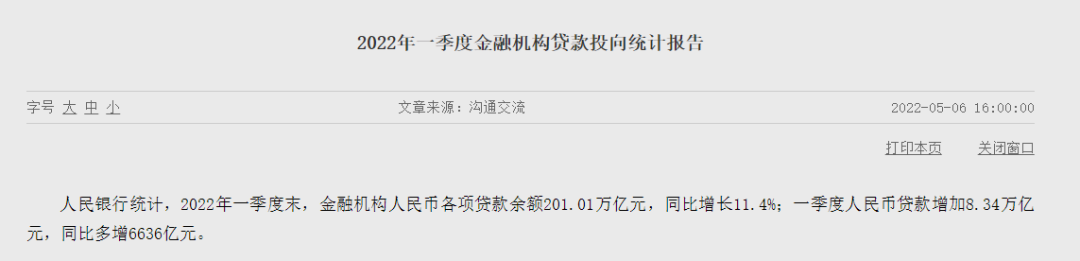

Chinese peoplebankOn May 6, the Statistical Report on the Loan Investment of Financial Institutions in the First Quarter of 2022 was released. The report shows that at the end of the first quarter, the balance of various RMB loans of financial institutions was 201.01 trillion yuan, a year-on-year increase of 11.4%; in the first quarter, RMB loans increased by 8.34 trillion yuan, an increase of 663.6 billion yuan year-on-year.

peoplebanksaid that in the first quarter peoplebankContinue to guide financial institutions to increase their involvement in the real economycreditSupport efforts to further optimize the structure while increasing the volume and decreasing the price. In the first quarter, various RMB loans increased by 8.34 trillion yuan, a year-on-year increase of 663.6 billion yuan.Business and Personal Loansinterest rategenerally fall. From the perspective of loan investment structure, the financial industry has achieved strong support for key areas and weak links of the national economy.

Image source: People’s Bank of China

personal housing loaninterest ratefall back

From the first quarter data,real estate developmentLoans increased month-on-month, and personal housing loan interest rates fell. The report shows that at the end of the first quarter of 2022, the balance of RMB real estate loans was 53.22 trillion yuan, a year-on-year increase of 6%, 1.9 percentage points lower than the growth rate at the end of the previous year; an increase of 779 billion yuan in the first quarter, accounting for 9.3% of the increase in various loans over the same period , accounting for 9.8 percentage points lower than the level of the previous year.

At the end of the first quarter,real estate developmentThe loan balance was 12.56 trillion yuan, a year-on-year decrease of 0.4 percentage points, and the growth rate was 1.3 percentage points lower than that at the end of the previous year; The balance of personal housing loans was 38.84 trillion yuan, a year-on-year increase of 8.9%, and the growth rate was 2.3 percentage points lower than that at the end of the previous year. In March, the new personal housing loan interest rate was 5.42%, 17 basis points lower than the beginning of the year.

At the same time, the report shows that the growth rate of household loans has slowed down, and the interest rate of consumer loans has dropped significantly. At the end of the first quarter, the balance of domestic and foreign currency household loans was 72.37 trillion yuan, a year-on-year increase of 10.1%, and the growth rate was 2.4 percentage points lower than that at the end of the previous year. In March, the interest rate of newly issued household other consumption loans was 7.68%, 67 and 41 basis points lower than the beginning of the year and the same period of the previous year, respectively.

In the consumer sector, financial institutions actively promote active personal consumption by reducing loan interest rates, the People’s Bank of China said. In the first quarter, the interest rate of personal housing loans fell. The interest rate of newly issued personal housing loans in March was 5.42%, 17 basis points lower than that at the beginning of the year. Consumer loan interest rates fell even more sharply, down 67 basis points from the beginning of the year, helping to further play the leading role of consumption in the economic cycle.

Supporting first and improving housing needs

The financial management department has recently made intensive voices, releasing a heavy signal to support rigid and improved housing demand. The People’s Bank of China recently stated that it will implement the prudent management system for real estate finance, optimize real estate credit policies in a timely manner, maintain stable and orderly real estate financing, and support rigid and improved housing demand.

The China Banking and Insurance Regulatory Commission said it would urge banks toInsuranceThe institution adheres to the positioning of “houses are for living, not for speculation”, implements differentiated housing credit policies according to city-specific policies, supports the demand for first and improved housing, and flexibly adjusts the personal housing loan repayment plan for those affected by the epidemic .

According to the analysis of many experts, it is expected that various support contents will be gradually implemented in the follow-up real estate field. The relevant local departments will continue to implement policies according to the city, and adjust the real estate loan and purchase restriction policies according to the conditions of different regions to meet reasonable rigid and improvement needs.

Yan Yuejin, research director of the Think Tank Center of the E-House Research Institute, said that follow-up policies will support both real estate companies and home buyers. At the same time, both the loan amount and the loan cost, that is, the interest rate, will develop in a direction that will help the market to become active and stable. “The current conditions for the stabilization of the real estate market are more mature, and the follow-up work of the banking system in various regions to support real estate will be further strengthened, which is worthy of the market’s expectations.” He said.

Green loans maintain rapid growth

The report shows that green loans maintain rapid growth. At the end of the first quarter, the balance of green loans in local and foreign currencies was 18.07 trillion yuan, a year-on-year increase of 38.6%, 5.6 percentage points higher than the end of the previous year, and 27.6 percentage points higher than the growth rate of various loans, an increase of 2.05 trillion yuan in the first quarter. Among them, loans to projects with direct and indirect carbon emission reduction benefits were 7.79 trillion yuan and 4.22 trillion yuan respectively, accounting for 66.5% of green loans in total.

In terms of different uses, the balance of loans to infrastructure green upgrade industries, clean energy industries, and energy conservation and environmental protection industries was 8.27 trillion yuan, 4.74 trillion yuan, and 2.32 trillion yuan, up 31.3%, 39.3%, and 58% year-on-year, respectively. By industry, electricity, heat,gasThe balance of green loans to the water production and supply industries was 4.82 trillion yuan, an increase of 29.2% year-on-year, and an increase of 342.7 billion yuan in the first quarter; the green loan balance of the transportation, warehousing and postal industries was 4.36 trillion yuan, an increase of 13.2% year-on-year, and an increase of 2,334 yuan in the first quarter. billion.

Ma Jun, director of the Green Finance Professional Committee of the China Society for Finance and Banking and dean of the Beijing Institute of Green Finance and Sustainable Development, said recently that the growth rate of green credit and bonds may slow down in the next few years, but overall their growth rate is still will be high. “The next 10 years will be much higher thanGDPincrease, becausegreen economyThe proportion of the overall economy will continue to increase. “He said.

The report also shows that loans in the area of inclusive finance maintained a rapid growth rate, the proportion of credit loans increased, and the interest rate of newly issued loans continued to decrease. At the end of the first quarter of 2022, the balance of loans in the RMB inclusive finance sector was 28.48 trillion yuan, a year-on-year increase of 21.4%, 1.8 percentage points lower than the end of the previous year; an increase of 1.98 trillion yuan in the first quarter, an increase of 17.8 billion yuan year-on-year.

The People’s Bank of China said that in the first quarter, inclusive small and micro loans increased by 24.6% year-on-year. Among them, the year-on-year growth rate of loans to individuals, that is, individual industrial and commercial households and small and micro business owners, was 21.3%, which was 10 percentage points higher than the growth rate of various loans. above. “The issuance of these loans has strongly supported the rescue and assistance for small and micro enterprises and individual industrial and commercial households, and is conducive to stabilizing market players.” The People’s Bank of China said.

In addition, industry is an important support for stabilizing the macroeconomic market, and infrastructure construction is an important area to boost investment demand. The financial system effectively guarantees the high-quality development of the manufacturing industry and the capital needs for major infrastructure construction.

The report shows that the growth rate of medium and long-term loans to the industry is relatively high, and the growth rate of medium and long-term loans to the infrastructure industry is stable. At the end of the first quarter, the balance of medium and long-term industrial loans in domestic and foreign currencies was 14.39 trillion yuan, a year-on-year increase of 20.7%, 9.7 percentage points higher than that of various loans, and 1.9 percentage points lower than that at the end of the previous year; an increase of 940.9 billion yuan in the first quarter, a year-on-year increase 24.9 billion yuan. Among them, the balance of medium and long-term loans for the heavy industry was 12.32 trillion yuan, a year-on-year increase of 19.7%, and the growth rate was 1.8 percentage points lower than that at the end of the previous year; percentage point.

(Article source: Chinasecuritiesnewspaper)