Fangda Group takes over the aviation sector and is required to not withdraw for ten years

At 3 pm on October 23, Beijing time, the Hainan Provincial High Court of the Communist Party of China announced that all reorganization plans (drafts) for the bankruptcy and reorganization of HNA Group and related companies have been voted on. On the evening of the 23rd, HNA listed companies such as *ST HNA and *ST Foundation also announced the results.

The mainland media “China Business News” reported on October 24 that HNA is currently the largest bankruptcy reorganization case in China. All procedures have been passed with a high number of votes. The court still needs a final ruling. After the court ruling, the reorganization plan will enter the implementation stage. Hainan Airlines will be divided into four independently operated sectors: aviation, airport, finance, commerce and others.

Among them, the aviation sector is dominated by *ST HNA (600221.SH), as well as related airline assets that are not listed in the listed company, including 12 domestic and two overseas passenger airlines such as Capital Airlines, Tianjin Airlines, and West Air. There are also 4 cargo licenses, 3 business jet licenses, in addition to business jethelicopter custody operations, aero engine maintenance, aviation material maintenance, pilot training, special service personnel health check and other qualification licenses.

In the aviation sector, Liaoning Fangda Group’s highest bid of 38 billion yuan (plus 3 billion yuan in risk relief funds) defeated the original hot bidders “Junyao” and “Fosix” and became the main aviation industry. Strategic investors will have absolute control over the aviation sector, and the remaining shares in the aviation sector will be held by a “trust plan” with creditors as beneficiaries.

According to people familiar with the matter, after the completion of the settlement, Fangda Group is expected to hold about 25% of *ST HNA (600221.SH) (part of it will obtain about 12% through direct capital increase, and the other part will be acquired through the purchase of *ST HNA’s major shareholder Grand Xinhua Airlines And indirectly holds about 13%), thus becoming the single largest shareholder and actual controller of *ST HNA. In addition to the requirement of the other party to become the master, in addition to the need to ensure that the existing registration places, brands and licenses of the airlines operating the “HU” code HNA Holdings and involving local state-owned shareholders remain unchanged, as mentioned in the strategic investment recruitment report, there are also “The equity cannot be transferred within ten years, and it cannot be turned into a financial investment.”

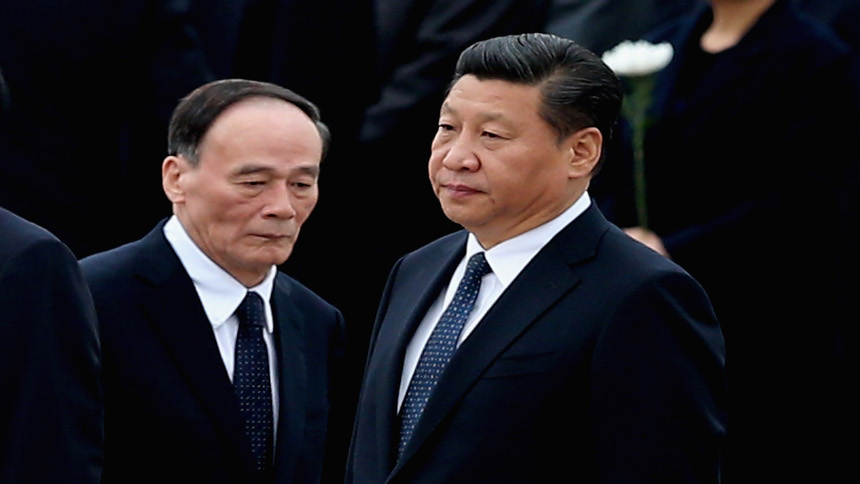

The passing of the HNA bankruptcy plan means that all Wang Qishan’s staff at HNA have been eliminated.

On the evening of September 24, news broke that HNA Group Chairman Chen Feng and CEO Tan Xiangdong were being investigated; and HNA announced that the bankruptcy plan was passed, only a month later.

The Epoch Times reported that it was only after Chen Feng and others were arrested that HNA’s bankruptcy and reorganization case could proceed smoothly.

According to Caixin.com, one of HNA’s most difficult issues in the process of bankruptcy and reorganization is the repayment of HNA’s personal wealth management products. The scale of claims exceeds 30 billion yuan, involving as many as 60,000 people, of which about 2 3,000 people are internal employees of the “HNA Department”. How to dispose of these personal financial products fairly and properly has been a major hurdle that has blocked the reorganization of HNA Group in the past few months.

The HNA working group had hoped that Chen Feng would use the assets of the Hainan Cihang Charity Foundation to repay these financial products to alleviate the urgent need, but Chen Feng refused. Public information shows that the foundation’s net assets are 1 billion yuan.

Chen Feng’s arrest was a warning sign. On September 18, Gu Gang, the head of the HNA joint working group, mentioned at the regular meeting of HNA that the old shareholder team and the Cihang Foundation, the rights and interests of the HNA Group and member companies will be cleared. zero.

According to the previously disclosed shareholding structure of HNA Group, Cihang Foundation and Cihang Foundation, both domestic and overseas, own more than 50% of HNA Group’s shares, and 12 natural-person shareholders hold 47.5% of the shares, of which Chen Feng and Wang Jian each hold 14.98 shares. %, is the largest natural person shareholder.

The clearing of the equity means that Chen Feng and others will officially withdraw from the HNA Group and all its subsidiaries in law. At the same time, Cihang Foundation no longer has any relationship with HNA.

In this way, the 12 original shareholders including Wang Qishan’s co-founder Chen Feng and the equity of the Cihang Foundation are all “cleared” and left alone.

HNA’s bankruptcy and reorganization, the most eye-catching is the Liaoning Fangda Group, the “receiver” of aviation’s main business.

Liaoning Fangda Group owns 4 listed companies, Fangda Carbon (600516.SH), ZTE Commercial (000715.SZ), Northeast Pharmaceutical (000597.SZ), and Fangda Special Steel (600507.SH), which have considerable capital strength.

According to Qixinbao data, Liaoning Fangda was established in 2000 with a registered capital of 1 billion yuan. The shareholders are Beijing Fangda International Industrial Investment Co., Ltd. and Fang Mingxian. The former holds 99.2% of Liaoning Fangda’s shares, and the latter’s The shareholding ratio is 0.8%. It is worth noting that Beijing Fangda International Industrial Investment Co., Ltd. has only one shareholder, namely Fang Wei, the actual controller of Liaoning Fangda. As early as 2009, Fang Wei ranked 79th on the Hurun Charity List; Forbes 2013 China’s 400 Richest List, Fang Wei ranked 102nd with 7.93 billion assets.

Fang Wei also has many titles: Procurator Supervisor of the Liaoning Provincial Procuratorate of the Communist Party of China, Outstanding Private Entrepreneur of Liaoning Province, “Outstanding Private Entrepreneur” of Fushun City, “Star Private Entrepreneur” of Fushun City, etc., and is also a representative of the 10th People’s Congress of Liaoning Province of the Communist Party of China , Representative of the 12th National People’s Congress of the Communist Party of China.

Public information shows that Fang Wei, chairman of the board of directors of Liaoning Fangda Group, was born in 1973 and was from Shenyang City, Liaoning Province.

The latest news that Fang Wei appeared on the official website of Fangda Group is that on August 23 this year (2021), Fang Wei, as Chairman of the Board of Directors of Liaoning Fangda Group, received the Nanchang Municipal Party Secretary Li Hongjun and Mayor Wan Guangming to Fangda. Special steel survey.

In 2010, Fang Wei claimed in an interview with the media that his corporate philosophy is to “listen to the party and follow the party.” This sentence was also used in the introduction of the official WeChat account of Liaoning Fangda Group.

In Jiangxi’s political circles and the steel industry, there is a saying that Fang Wei has a deep political background, and there are many calls from CCP leaders in his mobile phone address book.

Conveying the benefits with Su Rong, a senior official of the Chinese Communist Party

On July 13, 2014, the Supreme Procuratorate of the Communist Party of China issued a message that Su Rong, the former vice chairman of the CPPCC, was suspected of taking bribes, abusing power, and the source of a huge amount of property. The Provincial Procuratorate of Jinan City reviewed and prosecuted.

According to investigations conducted by reporters from China Business News in Gansu, Liaoning, and Jiangxi, Su Rong may be related to Fang Wei, chairman of the board of directors of Liaoning Fangda Group.

On June 14, 2014, the Central Commission for Discipline Inspection announced that Su Rong would accept an investigation. Just ten days later, on June 27, the Standing Committee of the Liaoning Provincial People’s Congress of the Communist Party of China dismissed Fang Wei as a deputy to the 12th National People’s Congress of the Communist Party of China.

Later, some media revealed that Fangda Group and Fang Wei had developed in Gansu and Jiangxi, and they crossed the political resumes of Su Rong. When Su Rong was the secretary of the Jiangxi Provincial Party Committee of the Communist Party of China, Fangda Group entered Jiangxi in a big way, and successively merged and restructured Nanchang Iron and Steel (Nangang), Pingxiang Iron and Steel (Pinggang) and many other well-known state-owned enterprises in Jiangxi Province.

China Business News reported that the reporter learned from multiple authoritative channels that during the process of “Nangang” restructuring, there might be problems with the transfer of interests between Fang Wei and Su Rong.

In 2014 media reports, Fang Wei was reported to have lost contact for a short time because of Su Rong’s case being questioned by relevant authorities. But Fang Wei later denied this.

Su Rong is a former deputy state-level official of the CCP and the confidant of Zeng Qinghong, a former member of the Politburo Standing Committee of the CCP Central Committee. He is an official promoted by Zeng Qinghong.

.