Under the background of high-low switching, low-level stocks have quietly risen.

He once made 1.8 billion yuan in stocks for half a year, and was hailed as “the most well-stocked listed company”Conch CementShot again.Last night, the latest market value of 218.278 billion yuanConch CementreleaseannouncementSaid that the company intends to participate in the subscription with its own funds of 1.76 billion yuanWest ConstructionThe number of non-public A shares to be subscribed for is 251 million shares.After this subscription of shares is completed, the company will holdWest Construction16.30% of the shares, becoming its second largestshareholder。

West ConstructionIt is a leading domestic comprehensive service provider for the building materials industry and a leading enterprise in the domestic commercial concrete industry.Conch CementSaid that it will further strengthen the strategic cooperation between the two parties in the supply and marketing of raw materials, concrete business, sand and aggregate business, logistics and transportation, and industrial Internet.

It’s worth noting that this is notConch CementThe first shot this year, according toYatai GroupAnnouncement, July 7 to October 8,Conch CementBuy by centralized bidding transactionYatai GroupOf shares. As of October 8,Conch CementCo-BuyYatai GroupShares of 162 million shares, accounting for 5% of the issued shares of Yatai Group.In the next 12 months, Conch Cement intends to conduct centralized bidding transactions through the trading system of the Shanghai Stock Exchange orLarge transactionsContinue to increase holdings of Yatai Group’s shares, and the number of increased holdings shall not be less than 10 million shares.

Conch Cement’s stock trading style is relatively stable, and its investment targets are basically peers, who are good at selling high and buying low.According to statistics, since 2006, Conch Cement has invested in stocks includingSony Financial、Jidong Cement、 Qilian Mountains、 Fujian Cement、 Huaxin Cement、evergreen, Tongli Cement,Green Pine JianhuaWait.

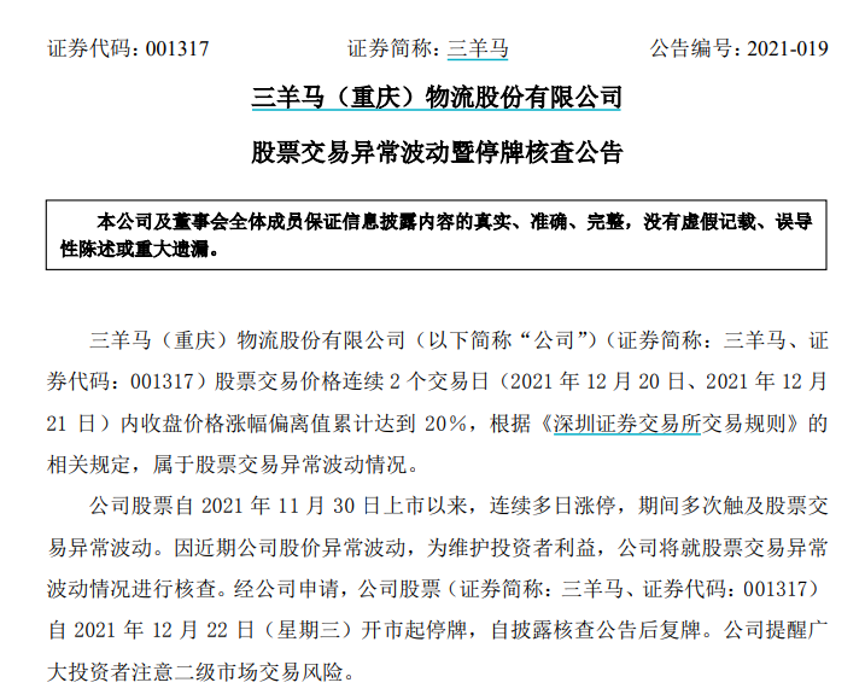

16 consecutive bull stocks releasedSuspensionannouncement

In the recent A-share market, there has been a polarization of high bids.New crotchThree sheepHas gained 16 consecutive boards,Hubei Radio and Television、Kingsoft、Longzhou shares、Renzhi sharesBoth gained 7 consecutive boards,Lanshi Heavy EquipmentWon 6 consecutive boards,Chongqing Development、Blu-ray development, Exchange rate ecologyEqually get 5 consecutive boards, in contrast,Shaanxi Golden Leaf、Yueling shares、Zhongrui shares、Fulin Transport Industry、China Aluminum International、Frand、Meisheng Culture、Sodium sharesThese high-level stocks have dropped their limits in the previous period.

Last night, it successfully recorded 16 consecutive boards since its listing on November 30Three sheepA trading suspension announcement was issued, stating that the company’s stock has been trading at a daily limit for many days since its listing, during which abnormal fluctuations in stock trading have been encountered many times.After the company’s application, the company’s shares will be suspended from the market opening on December 22, and since the disclosure of the verification announcementResumption of trading. The company reminds investors to pay attention to the risks of secondary market transactions.

Since the second half of the year, new shares have broken out frequently.Three sheepThe performance is quite eye-catching. The company’s issuance price is 16 yuan per share, and a payment of 8,000 yuan is required for 500 shares. The latest stock price of the company is 96.23 yuan per share, corresponding to a market value of 40,100 yuan. If the shares are held so far, a contract earns 32,000 yuan.

As for Sanyangma’s recent stock price continuous strong daily limit, some analysts believe that it is related to the favorable policies in cold chain logistics. However, the company stated on Hudongyi on December 12 that it has not yet started cold chain logistics business.

Low blue-chip stocks released

Towards the end of the year, market sectors are still switching rapidly. Judging from recent capital and market performance, low-level stocks have quietly risen under the attention of capital, and the high-prosperity growth sector has seen a significant correction.

SecuritiesAccording to the statistics of the Times and Databao, as of now, the P/E ratio of Shanghai and Shenzhen stocks is less than 30 times, and the latest stock price has fallen by at least 40% from the high point of the year. There are 175 high-performance stocks in the three quarterly reports.Chemical, medical and biological, mechanical equipmentAnd other industries.

Since December, more than 60 stocks have outperformed the market.Beixin Building Materials、Sunshine City、Sophia、World Union Bank、Mango Super MediumThe cumulative increase in stock prices has exceeded 15%, of whichSophia、World Union Bank、Mango Super MediumAcquired since DecemberNorthward capitalNet purchases,Mango Super MediumIn December, the net purchase of Beijing Capital exceeded 200 million yuan.

From the perspective of oversold range, the latest share price corrections from the high point of the year are mostly concentrated in the pharmaceutical and biological, chemical, food and other industries.Intech Medical、Kain Technology、Haitian shares、Gan Li PharmaceuticalThe oversold range of both exceeded 60%.

According to data statistics, among these low-value and low-value stocks,Peacebird、Rongsheng Petrochemical、Longbai Group、Changchun High-techMango Super MediaAll of them have been rated by more than 20 institutions, and in the past three trading days, they have received net purchases from Beijing Capital.

Based on the stock price performance of the previous two years, the cumulative annual increase and decrease of 70 shares has been positive for two consecutive years.Intech Medical、Golden Field Medical、China Free、Changchun High-tech、Bohui Paper、CITIC Special Steel、Zhifei Bio、Sany Heavy Industry、Aerospace developmentThe average increase of 11 stocks in 2019 and 2020 is more than 100%, of whichIntech Medical、Bohui Paper、Master BiologyThe price-earnings ratio is less than 10 times.

Related reports

Low-priced stocks “occupies” the gains list to pick up “cheap and good goods” is the time

Guosheng Securities: market style switching oversold low prices may become mainstream

Low-end and high-volume consumer stocks released the lowest price-earnings ratio of only 3 times (with shares)

(Article source: data treasure)

.