Author | Anita Tang

Editor | Su Jianxun

On November 2, an announcement about the cooperation between China Unicom and Tencent suddenly made the market boil.

The announcement of the State Administration for Market Regulation on October 27 shows that China Unicom Innovation and Venture Capital Co., Ltd. (referred to as “Unicom Venture Capital”) and Shenzhen Tencent Industrial Venture Capital (hereinafter referred to as “Tencent Industrial Investment”) Co., Ltd. established a new joint venture case The case closed on October 18.

This means that the new company that China Unicom and Tencent apply for a joint venture can continue to advance normally. According to the application materials, China Unicom Venture Capital and Tencent Industrial Investment intend to set up a joint venture company, mainly engaged in content distribution network (CDN) and edge computing business.

One is one of the three major operators, and the other is an Internet giant, both of which play a pivotal role. On November 2, the market reacted violently after the news was widely reported by the media. In the A-share market, China Unicom’s stock rose at the daily limit yesterday afternoon, and the stock price was reported at 3.75 yuan per share. The stocks of other similar companies on the communication board also rose sharply.

Many voices interpreted this as a prelude to “establishing a mixed-ownership reform company” and “state-owned enterprises holding Tencent”, but the rumors were quickly refuted.

First of all, this cooperation does not involve the parent companies of both parties. On the evening of November 2, China Unicom hurriedly issued an announcement to clarify, saying that the establishment of the joint venture was in the process of advancing, and the establishment registration had not been completed, which had no significant impact on the current production and operation of the company. , Edge computing industry chain.

And someone linked another news “Tencent Senior Executive Vice President Lu Shan as a director of Unicom” to this cooperation – but in fact, this has already happened in 2018, and there is no direct relationship with this cooperation. association.

Strategic cooperation between operators and Internet companies has long been nothing new. In 2017, China Unicom launched a mixed-ownership reform and a fixed increase, and introduced Internet giants such as China Life Insurance and BATD as strategic investors.

This cooperation is just the continuation of the cooperation between the two parties under the background of China Unicom’s mixed ownership reform five years ago. Cooperation is important, but the new company prefers business cooperation, not a new establishment for mixed-ownership reform.

Cooperation between Internet cloud vendors and operators is nothing new

After the announcement was made, the market reacted violently, and there are actually traces to follow. In October, Tencent has ushered in two rumors, both of which revolve around share changes:

On October 24, there were rumors that China Mobile may acquire part of Tencent’s equity; on October 31, there were rumors that CITIC Group was forming a group to negotiate with Naspers Group, Tencent’s major shareholder in South Africa, to acquire all Tencent shares held by it. But soon, both Tencent and the protagonists of the market rumors said the news was untrue.

The cooperation between China Unicom and Tencent has little to do with the parent company. In the announcement, the main body of cooperation is actually the investment companies under the two parties – “Unicom Ventures” and “Tencent Production Investment”.

Caijing quoted people close to China Unicom as saying that the cooperation between China Unicom and Tencent does not involve the change of the parent company’s shares. money to set up a joint venture. The stock price movement belongs to the short-term speculation of the market taking this news.

Source: State Administration for Market Regulation

“Mixed ownership reform” is a reform plan put forward in the 1990s, which refers to the introduction of domestic private capital and foreign capital into state-owned enterprises to participate in their reorganization and reform, so as to promote the productivity of state-owned enterprises.

Unicom is the vanguard of the “mixed ownership reform” of central enterprises, and it is also the most aggressive among the three major operators. In August 2017, China Unicom announced its mixed-ownership reform plan, introducing 9 private enterprises. Tencent invested about 11 billion yuan and became the fourth largest shareholder of China Unicom.

After introducing a number of private enterprises, China Unicom has carried out cooperation with them in areas including big data, new retail, industrial Internet, audio and video. After the mixed reform, China Unicom’s results were also quite satisfactory. In the first three quarters of this year, China Unicom’s industrial Internet revenue was RMB 53.1 billion, a substantial increase of 29.9%.

The cooperation between China Unicom and Tencent is typically focused on the business level – the main direction is CDN (Content Delivery Network) and edge computing. The cooperation can be approved because the proportion of the territory of the two parties is not large. According to the announcement, in 2021, China Unicom Ventures and Tencent Investment will have a combined 10%-15% market share in the CDN market, and a combined 0%-5% market share in the edge computing market.

The Internet has already become the infrastructure of today’s society, and it is naturally closely related to communication facilities. Joint ventures, such as China Unicom and Tencent, are a very common form of cooperation.

An IDC practitioner told 36Kr that Ali and China Unicom have also cooperated deeply for many years, and most of the leased computer rooms are based on China Unicom. In 2018, China Unicom and Ali jointly established “Yunli Wisdom”, which is mainly engaged in government and enterprise business.

The cloud market is still in a period of drastic changes, and everyone takes what they need

The cooperation between Tencent and China Unicom reflects the background that the cloud market is in a “shifting period”. Whether it is an Internet cloud manufacturer or an operator doing cloud, both sides have complementary aspects and can achieve a win-win situation.

Take the business of this cooperation – CDN and edge computing as an example. Whether it is CDN or cloud computing, the competition is largely based on the number of servers deployed in various places. CDNs need to help users obtain data faster. If users watch videos on their mobile phones, if the video data is cached in a server closer to their home, the network for watching videos will be smoother.

In the past, when the cloud industry was in the early stage of development, Internet manufacturers had already turned the CDN business into a red sea. Everyone was selling products at a loss, or using various resale methods to generate volume, wasting a lot of costs. However, if they cooperate with operators that already have a large number of servers, Internet manufacturers can also reduce costs and increase efficiency.

On the other hand, operators such as China Unicom are late to do cloud services. However, the technical difficulties such as CDN and edge computing are still relatively high, which is the advantage of Internet manufacturers. With the cooperation between the two parties, operators can also make up for their own technical shortcomings.

There will be more and more such collaborations as the cloud market has developed into a new phase. Internet cloud manufacturers, operators, and application manufacturers are gradually finding their own suitable positions in the market.

This is because the Internet dividend has subsided, and the main incremental force in the cloud market is no longer the original Internet customers, but the government and enterprise market – this is the home of operators. Starting from 2020, the three major operators have all developed their cloud business and demonstrated an astonishing growth rate. In 2021, China Unicom’s cloud business revenue will be 16.3 billion yuan, a year-on-year increase of 46.3%.

Internet cloud manufacturers such as Alibaba and Tencent have clearly abandoned the form of blind expansion of scale and grabbing large orders in the government and enterprise market this year. They still attach importance to the government-enterprise market – for example, Tencent Cloud has established a government-enterprise business line in 2022, hoping to further acquire benchmark users and expand the coverage of the industry.

However, in terms of cooperation methods, Internet cloud manufacturers have turned to seek to become operators’ technology partners, rather than directly competing for projects with them. This will allow them to set aside more time and energy to perfect their product matrix. In 2021, Alibaba Cloud shouted the slogan “Back to Basic”, and Tencent Cloud is also vigorously developing PaaS and SaaS products.

On November 2, at the “Alibaba Partner Forum” of the 2022 Internet Conference, China Telecom and Alibaba officially announced a strategic cooperation agreement.

Source: IDC

Source: IDC

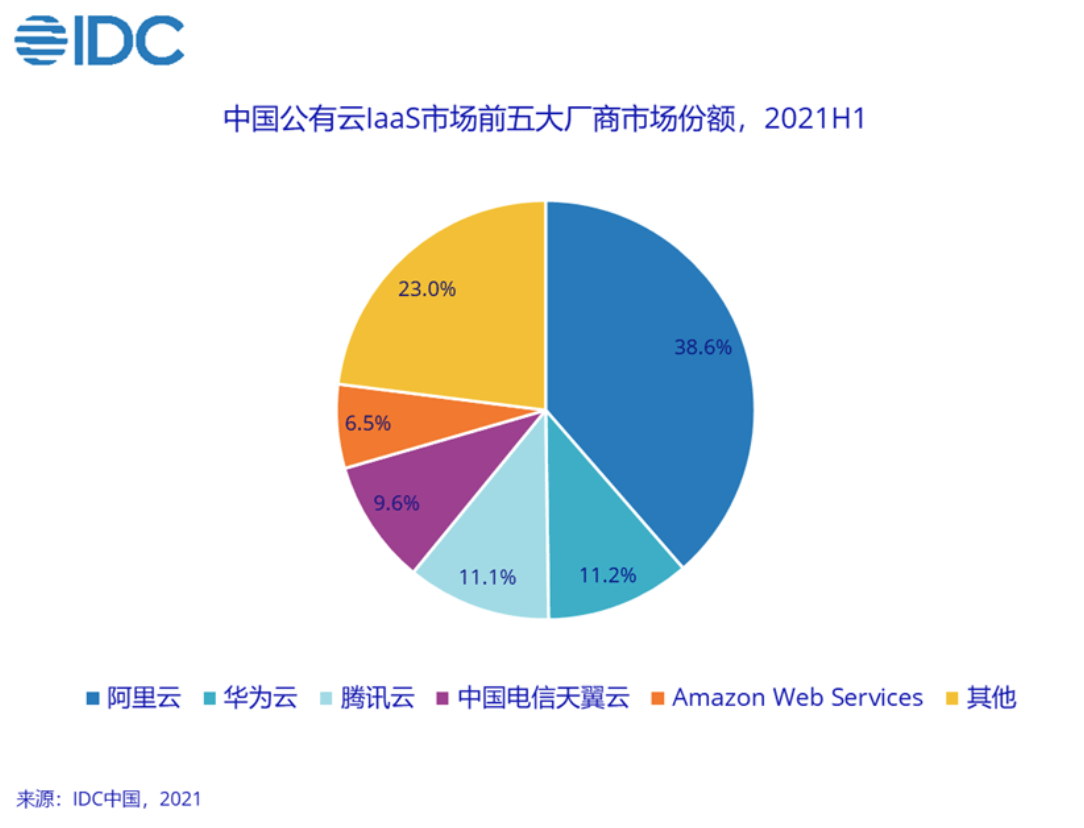

This trend has been going on for nearly a year. Reflected in specific figures, in the first half of this year, the market shares of Alibaba Cloud and Tencent Cloud, the top two in the cloud market, declined slightly; while the market shares of the three major operators and Huawei Cloud, which has served government and enterprise customers for many years, have increased.

In the past year, according to financial statistics, China Telecom received 104 orders for government and enterprise digitalization, 68 orders from China Mobile, 34 orders from China Unicom, 9 orders from Alibaba Cloud, and 9 orders from Tencent Cloud. These are all proofs that the cloud market is gradually shifting to a government-enterprise market-led growth.Return to Sohu, see more

Editor:

Statement: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.