Lei Jianping reported on November 26

Anhui Huasu Co., Ltd. (abbreviated as “Huasu Co., Ltd.”, stock code: “600935”) was listed on the Shanghai Stock Exchange today.

Huasu Co., Ltd. issued 385.99 million shares at an issue price of 3.94 yuan and a total fund-raising of 1.52 billion yuan. As of now, the closing price of Huasu shares is 5.67 yuan, with a market value of 19.887 billion yuan.

Revenue of 4.58 billion in the first 9 months

Huasu Co., Ltd. was established in March 2009 and is located in Dingyuan County, Chuzhou City, Anhui Province. It is mainly engaged in the production and sales of chlor-alkali chemical products with PVC and caustic soda as the core. The integrated circular economy system of electricity-chlor-alkali chemical industry-“three wastes” comprehensive utilization” has comprehensive competitive advantages in resources, cost, technology, scale, and environmental protection.

Huasu’s main products include PVC, caustic soda, limestone, co-processing “green” cement, lime, etc.

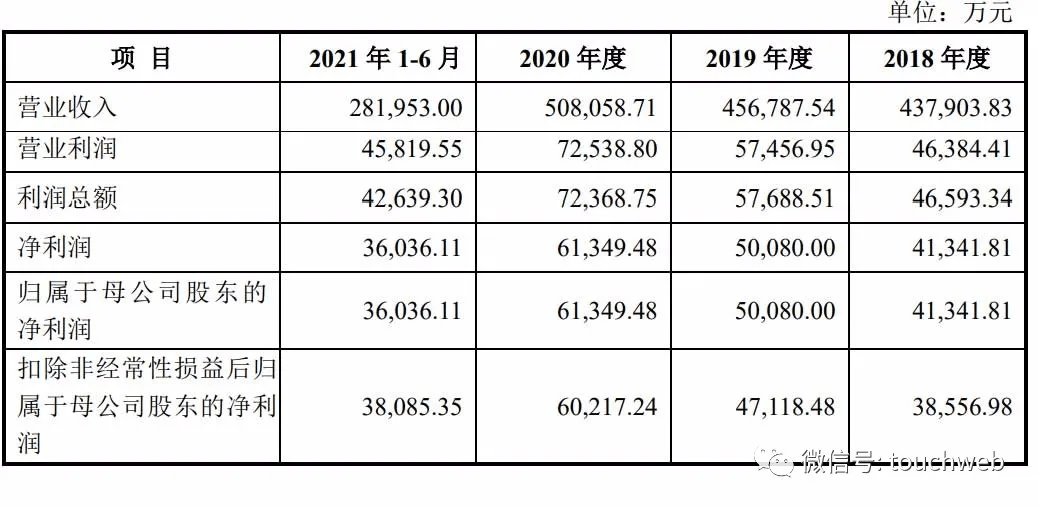

The prospectus shows that Huasu’s revenue in 2018, 2019, and 2020 will be 4.379 billion yuan, 4.568 billion yuan, and 5.08 billion yuan respectively; net profits are 413 million yuan, 500 million yuan, and 613 million yuan, respectively.

Huasu’s revenue in the first nine months of 2021 was 4.58 billion yuan, compared with 3.587 billion yuan in the same period last year; net profit was 585 million yuan, and net profit in the same period last year was 372 million yuan.

The company expects to achieve operating income of 6.273 billion yuan to 7.666 billion yuan in 2021, a year-on-year increase of 23.46% to 50.89%; net profit is expected to be 739 million yuan to 900 million yuan, a year-on-year increase of 20.46% to 47.23%.

Huai Mining Group is the major shareholder

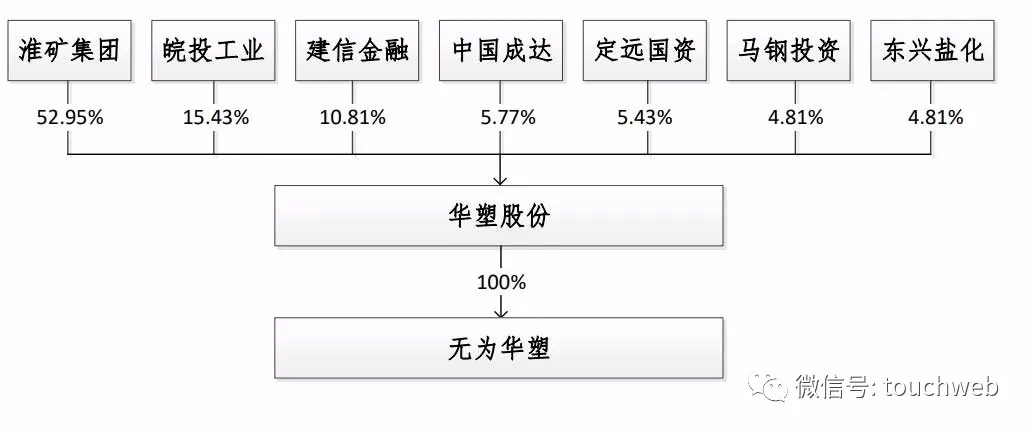

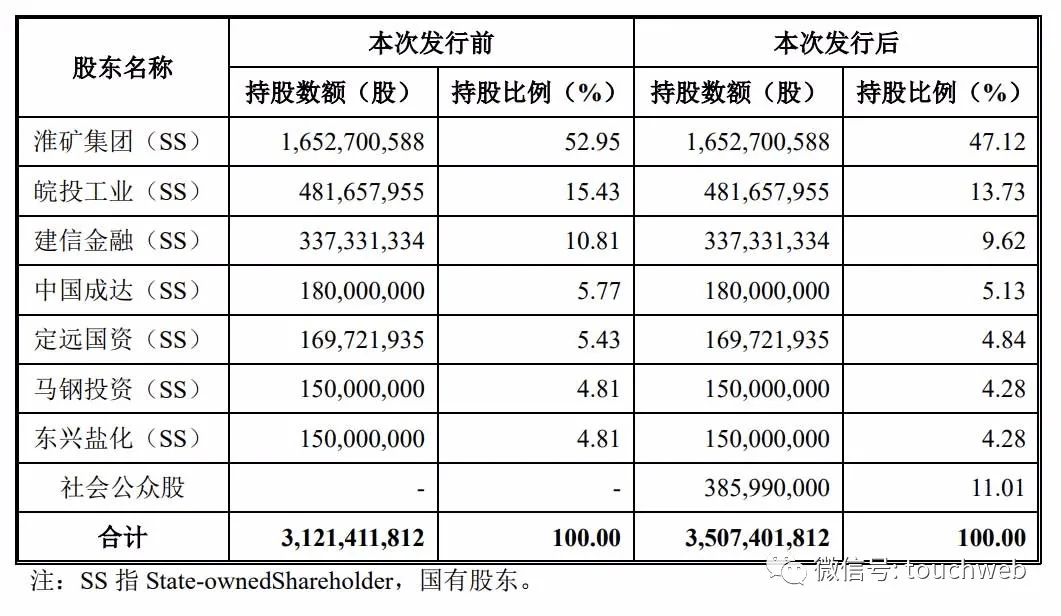

Before the IPO, Huai Mining Group held 1,652,700,588 shares of the company, accounting for 52.95% of the company’s total share capital, and was the controlling shareholder of the company; the Provincial State-owned Assets Supervision and Administration Commission directly held 100% of the equity of Huai Mining Group and was the actual controller of the company.

In addition, Wantou Industrial (SS) holds 15.43%, CCB Finance (SS) holds 10.81%, China Chengda (SS) holds 5.77%, and Dingyuan State-owned Assets (SS) holds 5.43%. Maanshan Iron & Steel Investment (SS) and Dongxing Salt & Chemical (SS) each hold 4.81% of the shares.

After the IPO, Huai Mining Group held 47.12%, Wantou Industry (SS) held 13.73%, CCB Finance (SS) held 9.62%, China Chengda (SS) held 5.13%, Dingyuan State-owned Assets (SS) holds 4.84%, and Maanshan Iron & Steel Investment (SS) and Dongxing Salt Chemical (SS) hold 4.28%.

———————————————

Lei Di was founded by Lei Jianping, a senior media person. If reprinted, please indicate the source.Return to Sohu to see more

Editor:

Disclaimer: The opinions of this article only represent the author himself. Sohu is an information publishing platform. Sohu only provides information storage space services.

.