Futu News reported on October 21 that the three major indexes of Hong Kong stocks were mixed. As of press time, the Hang Seng Index fell 0.11%, the Hang Seng Technology Index rose 0.29%, and the State-owned Enterprise Index rose 0.19%.

Big tech stocks were mixed,Kuaishou fell by nearly 4%, NetEase fell by nearly 3%, JD.com, Xiaomi, and Tencent rose by about 1%, and Alibaba and Meituan rose slightly.

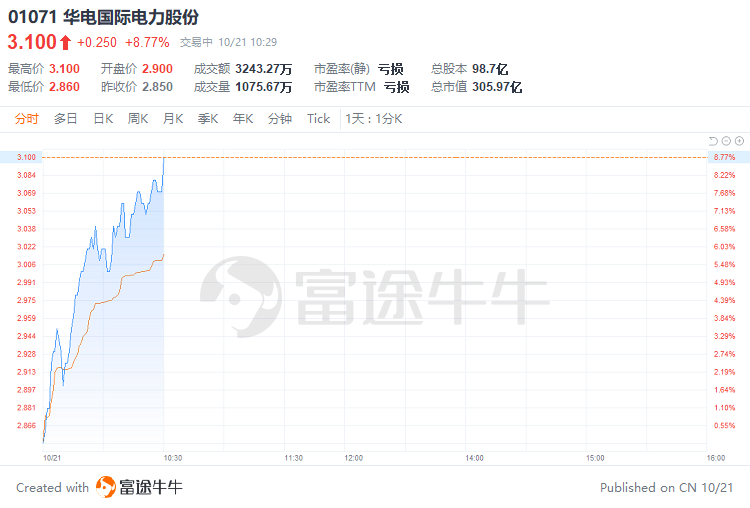

Power stocks rose collectively,Huadian International rose more than 6%, China Resources Power rose nearly 5%, Datang Power rose more than 4%, and China Power and Huaneng International rose more than 2%.

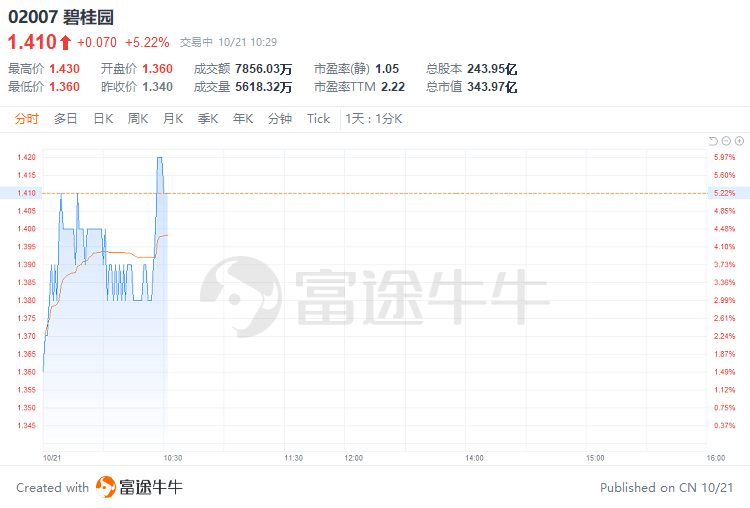

Most real estate and property management stocks rose,Country Garden and CIFI Holdings rose by nearly 4%, Vanke Enterprise and CIFI Yongsheng Services rose by more than 3%, and Country Garden Services and Longfor Group rose by more than 2%.

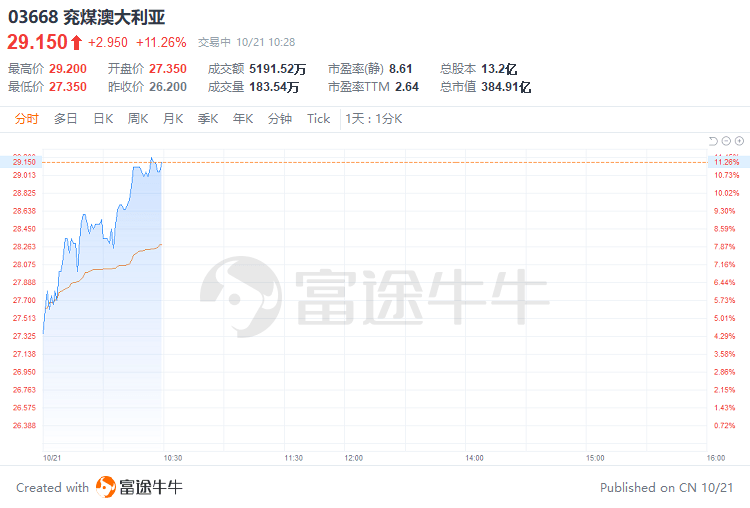

Coal stocks rose,Yancoal Australia rose more than 11%, Yankuang Energy and China Coal Energy rose more than 1%, and Shougang Resources followed suit.

Education stocks rose,New Oriental Online rose nearly 5%, Tianli International rose nearly 3%, and New Oriental-S followed suit.

For individual stocks,$ Huadian Power International (01071.HK) $ rose nearly 9% to lead power stocks, the agency said that the performance recovery of the thermal power sector is sustainable.

$Country Garden (02007.HK)$ rose more than 5% to lead the rise in Chinese property stocks. The China Securities Regulatory Commission allows real estate-related companies that meet certain conditions to raise funds in the A-share market.

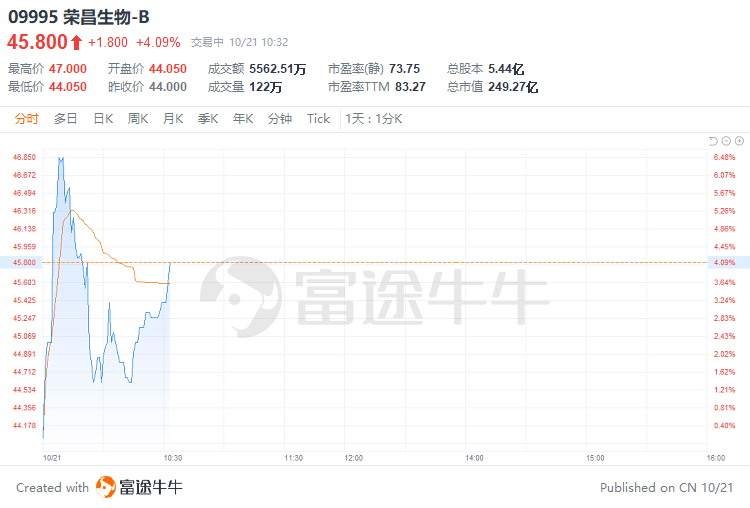

$Rongchang Bio-B(09995.HK)$ rose more than 4%. The agency said that the company’s sales revenue in the third and fourth quarters is expected to continue to grow month-on-month, maintaining a “buy” rating.

$Yancoal Australia (03668.HK)$ The group’s debt decreased, and the stock price rose by more than 11%. The company’s cash holdings in the third quarter increased by a record 1.9 billion Australian dollars; the company’s raw coal production in the third quarter was 13.2 million tons.

$ GCL New Energy (00451.HK) $ rose more than 23%,A few days ago, the company once again launched an offer to repurchase US dollar bonds. So far, the company’s cumulative repurchase of US dollar bonds during the year has reached about 200 million US dollars.

edit/ruby

Risk warning: The opinions of the authors or guests shown above have their own specific positions, and investment decisions need to be based on independent thinking. Futu will endeavour but cannot guarantee the accuracy and reliability of the above content, and will not be liable for any loss or damage arising from any inaccuracies or omissions.Return to Sohu, see more