Every reporter: Yuan Yuan Every editor: Chen Xu

On April 22, Xinhua Insurance disclosed its first-quarter performance forecast. It is expected that the net profit attributable to shareholders of the parent company in the first quarter of 2022 will be 1.261 billion yuan to 1.892 billion yuan, a year-on-year decrease of 70% to 80%.

Regarding the decline in performance, New China Insurance stated that the main reason was that, due to the high base of net profit in the same period last year, the current period was affected by the downturn in the capital market and investment income decreased, resulting in a large year-on-year change in net profit for the current period.

Net profit in the first quarter is expected to decrease by 4.414 billion-5.044 billion yuan year-on-year

According to the report, according to preliminary calculations, the net profit attributable to shareholders of the parent company of New China Insurance in the first quarter of 2022 is 1.261 billion yuan to 1.892 billion yuan. Compared with the same period in 2021, the net profit attributable to shareholders of the parent company after deducting non-recurring gains and losses is expected to decrease by 4.418 billion yuan to 5.049 billion yuan, a year-on-year decrease of 70%-80%.

The recent single quarter net profit of Xinhua Insurance

New China Insurance’s explanation for the decline in net profit attributable to the parent in the first quarter was the decrease in investment income. Data show that in the first quarter of 2021, New China Insurance achieved a total operating income of 81.365 billion yuan, a year-on-year increase of 19.4%; investment income was 19.558 billion yuan, a year-on-year increase of 57.8%; net profit attributable to the parent was 6.305 billion yuan, a year-on-year increase of 36%.

“The main reason for the decline in net profit attributable to the parent is 75%, which corresponds to the main net profit attributable to the parent in the first quarter of 2022 of 1.576 billion yuan. The main reason for the decline in profit is the high profit base of cashed investment floating profit in the same period.” Soochow Securities Research Report on Xinhua Insurance One According to the quarterly performance forecast drop analysis, in the first quarter of 2022, the CSI 300 and the ChiNext Index fell by 14.5% and 20.0%, respectively, while in the first quarter of 2021, they fell slightly by 3.1% and 7.0% respectively, and the company realized a floating profit, making profits in the same period. Base is high.

In the first quarter of 2021, the annualized total investment yield of New China Insurance was 7.9%, a year-on-year increase of 2.8 percentage points. Soochow Securities Research Report believes that after considering other comprehensive floating losses, its total investment rate of return is 7.0%, a year-on-year improvement of 2.9 percentage points. Soochow Securities calculated the proportion of available-for-sale financial assets cashing floating profits to investment income. 42.4% (about 20% of listed peers). The research report believes that the company’s residual margin at the end of 2021 will decline compared with the mid-term, and the amortization of the residual margin will slow down, dragging down the release of performance.

This view is also shared by insiders close to New China Insurance. An insider close to Xinhua Insurance said in an interview with the “Daily Economic News” reporter’s WeChat that the decline in investment income was the main reason for the decline in net profit. At the same time, the high base in the same period last year was also the reason for the large decline in net profit. “The net profit achieved by New China Insurance in the first quarter last year accounted for about 50% of the whole year. The base is too high, so it seems to have dropped a lot in the first quarter of this year.”

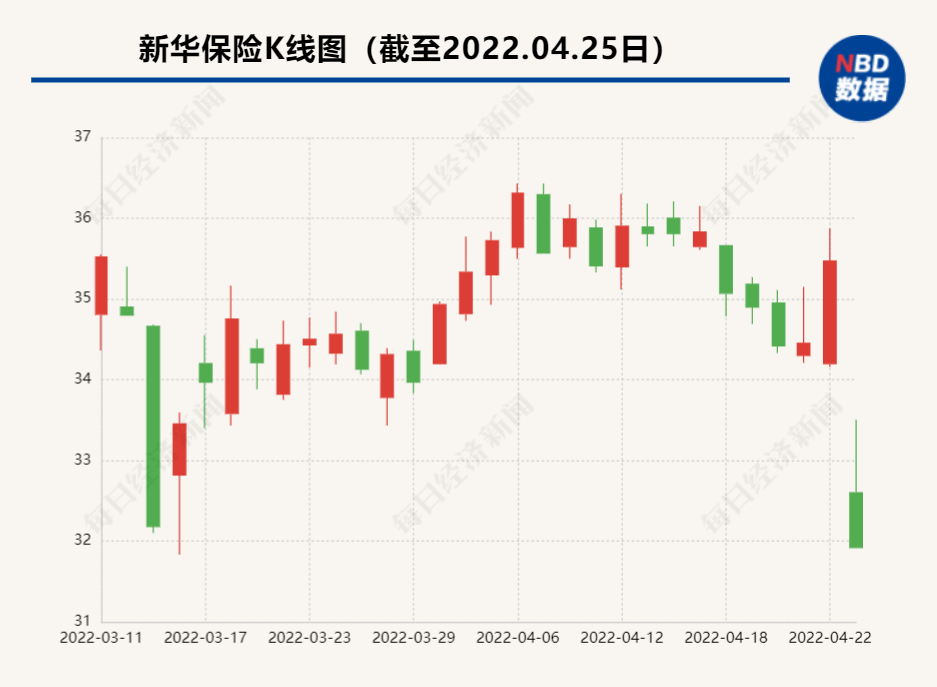

After the announcement of New China Insurance’s first-quarter performance forecast drop, the capital market quickly responded. On April 25, the stock price of New China Insurance showed a downward trend at the opening. As of the close, the company’s stock price fell by the limit and reported 31.92 yuan per share.

The first quarter of this year original insurance premiumRevenue is still growing steadily

At the performance conference at the end of March, Li Quan, president of New China Insurance, called “the pressure is huge” when asked about investment. Li Quan said that the complex investment environment in 2022 will be a lot of pressure for all investors.

“We are mentally prepared for the situation this year, so we actively respond to investment and make some adjustments in major assets.” Li Quan said that although the beginning of the year encountered a very severe situation, but the overall outlook for the future Still relatively optimistic, on the one hand, China’s overall economic situation is relatively good globally, and on the other hand, it is better to encounter such problems at the beginning of the year than at the end of the year, “This will give us more time to do some work. Adjustments and further investment operations, and the cash flow of insurance funds is still good.”

For this year’s arrangement, Li Quan said that he will work together on the liability side and the asset side. He emphasized that, judging from the current data, the asset side of New China Insurance performed well in 2019, 2020 and 2021, and supported the development of the liability-side business through continuously improving investment capabilities and achieving relatively good returns. In the “14th Five-Year Plan”, New China Insurance will further build a wealth management ecosystem, give full play to the complementary advantages of products at both ends of assets and liabilities, and actively explore the three lines of traditional life insurance, pension insurance and health care industry synergy, so as to provide life insurance Customers, especially high-net-worth customers, provide customized wealth management products and services, and support the development of debt business through wealth management business.

The “Daily Economic News” reporter noticed that although the investment income of New China Insurance in the first quarter was not satisfactory, its premium income was still growing steadily.

According to the report, the cumulative original insurance premium income of New China Insurance in the first quarter was 64.890 billion yuan, a year-on-year increase of 2.36% compared with 63.392 billion yuan in the same period last year, which also made securities companies have expectations for New China Insurance.

Soochow Securities Research Report stated that as of April 22, 2022, the share price of New China Insurance corresponds to 2022-2024 PEV 0.40, 0.36 and 0.33 times, considering the valuation price ratio, continue to maintain the “buy” rating.

daily economic newsReturn to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.