China Economic Net, Beijing, June 15th, Kede CNC (688305.SH) announced last night that the company received yesterday’s review opinion from the Shanghai Stock Exchange on the company’s application for issuing stocks to specific objects through simplified procedures: According to the “Shanghai Stock Exchange” The Rules for the Review of Securities Issuance and Listing of Companies Listed on the Science and Technology Innovation Board, Kede Numerical Control Co., Ltd. issues stocks to specific objects through simplified procedures that meet the issuance conditions, listing conditions and information disclosure requirements.

Kede CNC announced that the company still needs to obtain a decision to approve the registration from the China Securities Regulatory Commission for the issue of stock issuance to specific objects through simplified procedures. There is still uncertainty as to whether and when the China Securities Regulatory Commission will finally approve the registration. The company will perform its information disclosure obligations in a timely manner according to the progress of the matter, and investors are requested to pay attention to investment risks.

Yesterday, the prospectus (declaration draft) for the issuance of RMB ordinary shares (A shares) to specific objects in a simplified procedure disclosed by Kede CNC showed that the company’s issuing objects were all determined by bidding, and the final issue object was the national manufacturing transformation. Upgrade Fund Co., Ltd., Guotai Junan Securities Co., Ltd. All the issuers of this issue of shares subscribed in cash in RMB.

This issuance of shares adopts the method of non-public issuance to specific objects through simplified procedures, and the issuance and payment are completed within 10 working days after the China Securities Regulatory Commission makes the decision to register.

According to the investor’s subscription quotation, and strictly in accordance with the procedures and rules stipulated in the subscription invitation, the issue price of this issue is determined to be 65.10 yuan per share.

According to the bidding results of this issuance, the number of shares issued this time is 2,457,757 shares. The final number of issuances is subject to the number registered by the China Securities Regulatory Commission. The specific allocation of this issuance is as follows: National Manufacturing Transformation and Upgrade Fund Co., Ltd. subscribed for 150 million yuan and was allocated 2,304,147 shares; Guotai Junan Securities Co., Ltd. subscribed for 10,000,000 yuan and was allocated 153,610 shares.

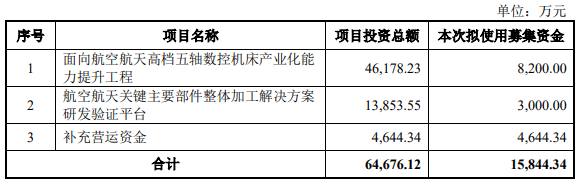

According to the bidding results of this issuance, the total amount to be subscribed by the issuers is 160 million yuan. After deducting the issuance expenses related to this issuance, the company intends to use the raised funds for the “Industrialization Capability Improvement Project of High-end Five-axis CNC Machine Tools for Aerospace”, “R&D and Verification Platform for Overall Processing Solutions for Key Main Components of Aerospace” and ” Supplementary working capital”.

Kede CNC stated in the application draft of the prospectus that due to the company’s initial public offering of stocks, the net amount of funds raised was 191.5245 million yuan, which was lower than the expected use of raised funds for related projects of 976.2429 million yuan. Therefore, the company adjusted and reallocated the investment amount of some raised funds using the raised funds. In addition to supplementing working capital, the funds raised from this issuance of shares will be used to continue the construction of the “Industrialization Capability Improvement Project for Aerospace High-end Five-axis CNC Machine Tools” in the above-mentioned investment projects of the previous raised funds. The project of “R&D and Verification Platform for Integrated Processing Solutions for Key Aerospace Key Components” was cancelled due to insufficient net funds, so as to make up for the funding gap for the construction of projects invested with raised funds caused by the lack of previous raised funds. Within the scope of the above-mentioned raised funds investment projects, the company may make appropriate adjustments to the investment order and specific amount of the corresponding raised funds investment projects according to the actual situation such as the progress of the project and capital needs. Before the raised funds of this issuance are in place, the company can invest in the self-raised funds first according to the actual situation of the investment projects with the raised funds, and replace them after the raised funds are in place.

The above-mentioned issuers have no affiliated relationship with the company before and after this issue, and this issue does not constitute an affiliated transaction.

Before this issuance, Guangyang Technology held 28.81% of the company’s equity and was the controlling shareholder of Kede CNC. The actual controllers of the company are father and son Yu Dehai and Yu Benhong. Yu Dehai and Yu Benhong hold 74% and 25% of the company’s controlling shareholder Guangyang Technology respectively, and Yu Benhong directly holds 10.43% of the company’s shares. Hong holds 10.00% and 35.00% of the company’s shareholders Dalian Yashou and Dalian Wanzhong Guoqiang respectively, and Yu Dehai and Yu Benhong directly and indirectly hold 39.89% of the shares of Kede CNC.

According to the bidding results of this issuance, the number of shares to be issued to specific objects is 2,457,757 shares. After the completion of this issuance, the company’s total share capital is 93,177,757 shares. After the completion of this issuance, the actual controllers Yu Dehai and Yu Benhong hold shares in total accounting for about 38.84% of the company’s total share capital, and still maintain actual control person’s status. This issuance will not lead to changes in the controlling shareholder and actual controller of Kede CNC.

The non-public offering of shares to specific objects this time shall not be transferred within six months from the date of the end of the offering (that is, the date on which the shares of this offering are registered in the names of the relevant parties). Shares obtained in this non-public offering due to bonus shares issued by the company or the conversion of capital reserve to share capital shall also comply with the above-mentioned share lock-up arrangement. After the expiration of the lock-up period, the relevant regulations of the China Securities Regulatory Commission and the Shanghai Stock Exchange shall be implemented.

The sponsor (lead underwriter) of this issuance is CITIC Securities. CITIC Securities stated in the sponsorship letter of Kede CNC that the implementation of the investment project with the raised funds will further enhance the issuer’s growth ability. After the project invested by the raised funds is completed and put into operation, it will expand the issuer’s production capacity, improve product quality, enhance the issuer’s profitability, and help the issuer to further expand the market. In addition, after the funds raised from this public offering are in place, the issuer’s capital strength will be further enhanced, the asset-liability structure will be improved, and the issuer’s comprehensive competitiveness and anti-risk capabilities will be enhanced.Return to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.