In the last week before the Spring Festival, the IPO market is still exciting. On the GEM,BYDsemiconductormeetingIt is eye-catching; in terms of the Science and Technology Innovation Board, the first company transferred to the Beijing Stock Exchange was unveiled; the companies that made it through the main board are also leaders in their respective fields.

Main Board: There are still 3 companies pending before the festival

What plans does the motherboard have for the last week before the Spring Festival? According to the website of the China Securities Regulatory Commission, the 18th Issuance Examination Committee is preparing to review Guangzhou Lushan New Materials Co., Ltd. (hereinafter referred to as Lushan New Materials), Wuhan Lide Power Technology Co., Ltd. (hereinafter referred to as Lide Power), The first launch of Shenzhen KTC Technology Co., Ltd. (hereinafter referred to as KTC Technology).

Lushan New Materials is a high-tech enterprise focusing on the research and development, production and sales of green, environmentally friendly and high-performance polymer hot melt adhesive materials. Its products are widely used in composite building materials, energy pipelines, high-barrier packaging, photovoltaic new energy, flat panel displays, etc. In this field, it provides comprehensive bonding solutions for customers in many countries and regions around the world. It is one of the leading high-performance hot melt adhesive material companies in China.

Reed Power is a special vehicle for the uninterrupted operation of the distribution network,Professional setting, special tools,professional serviceand system solution provider. The uninterrupted operation of the distribution network refers to an operation method that uses the live operation method, the bypass operation method or the mobile power method and other means to carry out the construction, maintenance, replacement and installation of the distribution network equipment under the premise of ensuring that the user does not have a power outage.

KTC Technology is a design and production enterprise focusing on the field of smart display. Its main business is the research and development, production and sales of smart display products. The main products include smart interactive display products in the commercial field and smart TVs in the home field. According to the description, KTC Technology has been engaged in the smart display industry for 26 years. Since 2001, its sales revenue has exceeded 1 billion yuan for 20 consecutive years. According to the statistics of FutureSource, the overseas shipments of the company’s intelligent interactive tablet among manufacturing suppliers in 2020 ranked first in the world. According to statistics from RUNTO, in 2020 and the first half of 2021, the company’s smart TV shipments ranked fifth in the world among manufacturing suppliers.

gem:BYDsemiconductormeeting

On the GEM, a total of 8 companies are scheduled to attend the meeting next week. Among them, on January 25, there were Jiangsu World Agricultural Machinery Co., Ltd., Shenzhen Zhilifang Automation Equipment Co., Ltd., and Shanghai State Cable Testing Co., Ltd., and on January 27, Beijing Zhongke Runyu Environmental Protection Technology Co., Ltd.,BYDsemiconductorCo., Ltd. (hereinafter referred to as BYD Semiconductor), Hebei University of Technology Keya Energy Technology Co., Ltd., and Ji’an Mankun Technology Co., Ltd. and Didong Planning and Design (Beijing) Co., Ltd. will meet on January 28.

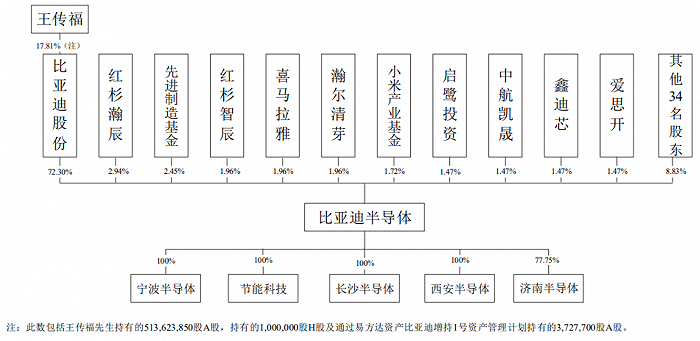

BYD Semiconductor was spun off and listed by BYD (002594.SZ). After the listing, BYD also has absolute control, and the actual controller of the company is Wang Chuanfu.

BYD Semiconductor is mainly engaged in the research and development, production and sales of power semiconductors, intelligent control ICs, intelligent sensors and optoelectronic semiconductors, covering the induction, processing and control of electrical, optical, magnetic and other signals. Since its establishment, the company has focused on automotive-grade semiconductors, and has simultaneously promoted industrial, home appliances, new energy,Consumer ElectronicsSemiconductor development in other fields.In the automotive field, relying on the company’s deep accumulation in the R&D and application of automotive-grade semiconductors, the company has mass-produced products such as IGBT, SiC devices, IPM, MCU, CMOS image sensors, electromagnetic sensors, LED light sources and displays, which are used in automotive applications.motorDrive control system, vehicle thermal management system, body control system,BatteryManagement system, vehicle imaging system, lighting system and other important fields. In industry, home appliances, new energy,Consumer ElectronicsIn the field, the company has mass produced products such as IGBT, IPM, MCU, CMOS image sensor, embedded fingerprint sensor, electromagnetic sensor, power IC, LED lighting and display.

It is described that automotive-grade semiconductors are the core of automotive electronics and are widely used in various vehicle body control devices, vehicle monitoring devices and vehicle electronic control devices. They have strict requirements on product reliability and safety because they directly affect the driving safety of vehicles. , the overall authentication period on the client is longer. From the perspective of the global market competition pattern, international manufacturers occupy a leading position in the field of automotive-grade semiconductors, and the localization rate of automotive-grade semiconductors is relatively low. According to Omdia statistics, there are no domestic companies in the world‘s top ten automotive-grade semiconductor manufacturers in 2020.

Data show that BYD Semiconductor’s revenue and revenue in 2020net profitThe data are 1.441 billion yuan and 58.6324 million yuan respectively. The company expects that in 2021, theOperating incomeIt reached 3.05 billion yuan to 3.2 billion yuan, and the net profit attributable to the parent company was 350 million yuan to 395 million yuan, a significant increase.

It is worth noting that BYD Semiconductor’s sales to related parties accounted for a high proportion of its operating income, mainly sales to BYD Group, which also made the company’s customer concentration high. From January to June 2018, 2019, 2020 and 2021, BYD Semiconductor sold goods, provided labor services andcontractThe amounts of energy management services were 910 million yuan, 601 million yuan, 851 million yuan and 670 million yuan, accounting for 67.88%, 54.86%, 59.02% and 54.24% of the operating income, respectively. Although the company’s export expansion is on the rise, the overall scale of domestic and foreign sales in the short term is still small.

In terms of acceptance, the GEM Listing Committee this week newly accepted a Hunan Hengchang Pharmaceutical Group Co., Ltd., which is a pharmaceutical distribution enterprise focusing on serving small and medium-sized chain pharmacies, individual pharmacies and primary medical and health institutions.

Science and Technology Innovation Board: The first transfer company may appear

In the last week before the Spring Festival, the Science and Technology Innovation Board Listing Committee arranged 3 deliberation sessions. On January 26, it will review Beijing Jiuzhou Yizhi Environmental Technology Co., Ltd., Nanjing Myland Medical Technology Co., Ltd. (hereinafter referred to as Myland), Hubei The first launch of Chaozhuo Aviation Technology Co., Ltd., and the first launch of Shanghai Xinlong Semiconductor Technology Co., Ltd. (hereinafter referred to as Xinlong Technology) will be reviewed on January 27. In addition, on January 27, the Science and Technology Innovation Board will welcome the first listed company to be transferred to the board: Guandian Defense (832317.BJ), which is also a topic of high market attention.

For a long time, the green channel of the new third board transfer board has been the focus of the market, and everyone wants to see who will win the title of the first successful transfer board. Since the debut of the Beijing Stock Exchange, many companies still choose to transfer the board. In addition to the above-mentioned Guandian defense, there are Hanbo High-tech (833994.BJ), Taixiang Shares (833874.BJ), etc., but Guandian The defense breakthrough is the Science and Technology Innovation Board, while Hanbo High-tech and Taixiang shares are on the Growth Enterprise Market.

The materials show that Guandian Defense is a domestic drone anti-drug service provider, and it is also the earliest domestic enterprise engaged in the research and development of drone anti-drug products and the industrialization of services. The company’s main business is the research and development, production and sales of UAV flight services and data processing, UAV systems and intelligent defense equipment. In the first half of 2020 and 2021, the operating income of Guandian Defense was 180 million yuan and 1.27 yuan, respectively, attributable to the parent companyshareholderThe net profit was RMB 53.4608 million and RMB 47.4598 million respectively.

Core Dragon Technology specializes in the research and development, design and sales of power management analog integrated circuits. The 82 products currently owned by the company are widely used in automotive electronic devices, industrial control, communication equipment,Consumer Electronicsand household appliances and many other fields, includingYutong bus、JAC、Beijing Auto,Chery Automobile,Dayang Electric、Superstar Technology、Xinjie Electric, Qixing Smart,Luxshare Precision, Huawei,ZTE、Anjubao, Xiaomi Group, No. 9 Company,Yadea Holdings、Cobos, Fangtai kitchenware,Vantage shares、Midea Group, Hisense Hitachi and other well-known end customers products.

Another Melland, mainly engaged in the business of pelvic floor and postpartum rehabilitation related products, the products mainly include pelvic floor and postpartum rehabilitation equipment, consumables and accessories, information products, etc., which are widely used in obstetrics and gynecology in medical institutions. , gynecology, pelvic floor rehabilitation center, confinement center, postpartum recovery center, mother and child center and other professional institutions.

(Article source: Interface News)