Original title: The contract amount in the first four months of opening shares dropped by nearly 30% to 27.928 billion yuan. The first-quarter performance dropped by 157%

Author: Starfire

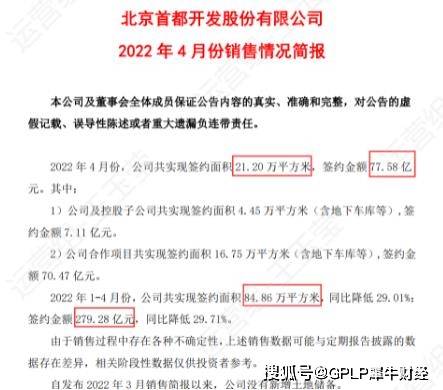

On May 10, Shoukai Co., Ltd. (600376.SH) disclosed a sales brief, saying that in April 2022, the contracted area will be 212,000 square meters, and the contracted amount will be 7.758 billion yuan. Among them, the company and its holding subsidiaries have achieved a total contracted area of 44,500 square meters (including underground garages, etc.), with a contracted amount of 711 million yuan; the company’s cooperation projects have achieved a total contracted area of 167,500 square meters (including underground garages, etc.), with a contracted amount of 7.047 billion yuan Yuan.

According to reports, from January to April 2022, Shoukai Co., Ltd. achieved a total contracted area of 848,600 square meters, a year-on-year decrease of 29.01%; the contracted amount was 27.928 billion yuan, a year-on-year decrease of 29.71%. Since the release of the March 2022 sales briefing, Shoukai has not added land reserves.

Source: Shoukai’s April 2022 sales briefing

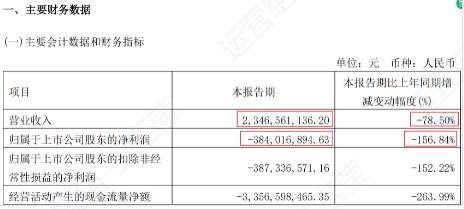

On April 29, the first quarterly report of Shoukai Co., Ltd. disclosed that the operating income in the first quarter of 2022 was 2.347 billion yuan, a year-on-year decrease of 78.50%; the net loss attributable to shareholders of the listed company was 384 million yuan, a year-on-year decrease of 156.84%; attributable to the listing. The company’s shareholders’ net loss after deducting non-recurring gains and losses was 387 million yuan, a year-on-year decrease of 152.22%.

Source: First Quarterly Report of Shoukai Shares in 2022

Judging from the first quarterly report, the decline in revenue of Shoukai Shares is mainly due to the lack of centralized housing delivery projects in the first quarter of 2022, and the decrease in housing sales revenue.

The industry of Shoukai Co., Ltd. belongs to the real estate industry, and its main businesses include real estate development, property management and property services, renovation of old urban areas, and real estate finance.

(This article is for reference only, does not constitute investment advice, and operate at your own risk accordingly)Return to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.