(Original title: Masukura in the third quarter of this pharmaceutical stock exceeded 26 times! Qiu Dongrong’s latest “low valuation formula” was released, a rare propaganda: the valuation of these stocks is “extremely low”!)

Every reporter Ren Fei every editor Peng Shuiping

On October 21, Qiu Dongrong’s management products under Zhonggeng Fund successively announced the third-quarter report. As before, Qiu Dongrong’s unique allocation of heavy-holding stocks is one of its biggest highlights. To make a fuss about it, medicine is one of the key points that is different from the previous one, and it is also an area that other non-pharmaceutical-themed active fund managers are less involved in allocation.

Statistics show that Kanghua Biotechnology and Xinhua Medical are their key targets for increasing their positions, and they have significantly increased their positions in Zhonggeng Value Smart, Zhonggeng Small Cap Value, and Zhonggeng Value Pilot. In addition, he also focused on increasing positions in Chuanyi Co., Ltd., Xindian Software, Shenhuo Co., Ltd., Yongmaotai, etc. this season, focusing on metal processing, electrical equipment, chemicals, electronics and other fields.

However, the net worth performance of the four managed funds was still negative during the quarter, but they were far ahead of their relative performance benchmarks. Two funds showed a net subscription status during the quarter, while Zhonggeng Value Pilot and Zhonggeng Value Quality showed a net redemption in one year. back.

Exploring medicine from a low valuation perspective, increasing positions in Kanghua Biotechnology and Xinhua Medical

“Don’t take the usual path” has always been Qiu Dongrong’s stock-picking personality, and because of his high success rate, he is called a diligent and reassuring fund manager by many investors. From the perspective of investment experience, it can always bring new insights or inspiration to the outside world.

This time he’s eyeing medicine. On October 21st, Zhonggeng Fund first released the third-quarter report of the four funds under its management, including Zhonggeng Small Cap Value, Zhonggeng Value Pilot, Zhonggeng Value Smart and Zhonggeng Quality One Year. In the case of Shigekura Pharmaceuticals, the number of individual stock positions increased by nearly 27 times compared with the previous period.

Xinhua Medical is the most typical. Qiu Dongrong has placed 6.9367 million shares in Xinhua Medical this time. Wind statistics show that the number of positions held in the previous period has increased by 2674.93%. Not only that, the stock has increased by 20.84% in the quarter. The first heavy-holding stock with flexible value is also held by Zhonggeng small-cap value heavy holding.

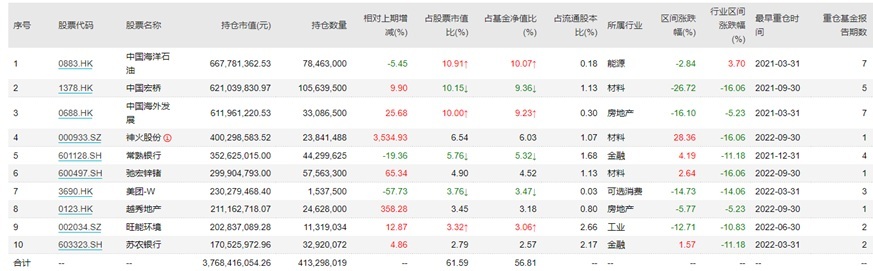

Top 10 heavy-holding stocks in the third quarterly report of Zhonggeng Value Smart

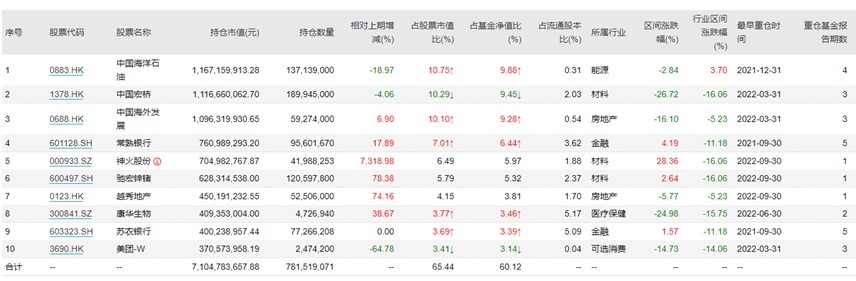

The pharmaceutical stocks that were also heavily held during the same period also included Kanghua Biology and Liuyao Group. The former ranks fourth, eighth and eighth in the three products of Zhonggeng Small Cap Value, Zhonggeng Value Pilot, and Zhonggeng Value Smart, respectively. Among them, the value of Zhonggeng’s small caps has increased the most compared with the previous position. Wind statistics show that the increase is nearly 360%. Unfortunately, the stock fell 24.98% in the quarter.

Top 10 heavy-holding stocks in the third quarterly report of Zhonggeng Small Cap Value

Regarding the allocation of pharmaceutical stocks, judging from the previous announcements of the third quarterly reports of listed companies including some funds, some non-pharmaceutical-themed fund managers rarely include such targets in their key investment scope, but from the recent performance of pharmaceutical stocks, it is true that There are signs of a recovery in valuation, and Qiu Dongrong also pointed out in the summary of the third quarterly report that its industry has a relatively high cost performance.

Qiu Dongrong said that the cost control policies such as price reduction in the centralized procurement of medicines have become normalized, and the marginal impact on the industry has been significantly weakened. business and improve operational efficiency. “The pharmaceutical sector has been adjusted for nearly two years, and the valuation has responded more fully to pessimistic expectations. Overall, the pharmaceutical industry has higher cost performance and more alpha opportunities for individual stocks.”

Qiu Dongrong: The valuation of some real estate stocks is “extremely low”

For fund managers who prefer to choose stocks, the pursuit of novelty comes from the judgment of cost performance. In the past, Qiu Dongrong has also seen attention to the competition pattern of the industry, but from the summary of this quarterly report, his judgment on the valuation of individual industries is based on ” Extremely “matched” and different.

Especially when it comes to real estate stocks, Qiu Dongrong believes that market policies will be further relaxed from multiple dimensions such as purchase restrictions and finance, and will enter the restoration stage after thorough risk exposure.

“Companies that have benefited from the optimization of the market structure and the continuous expansion of their share for a long time will have better anti-risk capabilities, potential growth and earnings quality, and their current valuations are extremely low, with good return potential.” During the quarter, Qiu Dongrong has increased positions in Poly Development, Yuexiu Real Estate, and China Overseas Development. The value of Zhonggeng is agile and the quality of Zhonggeng’s value has been reflected throughout the year.

Top Ten Heavy Holding Stocks of Zhonggeng Value Quality

It can be seen that, judging from its judgment on the “extremely low” valuation of the industry and the target, the market environment and the improvement of supply and demand are the keys to supporting its internal logic. He also mentioned in his investment research on energy companies that once the imbalance between supply and demand returns, energy and resource companies are still in the most favorable position from the bottom up, with extremely low valuations, good cash flow, low capital expenditure, The dividend yield is high and the expected rate of return corresponding to the current price is high.

Statistics show that in Qiu Dongrong’s previous quarterly reports in the past year, energy stocks did not change much with the adjustment of the portfolio. CNOOC has been listed in the sequence of heavy holding stocks for a long time, but this quarter, it has been lightened up in the one year of Zhonggeng value quality. , but still ranked the number one heavyweight stocks.

In addition, Chuanyi Co., Ltd., Xindian Software, Shenhuo Co., Ltd., Yongmaotai, etc. are also the targets of its key positions. In particular, Xindian Software, according to Wind statistics, has an increase of 23,556.23% in the value allocation of Zhonggeng small caps compared with the previous period; Chuanyi and Shenhuo also increased their positions significantly during the quarter, such as Shenhuo shares in the value of Zhonggeng. Allocation, at the end of the quarter has reached 41.9883 million shares, an increase of 7318.98% compared with the previous period.

Top 10 heavyweight stocks in the third quarterly report of Zhonggeng Value

In Qiu Dongrong’s view, there is still a lot of potential to discover cost-effective companies in the broad manufacturing industry, and they value pharmaceutical manufacturing, non-ferrous metal processing, electrical equipment and new energy, computers, machinery, chemicals, electronics, light industry, automobiles, etc. The low-risk, low-value, and high-growth small- and medium-cap targets have the potential to become big bull stocks.

In addition to increasing positions, Qiu Dongrong has been more thorough in lightening positions. For example, some chemical and energy stocks have completely faded out of the heavy-holding stock sequence in the second quarter. It can be seen that his attitude towards style and industry switching is very clear. .

But even so, the net worth performance of the four managed funds was still negative during the quarter, but they were far ahead of their benchmarks. Statistics show that the net value of the four funds of Zhonggeng Small Cap, Zhonggeng Value Smart, Zhonggeng Value Pilot and Zhonggeng Value Quality fell by 6.20%, 4.04%, 10.44% and 8.71% respectively during the quarter. At the same time, the first two funds showed a net subscription state during the quarter, and the latter two showed a net redemption.

Statement: Securities Times strives for true and accurate information. The content mentioned in the article is for reference only and does not constitute substantive investment advice. Operational risks are based on this.

Download the official APP of “Securities Times” or follow the official WeChat account to keep abreast of stock market dynamics, gain insight into policy information, and seize wealth opportunities.