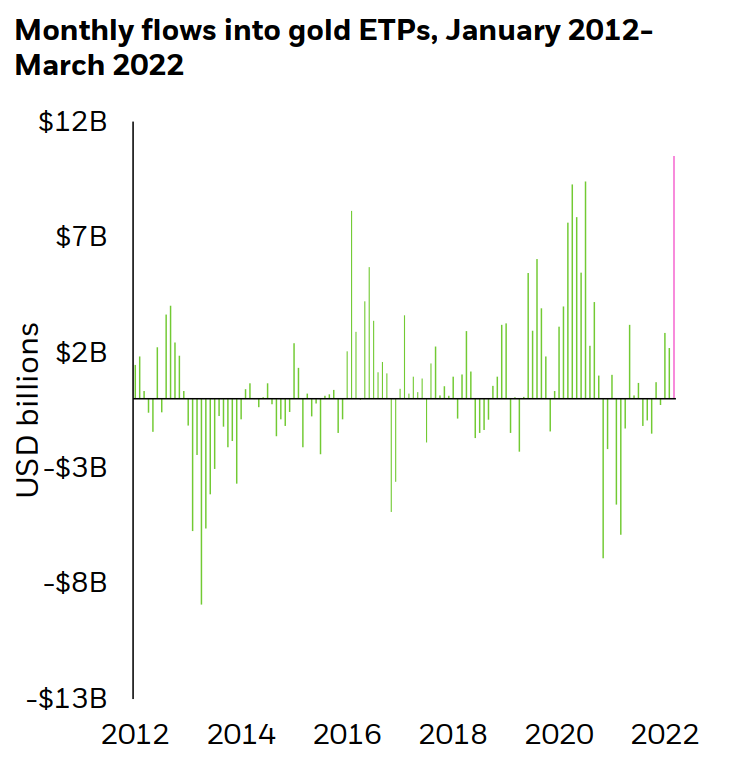

Record inflows for gold

March saw record inflows of $ 11.3 billion in gold ETPswhich quintupled from February levels, beating the previous high of $ 9.4 billion set in July 2020. The propensity to buy gold is therefore growing and BlackRock analysts have seen a persistent flow trend emerge, with three consecutive months of inflow for the first time since August-October 2020. Other commodity ETPs also remained popular investments, in fact, another $ 1.8 billion was added in March.

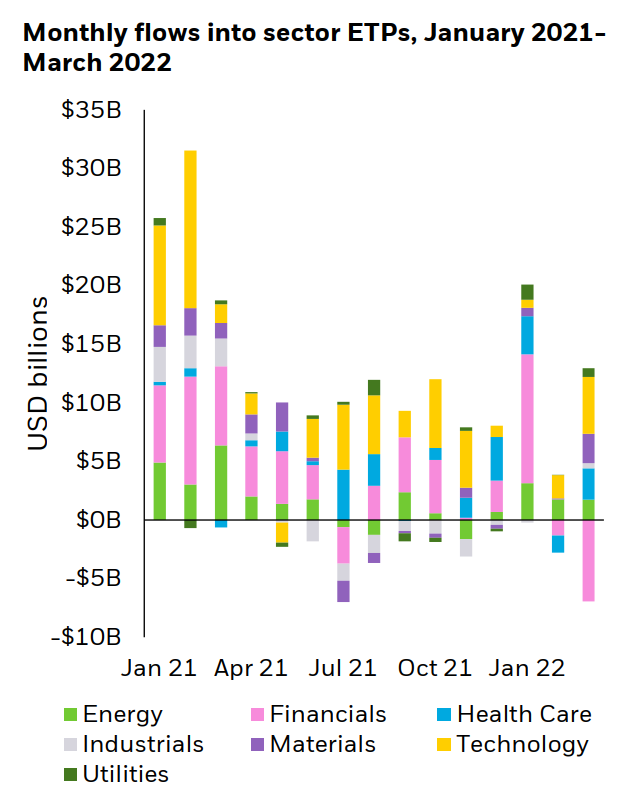

ETP flows by sector, bad for the financial sector

While investors paid the energy sector $ 1.7 billion in March, analysts saw a generalized increase in inflows across sectors, highlighting that investors are using this market volatility to balance the portfolio. Where were investors selling in March? The financial sector (- $ 7.0 billion), which appears to have been indiscriminately punished in this round of market volatility. While March represented a record level of monthly outflow from the financial sector, it had recorded record monthly inflows in January ($ 11.0 billion).

The popularity of energy among investors is nothing new to investors, it has been so since early 2020. The industrial sectors saw their first month of inflow since April 2021 with an added $ 0.5 billion in March, while i materials recorded the second highest level of monthly inflow ($ 2.5 billion), slightly below the record set in 2013. The technology sector ($ 4.6 billion) led the way in terms of allotments in March, reaping its largest monthly inflow since November 2021. Healthcare inflows of 2.6 billion dollars. The flows towards the Sustainable ETPs Listed in the US and EMEA fell to their lowest level from August 2020 to March, with $ 5.6 billion added. This decline is largely due to a decline in EMEA-listed ETP flows to $ 3.4 billion, while US-listed ETPs saw inflows of $ 2.2 billion.