Futu Information reported on October 20 that the three major indexes of Hong Kong stocks fell collectively. As of press time, the Hang Seng Index fell 2.24%, the Hang Seng Technology Index fell 3.31%, and the State-owned Enterprise Index fell 2.44%.

Big tech stocks fell again,Baidu fell by nearly 9%, Bilibili fell by nearly 7%, NetEase and JD.com fell by nearly 6%, Ali and Meituan fell by more than 5%, and Tencent and Kuaishou fell by about 4%.

Auto stocks tumbledWeilai fell by more than 9%, BYD, Ideal, and Xiaopeng fell by nearly 5%, and Geely Automobile and Great Wall Motor fell by nearly 4%.

Gaming stocks continue to fall,Wynn Macau and Melco International fell about 7%, Sands China fell nearly 6%, and SJM Holdings fell nearly 4%.

Sporting goods stocks continued to fall,Li Ning fell by more than 7%, Xtep and Bosideng fell by nearly 4%, Anta fell by more than 3%, and Taobo and 361 degrees followed suit.

Shipping stocks generally fell,COSCO SHIPPING Energy and Orient Overseas International fell about 5%, while COSCO SHIPPING Holdings and SITC fell nearly 4%.

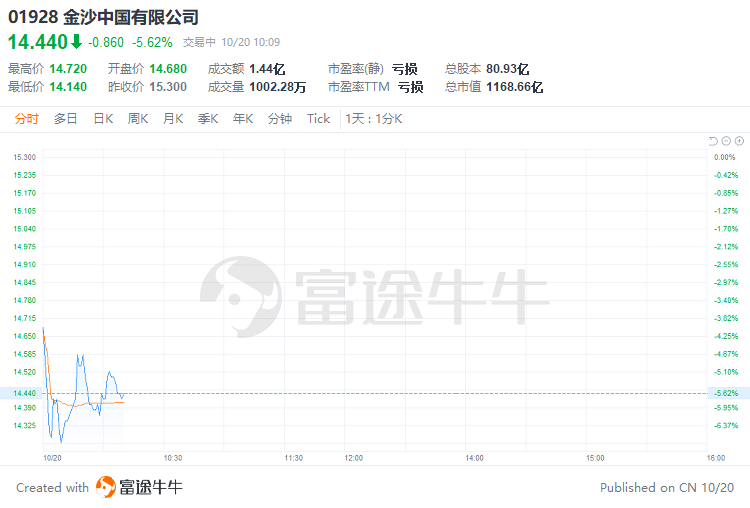

For individual stocks,Sands China Co., Ltd. (01928.HK) fell nearly 6% after the results, and its net loss in the third quarter expanded by 11.58% year-on-year to US$472 million. Lyon said Macau’s gaming industry’s third-quarter earnings performance was the worst since the third quarter of 2020.

BYD shares (01211.HK) fell nearly 6%, and institutions said that the market’s 2023 fiscal year earnings of car companies may be significantly overestimated.

$Li Ning (02331.HK)$ continued to fall by more than 7%, and has fallen by nearly 16% this week. CICC lowered the company’s EPS forecast for 2022/23 and lowered the target price by 19%.

$Weibo-SW(09898.HK)$ fell nearly 6%. Bank of America expects the company to be more affected by the exchange rate in Q4 and lowered its target price.

$Pacific Shipping (02343.HK)$ fell more than 6% to lead the decline in shipping stocks. The decline in demand combined with the increase in shipping capacity. The SCFI index has fallen for 17 consecutive weeks.

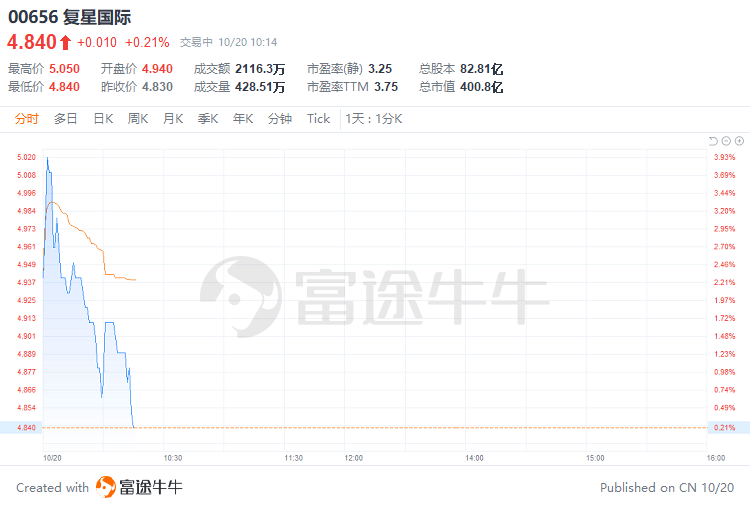

$Fosun International (00656.HK)$ rose nearly 4% in intraday trading after the resumption of trading. As of press time, the stock edged up 0.21%. On the news, the company plans to sell 60% of Nanjing Nangang Iron and Steel United to Shagang Group for no more than 16 billion yuan.

edit/ruby

Risk warning: The opinions of the authors or guests shown above have their own specific positions, and investment decisions need to be based on independent thinking. Futu will endeavour but cannot guarantee the accuracy and reliability of the above content, and will not be liable for any loss or damage arising from any inaccuracies or omissions.Return to Sohu, see more