Every reporter: Zhang Yun Every editor: Yang Xia

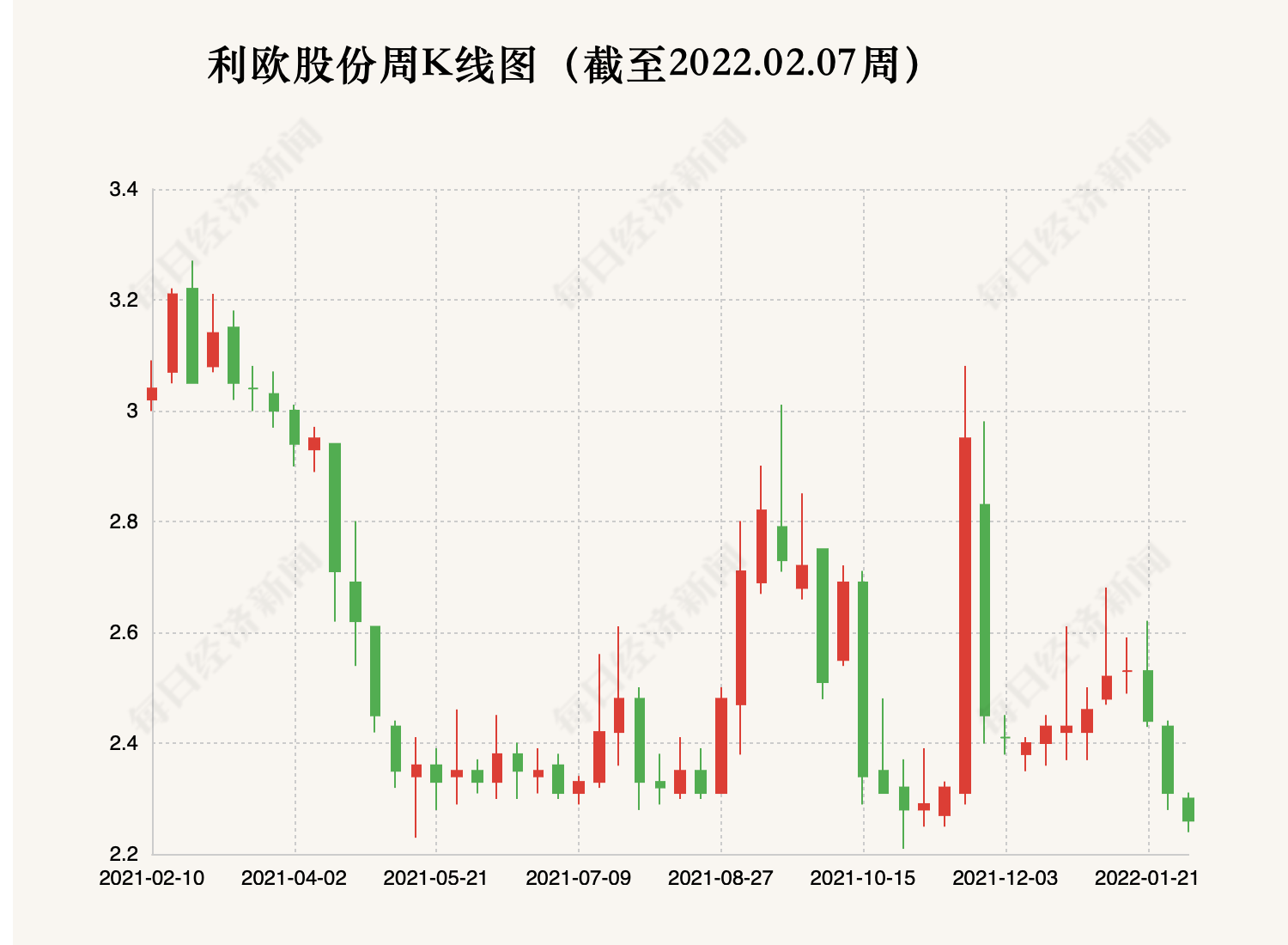

On February 7, Leo shares (002131, SZ) received a letter of concern, and the Shenzhen Stock Exchange asked the company to explain the reasons for the large amount of goodwill impairment provision in 2021, the amount and the specific calculation process.

On the eve of the Spring Festival, Leo shares disclosed an announcement on the pre-loss of net profit in 2021. According to the performance forecast, the company expects to realize a loss of 930 million yuan to a loss of 780 million yuan in 2021, and a loss of 1.4 billion yuan after deducting non-net profit. The loss of RMB 1.25 billion was mainly due to the provision for impairment of goodwill in the digital sector and the provision for bad debts of customer receivables.

The pre-loss is a large amount of goodwill impairment

After a lapse of two years, Leo shares once again provided a large amount of goodwill impairment to digest the historical problems brought about by the merger and acquisition of the digital sector. From the perspective of the proportion of performance contribution in 2020, since the acquisition, the digital sector has accounted for 35% of the overall operating income. 83.04%, gross profit margin was 4.87%.

In 2018, due to the unsatisfactory operating performance of some subsidiaries, LEO made a provision for impairment of 1.809 billion yuan on the goodwill formed by its investment, resulting in a loss of 1.967 billion yuan deducted from non-net profit that year. As of the end of the third quarter of 2021, the company still had goodwill of 1.768 billion yuan on the books.

On January 29, Leo shares stated in the performance forecast that the company combined industry development, current business operations and judgments on future operations. It is estimated that in 2021, the amount of impairment of the goodwill involved in the Leo digital sector will be about 12.5%. 100 million yuan – 1.45 billion yuan.

In this regard, the Shenzhen Stock Exchange issued a letter requesting the company to explain the formation process of the aforementioned goodwill, the reasons for accruing a large amount of goodwill impairment in 2021, the amount to be accrued and the specific measurement process, and whether the accrual for goodwill impairment in previous years was sufficient, Whether there is a situation of improper earnings management.

In addition to goodwill, the bad debt problem of accounts receivable is also worthy of attention. The announcement shows that due to the abnormal operating conditions of the customer, as of December 31, 2021, Leo shares still had a large amount of receivables of 332 million yuan from the customer that was difficult to recover. The management of the company believes that there are signs of impairment, and plans to make provision for bad debts based on 50% of all receivables from the customer.

Leo shares stated that after excluding the company’s additional bad debt provision for the above-mentioned customer receivables and the influence factors of the goodwill impairment provision on net profit, the company’s net profit range attributable to shareholders of listed companies in 2021 It is expected to be about 550 million yuan to 650 million yuan.

On February 7, a reporter from the “Daily Economic News” called the company, and the other party said: “This year, because of the provision of goodwill, the profit is a loss. The biggest profit from investment in this area comes from Ideal Auto. The sharp increase in profits last year was also due to this effect.”

The investment income of Ideal Auto affects the company’s performance

The above-mentioned letter of concern also mentioned that in 2020, Leo Co., Ltd. achieved a net profit of 4.772 billion yuan. The reason is that the income from changes in the fair value of Ideal Auto is about 4.5 billion yuan, and the net profit after deduction is 283 million yuan.

In 2021, the company’s Li Auto shares will affect the net profit attributable to shareholders of listed companies by 329 million yuan, which is included in non-recurring gains and losses, which reduces the net profit attributable to the parent from a maximum loss of 1.4 billion yuan to a maximum loss of 9.3 yuan. billion.

In this regard, the Shenzhen Stock Exchange requires the company to explain the reasons for the substantial loss in 2021 performance in light of the operating environment, main business conditions, and main products, and whether there have been major changes in the operating environment.

The secretary of the board of directors of Leo Co., Ltd. told reporters that it is still uncertain whether the company’s investment project in the ideal car will change in the future, and it needs to be determined by the company’s careful analysis according to the actual situation.

However, some voices in the market that believe that Leo shares “success is also ideal, and failure is also ideal” have existed for a long time.

On July 30, 2020, Ideal Auto landed on the U.S. stock market, and its stock price once soared to $47.70 per share. As an early investor, Leo shares once gained a book floating profit of more than 10 billion. It’s just that the good times don’t last long. Since December 2020, the stock price of Ideal Auto has suffered a 6-month turbulent downward trend, and it will not usher in a short-term rise until June 2021.

As of the first half of 2021, the book value of the company’s investment in Ideal Auto dropped to 6.192 billion yuan. By the first three quarters of 2021, the company’s investment income was -17.5 million yuan, a decrease of 163.95% compared with the same period of the previous year. Compared with the all-time high, at the end of 2021, Li Auto’s share price will almost halve, but it will be basically the same as the beginning of the year.

Due to the huge investment of Leo shares in Li Auto, the book floating profit of only 3 US dollars per share still allowed the company to reap an investment return of 438 million yuan. The company secretary said that the company’s investment projects in the next year will still mainly focus on high In the field of science and technology, “all those who are optimistic will be considered.”

daily economic newsReturn to Sohu, see more

Editor:

Disclaimer: The opinions of this article only represent the author himself, Sohu is an information publishing platform, and Sohu only provides information storage space services.