Japan, the ECB launches the alert on the effects of the hawkish turn of the Bank of Japan on BTP & Co.

And now there is also Japan among the threats looming over BTPs and government bonds in the euro area: the ECB says it clearly, referring to the increasingly probable change in the Bank of Japan’s monetary policy.

For now the BoJ, led by new governor Kazuo Ueda, continues to confirm itself as a white fly among the central banks of the most important economies in the world: if the latter have launched a cycle of rate hikes since last year, with the aim of dampening the surge in inflation, the Central Bank of Japan, at least to date, has confirmed both its bond-buying program and a bond-focused policy negative rates.

And it was precisely these sub-zero yields made in Japan that brought about Japanese funds and investors to focus on government bonds issued by foreign countries.

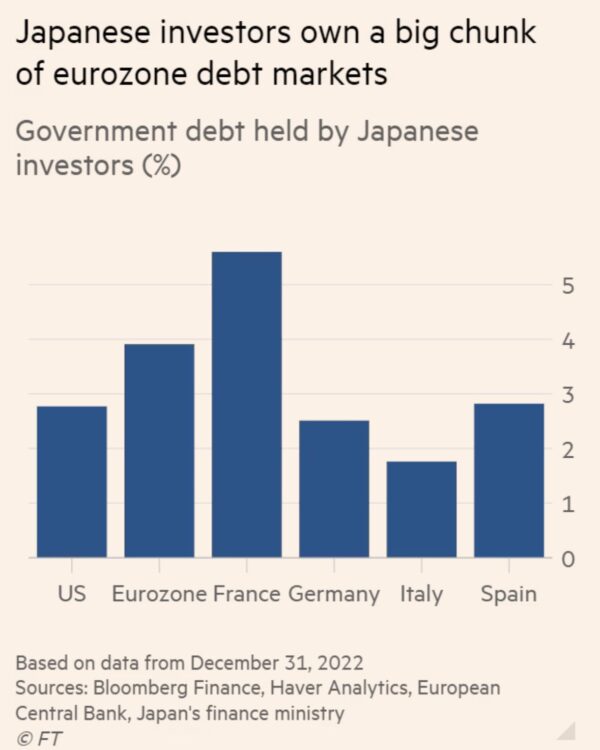

Japan, as the Financial Times reports in a graph, it effectively holds a large chunk of Eurozone sovereign bonds.

What would happen, therefore, in the case – increasingly probable – in which Should the Bank of Japan also raise interest rates?

Simple: Japan’s government bond yields would become more attractive e Japanese investors, who have so far looked at the foreign fixed income market, could decide to sell off those sovereign bonds they have in their portfolio, including BTPs, to bet more strongly on the bonds issued by Tokyo.

Alert Japan, ECB fears earthquake in euro bond market

The damage to government bonds in the euro area would be great, to the point that the ECB has warned of the risk that any change in Japan’s monetary policy could trigger a “earthquake in the Eurozone bond market”.

And not only that, given that the world‘s sovereign bond market would be threatened, with damage calculated in the monster figure of 3 trillion dollars, as the Japan Times article warned two months ago “A $3 trillion threat to global financial markets looms in Japan”.

The article took stock of the situation, recalling how la Bank of Japanwith its ultra dovish monetary policy, has bought ¥465 trillion worth of Japanese government bonds ($3.55 trillion, considering the exchange rate) since what will likely go down in history as the last dovish samurai of the Bank of Japan, former governor Haruhiko Kuroda, launched the massive Quantitative Easing plan about ten years ago.

The data are the official ones, compiled by the same central bank of Japan.

With the ambitious QE plan, the BoJ has depressed yields, causing, wrote the Japan Times, “unprecedented distortions in the sovereign debt market”.

The result is that private Japanese investors, insurance companies and funds, in the same period they sold Japanese government bonds for a value of 206 trillion yen, hunting for more attractive yields, which they found abroad: positioning themselves, precisely, on BTPs, Bunds, Treasuries, and other sovereign bonds which have presented progressively richer returns, in the wake of the monetary tightening launched by the various central banks of the world, such as those launched by the Fed di Jerome Powell and by Christine Lagarde’s ECB.

The change was so important that Japanese investors have become the main holders of US Treasuries outside the United States, while owning about 10% of Australian debt and Dutch bonds.

According to Bloomberg data, buys on Brazilian government bonds led to Japanese investors also holding 7% of Brazilian debt.

This data, which adds up to investor exposure to the Eurozone market taken together, they indicate how dependent the global sovereign bond market is on Japan.

Rates, ECB: watch out for risk on carry trades

“A rapid narrowing of interest rate differentials and an increase in exchange rate volatility could reduce the attractiveness of carry trades (financed by the yen)”, warned the ECB, referring to the threat posed by Japan.

Per carry trade means that strategy with which we borrow in yen to bet on currencies with higher yields, thus earning a profit thanks to the differential between the rates.

In this regard, an article by Bloomberg at the beginning of the year highlighted how the Japanese yen was the same regaining its historical position as the most attractive currency to finance carry trade operations, after months in which this strategy had stalled, in the wake of speculation about a Bank of Japan destined to abandon the dovish setting of its monetary policy, due to rising inflation.

The danger, however, remains: if the yen strengthens following a possible and increasingly likely change in Japan’s monetary policy, currency-financed carry trades they would lose again their palatability.

It should be noted that, in recent weeks, the prospect of a more hawkish than in the past Kazuo Ueda’s Bank of Japan has returned to the markets, thanks to the dovish tones of the new governor, who has repeatedly stressed that the growth in inflation, although higher by quite a bit than the central bank’s target of 2%, remains unconvincing and unsustainable.

READ ALSO

Bank of Japan: Kazuo Ueda and the interest-debt conundrum

Who is Kazuo Ueda, new Bank of Japan governor

Bank of Japan towards the conclusion of the yield curve control policy

Bank of Japan does not join the hawkish chorus of central banks. Here because

ECB: Japan very present in European bond markets

No one, however, is willing to bet that the Bank of Japan will stay dove forever.

The ECB therefore snapped to attention, expressing all its concerns in the Financial Stability Report which it publishes twice a year.

In the latest edition, released a few days ago – in which among the alerts there was also the one on the dangers threatening the financial stability of the Eurozone and on the increasingly evident cracks in the housing market of the block – the ECB also spoke of the threat posed by Japan.

“A move away from an environment of low interest rates, in Japan, could test the resilience of global bond markets.

The normalization of Japan’s monetary policy, it goes on to read, “could influence the decisions of Japanese investors, whose presence on global financial markets, including euro area bond markets, is significant”.

Escape from BTP & Co has already begun

Among other things, the bad news for BTPs and other euro government bonds they don’t end there.

In fact, an article by Bloomberg points out that the flight of Japanese investors from sovereign debt in the euro area is already at the highest levels in history.

Japanese investors sold off European bonds worth as much as 5.4 trillion yen in 2022, the equivalent of $38.7 billion: this is a record figure, according to Bloomberg surveys, since 2005.

Also, although Japanese funds have been firm since the start of the year net buyers of eurozone government bonds, purchases in the first quarter amounted to just 81 billion yen, the lowest value in the last six years.

“The BoJ is an anchor for global rates e an increase in funding costs would translate into downside risks to bond prices around the world,” he confirmed to Bloomberg Tsuyoshi Ueno, senior economist at the NLI Research Institute in Tokyo, at the same time calling the ECB’s message “a very rare case, which sees a central bank expressing concerns about the normalization of BoJ policy”.

But Lagarde’s ECB is really concerned about the effects that a possible hawkish turn by the Central Bank of Japan could have on euro area securities. in the specific case of Italy, for BTPs.

In launching an alert on the consequences that an increase in interest rates in Japan might have on carry trades, the Eurotower noted that higher rates in Japan could lead investors who have invested in foreign assets to repatriate their funds into Japanese assets.

And it goes without saying that, in the event that glo sells euro area bonds were major and abrupt, their value would eventually collapse.

“Such dynamics could be amplified by the increase in the net supply of these bonds due to the Quantitative Tightening of the ECB”, states the Eurotower Financial Stability report.

And yes, given that it was Christine Lagarde’s ECB itself, in its fight against inflation, that pulled the plug on QE (Quantitative easing), which had supported the value of BTPs and government bonds in the euro area for a about a decade, launching the diametrically opposite plan, which takes the name of QT-Quantitative Tightening.

What Kazuo Ueda said in the past few days

In the last days and in the last hours, Bank of Japan Governor Kazuo Ueda not much was said about the future of monetary policy, highlighting the uncertainty of the outlook on the economy.

It is true that, just a few days ago, Ueda admitted that “it might be difficult to deny the possibility that we are already in a New Normal other than the period of ‘low rates for a long period of time'”. A period that, also due to the high levels of public and private debt accumulated during the period of the Covid-19 pandemic, the governor continued, may have ended by now.

In today’s speech, Kazuo Ueda however said that “a more restrictive and premature monetary policy could also harm companies that are in good condition, weakening the potential of the economy”.

Consequentially, “patiently maintain an accommodating policy could help raise Japan’s level of potential GDP growth.

That said, the latest data has highlighted that the core component of Japan’s inflation measured by the consumer price index, it rose at a rate of 4.1% in April, more than double the 2% target set by the Bank of Japan.