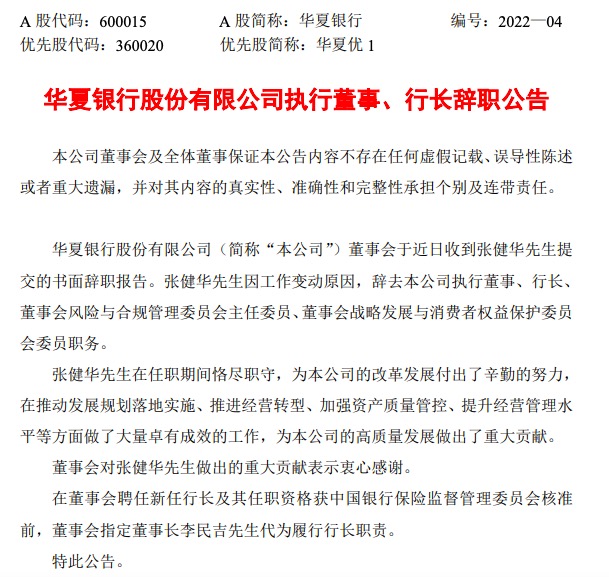

17,HSBC BankreleaseannouncementZhang Jianhua resigned as executive director, president, chairman of the risk and compliance management committee of the board of directors, and member of the strategic development and consumer rights protection committee of the board of directors due to job changes. Before the board of directors appoints a new president and his qualifications are approved, chairman Li Minji performs the duties of the president on his behalf.

According to public information, Zhang Jianhua was born in 1965, graduated from Tsinghua University with a bachelor’s degree, and graduated with a master’s degree from The People’s Republic of ChinaBankGraduate School. In 1989, Zhang Jianhua joined the central bank and started a 26-year working career in the central bank system.successively in the Department of Financial Management,BankIn 2012, he served as the president and party secretary of the Hangzhou Central Sub-branch of the Central Bank. January 2017,HSBC BankGovernor.

HSBC BankHe said that Zhang Jianhua performed his duties during his tenure, and made hard efforts for the company’s reform and development. He has done a lot of fruitful work in promoting the implementation of development plans, promoting business transformation, strengthening asset quality control, and improving the level of operation and management. The company’s high-quality development has made a significant contribution. The Board of Directors expresses its sincere gratitude to Zhang Jianhua for his significant contributions.

The announcement stated that the appointment of a new president and his qualifications for the appointment ofBank of ChinainsuranceBefore the approval of the Supervision and Management Committee, the board of directors designated Li Minji, the chairman of the board, to perform the duties of the president on his behalf.

It is worth noting that just 10 days ago, HuaxiaBankVice Chairman Luo Ganyi resigned. Hua Xia Bank announced that Luo Ganyi resigned from the positions of vice chairman, director and member of relevant committees of the board of directors of the company due to work reasons.

According to the data, Luo Ganyi is a doctoral student, a researcher-level senior 93 accountant, and an expert who enjoys special allowances from the State Council. Former Deputy Director of Financial Accounting Bureau of China North Industries Corporation; Deputy General Manager and Chief Accountant of China Yanxing Corporation; Director of Accounting and Audit Department of China North Industries Group Corporation; Chief Accountant of China North Industries Corporation; concurrently served as Ordnance Finance Co., Ltd. Vice Chairman, Chief Accountant of China Ordnance Industry Group Corporation and Chairman of Ordnance Industry Finance Co., Ltd.; Chief Accountant and Party Group Member of State Grid Corporation of China.

According to the financial report, the total profit of Hua Xia Bank in the first three quarters of 2021 was 21.656 billion yuan, a year-on-year increase of 16.86%; attributable to listed companiesshareholderofnet profit16.195 billion yuan, a year-on-year increase of 14.70%;Operating income72.493 billion yuan, a year-on-year increase of 2.60%.

As of the end of the third quarter of 2021, the total assets of Hua Xia Bank Group were 3,549.265 billion yuan, an increase of 149.449 billion yuan or 4.40% over the end of the previous year; total loans were 2,179.211 billion yuan, an increase of 70.218 billion yuan or 3.33% over the end of the previous year. The Group’s total liabilities were RMB 3,256,081 million, an increase of RMB 138,920 million or 4.46% over the end of the previous year; total deposits were RMB 1,871,999 million, an increase of RMB 53,669 million or 2.95% over the end of the previous year.

In terms of capital adequacy ratio, as of the end of the third quarter, Hua Xia Bank’s core tier 1 capital adequacy ratio was 8.70%, compared with 8.79% at the end of the previous year, a decrease of 0.09 percentage points; percentage points; the capital adequacy ratio was 12.86%, compared with 13.08% at the end of the previous year, a decrease of 0.22 percentage points.

In terms of asset quality, as of the end of the third quarter, the balance of non-performing loans of Hua Xia Bank was 38.703 billion yuan, compared with 37.976 billion yuan at the end of the previous year, an increase of 1.91%; of which, subprime loans were 15.505 billion yuan, a decrease of 4.82% compared with the end of the previous year, and doubtful loans were RMB 15.064 billion, an increase of 8.02% over the end of the previous year, loss loans were RMB 8.134 billion, an increase of 5.09% over the end of the previous year; the non-performing loan ratio was 1.78%, a decrease of 0.02 percentage points over the end of the previous year; the provision coverage ratio was 153.08%, an increase over the end of the previous year 5.86 percentage points; loan provision ratio was 2.72%, an increase of 0.07 percentage points over the end of the previous year.

As of press time, Hua Xia Bank reported 5.77 yuan per share, an increase of 0.70%, and a total market value of about 88.78 billion yuan.

(Article source: CDC Finance)